Recently, the DeFi space has been filled with alarm, with many veteran players warning of risks. A lot of people have abandoned short-term high yields and migrated their assets from various emerging DeFi protocols to safer ones.

The story begins on November 4, when the yield-bearing stablecoin xUSD experienced a flash crash, causing the issuer Stream to halt operations and resulting in a loss of $93 million. This event triggered a domino effect, leading to bad debts sweeping through mainstream lending protocols like Morpho and Euler, with total exposure reaching $285 million. It also brought to light the low transparency risks of the CeDeFi model and the incentive structure issues of Curators.

$93 Million Loss Triggers $285 Million Bad Debt

The catastrophic de-pegging of the yield-bearing stablecoin xUSD issued by Stream not only led the platform to suspend all deposit and withdrawal activities but also sparked a bad debt crisis in the DeFi market amounting to $285 million. This incident exposed a long-standing structural trap in the industry: the CeDeFi (a hybrid model of centralized and decentralized finance) packages opaque high yields as low-risk stablecoins and transforms individual risks into systemic risks through the Curator mechanism of mainstream lending protocols.

The crisis at Stream began when an external fund manager reported approximately $93 million in asset losses, prompting the platform to suspend all deposits and withdrawals and hire the law firm Perkins Coie to investigate. Following this news, xUSD experienced a panic sell-off, plummeting from $1 to $0.23, and then further crashing to a low of $0.08.

The timing of this event was particularly sensitive. Omer Goldberg, founder of Chao Labs, stated that the de-pegging of xUSD occurred right after a well-known DEX, Balancer, suffered a vulnerability incident exceeding $100 million. Although Stream's losses may not have a direct connection to Balancer's hack, it reflects the high interconnectivity within the DeFi ecosystem, where a negative event in one protocol can quickly trigger a chain reaction in other protocols through market sentiment and collateral links.

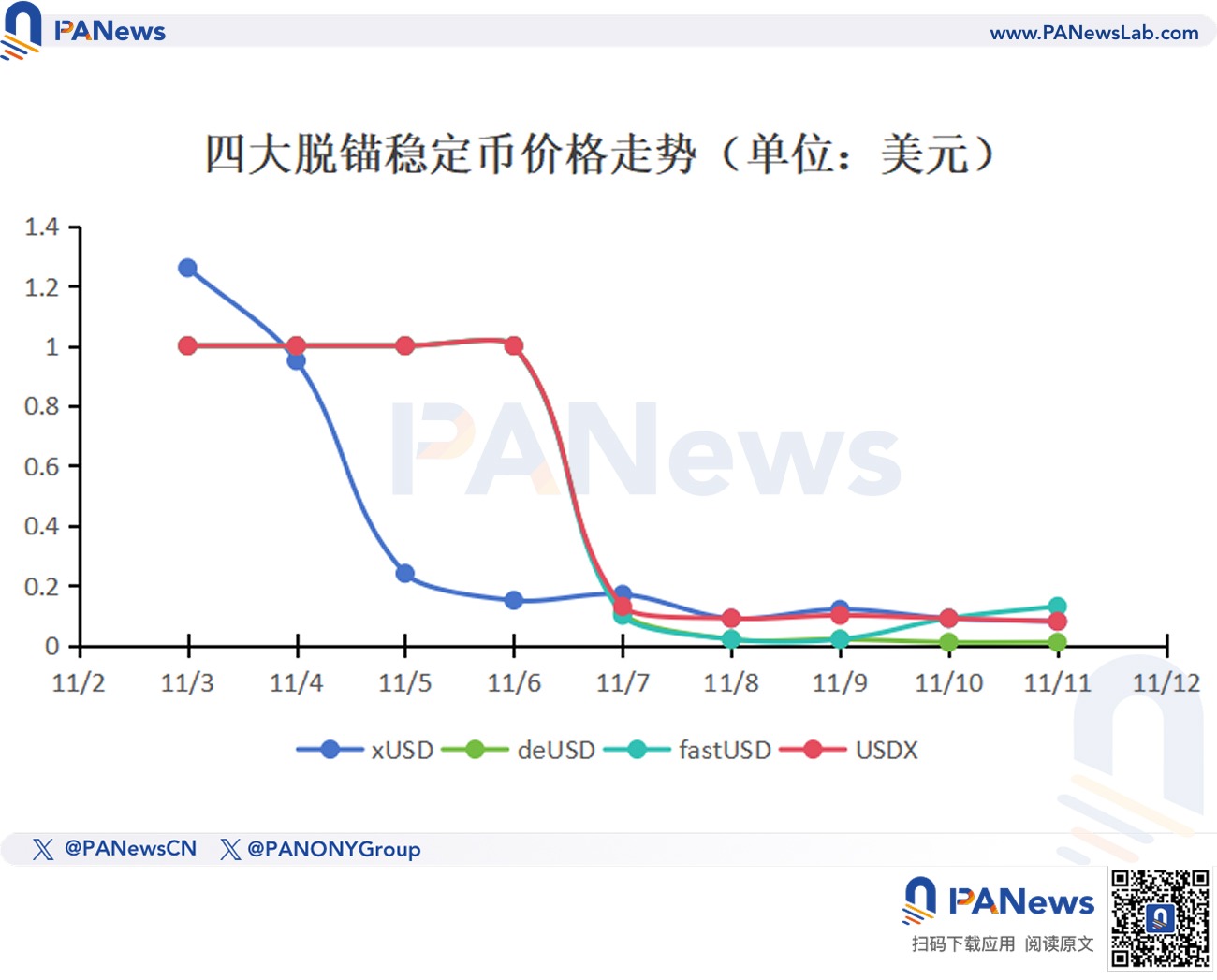

After the de-pegging of xUSD, several stablecoins that had related transactions or adopted similar mechanisms also rapidly fell to zero. Elixir had previously lent $68 million USDC to Stream, accounting for 65% of its issued stablecoin deUSD's total reserves, while Stream used its own stablecoin xUSD as collateral. When xUSD dropped by 65%, the supporting assets of deUSD almost instantly evaporated, leading to a liquidity run. Affected by market panic, stablecoins fastUSD and USDX, which were not directly related to xUSD/deUSD but employed similar mechanisms, also severely de-pegged, heading towards zero.

Even the leading synthetic stablecoin USDe was impacted, with its market cap dropping by about 8% over the past week, and the overall stablecoin market shrinking by more than $2 billion.

The collapse of xUSD also exposed the bad debt exposure of mainstream lending protocols, with major victims including lending protocols like Morpho and Euler that utilize the Curator mechanism. Data released by YAM indicated that the total collateral debt exposure associated with Stream reached approximately $285 million.

This crisis laid bare two major ailments of the DeFi market: first, under the CeDeFi hybrid structure, high yields mask the risks of information asymmetry; second, the Curator mechanism, as a bridge for risk allocation, rapidly amplifies the collapse of opaque single assets into cross-protocol systemic bad debts.

CeDeFi's Dark Operations Create High-Yield Trap for Stablecoins

The de-pegging of Stream's xUSD is a typical case of the structural risks inherent in the CeDeFi model. The essence of this model lies in combining the token synthesis capabilities of DeFi with the high risks and opaque yield strategies of CeFi (centralized finance).

xUSD is not a traditional stablecoin fully backed by fiat currency; rather, it is a type of "yield-bearing" stablecoin. Its peg does not depend on asset reserves but relies on a yield-generating investment portfolio. This portfolio typically includes collateral deployed in DeFi lending markets, LP positions, and a portion of off-chain capital managed by external asset managers.

The inherent risk of the CeDeFi model lies in information asymmetry. Stream claimed a TVL (Total Value Locked) of about $500 million, but on-chain tracking tools like DeBank could only trace about $150 million, revealing that the platform had transferred a significant amount of user funds to off-chain trading strategies through "dark operations."

The core value of DeFi lies in "minimizing trust." Users trust the protocol code, not manual operations. However, Stream placed one of its core yield processes off-chain and relied on external managers to report profits and losses. Once the off-chain managers incurred losses, centralized risks would flow back into the decentralized system.

Although xUSD was positioned as a stablecoin with a "Delta neutral strategy" aimed at reducing market volatility through hedging trades, it essentially resembled a "tokenized hedge fund." The reported loss of approximately $93 million by external fund managers indicates that Stream, while pursuing high yields through off-chain trading strategies, engaged in extreme leverage practices that contradicted the principle of "neutral" trading. This case also illustrates how CeDeFi can create the illusion of "high-yield stablecoins" through dark operations.

Curator Incentive Structure Misalignment Intensifies Risks

The Curator mechanism was initially designed to enhance capital efficiency and develop specialized strategies, but the xUSD de-pegging event exposed the potential for Curators to become "risk amplifiers" if not managed properly during a crisis.

Curators primarily exist in new-generation DeFi lending protocols like Morpho and Euler. They are a group of individuals or teams responsible for designing, deploying, and managing specific "strategy vaults." These vaults package complex yield strategies, allowing ordinary users to deposit and earn interest with a single click.

The core feature of the Curator mechanism is its non-custodial nature. Curators cannot directly access user funds; users' assets are always held by smart contracts, and they are limited to configuring and executing strategy operations through the protocol interface.

Despite the limitations on Curators' permissions, their profit model and incentive structure lay the groundwork for risk amplification. Their income primarily consists of performance fees and management fees. This performance-driven incentive structure is likely to encourage Curators to adopt more aggressive strategies in pursuit of higher yields, even introducing high-risk assets.

Essentially, this structure resembles hedge funds in traditional finance but lacks the corresponding regulatory and compliance scrutiny. In the DeFi environment, if a trading strategy fails, the losses will be borne by the users who deposited into the vault, while Curators may have already profited from the high yields in the early stages.

In the xUSD de-pegging event, the role of Curators with lax risk controls in amplifying risks was particularly evident. Through the strategy configurations of Curator vaults, low transparency stablecoins like xUSD were directly included in the collateral lists of mainstream lending protocols. From the list of Stream's victims, it was precisely because some Curators, such as MEV Capital and Re7, overlooked the risks of xUSD and allocated their funds to related asset pools that led to tens of millions of dollars in bad debts, transforming the crisis of a single asset's collapse into systemic risk.

CeDeFi Needs On-Chain Verifiability, Curators Need Interest Alignment

The collapse of Stream serves as a profound reminder to the industry that the innovative boundaries of DeFi are challenging its decentralization principles. To build a sustainable ecosystem, the industry must confront the transparency traps of the CeDeFi model and the misalignment of the Curator mechanism's incentive structure.

The de-pegging of xUSD and the resulting bad debts for mainstream lending protocols like Morpho and Euler also serve as further evidence of the failure to balance high yields with transparency in the CeDeFi space. High yields are often packaged with complexity, low transparency, and centralized risks.

When DeFi protocols introduce synthetic stablecoins as collateral, they inherit the mismanagement and information asymmetry risks of CeFi. The key to solving this issue lies in risk isolation and mandatory transparency.

- Risk Isolation and Layering: Lending protocols should require Curators to set stricter risk parameters for synthetic assets or completely isolate them into vaults with more conservative risk parameters, separate from other mainstream assets.

- Mandatory Transparency Standards: For synthetic stablecoins that rely on off-chain trading strategies for yields, there should be mandatory requirements for auditable real-time reserve proofs and asset allocation disclosures. Relying solely on smart contracts is insufficient to ensure safety; systems should integrate risk isolation and accountability mechanisms.

The original intention of the Curator mechanism was to enhance capital efficiency, but in the absence of effective accountability and low transparency, it can easily evolve into a shortcut for embedding low liquidity, high-risk assets into mainstream DeFi, thereby transforming single-point risks into systemic bad debts.

The future of Curators will depend on whether the mechanism itself can effectively balance capital efficiency with moral hazard. Protocol governance should adopt stronger measures to mitigate the issues with its incentive structure:

- Introduce Staking Penalty Mechanisms: Lending protocols should require Curators to stake a significant amount of their own assets and establish clear penalty mechanisms. If a Curator causes bad debts due to improper strategies or risk control failures, the protocol should confiscate their staked assets to cover part of the losses. This will also force Curators to align their motivation for pursuing high yields with their responsibility towards user principal.

- Enhance Transparency and Third-Party Verification: Protocols should mandate Curators to fully disclose their strategy models, risk exposures, and real-time conditions of underlying assets, and introduce independent third-party risk management agencies to verify Curators' model data, rather than relying solely on their claims.

Ethereum founder Vitalik Buterin once pointed out in a blog post that focusing more on low-risk DeFi can help the market better maintain the stability of the ecosystem economically. As he stated, the industry urgently needs protocols and Curators that respect risks.

PANews believes that even though the collapse of Stream has led to significant user fund losses for some Curators and caused the collapse of four stablecoins, the market should not completely deny yield-bearing stablecoins and the Curator mechanism, nor should the blame be placed on lending protocols like Morpho and Euler. Many projects and Curators have been collateral damage; they themselves are also "victims."

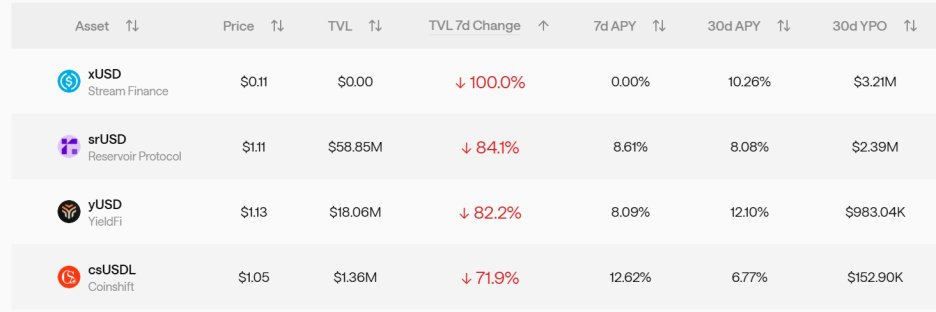

From a positive perspective, the market is currently in a phase of risk clearing. In this process, users can also identify Curators and protocols that truly respect risks and have real value. In the past week, four stablecoins in the market have successively gone to zero, each with numerous associated protocols or counterparties. However, Curators like Gauntlet and SteakhouseFi effectively prevented risks and avoided a chain crisis. Additionally, data from stablewatch shows that although protocols like Reservoir, YieldFi, and Coinshift have experienced significant capital outflows and sharp declines in TVL, the stablecoins they issued have still maintained their peg. PANews believes that both yield-bearing stablecoins and the Curator mechanism have their value and necessity; the industry simply needs to establish a more robust system to further improve them.

For investors, the scope of due diligence should also be more in-depth: it is essential not only to assess the security of the protocol code but also to evaluate the reputation of the Curators they are connected to, the transparency of their strategies, and the robustness of the underlying assets. The future of the industry depends on whether it can eliminate dark operations under the CeDeFi model through technological means and stricter governance structures, establishing a safer, more sustainable, and highly transparent DeFi ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。