Jito is at the intersection of new capital inflows and microstructure improvements.

Written by: Sam Schubert, Carlos

Translated by: AididiaoJP, Foresight News

The Bitwise SOL Staking ETF (BSOL) has begun trading, becoming one of only two Solana spot ETFs in the U.S. alongside SSK. Notably, Bitwise aims to maximize staking rewards by achieving a 100% staking ratio, targeting a staking reward rate of 7.34%. It will be interesting to see if it can indeed stake 100% of its SOL holdings. SSK and the European SOL ETP have been operating for over four years, intentionally keeping their staking ratios well below 100%. The reason is purely operational: these issuers need to ensure sufficient liquidity to meet daily redemption demands.

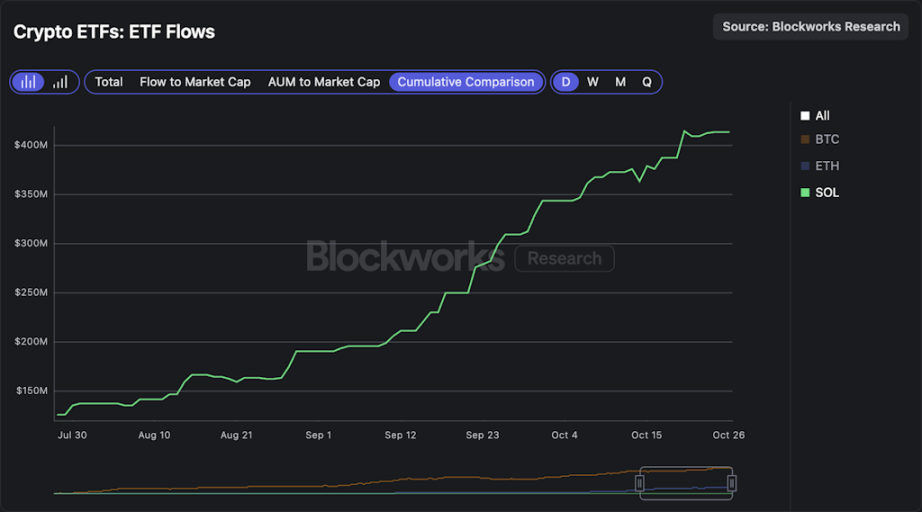

Compared to these participants, Bitwise will conduct internal staking through Helius, which may enhance the operational efficiency of BSOL. Within three months, Bitwise will waive management fees on the first $1 billion of assets under management. BSOL will open the floodgates for more SOL ETFs, which could attract significantly more capital than the $415 million that SSK has accumulated since July.

In the crypto space, the public sale of MegaETH launched yesterday, and as of the time of writing, it has received approximately 9 times oversubscription, with committed amounts nearing $450 million. So far, it is clear that the auction will settle at a price of $0.0999, implying a fully diluted valuation of $999 million. As the sale ends in two days, we may see the oversubscription multiple rise further (unverified speculation is around 20 times), with allocation standards determined based on social information (Twitter profiles, on-chain history, etc.). In recent days, MEGA's fully diluted valuation in the pre-listing market on Hyperliquid has traded between $4 billion and $5 billion, indicating that participants in this sale are likely to see returns, although most users may not receive their expected allocation amounts.

Analyzing Jito's Weaknesses and Potential Reversal Forces

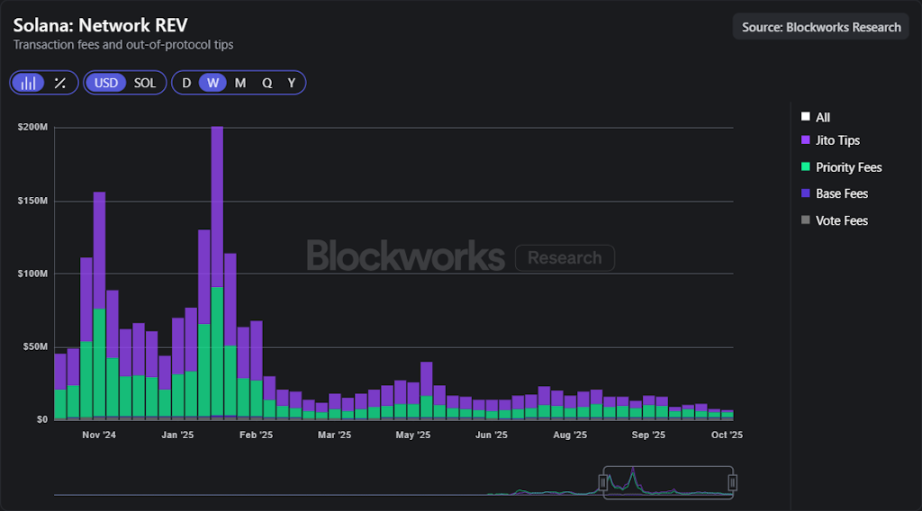

The Jito token (JTO) has been underperforming in price and has significantly lagged behind Solana itself. Jito's share of fees in network revenue has sharply declined, dropping from over half of Solana's revenue base to now below 30%, compounded by the overall decline in Solana's revenue. The question now is whether Jito possesses reflexivity and can benefit from a rebound in Solana network activity, for which it was designed to enhance.

Solana's architectural design was once highly praised but has recently come under scrutiny, as many applications and DeFi activities have underperformed compared to the broader crypto market. This raises the question of why there has not yet been a competitive perpetual contract exchange on Solana that can match the execution quality of Hyperliquid? Why are teams like Elipisis Labs turning to build Atlas? The architecture offers speed but does not always provide predictable trade ordering, fair fee routing, or robust anti-spam capabilities.

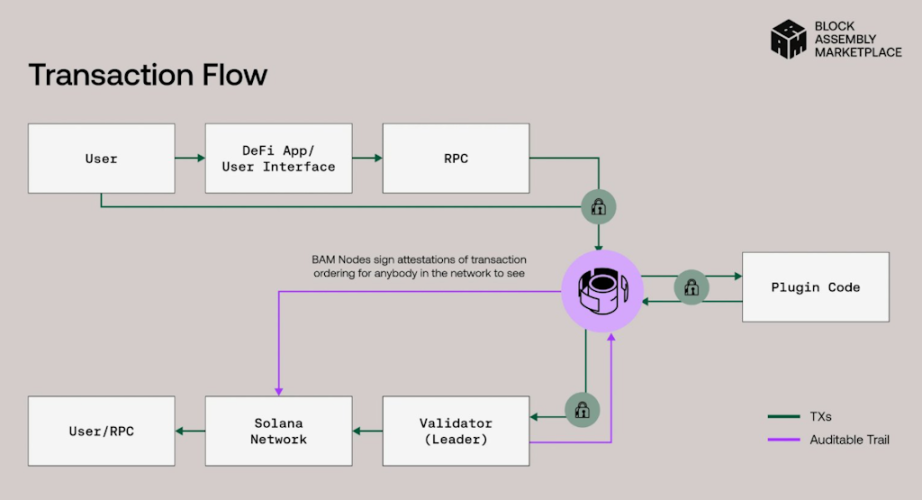

Jito's Block Assembly Market (BAM) aims to address this issue by retaining Solana's monolithic design while giving applications chain-like control over trade ordering and fees. A potential example is adopter speed buffering, which can slow down harmful traffic and narrow spreads, similar to the solutions deployed by Hyperliquid. The goal is clearer queues, less latency gaming, and higher quality trades, which could foster better applications and strengthen DeFi activity, potentially supporting a rebound in Solana's revenue. All BAM fees will be routed to the DAO, providing a new source of fees, and the BAM mainnet has recently crossed the threshold of over 10 million SOL staked.

The recent $50 million strategic investment led by Andreessen Horowitz indicates strong confidence from supporters. It highlights BAM's position as a core Solana infrastructure, improving the market by giving applications control over trade ordering while reducing harmful MEV. BAM is a network that expands Solana and unlocks on-chain primitives (such as central limit order books and dark pools) that have previously been unattainable due to MEV.

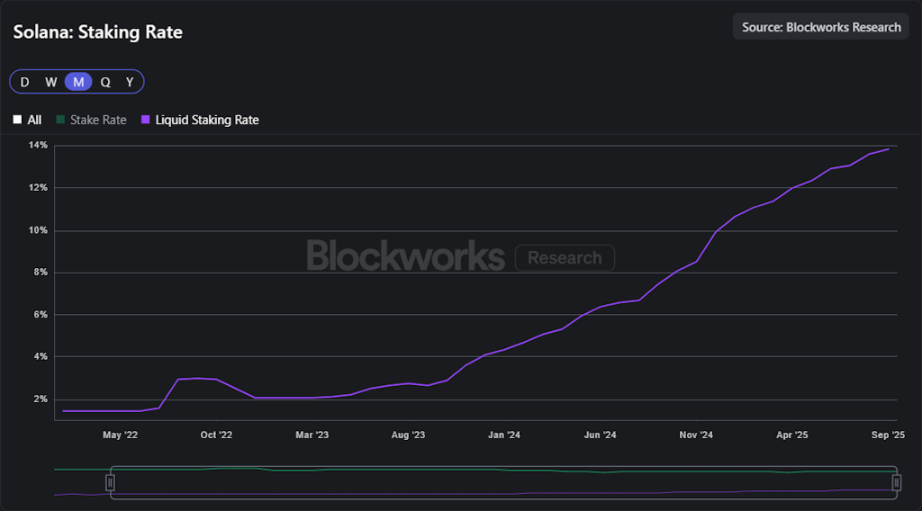

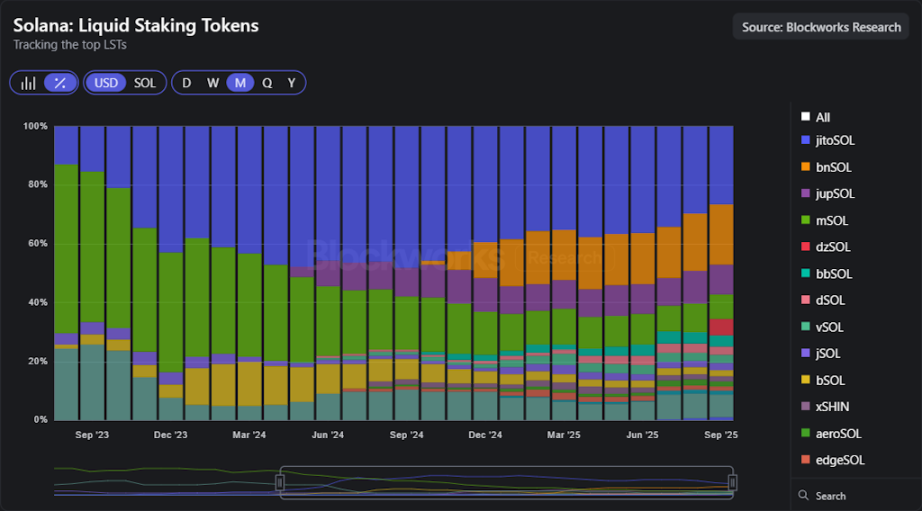

The Solana staking ETF is on the horizon. VanEck has submitted an S-1 application for a JitoSOL ETF, which will directly hold Jito's liquid staking tokens. As more funds are launched and scaled, the potential for LST penetration increases, and the connection between traditional financial inflows and the Jito value cycle becomes tighter. Note that liquid staking on Solana has been steadily increasing, currently reaching nearly 15% of the staked amount.

Since SIMD-0096, validators have received all priority fees instead of sharing them with the burn mechanism, resulting in a disproportionate share of network revenue. Once SIMD-0123 is activated, it will reintroduce balance by requiring validators to share part of these fees with stakers, thereby increasing staking yields and distributing rewards more evenly across the network. These two dynamics, along with the ecosystem activity shared more with stakers and the expansion of liquid staking, directly translate into revenue generated by Jito from liquid staking management fees.

However, competition in the Solana liquid staking market has intensified. JitoSOL once held nearly half of the staking liquidity, but its share has dropped to about 25% as new entrants have fragmented the market. In particular, Sanctum has gained momentum through its branded LST model and partnerships, enabling the protocol to launch customized staking products that directly compete with Jito's offerings.

In this context, Jito is aligning protocol incentives with token holder value. After JIP 24, all block engine and BAM fees flow into the DAO treasury. The DAO allocates all revenue to ongoing JTO buybacks, which have executed approximately $2.5 million in buybacks since August 2025. SubDAO is launching Vault, JTO auctions, and TWAP buyback systems to automate this process. The monthly buyback amount is set to match the previous month's revenue, thereby establishing a direct and recurring link between network activity and token value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。