Article Author: Prince

Article Translation: Block unicorn

One of the biggest issues in the cryptocurrency space is rarely discussed. To achieve a permissionless market, we replaced the natural price discovery mechanism with formulas. This made trading continuous and accessible, but it also removed the elements that maintain price fairness.

Price discovery has always been a natural component of market operations. Buyers and sellers trade openly, and prices are formed during the transaction process. It does not require any formulas or fixed curves; it is simply a way for the market to reach a consensus.

With the development of decentralized finance (DeFi), this process began to change. Automated market makers opened trading to everyone, replacing buy and sell quotes with curves. Liquidity became stable, and the market could operate without counterparties. This undoubtedly improved the convenience and speed of trading, but in the process, some important factors also changed. Prices were no longer formed through interaction but began to be derived from formulas.

Virtual AMMs further advanced this concept. They price perpetual contracts through formulas and oracles rather than actual trades. The market became predictable, but it became increasingly disconnected from the demand and risk flows that once defined it. The factors that used to drive market dynamics now exist only in code.

Uniswap v3 added new tools to improve precision. Liquidity providers can concentrate their funds within smaller ranges, thereby increasing efficiency. This has a significant effect on trading volume but also fragmented the price discovery process. Each range reflects only a part of the market, not the whole. Liquidity became specialized, and the collective pricing mechanism disappeared.

The Hidden Side of Credit

The development path of the lending market is different. Although trading has undergone several design iterations, the lending market has remained largely unchanged. Each protocol creates its own liquidity pool, which has a fixed yield curve and parameters controlled by governance mechanisms. Interest rates automatically adjust with changes in capital utilization, but these adjustments rarely reflect changes in other markets.

Borrowers compare data across different protocols, but the results never seem to reflect the full picture. Each market operates independently, with its own rules and liquidity. The stagnation of capital is due to a lack of competitive pathways. What appears to be an efficient mechanism from the outside often feels stagnant to users.

Anyone who has borrowed or provided funds in these markets can deeply relate. You open several applications, compare interest rates, yet still cannot determine which rate reflects real market demand. Sometimes, you find that different markets under the same protocol yield completely different results. The system functions normally, but it feels incoherent.

Lessons from Hyperliquid

Hyperliquid demonstrated that markets can regain autonomy without sacrificing efficiency. Its on-chain order book directly links trading activity to prices. Every buy, sell, and cancellation contributes to a real-time view of demand. Prices begin to reflect trading participation once again.

This outcome reminds builders that minor inefficiencies are not problems to be eliminated but signals. The gap between bids and asks, changes in bid depth, and the time required for price adjustments all reveal information. These differences indicate how the market reaches agreements.

The Avon Structure

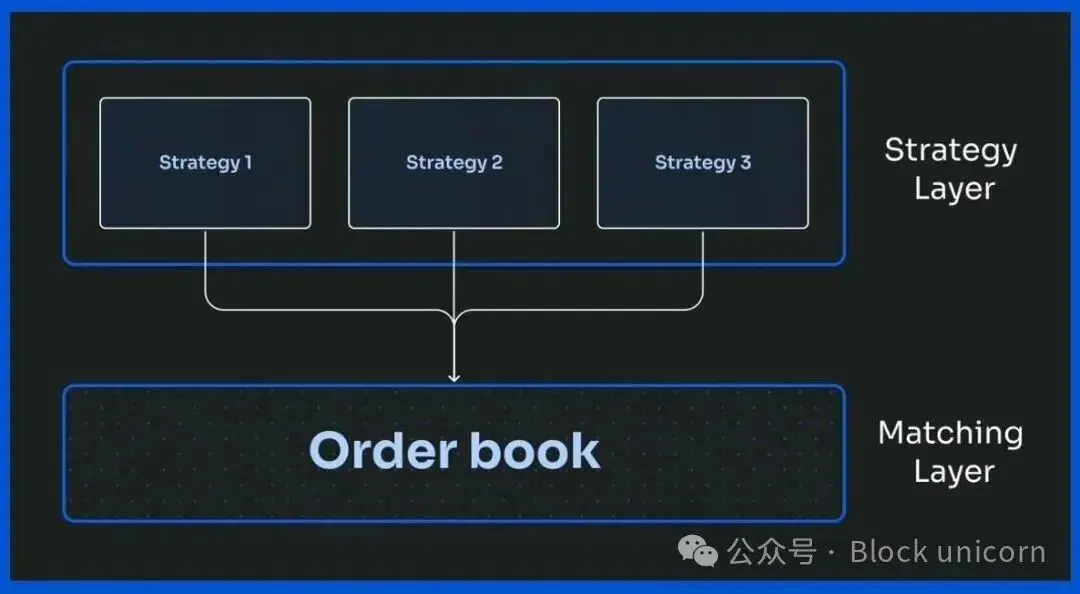

Avon applies the same concept to the credit space. Each strategy functions like an HLP vault: an independent lending market with its own logic and liquidity. Above these strategies is a coordination layer, an on-chain order book that connects all strategies through shared information rather than liquidity pools.

When someone deposits, borrows, or repays, the shared layer updates immediately. All strategies can observe these changes. Liquidity will naturally gravitate towards more favorable conditions. Interest rates are not set by regulators or external entities but are continuously formed by activities within the network.

It is this mechanism that allows Avon to operate without external market makers. The coordination layer itself becomes the balancing mechanism. Every transaction updates the market in real-time, allowing liquidity to respond to changes across all strategies.

Over time, lending began to operate like trading. The market reflects participants' valuations of risk and return as the market environment changes. Credit becomes part of a real-time system that constitutes the modern trading framework.

Consistency Returns

MegaETH timely restored coordination by centralizing all activities onto a shared sequencer. Its high throughput and Giga Gas limits make it possible to coordinate complex systems entirely on-chain. For the first time, the lending market can operate a continuous order book without sacrificing transparency or performance.

Avon developed on this foundation. The shared environment of the network allows the credit market to quote prices in real-time and respond to one another. Prices are formed publicly, within the same block space that records every transaction. The discovery process becomes visible again.

When the discovery process is transparent, pricing becomes fairer. Fair pricing can attract deeper liquidity and higher-quality capital. Institutional funds that rely on transparency can participate smoothly. Various forces that once led to market fragmentation now begin to reinforce each other. Liquidity flows faster, terms become better, and the market becomes more favorable for all participants.

This is the possibility brought by the era of high throughput: a system where discovery, coordination, and fairness operate within the same block space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。