Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Outflow of $1.111 Billion

Last week, the US Bitcoin spot ETFs experienced a net outflow over three days, totaling $1.111 billion.

Six ETFs were in a net outflow state last week, with the outflows primarily coming from IBIT, BTC, and GBTC, which saw outflows of $532 million, $289 million, and $112 million, respectively.

Data Source: Farside Investors

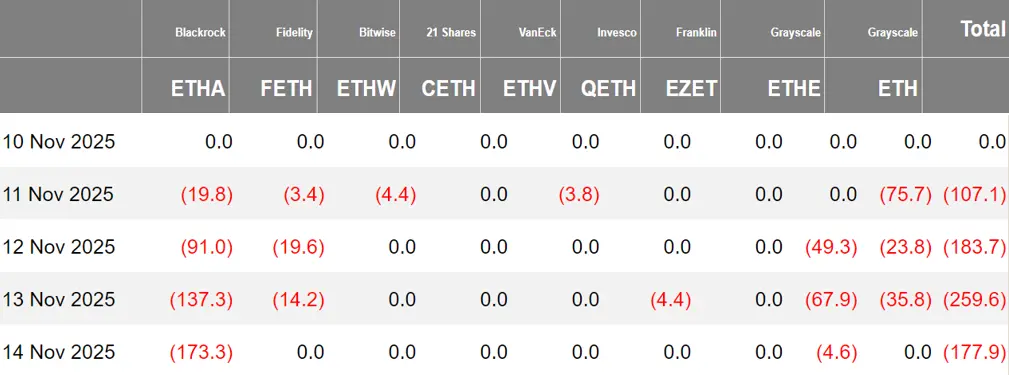

US Ethereum Spot ETF Net Outflow of $728 Million

Last week, the US Ethereum spot ETFs experienced a net outflow over four days, totaling $728 million.

The outflow last week was mainly from BlackRock ETHA, with a net outflow of $261 million. Seven Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

Overview of Crypto ETF Dynamics Last Week

Avenir Group Bitcoin ETF Holdings Rise to $1.189 Billion, Setting New Record

According to ChainCatcher, based on SEC 13F filings, Avenir Group, a family office led by Li Lin, held 18.297 million shares of BlackRock iShares Bitcoin Trust (IBIT) in Q3 2025, with a market value of $1.189 billion, an increase of about 18% from the previous quarter, maintaining its position as the largest institutional holder in Asia for five consecutive quarters.

The group has continuously increased its holdings during multiple rounds of market adjustments over the past 15 months and has also expanded its investment in crypto financial infrastructure, including participating in OSL Group's approximately HKD 2.355 billion financing, investing in Tiger Brokers, and leading the Metalpha PIPE. Additionally, Avenir is advancing the expansion of Bitcoin, Ethereum, and Solana ecosystems, launching a $500 million cooperative fund, and participating in Sharps Technology's over $400 million financing.

According to Bloomberg analyst Eric Balchunas, the SEC's latest guidance indicates that the US Securities and Exchange Commission has received over 900 registration documents during the government shutdown and is now accelerating the clearance of the backlog.

The guidance states that if a registration statement submitted by an issuer during the shutdown does not include a delayed effectiveness clause (8(a) path), it may automatically take effect after 20 days, and the issuer can submit a supplemental delayed clause and apply for acceleration to take effect earlier. Analysts believe this may prompt some crypto ETF issuers that have not completed the 8(a) process to accelerate their listing, with Bitwise's XRP ETF considered a potential frontrunner.

The US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are set to resume operations after a 43-day government shutdown. According to the operational plans of the two agencies, employees will return to work on the "next regular business day after the appropriations bill officially takes effect."

During the government shutdown, both agencies significantly reduced staff, and operations were nearly halted. The SEC's review capacity was severely limited, especially regarding the approval of applications for exchange-traded funds (ETFs, including those related to cryptocurrencies). The CFTC "stopped most of its operations," including enforcement, market oversight, and regulatory rule-making. After the government reopens, the SEC and CFTC will need some time to process the backlog of matters, including registration applications submitted during the past 43 days.

Some crypto companies learned towards the end of the shutdown that it was about to end and rushed to submit IPO and ETF applications. SEC Chair Atkins recently revealed that the SEC plans to "establish a token taxonomy" in the coming months, anchored by the Howey test. CFTC Acting Chair Pham stated that the commission has been pushing for the approval of leveraged spot cryptocurrency trading as early as December.

Canary Staked SEI ETF Listed on DTCC, Trading Code SEIZ

According to the DTCC website, the DTCC (Depository Trust & Clearing Corporation) has listed the Canary Staked SEI ETF, with the trading code SEIZ.

It is reported that the listing on the DTCC website is a standard process in preparation for launching a new ETF, but this does not indicate that the related ETF has received any regulatory approval or completed other approval processes.

VanEck Submits 8-A Form for Its Solana Spot ETF to the SEC

According to market news, well-known ETF issuer VanEck has submitted an 8-A form for its Solana spot ETF to the US Securities and Exchange Commission (SEC), a document that typically indicates that the product is about to be listed. This form is usually submitted shortly before the launch of a new asset. This submission follows the S-1 form submitted at the end of October.

Data: Emory University Bitcoin ETF Holdings Valued at $51.8 Million, Up 91%

According to Cointelegraph, as of September 30, 2025, Emory University's holdings in the Grayscale Bitcoin Mini Trust ETF have reached a value of $51.8 million, a staggering 91% increase from the reported holdings in June.

Canary Capital Submits S-1 Application for MOG ETF to the SEC

According to Cryptopolitan, Canary Capital has submitted an S-1 application for the Meme coin MOG-related ETF to the US Securities and Exchange Commission (SEC).

Canary XRP ETF Completes Listing Certification on Nasdaq, Trading to Start at Market Open

According to crypto journalist Eleanor Terrett, as of 5:30 PM Eastern Time, the Canary XRP ETF has officially taken effect after completing its listing certification on Nasdaq, and XRPC has been approved to start trading at tomorrow's market open.

REXShares' XRPR ETF is the First Fund to Partially Hold XRP Spot

Crypto journalist Eleanor Terrett stated on X platform that REXShares' XRPR ETF is the first fund established under the Investment Company Act of 1940 to partially hold XRP spot, but its tax treatment efficiency is relatively low.

CanaryFunds will launch the first pure spot XRP ETF established under the Securities Act of 1933, which will hold 100% XRP.

Bitwise Chainlink ETF Listed on DTCC Website, Code CLNK

The Bitwise Chainlink ETF has appeared on the DTCC (Depository Trust & Clearing Corporation) website, with the code CLNK.

11 XRP ETFs Listed on DTCC Website

According to Cointelegraph, 11 XRP ETF products are now listed on the DTCC website, and analysts suggest that the end of the US government shutdown may open the door for a surge of XRP ETFs.

Views and Analysis on Crypto ETFs

Bloomberg ETF Analyst: Canary XRP ETF Achieves $26 Million Trading Volume in First 30 Minutes

Bloomberg senior ETF analyst Eric Balchunas stated that the Canary XRP ETF "XRPC" achieved a trading volume of $26 million in the first 30 minutes of its launch, far exceeding my previous estimate of $17 million. It is likely to break the record of $57 million set by BSOL, becoming the highest trading volume record for all new stock issuances on their first day this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。