Author: arndxt

Compiled by: Tim, PANews

The U.S. economy has split into two worlds: financial assets continue to thrive, while the real economy is trapped in a slow decline.

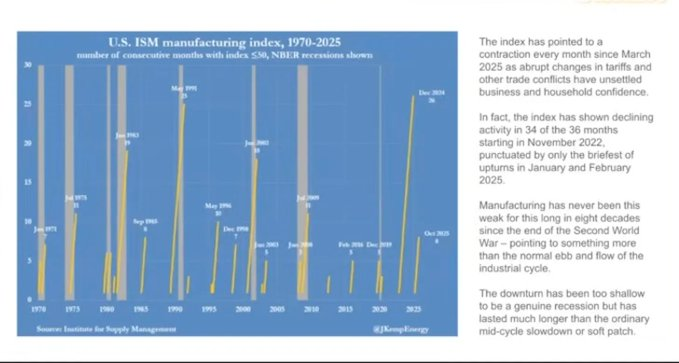

The ISM Manufacturing Index has been in contraction for over 18 months, setting a post-World War II record, but the stock market continues to rise, driven by profits concentrated in tech monopolies and the financial sector.

All of this is a result of balance sheet expansion.

Monetary liquidity continuously drives up financial asset prices, while wages, credit, and small business activity stagnate.

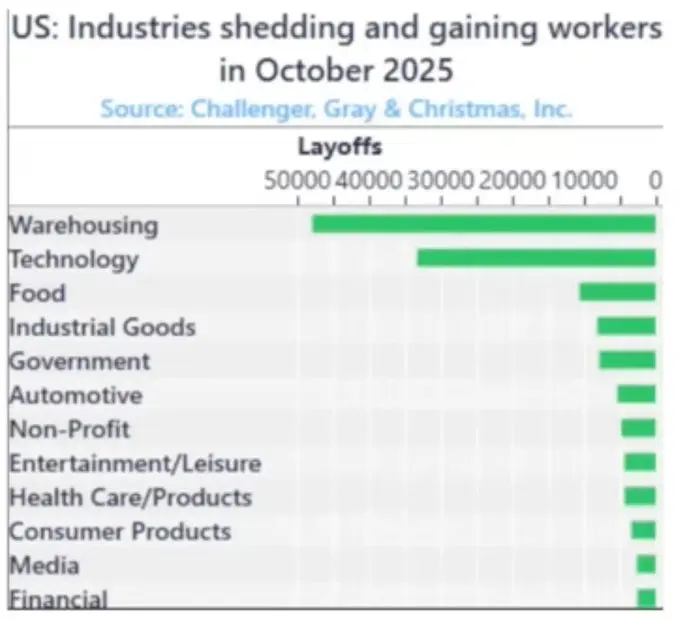

The result is the formation of a K-shaped economy, where different economic sectors develop in completely opposite directions.

K-shaped upward line: Capital markets, asset holders, the tech industry, and large enterprises are all experiencing soaring trends (profits, stock prices, wealth growth).

K-shaped downward line: The working class, small businesses, and blue-collar industries are facing stagnation or decline.

Growth and pain coexist.

Policy Collapse

Monetary policy has stopped transmitting to the real economy.

When the Federal Reserve cuts interest rates, it raises stock and bond prices but fails to create new jobs or increase wage levels. Quantitative easing makes it easier for large enterprises to obtain loans, rather than supporting the development of small and micro enterprises.

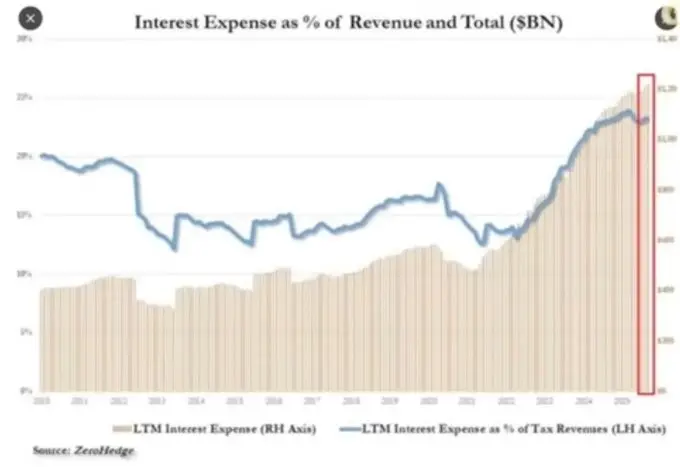

Fiscal policy also has little room to maneuver.

Currently, nearly a quarter of U.S. government fiscal revenue is used to pay interest on national debt.

This has left policymakers in a bind.

If they tighten policies to curb inflation, the capital markets will stagnate; if they loosen policies to support growth, prices will rise again. The entire economic system has become self-contained, and any attempt to reduce debt or balance sheets will inevitably impact the core assets that maintain economic stability.

Current Structure of Capital Markets

Passive fund flows and high-frequency arbitrage have transformed the public market into a closed-loop liquidity machine.

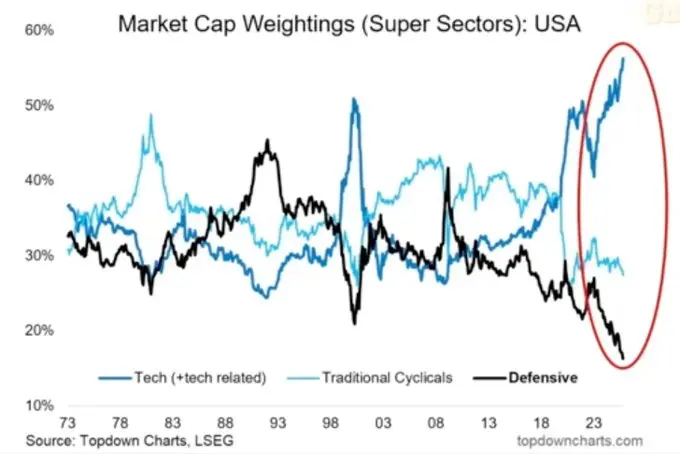

The importance of fundamental factors has been supplanted by position allocation and volatility mechanisms. Retail investors essentially play the role of counterparties to quantitative funds. This explains why defensive sectors have been abandoned and tech stock valuations continue to expand, as the current market structure rewards quantitative strategies over value investing.

The market we have designed, while maximizing price discovery efficiency, has undermined capital efficiency.

The public market has evolved into a self-recycling liquidity machine.

Funds automatically flow through passive index funds, ETFs, and algorithmic trading → forming a persistent buying spree that ignores fundamentals.

Price movements depend on capital flows rather than value.

High-frequency trading and quantitative funds dominate daily trading volume, while retail investors effectively act as counterparties to these trades. Stock price fluctuations depend on position allocation and volatility mechanisms.

This is why the tech sector continues to rise while defensive sectors perform poorly.

Social Reflexivity: The Political Cost of Liquidity

Wealth creation in this cycle is concentrated among the top wealthy individuals.

The richest 10% hold over 90% of financial assets, so when the market rises, inequality intensifies. Policies that drive up asset prices are eroding the purchasing power of everyone else.

If real wages do not increase and housing costs remain high, voters will ultimately demand change through wealth redistribution or political reform. Both pathways will increase fiscal pressure and exacerbate inflation.

For policymakers, the motivation is clear: maintain liquidity, stimulate market rebounds, and call it a recovery. Surface-level efforts have replaced thorough reform. Before the next major election in the U.S., although the economy is fragile, the chart data looks impressive.

Cryptocurrency as a Social Pressure Release Valve

Cryptocurrency is one of the few tools that allows people to store and transfer assets without relying on banks or governments.

Traditional markets have become a closed system: before the public is allowed to enter, large capital has already captured most of the profits through private placements.

For the younger generation, Bitcoin is less of a speculative tool and more of a new participation channel: when the entire system is filled with opaque operations, this becomes their only way to stay at the table.

Although many retail investors have suffered heavy losses due to overvalued token offerings and VC sell-offs, the core demand remains strong: people still crave a financial system that is open, fair, and self-controlled.

Outlook

The U.S. economy is caught in a reflexive cycle: tightening policies will trigger a recession, leading to panic, which will then initiate a liquidity flood, pushing inflation higher, and so on.

As economic growth data deteriorates and fiscal deficits widen by 2026, the U.S. is likely to initiate a new round of easing. The stock market will experience a brief frenzy, but unless capital shifts from financial assets to productive investments, the fundamentals of the real economy are unlikely to improve significantly.

We are currently witnessing the late symptoms of a financialized economy:

- Liquidity acts as GDP

- The market has become a policy tool

- Bitcoin serves as a social pressure release valve

As long as this system continues to inject debt cycles into asset inflation, what we will get is not a true recovery, but merely a slow stagnation disguised by rising nominal data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。