They imitated Strategy's balance sheet but did not replicate its capital structure.

Author: Decentralised.Co

Translated by: Deep Tide TechFlow

Strategy built a $70 billion asset reserve by holding Bitcoin.

Now, every token project wants to become an asset reserve company.

The problem is: a quarter of Bitcoin asset reserve companies have a market value that is already below the value of the assets they hold.

Here’s why most companies will fail.

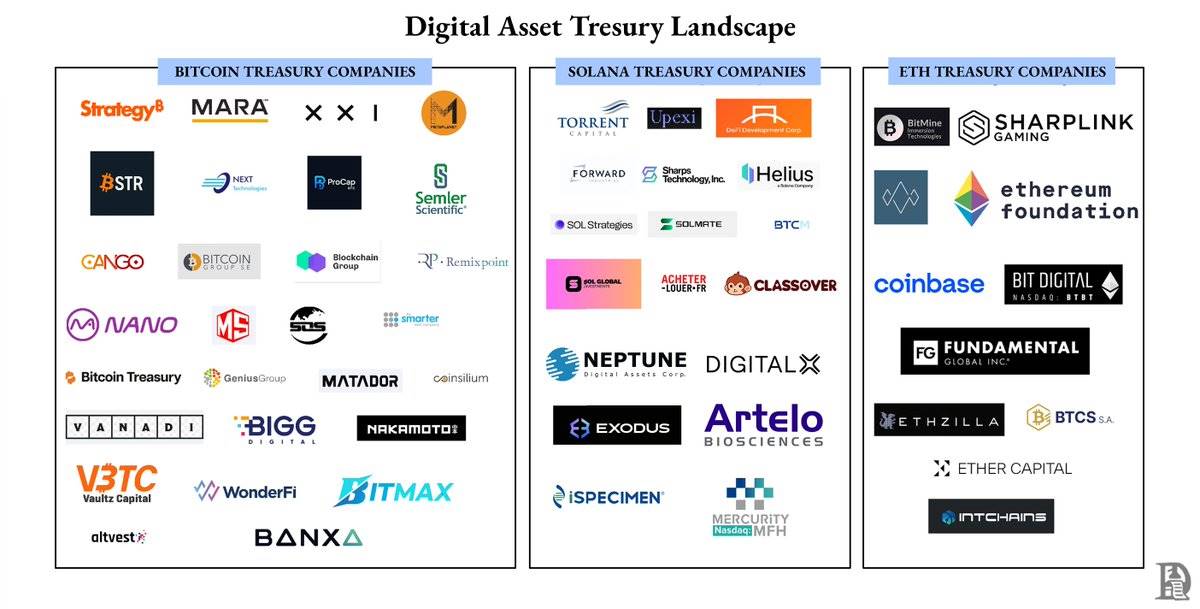

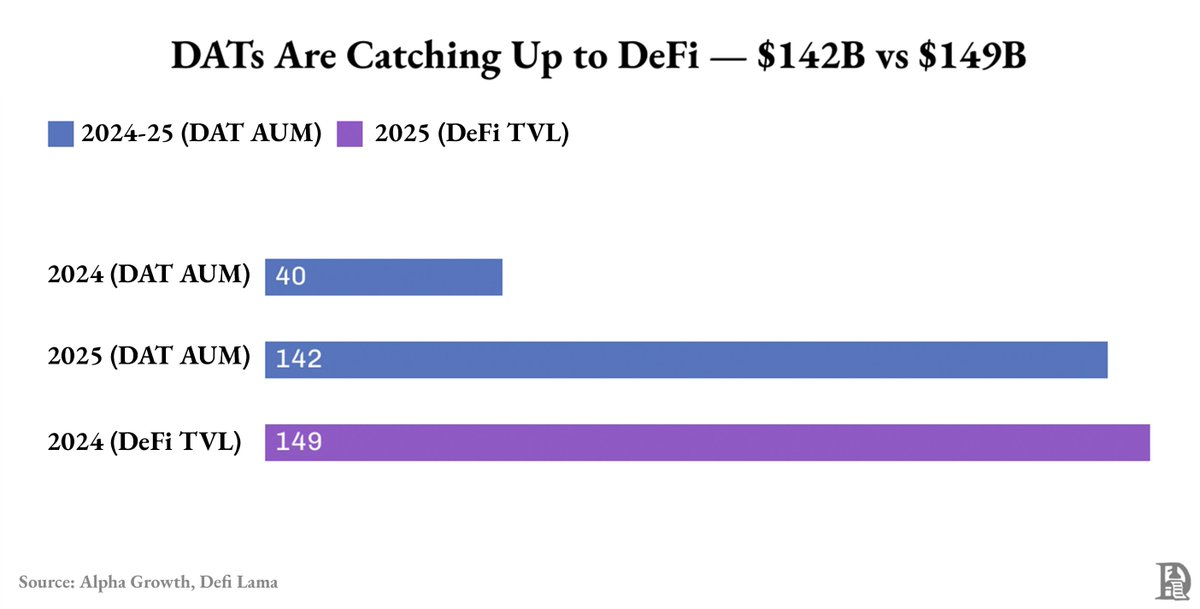

Asset reserve companies have become one of the fastest-growing categories in the crypto space.

In just one year, their total asset value surged from $40 billion to $142 billion, nearly matching the total value locked (TVL) in the entire DeFi space.

Nearly 90% of these assets are Bitcoin and Ethereum.

But this "growth" mostly comes from the rise in Bitcoin and Ethereum prices, rather than business cash flow or financial engineering.

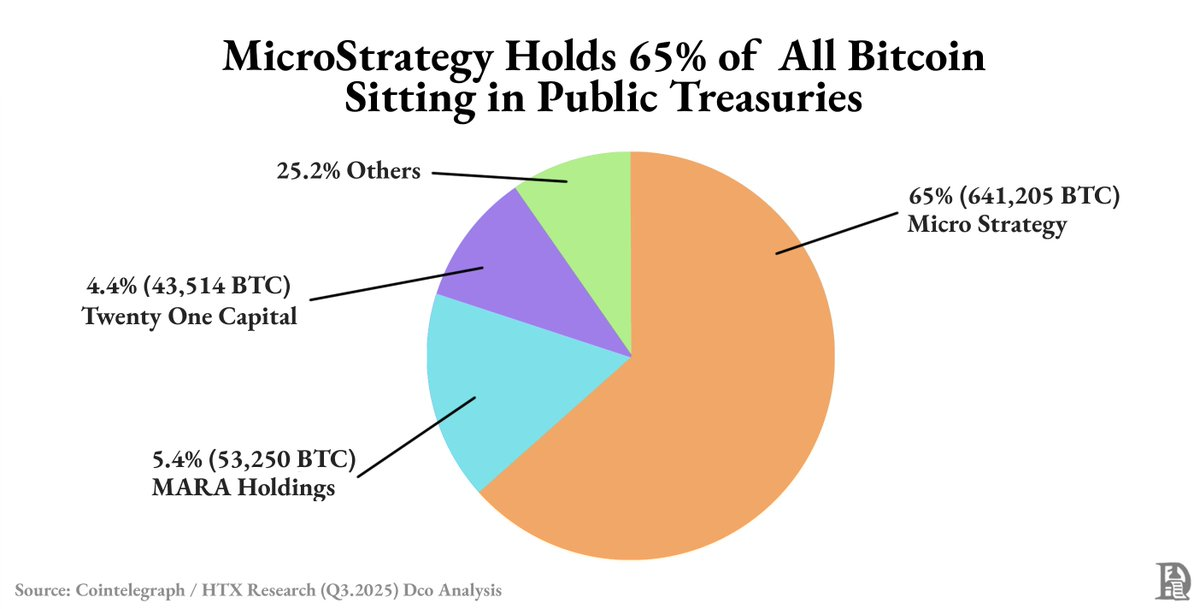

Even this growth is not evenly distributed.

Strategy alone holds nearly 63% of all publicly reserved Bitcoin. The majority of the rest is controlled by the top six companies.

Outside of these giants, most digital asset reserve companies (DATs) are in a state of thin liquidity and fragile premiums, with their valuations fluctuating with market volatility rather than their own performance.

What is the reason?

When the market performs strongly, the stocks of asset reserve companies trade at a premium above their asset value. This premium exists because they provide investors with compliant investment channels for Bitcoin or Ethereum. Issuing new shares at this premium not only raises funds but also enhances book value.

Each round of financing adds more crypto assets, driving both total assets and stock prices up. This creates a reflexive cycle: rising prices lead to value-enhancing financing, which is used to purchase more assets, and valuations climb until the premium disappears.

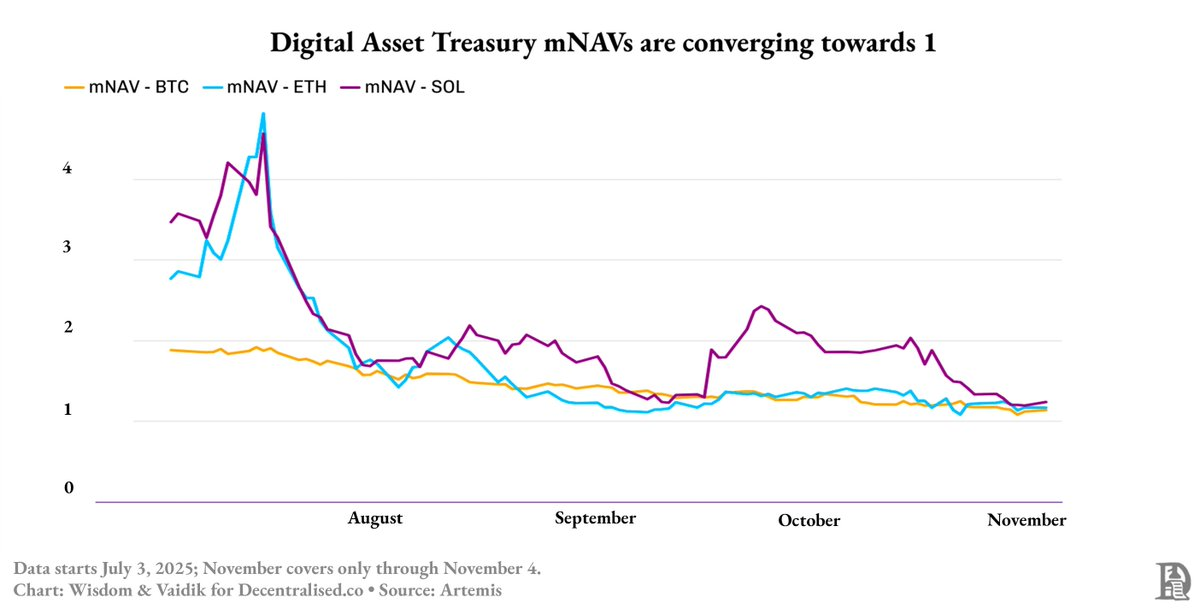

By mid-2025, this cycle was broken: the premium for Bitcoin asset reserve companies dropped from 1.9 times to 1.3 times, while the premiums for Ethereum and SOL (Solana) asset reserves plummeted from 4.8 times to about 1.3 times within two months.

So, how did Strategy survive?

Because it built not just an asset reserve but a financial instrument.

While most asset reserve companies continuously purchase more crypto assets by issuing stock, Strategy raised $4 billion through convertible bonds and senior notes, with long-term loan rates around 0.8%.

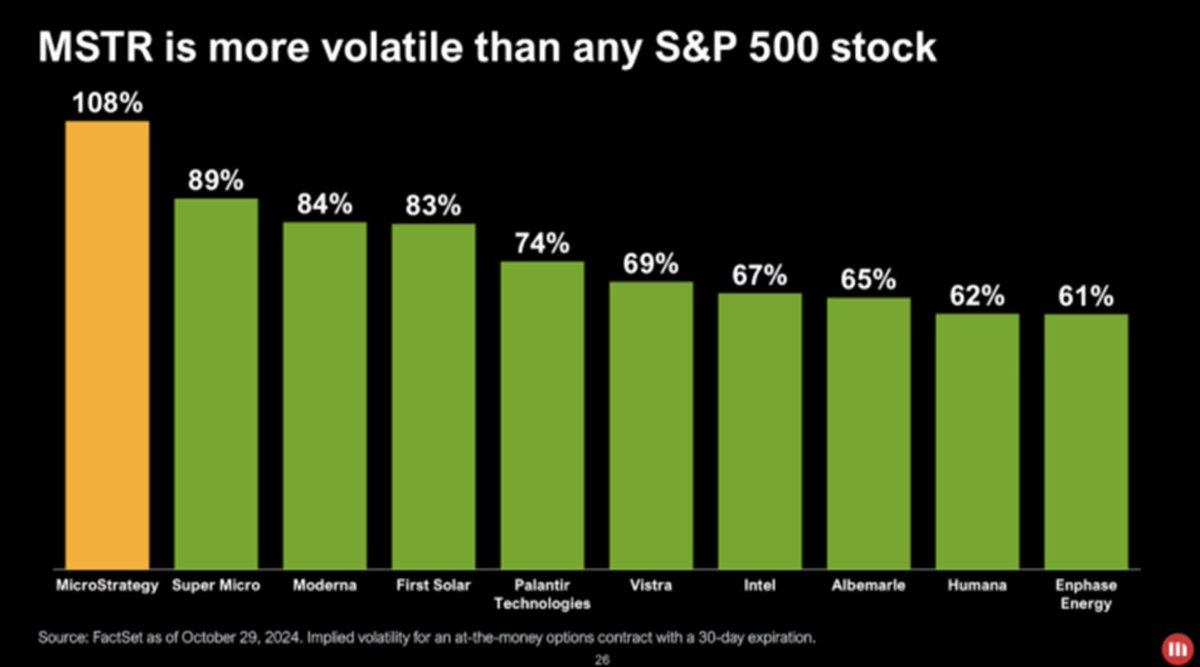

Its stock became a high-beta version of Bitcoin. When Bitcoin's price fluctuates by 1%, its stock price slightly amplifies that movement in the same direction. By using debt to purchase Bitcoin, Strategy magnified each price fluctuation, providing investors with a leveraged and compliant way to bet on Bitcoin without holding it directly.

This tradable volatility attracted new investors: funds, ETFs, and even a debt market built around it.

Traders capitalized on Strategy's volatility to generate profits. Although their capital was locked until the notes matured, they earned returns through stock price fluctuations.

With higher liquidity and greater volatility than Bitcoin, traders could profit without waiting for the notes to mature.

Most new asset reserve companies mimicked Strategy's model but only copied its simpler parts.

They imitated the balance sheet but did not replicate the capital structure.

Strategy has convertible bonds, senior notes, and liquidity, which help it convert volatility into financing capability.

Other companies do not have such resources; they cannot raise capital and can only chase yields through staking, lending, or purchasing tokenized government bonds.

Substituting yields for real financing looks good when prices are rising. Yields remain high, and liquidity appears strong, giving the impression that the model is effective.

But this masks the reflexive risks similar to equity.

Most digital asset reserve companies (DATs) lock assets in staking or lending to earn yields while allowing investors to enter and exit freely.

When the market cycle reverses, redemption demand rises, and yields fall, they are forced to sell those locked assets at a loss.

This is exactly what is happening now.

As market confidence wanes, stocks that once traded at a 3-4 times premium to asset value have collapsed to parity with asset value.

Even those "yield-driven" asset reserve companies based on Ethereum (ETH) or Solana (SOL) are not immune, as their solvency remains closely tied to token prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。