Smart Money Chooses Solana ETF Inflows Over Bitcoin Ethereum Outflows

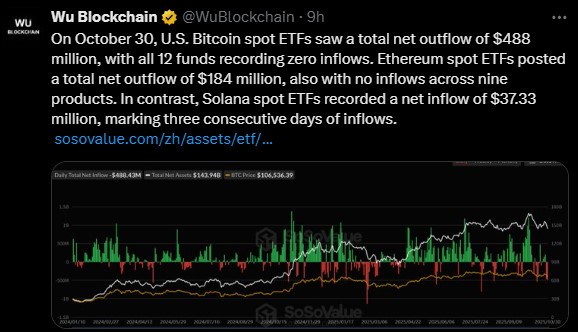

The crypto world just saw a big change. On October 30, as per Wu Blockchain , Bitcoin ETFs outflows recorded $488 million tokens exit, and all 12 funds saw zero inflows.

Ethereum ETFs also lost money, recording $184 million in outflows across nine products. But in a surprising twist, Solana ETFs inflows surged.

Yes, it's a third straight day of gains, as they had $37.33 million in inflows. This shows a clear move by institutions from old giants to the fast-rising $SOL.

Why Is Bitcoin Ethereum ETF Outflows Surging? Reason Explained

The recent Bitcoin ETF net outflows and Ethereum outflows are linked to global market fear, not just crypto weakness. The U.S.– China tariff issue has created major uncertainty.

Recently, the U.S. Senate voted 50–46 to take away Donald Trump’s tariff powers, with some Republicans siding with Democrats.

Even after Trump’s post on X about his “great meeting” with China’s President Xi, traders stayed cautious. The Crypto Fear & Greed Index is now at 29 (Fear), showing that investors are scared and avoiding risk.

Because of this fear, big investors are taking profits and pulling out of both of these assets after their strong September rallies. They are now choosing safety and waiting for clearer signals before jumping back.

Solana ETF Inflows: The New Institutional Favorite

While top cryptocurrencies are cooling off, Solana ETF inflows are rising fast. The SEC’s approval of the Grayscale gave a big boost to market confidence. This Crypto news today is making in nothing but a clear sign of how and where the institutional money is moving now.

Plus, three new exchange traded funds for Solana ($SOL), Litecoin (LTC), and Hedera (HBAR) just started trading in the U.S. This move gives investors more options beyond the usual BTC and ETH.

This has made the $SOL ETF news trend across the market. Big investors are cutting down on top digital assets exposure and shifting to this altcoin. Analysts are calling it a “smart money move.”

What $SOL, $BTC, and $ETH Price Charts Are Telling

1. Bitcoin Price Analysis: On the charts, it is trading around $110,089 after a month of big ups and downs. As per TradingView price chart , the RSI at 49 shows it’s neutral, while the MACD hints at a possible small recovery.

-

Bullish case (December 2025): If influx returns and global tensions ease, it could rise to $125K–$130K.

-

Bearish case: A drop below $90K is possible, market adds another negative news.

2. Ethereum ETF Outflows and Price Trend: It is now trading around $3,857.94, with a 24-hour volume of $38.51 billion, down by 5.62%. It touched the $3,700 support level and bounced slightly, but the recovery is still slow.

Unless ETH closes above $4,000, it may stay range-bound. If the altcoin supercycle starts in November, ETH price target could aim for $5,000 by late 2025.

3. Solana Price Prediction: $SOL is trading around $187, down slightly by 0.7%, but institutional interest keeps growing. The charts show a consolidation between $180–$195, with RSI at 45 and MACD signaling an early bullish turn.

If inflows continue and crypto king stays stable, it could retest $200–$210 soon. The steady Solana ETF inflows and calm price action show quiet strength.

Conclusion

The message is clear: investors aren’t leaving crypto; they’re changing where they invest. While Bitcoin Ethereum ETFs outflows surge , Solana ETF inflows are rising fast because of listed funds SEC approvals, investor confidence, and chart strength.

In short, as fear dominates headlines, big money is shifting from old favorites to new opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。