Author: Chloe, ChainCatcher

The market has yet to recover from the aftershocks of October 11, and another wave of the DeFi domino effect is unfolding.

According to data from stablewatch, yield-bearing stablecoins experienced the most severe capital outflow since the collapse of Terra UST in 2022, totaling up to $1 billion over the past week. Among them, Stream Finance's xUSD alone saw an outflow of $411 million, acting as the trigger, and unexpectedly, this was not a singular event; this chain liquidation tore apart the fragile structure of the DeFi Lego stack.

Extreme Negative Returns Amid Plummeting Collateral Values and Near 100% Utilization

The crisis was ignited on November 3, when Stream Finance suddenly announced that an external fund manager had incurred a loss of $93 million in trading, subsequently freezing all deposit and withdrawal functions. The price of xUSD plummeted from $1 to $0.43, with a market cap evaporating by over $500 million, currently struggling around $0.11. The chain reaction was instantaneously triggered, with Elixir's deUSD being the first to bear the brunt, as a lending partner of Stream, holding a large amount of xUSD as collateral, which saw its value evaporate by 65%, approximately $68 million USDC.

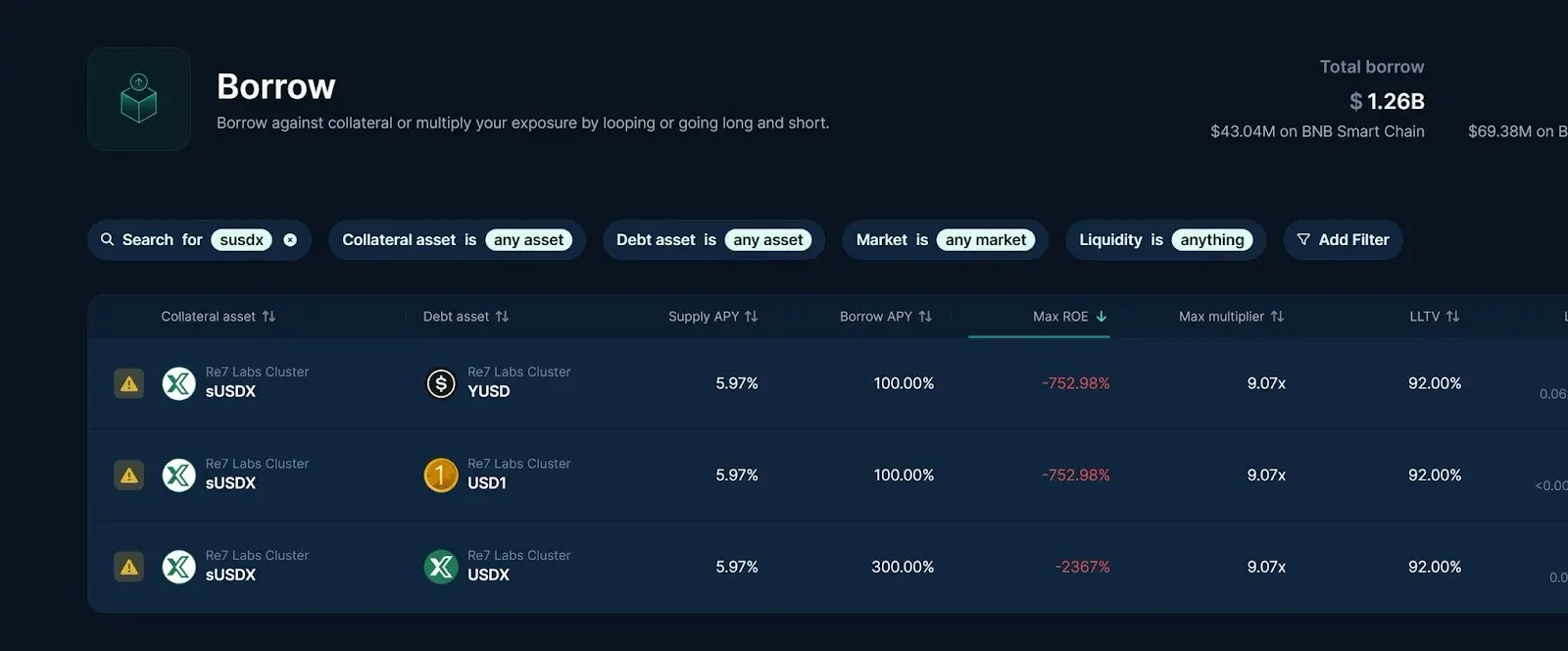

Meanwhile, the hidden market utilization rates of lending platforms Morpho and Euler surged to 95% to 100%, with borrowing rates once showing an anomalous value of negative 752%, indicating that the collateral had become a dead asset. Compound urgently closed parts of its markets, and protocols like Silo and Treeve's scUSD also followed suit in decoupling.

Today, Elixir's official Twitter announced that the stablecoin deUSD has officially been retired and no longer holds any value, and the platform will initiate a USDC compensation process for all holders of deUSD and its derivatives (such as sdeUSD). The affected range includes collateral providers on lending platforms, AMM LPs, Pendle LPs, and more. Elixir also warned users not to purchase or invest in deUSD through AMM or other channels.

This marks the first time in DeFi history that a protocol has actively announced the "euthanasia" of a stablecoin; while it preserved the principal for holders, it completely ended the deUSD ecosystem. Elixir emphasized that the compensation funds come from the protocol's reserves and assets recovered from Stream, but did not disclose specific timelines or audit details. The market interprets this as the protocol's choice to "cut its losses to survive" to avoid legal risks.

The Fundamental Cause of Stream xUSD Decoupling on October 11

To understand the root of this storm, one may need to trace back to the liquidation event on October 11. A deep dive by Trading Strategy on November 5 pointed out on X that the fundamental cause of Stream xUSD's decoupling was not the Balancer hack incident, but rather the failure of the Delta neutral strategy during the historic liquidation on the 11th. Although Stream claimed to adopt a Delta neutral hedging strategy (with a 1:1 configuration of spot and short positions), during the extreme volatility on October 11, the exchange's automatic deleveraging (ADL) system forcibly liquidated its positions, breaking the original hedging balance. This led to a direct loss of principal for Stream, subsequently triggering the decoupling of xUSD.

Underlying issues include: a severe lack of transparency (only $150 million/$500 million TVL visible on-chain), high-risk off-chain trading strategies (including selling volatility strategies), and excessive leverage (recursive lending through Elixir). Analysis also indicated that Stream was merely the first batch of victims to surface; given that October 11 was an unprecedented extreme liquidation event, "it is expected that more DeFi projects will face similar explosions." Little did anyone expect that just a few days later, various DeFi protocols would explode in a domino effect.

The $1 Billion Outflow of Stablecoins is a Major Warning for the Market

According to analysis by @cmdefi, DeFi can be divided into two models: protocol-governed and permissionless independent lending. The former, like AAVE and Spark, requires governance voting for asset listings, with the platform responsible for backing; the latter, like Morpho and Euler, has each market independently managed by Curators, often project parties or stakeholders.

The risk for Curators lies in self-established pools, allowing various assets to be listed without platform endorsement responsibility. "Issues like xUSD, or certain stablecoin projects that have underlying problems, will see utilization rates soar to 95%-100%, with the phenomenon of not repaying under extremely high interest rates, because their collateral is no longer valuable, making it impossible to redeem it, regardless of how high the interest is, it’s all just numbers."

Additionally, Mr. Block also pointed out that this week's DeFi events remind users that although the term "isolated lending markets" suggests risks are confined to a specific pool/market, the reality is that risks can still be exposed to other asset risks due to cross-dependencies, chain infections, curators, borrowers, and structural issues.

If the Stream Finance incident serves as a lesson, then the $1 billion outflow of stablecoins is undoubtedly a warning to the market; in DeFi, any risk can potentially transmit down five or six layers, even across protocols and chains.

Moreover, not all asset allocations in DeFi protocols are visible on-chain, and the DeFi domino event may not yet be over. For users, controlling risk must be the top priority.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。