Let Crypto be a carrier of technology, not a paradise for gamblers.

Written by: Zhou Zhou, Foresight News

For Crypto, there is only one path ahead—no longer drifting outside the mainstream, but becoming the mainstream world itself.

On October 29, when Nvidia's market value surpassed $5 trillion, becoming the first publicly traded company in the world to exceed a $5 trillion market cap, crypto practitioners collectively "broke down." This was not only because Nvidia's market value alone exceeded the total market value of cryptocurrencies ($4 trillion), but also because Nvidia and the AI sector it represents are striving to expand the boundaries of this world, seeking growth, while Crypto often gives the impression of being trapped in a zero-sum game. Many people not only failed to gain wealth but also lost their future.

The hot topics discussed daily by AI industry practitioners include: autonomous driving, robotics, life sciences, space navigation… How AI deeply changes and reshapes the value of these industries. As a crypto KOL said, the hot topics discussed daily by crypto industry practitioners are: cats, dogs, frogs, Chinese memes, who got listed on Binance, which celebrity liked or retweeted… After the excitement, it’s just a mess.

The repeated crashes of altcoins and meme trends may gradually help crypto practitioners recognize the direction. Only by combining technology with the real world can Crypto have a more sustainable and long-lasting future. Let Crypto be a carrier of technology, not a paradise for gamblers.

A more realistic issue is: when the market value of USD stablecoins reaches $250 billion (the circulation of USD is about $2.5 trillion), Bitcoin's market value exceeds $2.2 trillion (the market value of gold is $27 trillion), and Binance's daily trading volume for spot and contracts reaches $100 billion (the daily trading volume of Nasdaq is about $500 billion), Crypto has no way forward but to become the mainstream itself.

1: Replace the entire global financial system with blockchain technology.

Stablecoins are gradually replacing the original operating system of fiat currencies; cryptocurrency exchanges are eating into the market share of traditional stock exchanges like Nasdaq; Bitcoin is becoming a new global value anchor after gold; public blockchains like Ethereum are attempting to replace Swift and build a new international value circulation network… From the currency market, securities market, gold market, international trade market, to payment systems, cryptocurrencies are reshaping the entire financial world.

In this process, the crypto industry itself is also constantly evolving.

Stablecoins are evolving towards "decentralized stablecoins," with decentralized stablecoin attempts like Ethena following USDT and USDC; cryptocurrency exchanges are developing towards "decentralized exchanges," with centralized exchanges like Binance and Coinbase thriving, and decentralized exchanges like Uniswap, Phantom, and Hyperliquid emerging; Bitcoin is approaching one-tenth of gold's market value; more and more countries are viewing Ethereum as a new international trade settlement network.

Every evolution in each of these fields is a change and reconstruction of the real world by technology.

The internet once led to a complete reconstruction of the global financial system. And blockchain is driving the second one, and this time it is a more systematic reconstruction.

Cryptocurrencies have gradually emerged from the marginal financial system, integrating into and even potentially surpassing the mainstream financial system, with pioneering progress in multiple fields already occupying one-tenth of the mainstream financial system.

For example, USD stablecoins account for exactly one-tenth of the circulating USD, with a market value of about $240 billion compared to $2.4 trillion; Bitcoin's market value is exactly one-tenth of gold's market value, with Bitcoin at $2.2 trillion and gold at $27 trillion; Binance's daily trading volume is about one-tenth of Nasdaq's daily trading volume, with Binance's daily spot trading volume around $30 billion and total trading volume around $100 billion, while Nasdaq's daily trading volume is about $500 billion.

2: Gradually become a carrier for marginal technology companies, like early Nasdaq.

Early Nasdaq, like today's Binance and other cryptocurrency exchanges, was a platform where "penny stocks" were most prevalent.

Initially, Nasdaq was not a mainstream exchange trading blue-chip stocks like the NYSE; it primarily focused on small and medium-sized stocks, tech stocks, and stocks of unlisted companies, providing price transparency and electronic matching for trades. At that time, the NYSE, as the mainstream exchange, still relied on manual bidding and trading floor systems.

Early Nasdaq was also not as "high-end" as it is today. During the 1970s and 1980s, the Nasdaq market was filled with various scams, almost like the "penny stock market" depicted in "The Wolf of Wall Street," with "junk stocks" and manipulated penny stocks everywhere.

Leonardo DiCaprio's character, Jordan Belfort, was a fund sales manager during that chaotic period, skilled at selling junk stocks. He would pick a stock from the penny stock market that no one had heard of, like the one mentioned in the movie: "Aerotyne International"—which was actually a non-existent airline. Jordan Belfort's original words were:

"Sir, I have a company developing revolutionary aerospace technology, with investors from Boeing and NASA is paying attention. You wouldn't want to miss this opportunity, would you?"

A large number of Nasdaq investors bought into these penny stocks, just like the media and KOLs in today's crypto market:

"Sir, this is a revolutionary x402 protocol token, and companies like Google and Visa are paying attention to this protocol, with Coinbase also getting involved. You wouldn't want to miss this opportunity, would you?"

However, behind many tokens, there are actually no such companies.

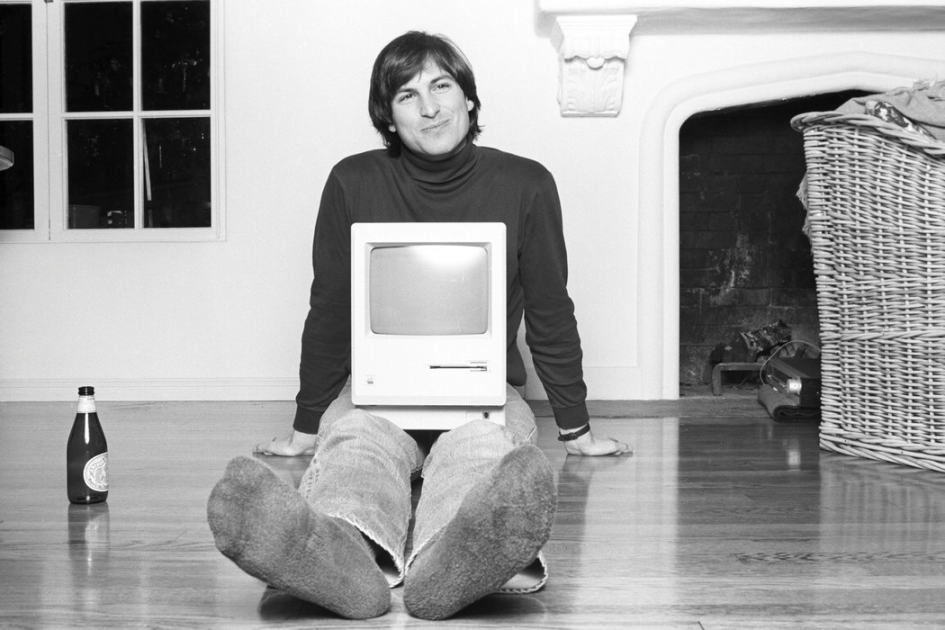

It wasn't until the late 1980s and the 1990s tech stock boom that Nasdaq gradually became one of the mainstream exchanges, attracting large tech companies like Microsoft, Apple, and Intel to go public, thus achieving its current mainstream status.

In 2004, Nasdaq's average daily trading volume first equaled that of the New York Stock Exchange (NYSE). From its establishment in 1971, with Apple going public on Nasdaq in 1980, it wasn't until 2004 that Nasdaq first surpassed the NYSE. Nasdaq took a full 33 years to achieve this.

During this long process, Nasdaq also lost its way, but it ultimately waited for the growth of internet and high-tech companies like Apple, Microsoft, Intel, and Nvidia, eventually becoming the most mainstream stock capital trading market today.

The growth journey of Nasdaq may provide some insights for crypto practitioners to focus on the unique advantages of the Crypto trading market (fair launches, global circulation, early user airdrop holdings), just as Nasdaq's initial advantages (price transparency and electronic matching) did. They should not fear the chaos of the early market, just as Nasdaq faced the prevalence of junk stocks in its early days, similar to the current crypto market's prevalence of junk altcoins and memes.

The future of Crypto will always lie with those companies that can bring significant impact to humanity. Just as Nasdaq relied on Apple, Microsoft, Intel, and Nvidia, the cryptocurrency market will rely on companies and organizations like Tether, Ethereum, Polymarket, Hyperliquid, Farcaster, and Chainlink. The vast majority of altcoins and memes will disappear into the annals of history.

Nasdaq's daily trading volume is in the hundreds of billions, while the world's largest cryptocurrency exchange, Binance, also reaches daily trading volumes in the hundreds of billions. From the perspective of trading volume, it is not a fantasy for cryptocurrency exchanges to surpass Nasdaq and become the new largest capital market globally.

A trading market becomes legendary because it gathers the vast majority of technology innovation companies worldwide. Here, there is not only the flow of capital but also the pulse of technological progress; it carries the latest productivity of the world and the greatest investment enthusiasm globally.

3: Crypto will eventually break free from the "meme era" and enter the "iPhone moment."

Binance's daily trading volume has reached one-tenth of Nasdaq's, USD stablecoins have reached one-tenth of circulating USD, and Bitcoin's market value is also approaching one-tenth of gold's market value… The next step for Crypto has only one path, which is to become the mainstream world itself.

Fortunately, early Nasdaq was also just a marginal trading market, and for the first twenty years, Apple computers were products created for niche enthusiasts and hobbyists. At that time, no one imagined they would become the mainstream of today's world.

Apple was born in 1980, and it wasn't until 20 years later that the wave of the internet revolution officially began. Nasdaq also only surpassed the NYSE for the first time in 2004, becoming the most important capital trading market globally, truly integrating into the mainstream world.

Without the establishment and improvement of foundational infrastructure companies like Apple and Microsoft, internet and AI companies could not have emerged in large numbers. Just like the current companies such as Ethereum, Tether, Solana, Binance, and Hyperliquid, their growth and improvement as foundational infrastructure still require time, and only when they fully mature will the Web3 revolution truly arrive, and mass adoption products like Amazon, Facebook, and TikTok will emerge explosively.

The internet is a vast concept that encompasses not only internet companies and internet finance companies but also foundational infrastructure companies like computers and smartphones, as well as capital markets like Nasdaq that apply the latest technologies, ultimately impacting all real enterprises. Similarly, Crypto is also a vast concept that involves not only cryptocurrency companies but also underlying technology infrastructure protocols and companies, involving capital markets like Hyperliquid and Binance that apply the latest technologies, and will eventually give rise to new application-based companies on a large scale, even impacting a wide range of real enterprises.

Technology is the ultimate tool for continuously elevating the quality of human life. The future of Crypto is destined to be deeply integrated with technology, even becoming the carrier and synonym for the next generation of technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。