Author: zhou, ChainCatcher

On November 10, a comparison chart of X followers ignited heated discussions in the crypto community. Binance founder Zhao Changpeng (CZ) unfollowed over three hundred accounts from his X account in less than two months. This number, far exceeding the usual maintenance, is seen as a precise cleanup and reveals a hidden yet once very active gray industry chain: accounts followed by CZ were publicly traded for tens of thousands of dollars.

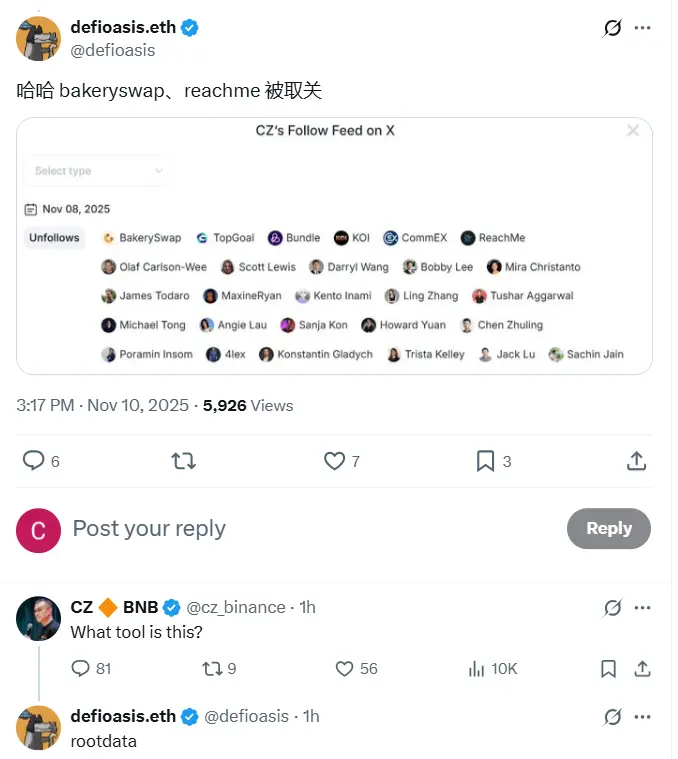

Image source: X user @_FORAB

According to crypto data statistics platform RootData, on November 8-9, CZ unfollowed a batch of accounts, including active projects on the BNB chain such as BakerySwap and ReachMe. CZ initially responded that he was just cleaning up inactive accounts, but later publicly stated not to buy accounts he follows, and if any are found for sale, he would immediately unfollow. The community also reported that during the bull market, the highest transaction price for a single account followed by CZ reached $80,000, with cases of $20,000 and several thousand dollars being common.

It is worth mentioning that Oracle is a typical case of buying accounts to gain traffic and ultimately running away with the money. It is reported that on October 10, 2025, the Oracle project team disappeared with the funds, and the account ceased operations. Community investigations show that Oracle likely acquired its status by "buying accounts" (originally an old account on CZ's follow list), and after the buyer took over, they renamed it, changed the avatar, issued tokens, and used the residual halo to inflate prices, only to be clarified by Four Meme that they were not partners, ultimately leading to the exit.

On the surface, this is a farce of account trading, but it actually exposes deeper issues of attention distortion in the industry and the extreme marketing methods of project teams.

As one of the largest platforms by trading volume globally, Binance's listing review process has long been criticized for its vague standards, with decision-making power highly concentrated in a few executives or internal teams. While mechanisms like community voting and budget transparency appear to provide fair entry opportunities, the final decisions are still controlled manually (compliance review, liquidity assessment, risk control judgment); the chances for small projects to gain exposure through formal channels are more like products of internal relationships or personal preferences of the bosses, rather than the objective strength of the projects themselves. This directly leads to extreme choices by project teams, spending tens of thousands of dollars to buy an account "followed by CZ," rebranding it to harvest traffic, which is far more cost-effective than spending months refining products or building communities.

At the same time, this phenomenon also reflects a systemic distortion of attention in the industry, where the lack of effective evaluation mechanisms has turned traffic into hard currency. Retail investors tend to treat celebrity dynamics as endorsements, and project teams no longer compete on code quality, on-chain data, or long-term planning, but rather on who can seize the spotlight faster, leading the industry into a vicious cycle of "the less transparent, the more reliant on connections and shortcuts."

The editor also pointed out in the article “What Happened to Those Who Followed CZ?” that the so-called signal calling is just a spark, and the community riding the concept adds fuel to the fire; the combination of the two ignited the market, indicating that the market itself needs hotspots to maintain attention and liquidity. Whether it is public signal calling or "invisible endorsements" in the follow list, under an immature evaluation mechanism, both can become short-term FOMO drivers.

CZ's recent purge, in a sense, serves as a wake-up call for the industry: when project exposure no longer relies on the preferences of a single person or platform, project teams will return to the product itself, and retail investors will learn to judge value using data.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。