AI intelligent agents are revolutionizing three major tracks in the cryptocurrency field and significantly enhancing user efficiency.

Author: Diego

Translation: Deep Tide TechFlow

Are you engaged in cryptocurrency trading, using stablecoins for yield farming in DeFi, or participating in prediction market betting?

Congratulations! You are one of the 99% of people in the crypto space and one of the biggest beneficiaries of the AI intelligent agent revolution.

Let me be straightforward: AI intelligent agents can optimize your trading, yield farming, and prediction processes, helping you earn more while giving you more leisure time to enjoy life.

Sounds too good to be true? Let me explain in detail…

By the way, let me introduce myself. I am @diego_defai, a researcher focused on crypto and AI, with over 3.5 million views on X (formerly Twitter), and AI intelligent agents are my research obsession.

In this article, we will explore why you should integrate AI intelligent agents into your workflow and analyze the top AI intelligent agent tools available today.

Three Areas Disrupted by AI Agents

AI intelligent agents are disrupting three major tracks in the cryptocurrency field and significantly enhancing user efficiency:

Trading (Spot & Perpetual Contracts)

Yield Farming (especially related to stablecoins)

Prediction Markets (such as Polymarket)

In these three areas, AI intelligent agents bring countless advantages—from higher yields to more precise execution and analysis, greatly enhancing user experience and returns.

How Do AI Intelligent Agents Truly Help Users?

Let’s put it simply.

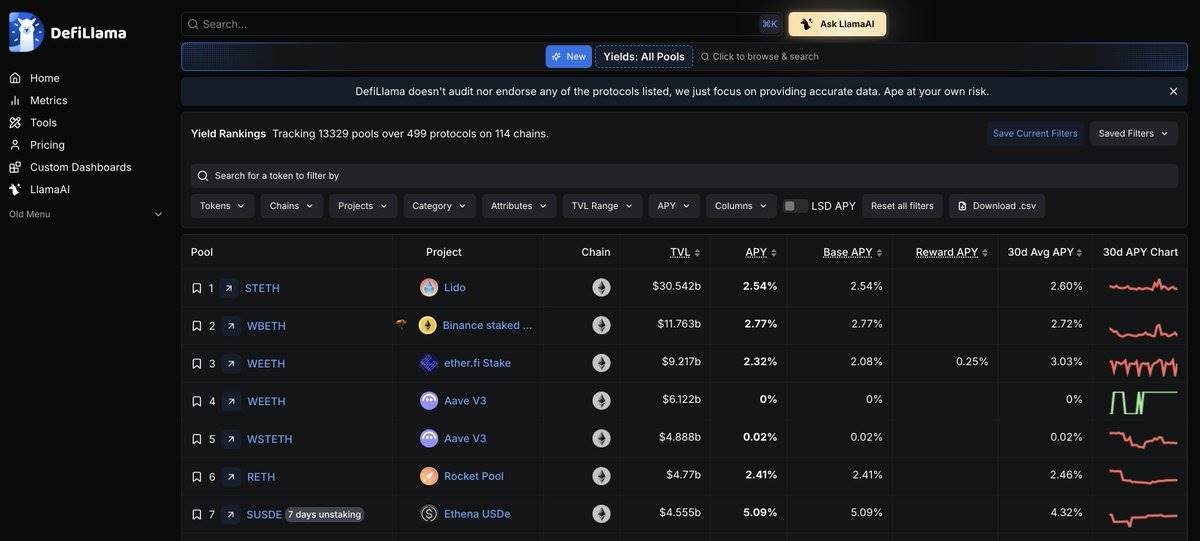

Suppose you have 10,000 USDC and want to invest it in the most profitable yield farming opportunities in DeFi.

Before AI agents, you would need to manually research various protocols. And since APY (Annual Percentage Yield) frequently changes, you would have to monitor the screen 24/7 to stay updated.

If you are a savvy miner, you might use an APY aggregator to quickly check opportunities. But even then, it’s still not the optimal solution.

Now, imagine having a digital assistant—an AI intelligent agent—that can track on-chain APY in real-time and automatically transfer your funds when better opportunities arise.

You no longer need to manually check APY or personally transfer your 10,000 USDC every time a new opportunity comes up.

Today, AI intelligent agents can:

Earn higher APY than humans (because they never rest)

Automatically deploy assets when new opportunities arise

Analyze data far beyond human capability

Humans might evaluate a maximum of 10 protocols, while AI agents can scan 1,000 and instantly choose the best option.

That’s why with AI agents, you can enjoy higher returns while having more time to "slack off" (enjoy life).

The Boring Part—They Are Also Safer

In addition to these advantages, AI agents also significantly enhance security:

- They interact directly with whitelisted smart contracts, avoiding the risks of phishing sites, failed transactions, and malicious interfaces.

The end result? Overall higher security.

Summary: Why Should You Use AI Agents?

They are safer

They can analyze vast amounts of data

They never rest

They can automatically deploy funds

Top AI Agents in Application Scenarios

Now that we understand why to use them, it’s time to explore the top AI agents in the three major scenarios of yield farming, crypto trading, and prediction markets.

Yield Farming

If you want the best optimized and completely passive stablecoin yield:

@ZyfAI: A multi-chain stablecoin agent that can transfer your USDC between Base and Arbitrum, with an average annual yield of about 22%.

@Almanak: If you like earning through airdrops, this is your best choice. Deposit stablecoins to earn a 7% native APY while also earning points for future airdrop rewards.

@gizatechxyz** (Arma Agent)**: If you prefer predictable returns, Giza offers a fixed 15% annual yield.

Additionally, there are some agents that provide passive income from BTC and ETH:

@mamo: Using $cbBTC, it offers an average annual yield of 1–2%.

@gizatechxyz** (Pulse Agent)**: Based on @pendle_fi stack, it offers a fixed 12% ETH annual yield.

AI Intelligent Agents Supporting Traders

In the trading field, AI agents are mainly divided into two types:

Trading Companions: Help you analyze the market and optimize decision-making processes.

Autonomous Trading Agents: Handle the entire trading process, including research, execution, and position management.

Trading Companions

@Velvet_Capital: If you enjoy trading small coins (commonly known as "shitcoins"), you can try using their AI agent on the Velvet trading terminal.

@Cod3xOrg: Create your own trading agent and ask it for trading advice.

@HeyAnonai: Their HUD is a graphical layer that can be applied to different trading interfaces, providing real-time AI-driven insights.

Autonomous Trading Agents

- @modenetwork: They offer two types of agents: Breakout Agent and Trend Agent. Just deposit USDC into their agent wallet, and let them handle the rest.

AI Intelligent Agents Supporting Prediction Markets

If you enjoy betting in prediction markets, you can choose from the following two types of AI agents:

Companion Agents: Help you conduct research and optimize decision-making.

Autonomous Agents: Place prediction bets directly for you.

Prediction Companions

@polytraderAI: An AI assistant that identifies arbitrage opportunities ahead of humans by analyzing news, market sentiment, and market inefficiencies.

@polybroapp: A research terminal that provides in-depth AI analysis of different prediction markets.

@polytaleai: Focused on politics and sports, tracking whale movements, X platform sentiment (such as X social platform), and news cycles to predict outcomes before others notice.

Autonomous Prediction Agents

@quantrix_agent: The Quantrix agent can autonomously conduct research, predict outcomes, and manage users' portfolios.

@SemanticLayer: The first Polymarket agent that utilizes the x402 standard for autonomous trading and generating passive income.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。