As long as the system continues to cycle debt into asset bubbles, we will not achieve a true recovery, only a slow stagnation masked by rising nominal numbers.

Written by: arndxt

Translated by: AididiaoJP, Foresight News

The U.S. economy has split into two worlds: one side is a booming financial market, while the other side sees the real economy trapped in a slow decline.

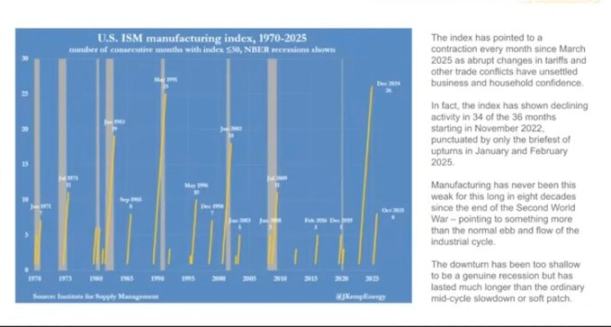

The manufacturing PMI index has contracted for over 18 consecutive months, the longest record since World War II, yet the stock market continues to rise, as profits become increasingly concentrated among tech giants and financial companies. (Note: The full name of "manufacturing PMI index" is "Manufacturing Purchasing Managers' Index," which measures the health of the manufacturing sector.)

This is essentially "balance sheet inflation."

Liquidity continuously drives up the prices of similar assets, while wage growth, credit creation, and small business vitality remain stagnant.

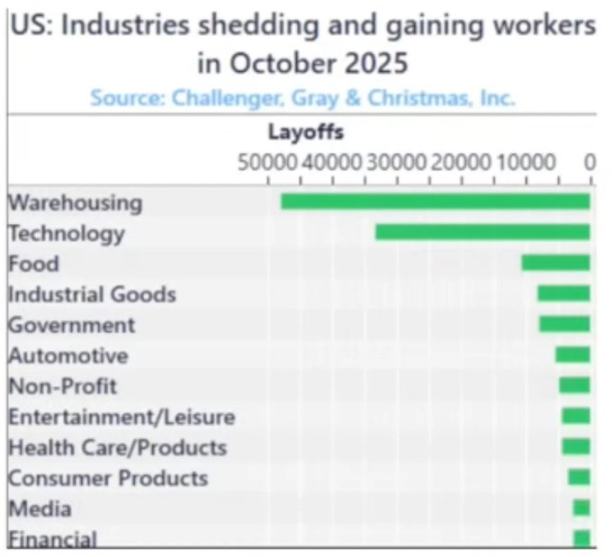

As a result, an economic divide has formed, with different sectors moving in completely opposite directions during recovery or economic cycles:

On one side: capital markets, asset holders, the tech industry, and large corporations are rapidly rising (profits, stock prices, wealth).

On the other side: wage earners, small businesses, blue-collar industries → declining or stagnating.

Growth and hardship coexist.

Policy Failure

Monetary policy can no longer truly benefit the real economy.

The Federal Reserve's interest rate cuts have driven up stock and bond prices but have not brought new jobs or wage growth. Quantitative easing has made it easier for large companies to borrow money but has not helped small businesses develop.

Fiscal policy is also nearing its end.

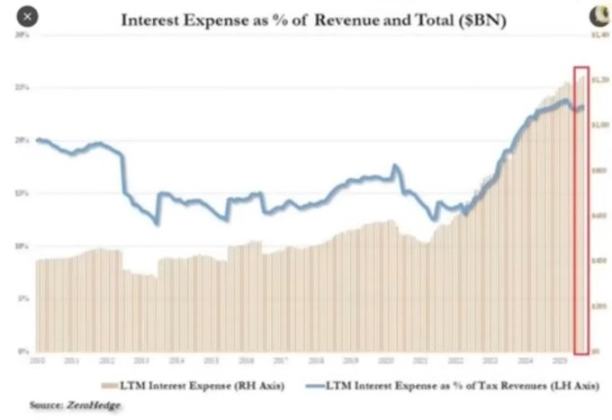

Today, nearly a quarter of government revenue is used solely to pay interest on national debt.

Policymakers find themselves in a dilemma:

Tightening policies to combat inflation leads to market stagnation; loosening policies to promote growth causes prices to rise again. This system has become self-reinforcing: once attempts are made to deleverage or reduce the balance sheet, it will impact the asset values that it relies on for stability.

Market Structure: Efficient Harvesting

Passive fund flows and high-frequency data arbitrage have turned the open market into a closed-loop liquidity machine.

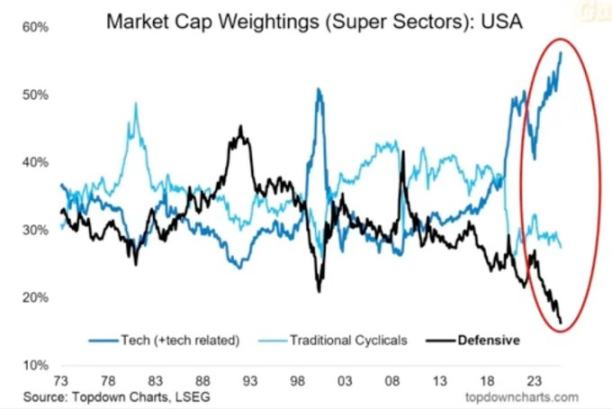

Positioning and volatility supply are more important than fundamentals. Retail investors have effectively become counterparties to institutions. This explains why defensive sectors are abandoned while tech stock valuations soar; the market structure rewards chasing gains, not value.

We have created a market that is highly price-efficient but has very low capital efficiency.

The open market has become a self-reinforcing liquidity machine.

Funds flow automatically → through index funds, ETFs, and algorithmic trading → creating continuous buying pressure, regardless of fundamentals.

Price movements are driven by fund flows, not value.

High-frequency trading and systematic funds dominate daily transactions, with retail investors actually standing on the opposite side of trades. Stock price fluctuations depend on positioning and volatility mechanisms.

Thus, tech stocks continue to inflate while defensive sectors lag behind.

Social Backlash: The Political Cost of Liquidity

Wealth creation in this cycle is concentrated at the top.

The richest 10% hold over 90% of financial assets; as the stock market rises, the wealth gap widens. Policies that drive up asset prices simultaneously erode the purchasing power of the majority.

Without substantial wage growth and the ability to afford housing, voters will ultimately seek change, either through wealth redistribution or political turmoil. Both exacerbate fiscal pressure and drive up inflation.

For policymakers, the strategy is clear: maintain rampant liquidity, boost the market, and claim economic recovery. Substitute superficial prosperity for substantive reform. The economy remains fragile, but at least the data can hold up until the next election.

Cryptocurrency as a Pressure Release Valve

Cryptocurrency is one of the few areas that does not rely on banks or governments to hold and transfer value.

Traditional markets have become a closed system, with large capital siphoning off most profits through private placements before going public. For the younger generation, Bitcoin is no longer just speculation; it is an opportunity to participate. When the entire system seems manipulated, at least there is still a chance here.

Although many retail investors have been hurt by overvalued tokens and VC sell-offs, the core demand remains strong: people crave an open, fair financial system that they can control.

Outlook

The U.S. economy is caught in a "reflexive" cycle: tighten → recession → policy panic → loosen → inflation → repeat.

The next round of easing may come in 2026 due to slowing growth and expanding deficits. The stock market may have a brief celebration, but the real economy will not truly improve unless capital shifts from supporting assets to productive investment.

Right now, we are witnessing the late-stage form of a financialized economy:

Liquidity acts as GDP

The market has become a policy tool

Bitcoin serves as a social pressure valve

As long as the system continues to cycle debt into asset bubbles, we will not achieve a true recovery, only a slow stagnation masked by rising nominal numbers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。