1. Market Background

Recently, the market rotation pace has noticeably accelerated, with underperforming sectors showing temporary activity. The leading anonymous coins DASH and ZEC initiated the movement, followed by the storage sector representatives AR and FIL, forming a short-term structure driven by "capital low absorption + oversold rebound."

At the same time, mainstream coins BTC and ETH have gradually stabilized in the bottom region, with sufficient leverage clearing, and market sentiment has shifted from extreme panic to cautious observation.

Against this backdrop, the willingness of capital to bet on undervalued sectors has increased, with the anonymous and storage sectors becoming the most resilient representatives in this round of rebound.

2. Correlation Between Sentiment and Price

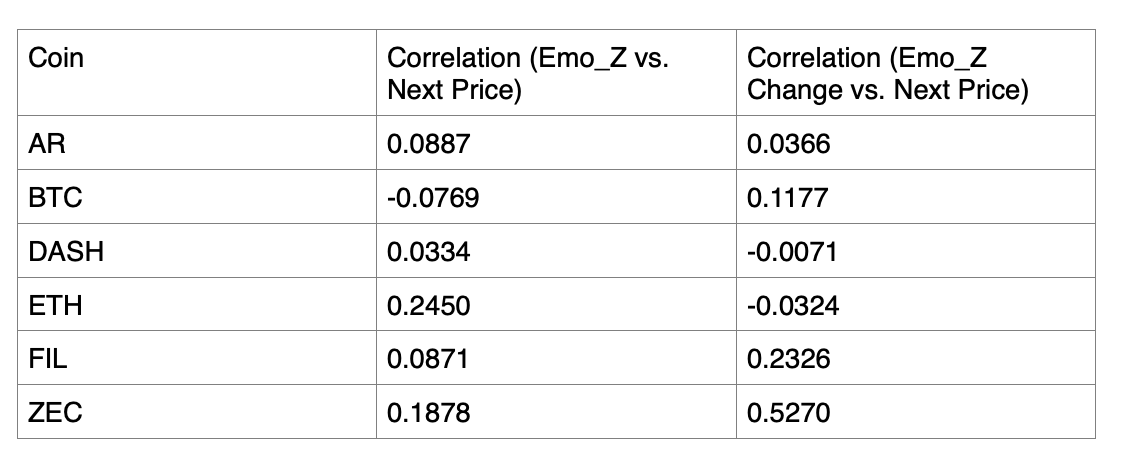

Based on hourly data, we calculated the Pearson correlation coefficient between the sentiment indicator (Emo_Z) and the price change rate in the next hour.

The results show that the sentiment correlation for ETH and ZEC is particularly prominent, especially the sentiment changes for ZEC, which exhibit a significant positive correlation with price changes (R=0.527), indicating that the anonymous coin sector is more sensitive to fluctuations in market sentiment. In other words, when the sentiment indicator changes sharply, prices often respond with synchronous feedback in the short term.

3. Model Logic and Signal Interpretation

The model adopts a correlation adaptive strategy framework, automatically switching signal directions based on the sentiment-price relationship of different coins:

- Trend Following Strategy (Momentum): When sentiment and price are positively correlated (R ≥ 0), rising sentiment is viewed as a signal of enhanced momentum;

- Contrarian Strategy: When sentiment and price are negatively correlated (R < 0), extremely pessimistic intervals become potential buying points;

- The threshold is set at ±2, corresponding to the extreme intervals of sentiment distribution, triggering signals only when market sentiment shows strong deviation.

This design allows the model to flexibly switch logic in different market environments, capturing the trend of strong coins while also identifying reversal opportunities for underperforming coins.

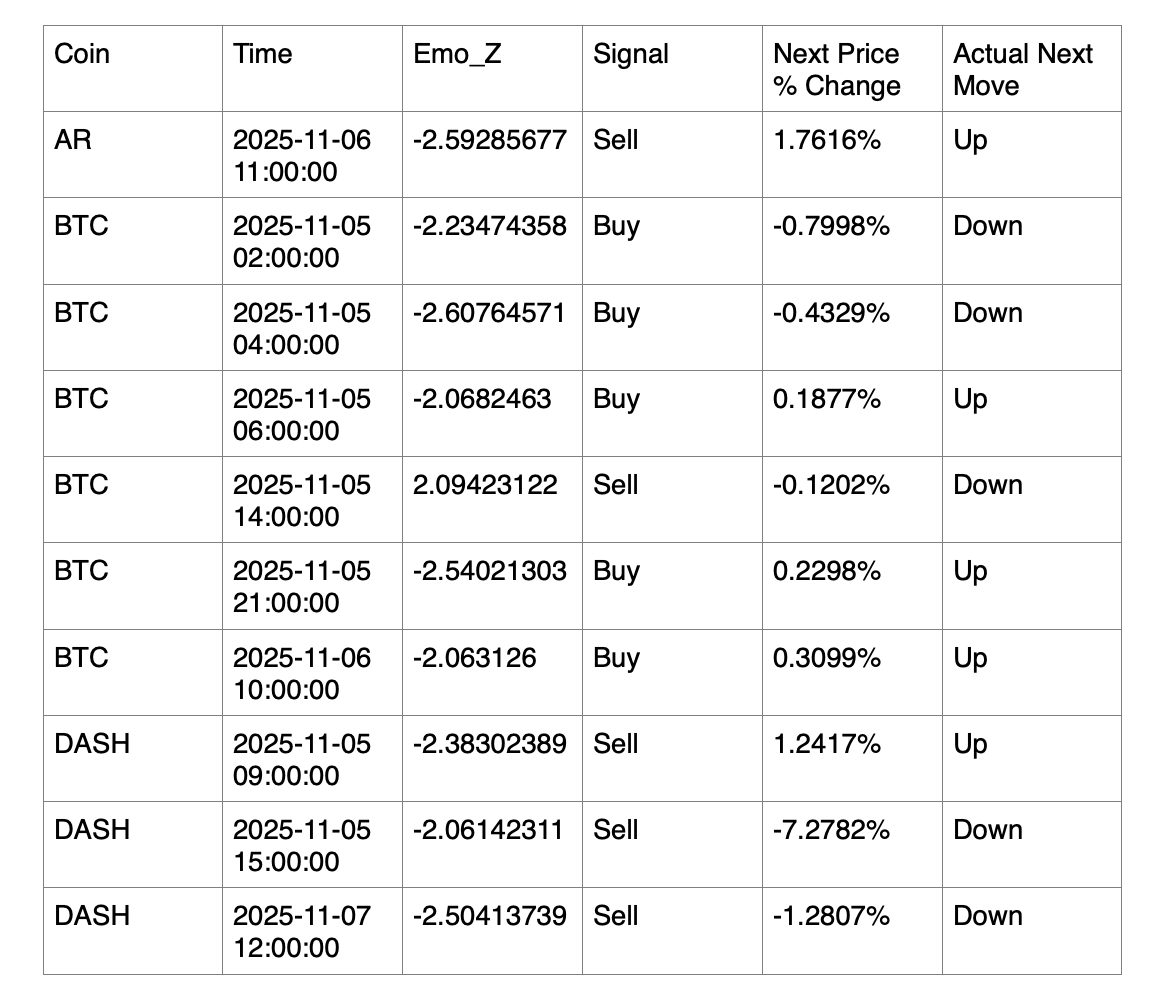

4. Signal Backtest Performance

In the sample period at the beginning of November 2025, the model triggered a total of 17 valid signals, of which 11 were correct, resulting in a next-hour price direction prediction accuracy of 64.71%.

Signals were mainly concentrated in the activation phase of the anonymous and storage sectors from November 5 to November 7, particularly with ZEC, DASH, and AR entering extreme sentiment intervals multiple times.

Some typical signals are as follows:

5. Core Conclusions

- The anonymous and storage sectors performed first in this round of market rotation, showing a clear oversold rebound structure;

- The sentiment indicator Emo_Z ±2 interval can effectively identify extreme market conditions, providing quantitative references for phase reversals;

- The process of capital flowing from mainstream coins to underperforming coins is accompanied by rapid sentiment recovery and improved transaction efficiency;

- Extreme sentiment often leads price to form "resonance turning points," possessing high monitoring value;

- It is recommended to focus on short-term opportunities in high-resilience sectors like anonymous and storage when similar extreme sentiment intervals occur in the future.

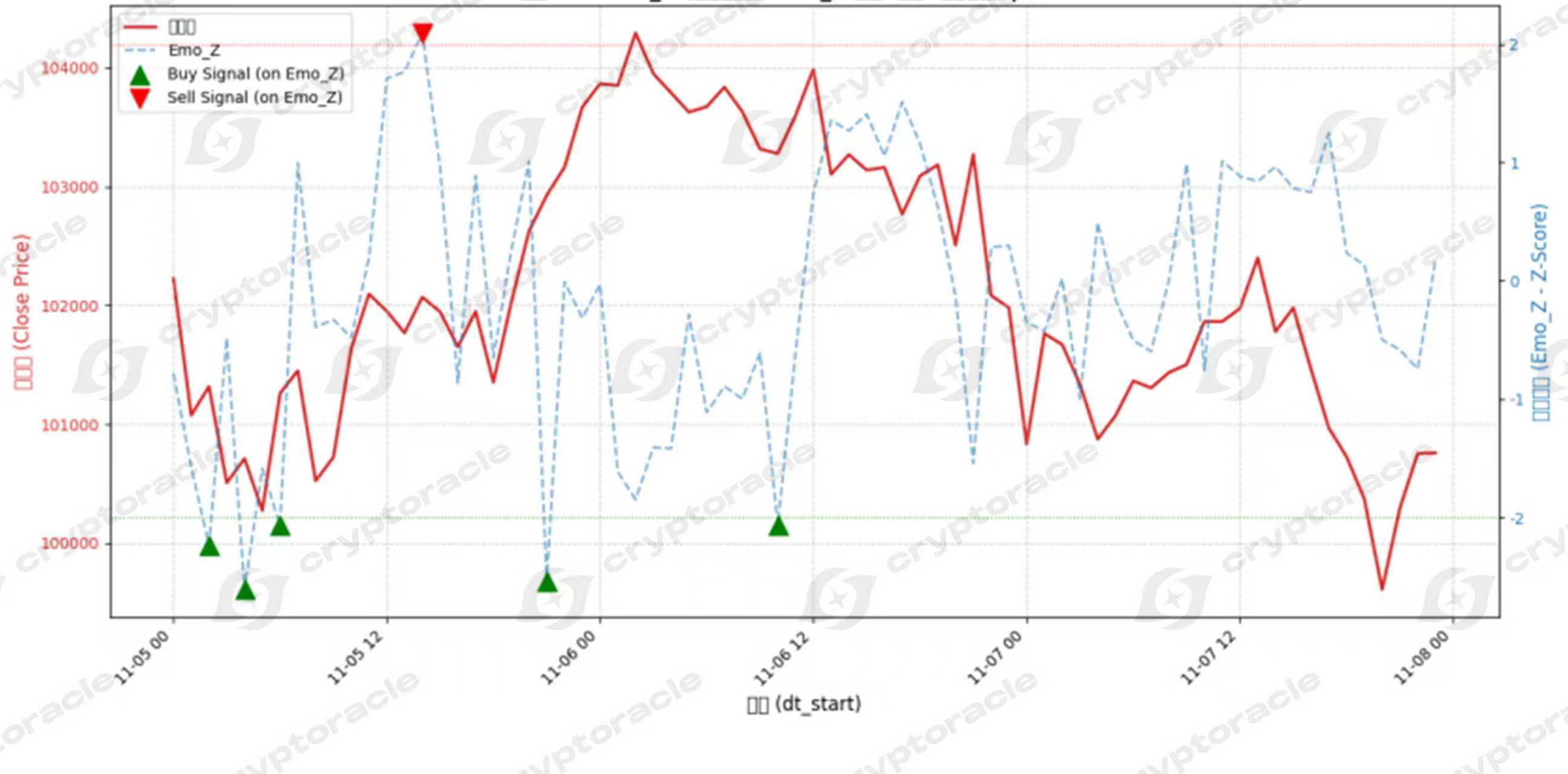

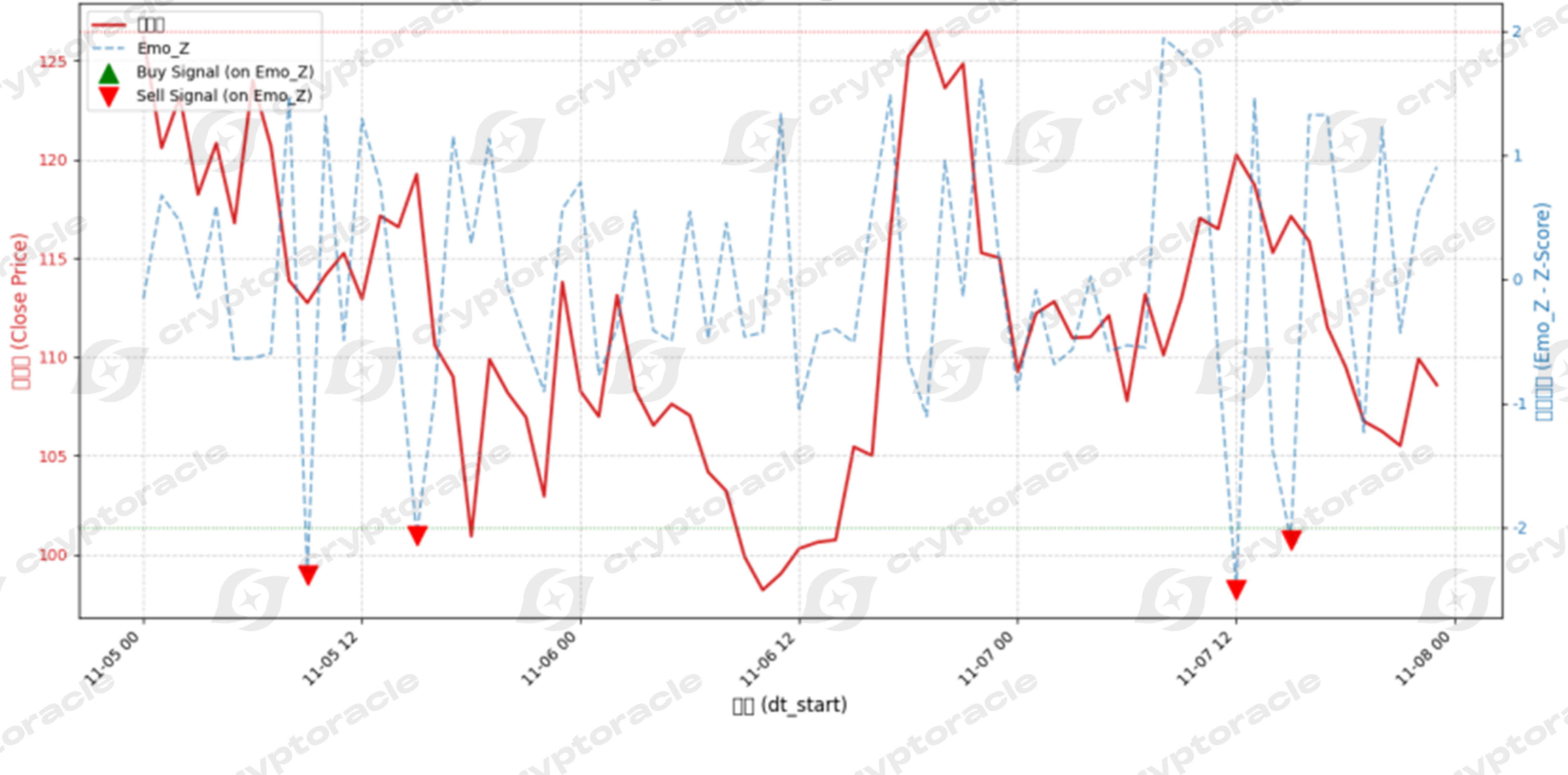

6. Chart Display

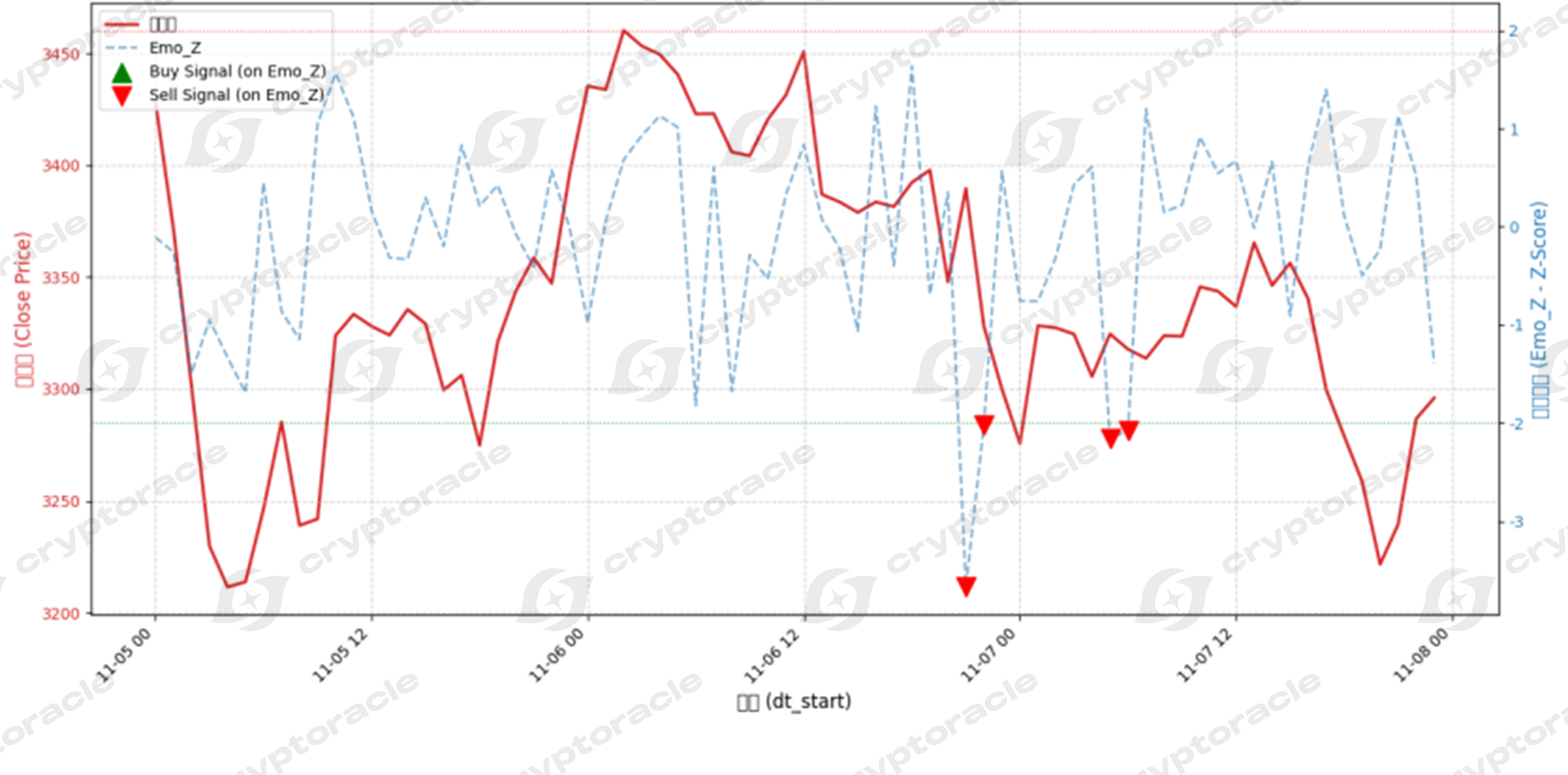

The report includes a dual-axis chart of sentiment and price that clearly shows the signal distribution of various coins at different stages:

BTCPriceEmoZ_OnEmoZLine:

DASHPriceEmoZ_OnEmoZLine:

ETHPriceEmoZ_OnEmoZLine:

- Green Up Triangle: Buy signal triggered when sentiment is extremely low;

- Red Down Triangle: Sell signal triggered when sentiment is overheated.

In the chart, it can be observed that the sentiment curve for anonymous coins showed a significant turning point in early November, with signals concentrated and possessing a certain degree of foresight.

7. Risk Warning

- This report is based on historical data and statistical correlations and does not constitute any investment advice.

- The volatility of crypto assets is high, and sentiment indicators may lag or distort under extreme market conditions.

- Investors should comprehensively assess factors such as macro liquidity, capital structure, and market expectations, and operate cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。