Author: Azuma; Editor: Hao Fangzhou

Produced by: Odaily Planet Daily

DeFi is once again at the forefront of attention.

As one of the most vibrant narrative directions in the industry over the past few years, DeFi carries the hopes for the continued evolution and expansion of the cryptocurrency industry. I, who firmly believe in its vision, am accustomed to deploying over 70% of my stablecoin positions into various on-chain yield strategies, willing to take on a certain level of risk.

However, with the recent escalation of multiple security incidents, the interconnected effects of some historical events, and the gradual exposure of inherent issues that were originally hidden beneath the surface, a dangerous atmosphere has enveloped the entire DeFi market. Consequently, I, as the author of Odaily, chose to consolidate the majority of my on-chain funds last week.

What exactly happened?

Upper Chapter: Opaque High-Yield Stablecoins

Last week, several noteworthy security incidents occurred in DeFi. If the theft of Balancer was an unexpected isolated case, then the consecutive de-pegging of two so-called yield-bearing stablecoin protocols, Stream Finance (xUSD) and Stable Labs (USDX), exposed some fundamental issues.

The commonality between xUSD and USDX is that both are packaged as synthetic stablecoins similar to Ethena (USDe), primarily utilizing delta-neutral hedging arbitrage strategies to maintain their peg and generate yield. Such yield-bearing stablecoins have thrived in this cycle, as their business models are not overly complex, and with the prior success of USDe, a plethora of stablecoins have emerged, even experimenting with every possible combination of the 26 letters of the alphabet with the term USD.

However, many stablecoins, including xUSD and USDX, lack transparency regarding their reserves and strategies. Yet, under the stimulus of sufficiently high yields, these stablecoins still attracted a significant influx of funds.

In relatively calm market fluctuations, these stablecoins could maintain operations, but the cryptocurrency market is always subject to unexpected large-scale volatility. Trading Strategy analysis states (see "In-Depth Analysis of the Truth Behind xUSD's De-Pegging: The Domino Crisis Triggered by the October 11th Crash" (https://www.odaily.news/zh-CN/post/5207356)) that the key reason for xUSD's significant de-pegging was Stream Finance's opaque off-chain trading strategy encountering "automatic deleveraging" (ADL) during the extreme market conditions on October 11th (for a detailed explanation of the ADL mechanism, see "Detailed Explanation of the ADL Mechanism in Perpetual Contracts: Why Does Your Profitable Trade Get Automatically Liquidated?" (https://www.odaily.news/zh-CN/post/5206797)), which broke the originally delta-neutral hedging balance. Stream Finance's overly aggressive leverage strategy further amplified the impact of this imbalance, ultimately leading to Stream Finance being effectively insolvent and xUSD completely de-pegging.

The situation with Stable Labs and its USDX should be similar. Although its official announcement later attributed the de-pegging to "market liquidity conditions and liquidation dynamics," considering that the protocol has consistently failed to disclose reserve details and fund flow specifics as requested by the community, coupled with the suspicious behavior of the founder's address collateralizing USDX and sUSDX on lending platforms while unwilling to repay despite facing interest rates exceeding 100%, the situation of this protocol may be even worse.

The conditions of xUSD and USDX expose serious flaws in the emerging stablecoin protocol model. Due to the lack of transparency, these protocols exhibit a significant black-box space in their strategies. Many protocols claim to be delta-neutral models in their external communications, but the actual position structures, leverage ratios, hedging exchanges, and liquidation risk parameters remain undisclosed, making it nearly impossible for external users to verify whether they are truly "neutral," effectively becoming a party that bears transferred risks.

A classic scenario for the outbreak of such risks is when users invest mainstream stablecoins like USDT and USDC to mint emerging stablecoins like xUSD and USDX to earn attractive yields. However, once the protocol encounters issues (and it must be noted that there is a distinction between real problems and staged events), users find themselves in a completely passive position. Their stablecoins may quickly de-peg under panic selling, and if the protocol is conscientious, it might offer some compensation from remaining funds (even if compensation is offered, retail investors are often last in line). If not conscientious, it could simply soft-rug and disappear.

However, it would be unfair to dismiss all delta-neutral yield-bearing stablecoins. From the perspective of industry expansion, actively exploring diverse yield paths through emerging stablecoins has its positive significance. Some protocols, represented by Ethena, provide clear disclosures (Ethena's recent TVL has also significantly shrunk, but the situation is different; Odaily will write another article on this later). However, the current situation is that you do not know how many undisclosed or inadequately disclosed protocols have encountered similar issues as xUSD and USDX. While writing this article, I can only assume innocence, so I can only use "explosive" protocols as examples, but from the perspective of ensuring the safety of one's positions, I would recommend you assume guilt.

Lower Chapter: Lending Protocols and Curators

Some may ask, can't I just avoid these emerging stablecoins? This leads us to the two main characters in the second half of this round of systemic risks in DeFi—modular lending protocols and Curators (the community seems to have gradually accustomed to translating this as "Curator," and Odaily will directly use this translation below).

Regarding the role of Curators and their function in this round of risks, we provided a detailed explanation last week in the article "What is the Role of Curators in DeFi? Could They Be the Hidden Dangers of This Cycle?" (https://www.odaily.news/zh-CN/post/5207336). Interested readers can directly refer to that article, while those who have read the original can skip the following paragraphs.

In short, professional institutions like Gauntlet, Steakhouse, MEV Capital, and K3 Capital act as Curators, packaging relatively complex yield strategies into user-friendly funds on lending protocols like Morpho, Euler, and ListaDAO, allowing ordinary users to deposit mainstream stablecoins like USDT and USDC with a single click to earn high yields. The Curators then determine the specific yield strategies for the assets on the backend, such as allocation weights, risk management, rebalancing cycles, withdrawal rules, and so on.

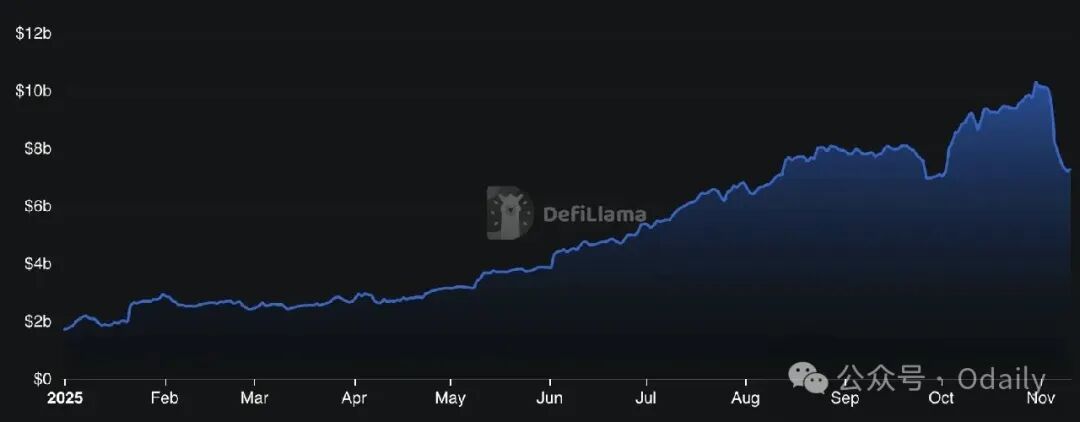

Since this fund pool model often provides more attractive yields than classic lending markets (like Aave), it naturally attracts a surge of funds. Defillama shows that the total scale of fund pools operated by major Curators has rapidly grown over the past year, briefly surpassing $10 billion at the end of October and the beginning of this month, and as of the time of writing, it still reports $7.3 billion.

Curators' profit paths mainly rely on performance sharing and fund pool management fees. This profit logic dictates that the larger the scale of the fund pools managed by Curators and the higher the strategy yield, the greater their profits will be. Since most deposit users are not sensitive to brand differences among Curators, their choice of which pool to deposit into often depends solely on the apparent APY figures. This means that the attractiveness of fund pools is directly linked to strategy yield, making the yield of the strategy the core factor determining the Curators' profitability.

Under the yield-driven business logic, coupled with a lack of clear accountability paths, some Curators have gradually blurred the safety issues that should have been prioritized, choosing to take risks—"After all, the principal is the user's, and the profit is mine." In recent security incidents, Curators like MEV Capital and Re7 allocated funds to xUSD and USDX, indirectly exposing many users who deposited through lending protocols like Euler and ListaDAO to risks.

However, the blame cannot solely rest on the Curators. Some lending protocols are equally culpable. In the current market model, many deposit users are not even aware of the role of Curators, simply believing they are depositing funds into a well-known lending protocol for yield. In this model, lending protocols play a more explicit endorsement role and also benefit from the model's explosive growth in TVL, so they should bear the responsibility of monitoring the Curators' strategies. However, it is evident that some protocols have failed to do so.

To summarize, a classic scenario of such risks is when users deposit mainstream stablecoins like USDT and USDC into a lending protocol's fund pool, but most are unaware that Curators are utilizing the funds to run yield strategies and are unclear about the specific details of those strategies. The backend Curators, driven by profit margins, then deploy funds into the aforementioned emerging stablecoins. After the emerging stablecoins explode, the fund pool strategy fails, and deposit users indirectly suffer losses. Subsequently, the lending protocol itself may face bad debts (it seems that timely liquidation would have been better; forcibly locking in the de-pegged stablecoin's oracle price to avoid liquidation could exacerbate the problem due to large-scale hedging borrowings), causing more user groups to be affected… In this pathway, risks are systematically transmitted and diffused.

Why have we reached this point?

Looking back at this cycle, the trading side has already entered a hellish difficulty.

Traditional institutions only favor a very small number of mainstream assets; altcoins are in a continuous decline with no bottom in sight; insider trading and machine programs run rampant in the meme market; and the massacre on October 11th… A large number of retail investors have merely been running alongside or even incurring losses in this cycle.

Against this backdrop, the demand for wealth management, which appears to be a more certain path, has gradually increased, compounded by the milestone breakthroughs in stablecoin legislation. A plethora of emerging protocols packaged as yield-bearing stablecoins have emerged in bulk (perhaps these protocols should not even be called stablecoins), throwing olive branches to retail investors with annualized yields often exceeding ten or even dozens of points. Among them, there are certainly standout protocols like Ethena, but it is also inevitable that there are mixed offerings.

In the highly competitive yield-bearing stablecoin market, to make the product's yield more attractive—without needing to sustain it long-term, just maintaining better data until the token issuance or exit—some protocols may seek higher yields by increasing leverage or deploying off-chain trading strategies (which may be completely non-neutral).

At the same time, decentralized lending protocols and Curators conveniently address some users' psychological barriers regarding unknown stablecoins—"I know you don't feel secure storing your money as xxxUSD, but you're depositing USDT or USDC, and the Dashboard will also show your positions in real-time. How can you not feel secure?"

The operational status of the above model has been relatively good over the past year, at least not experiencing large-scale explosions for an extended period. Since the market has generally been in a relatively upward phase, there has been sufficient basis for arbitrage between spot and futures markets, allowing most yield-bearing stablecoin protocols to maintain relatively attractive yield performances. Many users have also relaxed their vigilance during this process, and double-digit stablecoin or fund pool yields seem to have become the new norm for wealth management… But is this really reasonable?

Why do I strongly recommend that you temporarily withdraw?

On October 11, the cryptocurrency market suffered an epic bloodbath, with hundreds of billions of dollars being liquidated. Evgeny Gaevoy, founder and CEO of Wintermute, stated at the time that he suspected some entities operating long-short hedging strategies had incurred severe losses, but it was unclear who had lost the most.

In hindsight, the consecutive explosions of so-called delta-neutral protocols like Stream Finance partially confirmed Evgeny's suspicions, but we still do not know how many hidden dangers remain underwater. Even for those not directly affected by the liquidation on that day, the rapid tightening of market liquidity following the October 11 crash, combined with the contraction of basis arbitrage space due to cooling market sentiment, will increase the survival pressure on yield-bearing stablecoins. Various unexpected incidents often occur during such times, and due to the complex interconnections often present in opaque fund pool strategies, the entire market is prone to a "domino effect."

Data from Stablewatch shows that as of the week of October 7, yield-bearing stablecoins experienced their largest outflow since the collapse of UST during the Luna crisis in 2022, totaling $1 billion, and this outflow trend is ongoing. Additionally, data from Defillama indicates that the scale of fund pools operated by Curators has shrunk by nearly $3 billion since the beginning of the month. It is clear that funds have reacted to the current situation through their actions.

DeFi also applies to the classic "impossible triangle" of investment markets—high yield, safety, and sustainability can never be satisfied simultaneously, and the current factor of "safety" is teetering on the brink.

Perhaps you have become accustomed to investing funds in a certain stablecoin or strategy for yield, and have achieved relatively stable returns through this operation over a long period. However, even products that consistently employ the same strategy do not have static risk profiles. The current market environment is characterized by relatively high risk factors and a window where unexpected incidents are most likely to occur. At this time, caution is paramount, and a timely withdrawal may be a wise choice; after all, when a low-probability event happens to you, it becomes 100%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。