Chapter 1: The Rise of Chinese Memes - A 72-Hour Wealth Creation Experiment

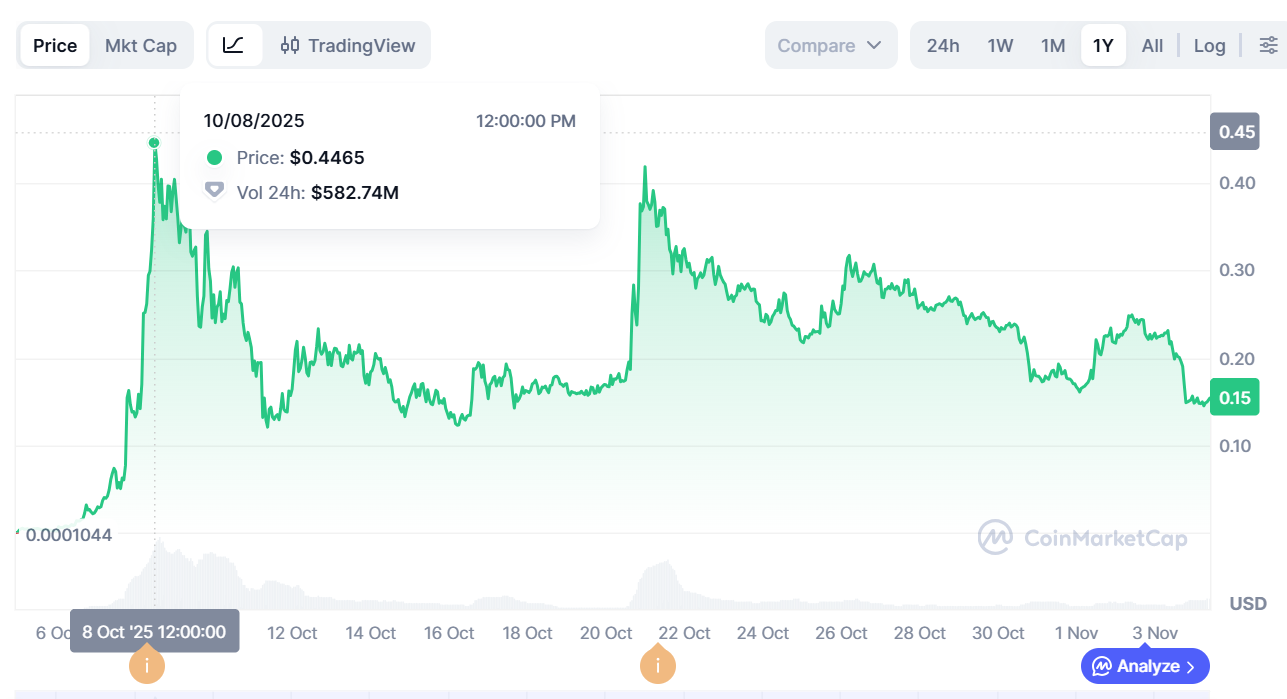

In October 2025, a Chinese meme coin named "Binance Life" surged from zero to a market value of $150 million within 72 hours, becoming the first large-scale wealth creation movement in crypto history dominated by a non-English culture. This pun originated from the Douyin internet celebrity Hu Chenfeng's "Apple vs. Android" debate, capturing the collective anxiety of the Chinese community regarding class mobility with the slogan "Drive a Binance car, live in a Binance community, enjoy a Binance life." After launching on Binance Alpha on October 7, over 100,000 investors flocked in, and the daily trading volume on BSC soared to $6.05 billion, surpassing Solana. At one point, the on-chain profits exceeded $6 million, including notable figures like 0xSun, Lengjing, Wang Xiaoer, Shen Da Gaocai Sheng, and Laser Cat.

The uniqueness of this frenzy lies in the financialization of cultural barriers. Chinese memes exhibit a cultural gene that is starkly different from the West. Western memes like Pepe emphasize nihilism and "having nothing," with official claims of "no intrinsic value," rebelling against the system; whereas Chinese memes like Binance Life emphasize upward mobility and "becoming someone important," with community consensus that "the official must support it," relying on the system. This difference is rooted in a deeper logic: the community pays homage to the platform through the "Binance Life" meme, and the more popular the meme becomes, the harder it is for the platform to ignore it. If the platform does not support it, it is seen as a slap in the face to the brand, thus the platform "must" support it—this is a game strategy that forces official participation by creating a sufficiently large consensus.

Chapter 2: The Tide of the Bubble Recedes - The Truth from 70% Profit to 80% Loss

Beneath the surface of prosperity lies a structural crisis. The early "70% profit rate" had a fatal flaw: it was based on a static snapshot at the peak moment on October 8. Subsequently, Binance Life experienced two crashes—falling 28.4% to $110 million on October 14, and dropping 24% from a high of $260 million to $198 million on November 2 due to unmet "spot expectations." Recalculation showed that 50% were on paper profits, but actual sell-out profits were only 10-20%, with losers reaching 70-80%. The "wealth creation myth" of 70% turned into the "standing guard reality" of 80% a month later.

The crash of PALU is even more cautionary. This project, which launched on Alpha the same day, plummeted from $60 million to $10 million, with a drop of over 80%, evaporating $50 million, and only 5% were profitable while 95% were at a loss.

As of November 4, the Chinese meme market collapsed entirely: PALU fell 70% in a week, Hakimi dropped 61%, customer service Xiao He fell 66%, and Xiu Xian dropped 69%. The lifecycle shrank from weeks to days, with the market cap threshold dropping from hundreds of millions to millions, and most projects surviving less than 48 hours.

The two peaks and subsequent declines revealed a fatal weakness: when the entire value of a project is built on "possible actions from the platform," every unmet expectation leads to a crash. This is not decentralization, but a more covert form of centralization.

Chapter 3: Benchmarking Doge and Pepe - What is Missing in Chinese Memes?

3.1 Doge's Decade-Long March: From Joke to Mainstream Payment Tool

Dogecoin was born in 2013, initially just a joke contrasting Bitcoin's serious demeanor. However, it took 12 years to transform from a joke to a mainstream currency. The three pillars of Doge's success are worth pondering.

- First is an independent cultural IP. The Shiba Inu image comes from the 2010 Japanese internet celebrity dog Kabosu, which was already a globally recognized meme before entering the crypto space, not relying on any platform and having universal appeal across languages and cultures. In contrast, Binance Life's IP essentially "borrows the Binance brand," heavily relying on the platform's attitude, with cultural connotations limited to the Chinese community.

- Second is a community driven by values. The core of Doge is "Do Only Good Everyday," which is not an empty slogan but a real action. Even during price slumps, the community remains active because members gather around shared values rather than "waiting for a pump." In contrast, the only topic in the Binance Life community is price; when prices drop, the community immediately fractures, and Telegram group activity declines by over 70%.

- Third is the endorsement of super influence. Elon Musk has repeatedly endorsed Doge since 2019, calling it "the people's cryptocurrency," and in 2021, he propelled it to a peak market cap of $88 billion on SNL. Subsequently, Tesla and SpaceX began accepting Doge payments. Musk's continued support provided Doge with long-term credit backing, allowing investors to believe that even with price fluctuations, the community would not disappear. In contrast, CZ's support for Binance Life was limited to initial ambiguous interactions and the Alpha launch, followed by a strategic retreat, with the November 3 "spot expectations" failure proving the platform's unwillingness to deeply bind.

3.2 Pepe's Cultural Foundation: 18 Years of Accumulation and the Purity of Nihilism

Pepe the Frog originated from a comic by artist Matt Furie in 2005, and after 18 years of internet cultural accumulation, it has become a meme seen by billions worldwide. After the launch of Pepe coin in 2023, it reached a market cap of over $1 billion, surviving a 70% correction and remaining stable at several hundred million in market cap for over 18 months, still ranking in the top 100 on CMC.

The key to Pepe's success lies in two points. First is a deep cultural accumulation, with 18 years of internet meme history far exceeding the 2 months of the Binance Life Douyin meme, and its recognition spans globally rather than being limited to the Chinese community. Second is the purity of nihilism, with the official stance clearly stating, "PEPE has no intrinsic value, is completely useless, and is for entertainment only." This "anti-value" position creates a paradoxical effect: it lowers investor expectations, establishes a purely speculative consensus, and reinforces cultural identity—buying Pepe is not an investment but an expression of attitude. In contrast, the Binance Life community continuously expects "official pumps," and every unmet expectation leads to a crash.

3.3 Comparative Analysis: Three Fatal Flaws of Chinese Memes

Through systematic comparison, the differences become clear. In terms of birth time, Doge has existed for 12 years, Pepe for 2 years, and Binance Life for only 1 month; in terms of cultural accumulation, Doge has 10 years, Pepe has 18 years, while Binance Life has only 2 months; regarding IP ownership, Doge and Pepe have independent Shiba Inu and frog images, while Binance Life borrows the Binance brand; in terms of official attitude, Doge and Pepe are independent and do not rely on the platform, while Binance Life is highly dependent on Binance.

In terms of price resilience, Doge survives in bear markets, Pepe stabilizes after corrections, while Binance Life has experienced two crashes of -28% and -24%; in lifecycle, Doge lasts over 12 years, Pepe over 2 years, while Binance Life may last less than 6 months.

This reveals three fatal flaws. The first is the lack of an independent IP; the value of Binance Life equals Binance's support, and once the platform withdraws support, the project collapses. The second is the absence of application scenarios; it has no use beyond speculation, and when the speculative heat fades, there is no support. The third is the lack of community consensus; the only consensus is "waiting for the official pump," and price declines lead to the disintegration of consensus and community fragmentation.

3.4 Future Paths: Zeroing Out, Transformation, or Symbolization?

Based on current data and historical experience, Binance Life faces three potential paths.

Path A is zeroing out within 6 months. The trigger condition is if Binance takes no action in the next 3-6 months, the market enters a bear phase with liquidity drying up, and new hotspots like AI memes emerge. The evolution process would see the market cap oscillating between $150-200 million, with minor rebounds on rumors but decreasing in height, ultimately falling to $10-30 million and becoming a "zombie coin," with some price but no liquidity. Historical references include the 2021 BSC "mechanism coin" Safemoon, which has gone to zero from peak valuations in the billions, and 90% of early Solana memes have disappeared by 2023.

Path B is evolving into a "cultural heritage coin." The trigger condition is the community actively abandoning the fantasy of "waiting for the official pump" and beginning to spontaneously build application scenarios, integrating with the BSC ecosystem. Possible directions include a meme plus DeFi model, such as holding Binance Life to receive dividends from BSC chain DeFi protocol fees, collaborating with PancakeSwap to launch exclusive liquidity pools, and introducing staking mechanisms. A successful case is Shiba Inu's ShibaSwap. Another direction could be a meme plus community governance DAO, establishing a "Binance Life DAO" where token holders vote on development and set up a community treasury to invest in BSC projects. However, the realistic assessment is that the probability of transformation is extremely low; the current community lacks the motivation and ability to transform, and most holders only care about "when the pump will happen." Even if someone proposes a plan, it is difficult to reach a consensus. The key difference is that Doge and Shiba have independent IPs that do not rely on the platform, while Binance Life's IP essentially "borrows the brand," making any transformation meaningless once Binance clearly opposes it.

Path C is becoming a "symbolic existence." The trigger condition is if Binance selectively maintains Binance Life for strategic reasons, and the community accepts the reality of "never becoming mainstream," with the token becoming a symbol of Chinese crypto culture. A reference is Doge, which lingered in market cap between $5 million and $500 million from 2014 to 2020, yet the community remained active. Binance Life may stabilize in the range of $5 million to $200 million, with minor price fluctuations during major events in the BSC ecosystem, becoming the "number one Chinese meme coin" in historical status, occasionally mentioned but no longer fervently. However, there are three key obstacles: the meme of Binance Life is too shallow to be passed down long-term, relying on the platform's will, Binance could "zero it out" at any time, and under competitive pressure, another Chinese meme may be more attractive. The failure of the November 3 "spot expectations" shows that Binance is unwilling to deeply intervene, believing that "enough support has been given" and that Alpha is a gift; if "Binance Life 2.0" emerges, the original may be forgotten.

3.5 Core Conclusion: Can Chinese Memes Replicate the Doge Legend?

The short-term answer is that it is almost impossible in the next 1-2 years. The cultural accumulation is insufficient, only 2 months, far below Doge's 12 years and Pepe's 18 years; the IP is not independent and relies on the Binance brand rather than being an original cultural symbol; the lack of application scenarios means it can only speculate and cannot serve as payment like Doge or expression like Pepe; the community is unstable, with values centered on "waiting for a pump" rather than "doing good" or "embracing nihilism"; and the lifecycle is too short, with only 1 month from birth to decline, far below the resilience of Doge and Pepe.

The most likely outcome for Binance Life is a slow death rather than a dramatic collapse. It will see minor rebounds on rumors over the next few months, then continue to decline, with trading volume shrinking from millions to hundreds of thousands, and the market cap ultimately falling to $10-30 million, becoming a "zombie coin" with a price but no liquidity. Just like those "mechanism coins" on BSC in 2021, or the clones on Solana in 2023, they once shone brightly but ultimately disappeared into the dust of history.

This report's data is edited and organized by WolfDAO. For any questions, please contact us for updates.

Written by: Nikka / WolfDAO (X: @10xWolfdao)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。