Original Title: "Coinbase Anti-Money Laundering Reform Proposal: Balancing Innovation and Compliance"

Original Source: Hong Kong Anti-Money Laundering Alliance HKAML

Recently, Coinbase, one of the largest cryptocurrency exchanges in the United States, submitted a 30-page policy proposal to the U.S. Department of the Treasury, calling for a complete reform of anti-money laundering (AML) regulations that have been in place for decades. Its core argument—"When bad actors innovate, good actors must innovate too"—quickly sparked widespread discussion both within and outside the cryptocurrency industry. Coinbase advocates for a greater reliance on technological innovation rather than simply enhancing law enforcement in the face of increasingly complex digital asset crimes. As an organization committed to maintaining the integrity of the financial system, the Hong Kong Anti-Money Laundering Alliance believes that Coinbase's proposal touches on a core issue of the global anti-money laundering system: how to encourage financial innovation while ensuring a solid and effective regulatory framework to prevent the expansion of risk exposure.

We acknowledge that technology is an indispensable ally in the fight against money laundering. However, while embracing innovation, we must carefully assess the potential risks it may bring and remain vigilant against any attempts to undermine core regulatory principles in the name of "innovation." This article will analyze the rationale and potential risks of the Coinbase proposal from a regulatory perspective and explore the balance of future digital asset anti-money laundering efforts, drawing on Hong Kong's practical experience in global virtual asset regulation.

The Double-Edged Sword of Innovation: Core Demands and Potential Risks of the Coinbase Proposal

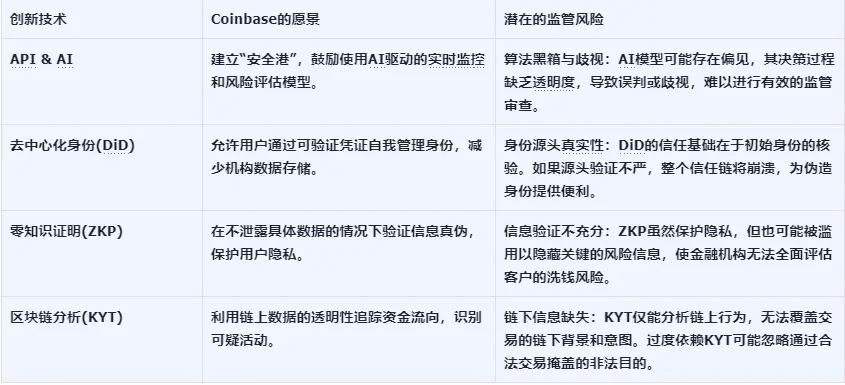

Coinbase's proposal primarily revolves around four major technological innovations: Application Programming Interfaces (APIs), Artificial Intelligence (AI), Decentralized Identity (DiD), and Zero-Knowledge Proofs (ZKP), as well as blockchain-based transaction analysis (KYT). Its core demand is to establish "Regulatory Safe Harbors" for financial institutions adopting these innovative technologies, to alleviate their compliance burdens and encourage technological application.

In its response document, Coinbase clearly states: "The era of a person walking into a bank to open an account by showing identification is long gone… Requiring businesses to collect copies of identification online not only poses a significant risk of identity theft but also demands substantial compliance resources."[1]

This viewpoint reflects the reality of financial services in the digital age. However, the establishment of "safe harbors" must be based on extremely prudent and clear conditions. If the standards are too lenient, it may lead to the following risks:

Hong Kong Experience: Leading Innovation Through Prudent Regulation

In the wave of global virtual asset regulation, Hong Kong has chosen a prudent and forward-looking path. Since June 1, 2023, Hong Kong has officially implemented a mandatory licensing system for Virtual Asset Service Providers (VASP), bringing all centralized cryptocurrency exchanges under the comprehensive regulation of the Securities and Futures Commission (SFC). This framework has not sacrificed regulatory certainty and rigor in pursuit of innovation, providing a model worth emulating globally.

Unlike Coinbase's pursuit of "safe harbors," Hong Kong's regulatory philosophy is "same business, same risk, same rules." This means that regardless of the innovative technologies employed by VASPs, their core AML/CFT obligations—including Customer Due Diligence (CDD), ongoing transaction monitoring, Suspicious Transaction Reporting (STR), and compliance with the Financial Action Task Force (FATF) "Travel Rule"—must be executed without exception.

The Hong Kong SFC explicitly states in its regulatory framework that VASPs must demonstrate the reliability, safety, and compliance of their technologies to the regulatory authorities when adopting new technologies, and establish sound governance and oversight mechanisms. For example, when using AI for transaction monitoring, platforms must be able to explain the logic of their algorithms to regulators, validate their effectiveness, and take responsibility for the final decisions. This approach does not stifle innovation but rather guides it to develop along responsible paths.

Conclusion: Moving Towards Responsible Innovation

Coinbase's proposal serves as a wake-up call for global regulators: in the face of rapidly evolving technologies in the digital asset space, clinging to outdated practices may indeed lead to regulatory failure. We support enhancing the efficiency and accuracy of anti-money laundering efforts through technology. However, the core principles of anti-money laundering—Know Your Customer (KYC), risk assessment, and behavior monitoring—must never be undermined by the guise of technology.

We call for any reforms to the anti-money laundering system to adhere to the following principles:

Technological neutrality, risk-based: Regulation should focus on the risks inherent in financial activities themselves, rather than the technological forms through which they are realized. Both traditional banks and crypto platforms should be subject to regulation commensurate with their risk levels.

Clear responsibilities, rather than reliance on "safe harbors": Financial institutions should always be the primary responsible parties for fulfilling anti-money laundering obligations. Regulatory authorities can provide guidance but should not establish vague "safe harbors" to exempt or lessen the core responsibilities of institutions.

Strengthen international cooperation to fill regulatory gaps: As Coinbase pointed out, non-compliant offshore entities are a significant source of risk. Regulatory authorities in various countries should enhance cooperation under the framework of international organizations like the FATF to jointly combat cross-border money laundering activities.

The Hong Kong Anti-Money Laundering Alliance will continue to closely monitor the latest developments in global digital asset regulation and work closely with the industry and regulatory authorities to promote the establishment of a healthy financial ecosystem that embraces innovation while effectively mitigating risks. We believe that only through a prudent balance between innovation and compliance can the digital asset industry achieve a sustainable future.

References

[1] Coinbase. (2025, October 17). Response to Treasury RFC on Innovative Methods to Detect Illicit Activity Involving Digital Assets. https://assets.ctfassets.net/sygt3q11s4a9/2JiDDSZgdu1zwNlwkLgE24/12b9465b1b96198a702288555713dbd3/Coinbase_Response_to_Treasury_RFC_on_Innovative_Methods_To_Detect_Illicit_Activity_Involving_Digital_Assets__1_.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。