Author: Proton Capital Research Team

Since the liquidation event on October 11, the sentiment in the cryptocurrency market has noticeably weakened. Large-scale contract liquidations and liquidity withdrawals have triggered a chain reaction, with the market generally believing that it may already be in the late stage of a bull market. The concept of the "four-year cycle," which was rarely mentioned during this round of upward movement, has once again become a mainstream narrative in the market, reflecting investors' heightened sensitivity to the cycle's peak and concerns about a potential bear market.

On a macro level, the Federal Reserve's continued balance sheet reduction and the withdrawal of liquidity from the TGA account have tightened global funding conditions, becoming an important backdrop for the recent widespread decline in crypto assets. However, from a trend perspective, liquidity tightening has reached a temporary bottom, and with the Fed slowing down its balance sheet reduction and the U.S. government resuming spending, marginal liquidity is expected to improve.

From a market structure perspective, although there has been a net outflow from spot ETFs, the scale is manageable, and the supply of stablecoins continues to grow, indicating that on-chain funds have not systematically withdrawn, and the market's fundamentals remain resilient. Bitcoin has shown relative resistance to declines following the October 11 event, while the altcoin sector has experienced significantly amplified volatility, indicating that funds are increasingly gravitating towards core assets.

Overall, the current market is in a consolidation phase at the late stage of a bull market, with sentiment leaning towards pessimism but liquidity not yet exhausted. If macro liquidity improves, the crypto market may still continue its upward cycle; if liquidity remains constrained, it may accelerate the entry into the early stages of a bear market.

October Review: Frequent Risk Events

Overall, the cryptocurrency market in October experienced a panic decline following a brief new high for BTC after the October 11 liquidation event, with market sentiment plummeting sharply. The "Uptober" rally that the market had high hopes for quickly transformed into a volatile "Voltober." The resurgence of the U.S.-China trade war, the massive liquidation event on October 11, the decoupling of USDE, rumors of market maker failures, and lending risks from U.S. regional banks all contributed to a surge of FUD news, compounded by the exhaustion of market liquidity, making mid-October the most panic-stricken period of the year.

1. October 11 Liquidation Event

The October 11 liquidation event became the largest liquidation in crypto history. On that day, approximately $19 billion in nominal value was liquidated, affecting over 1.6 million accounts. The trigger came from Trump's announcement on October 10 of a 100% tariff on Chinese imports, which sparked global panic. Under the amplified fear, the crypto market experienced a sharp short-term drop, with BTC falling nearly 13% within 30 minutes, triggering a chain liquidation. Most market makers withdrew liquidity to control risks, leading the market into a brief "liquidity vacuum," with altcoins suffering severe declines, some dropping over 99%, and stablecoin USDe briefly decoupling. Subsequently, the automatic liquidation mechanism (ADL) was activated, but some exchanges experienced priority confusion and lack of transparency in execution, causing some positions to be liquidated at irrational prices.

Figure 1. Cryptocurrency Contract Liquidation Data (Source: Coinglass)

Unlike single-point events such as the LUNA collapse or FTX bankruptcy, this round of decline stemmed from the systemic fragility of the contract trading system. In extreme market conditions, the limitations of market makers, liquidation mechanisms, and liquidity models were thoroughly exposed. The scale of this liquidation far exceeded the second-largest event in history, severely undermining market confidence, with altcoins being the hardest hit. In the short term, funds may further flow back to mainstream assets like Bitcoin and Ethereum, while the altcoin market remains sluggish.

2. Market Maker Failure Rumors

After the October 11 liquidation event, rumors of significant losses from several market makers emerged, with Wintermute being the most notable. At the same time, USDE briefly decoupled on Binance, exacerbating panic and evoking memories of the 2022 LUNA collapse and the 3AC bankruptcy chain crisis. The founder of Wintermute later stated that the current market contagion is far lower than in 2022, when institutional funds were highly intertwined, whereas current risk isolation is more robust, significantly reducing systemic risk. This round of liquidations was mainly concentrated in high-leverage trading of altcoins, with mainstream coins being less affected, but small and mid-cap assets and the derivatives market may still maintain high volatility.

Although the liquidation scale has reached five to ten times that of the LUNA collapse, there have been no reports of market makers or lending institutions going bankrupt. Overall, core institutions remain stable, but investors need to be cautious of the low liquidity and potential extreme volatility in the altcoin market.

3. USDE Decoupling

During the market turmoil on October 11, the stablecoin USDe briefly fell to about $0.65 on some exchanges (especially Binance), far below its $1 peg, triggering panic. The issuer, Ethena, later clarified that the minting and redemption mechanisms remained normal, and the protocol's collateralization ratio was safe, with no risk of default.

This decoupling is different in nature from the 2022 UST collapse; the volatility of USDe mainly stems from liquidity mismatches on exchanges rather than a failure of the mechanism. On DeFi platforms like Curve and Aave, its price remained close to par. Overall, this incident resembles a liquidity stress test. In the short term, investor confidence in new stablecoins may be affected, but as long as Ethena maintains transparency and sufficient collateral, market trust is expected to gradually recover.

4. Bank Lending Risk Issues

Recently, Zions Bancorp and Western Alliance have been exposed to loan and credit risk issues, raising concerns about the asset quality of U.S. regional banks. Zions reported a $50 million impairment due to two suspected fraudulent loans and an additional $10 million provision; Western Alliance disclosed about $198 million in non-performing loans related to Cantor Group V, of which $30 million has been included in reserves. The related borrowers have been accused of concealing collateral and engaging in structured fraud with sub-loans.

Although the news has caused market fluctuations, the overall scale and risk exposure of this event are far lower than the 2023 Silicon Valley Bank crisis. Currently, the problem loan scale for Zions and Western Alliance is relatively limited—less than 1% of their total loans, even lower than the average bad debt ratio in the U.S. banking industry. This indicates that the event is more of a case-specific risk exposure rather than a systemic liquidity crisis.

The risk events of the past week evoke memories of the last bear market, but a closer look reveals essential differences between this round and the 2022 LUNA collapse and Silicon Valley Bank crisis. The decoupling of USDe and regional bank bad debts reflect liquidity mismatches at the exchange level and individual credit fraud, rather than a complete failure of protocols or the banking system. The October 11 liquidation indeed caused a significant shock, but core market makers and the underlying financial structure remain stable, and the subsequent impact still needs to be observed. Overall, this round of panic appears to be a concentrated exposure of market leverage and liquidity fragility, rather than a systemic collapse.

Next, we will look at which stage of the cycle we are in from three main lines: liquidity, market sentiment, and macro events.

Macro Liquidity: Initial Signs of a Bottom

Currently, the Federal Reserve is still in the process of balance sheet reduction, but the pace has noticeably slowed. Since April of this year, the Fed has reduced the monthly limit for Treasury bond redemptions from $25 billion to $5 billion, while the MBS redemption limit remains unchanged at $35 billion. On October 14, Powell indicated in a speech in Philadelphia that the balance sheet has shrunk by about $2.2 trillion since 2022 and hinted that "we may be approaching the point of stopping the balance sheet reduction in the coming months," or entering a stabilization phase ahead of schedule.

Additionally, strategists from JPMorgan and Bank of America have recently predicted that, given the tightening funding conditions, the Fed is likely to announce the cessation of its balance sheet reduction at the October FOMC meeting, marking the end of this process of extracting liquidity from the financial markets. This timeline is significantly earlier than the previously expected December or early next year.

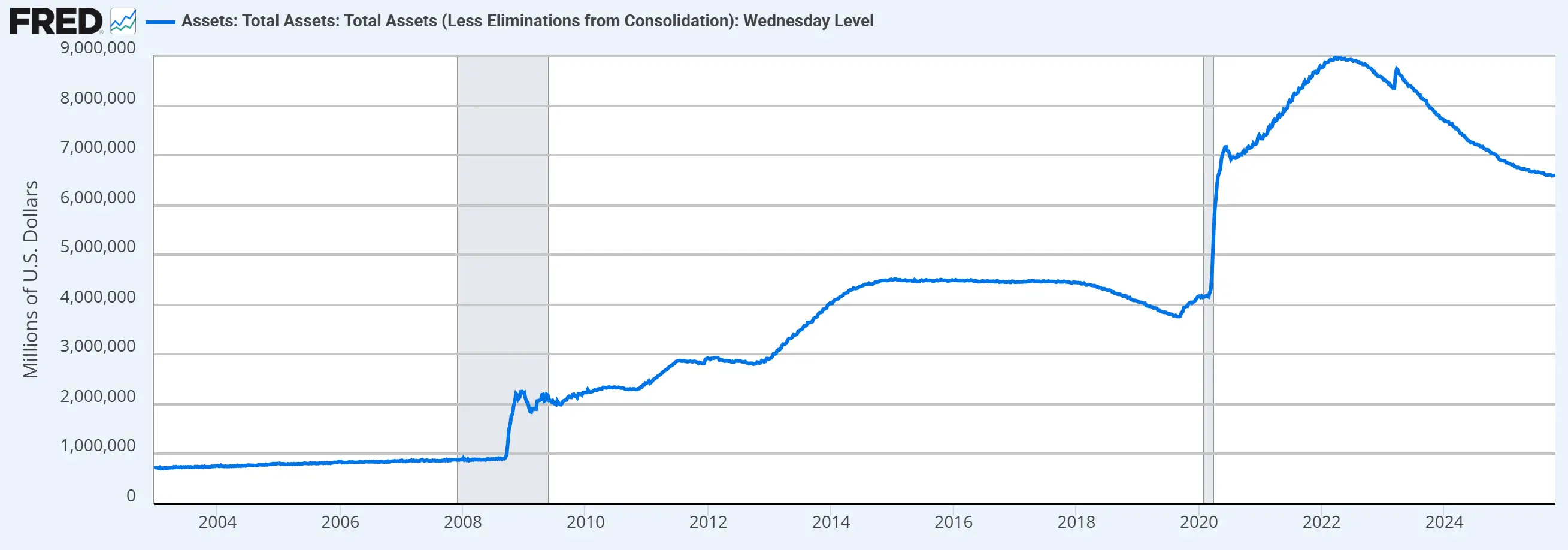

Figure 2. Federal Reserve Balance Sheet (Source: FRED)

Currently, the Federal Reserve's balance sheet has decreased by $2.38 trillion from its peak. The New York Fed, as the operational agency for the Fed's balance sheet policy, had previously expected that during the balance sheet reduction process, bank reserves would drop from the current approximately $3.6 trillion to between $2.5 trillion and $3 trillion, with the balance sheet size reducing to around $6 trillion or $6.5 trillion. Currently, bank reserves have fallen to $2.93 trillion, and the Fed's balance sheet has also reached the edge of the range.

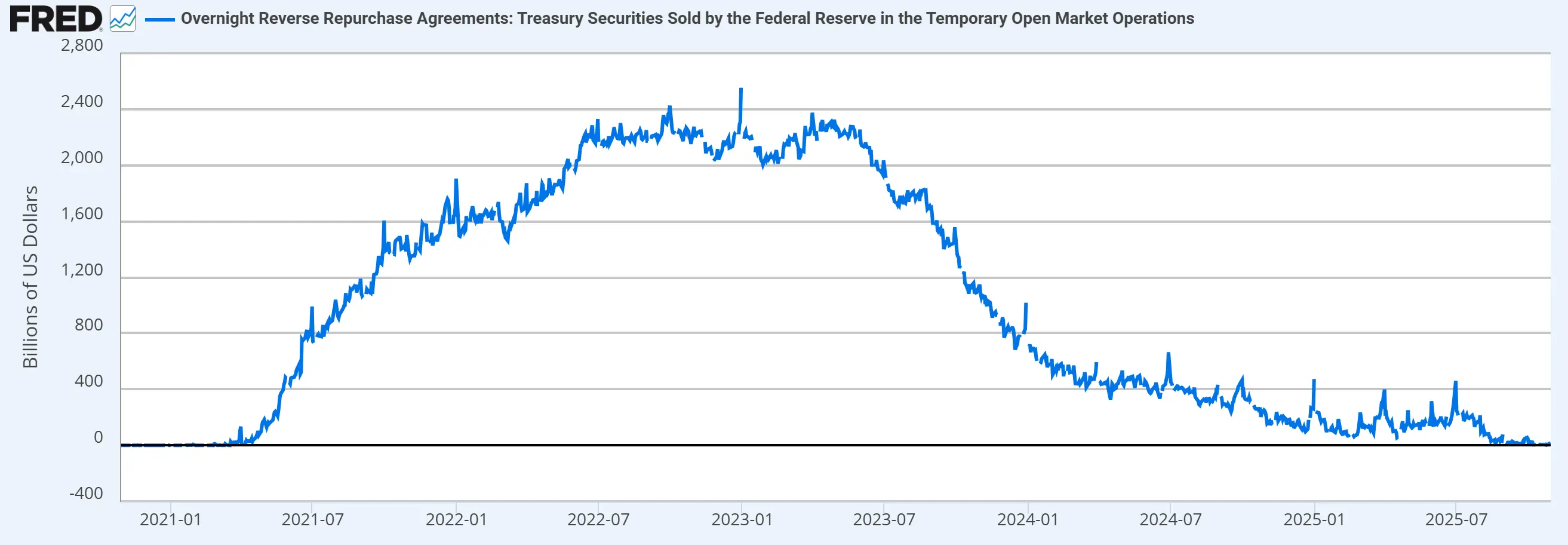

The overnight reverse repurchase agreement tool is the Fed's mechanism for withdrawing liquidity from the market, working in conjunction with the balance sheet reduction to manage bank reserve levels. Data shows that since August of this year, the reverse repurchase tool has been drained and can no longer release liquidity.

Figure 3. Federal Reserve Reverse Repurchase Tool Balance (Source: FRED)

The TGA account is a "checking account" opened by the U.S. Treasury at the Federal Reserve to manage the federal government's daily receipts and expenditures. By adjusting the TGA balance, the Treasury can influence the dollar liquidity in the financial markets. Although the TGA currently has a large balance (the "Inflation Reduction Act" increased the debt ceiling, allowing the Treasury to increase cash reserves, which can also be understood as extracting liquidity from the market), the U.S. government's shutdown has affected the Treasury's ability to release liquidity.

Figure 4. U.S. Treasury Account Balance (Source: FRED)

Overall, the macro environment is at a liquidity bottom: balance sheet reduction is ongoing, reverse repos have been exhausted, and the fiscal side is constrained by the government shutdown. This has become an important backdrop for the recent pullback in the crypto market. However, with the end of balance sheet reduction and the resumption of government operations, overall liquidity is expected to rebound. Whether this can drive a rebound in the crypto market still depends on whether funds can flow back into the crypto ecosystem.

Crypto Market Liquidity: No Significant Withdrawals Yet

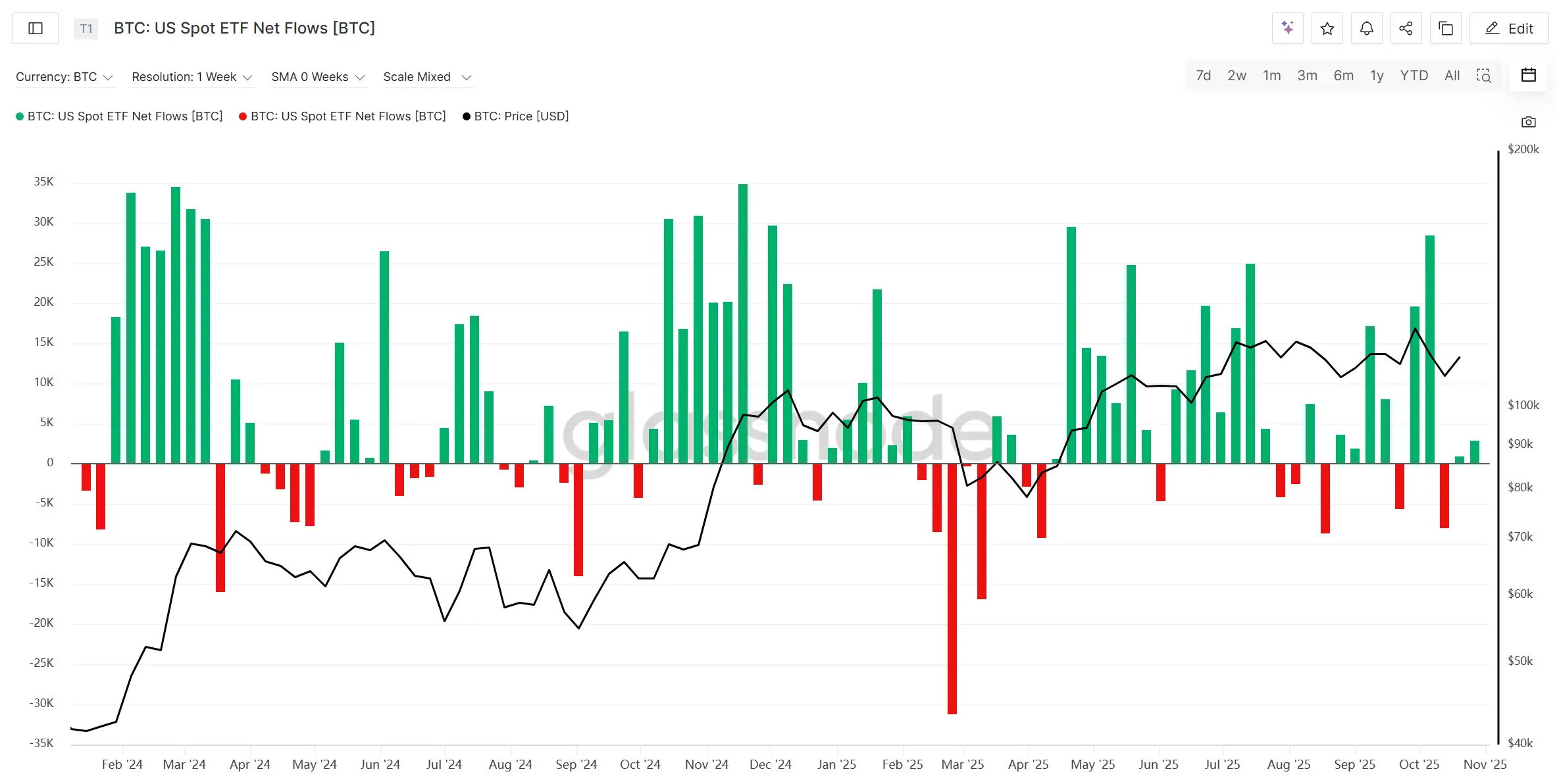

First, let's look at the inflow and outflow of BTC and ETH spot ETFs. In this bull market, their inflow and outflow can reflect the liquidity entering and exiting the crypto market to some extent. From the flow of funds, BTC and ETH spot ETFs recorded net outflows for two consecutive weeks following the "October 11 liquidation event," but the scale is limited and remains within a controllable range, showing no signs of systemic withdrawal.

Figure 5. BTC and ETH Spot ETF Net Outflow Situation (Source: Glassnode)

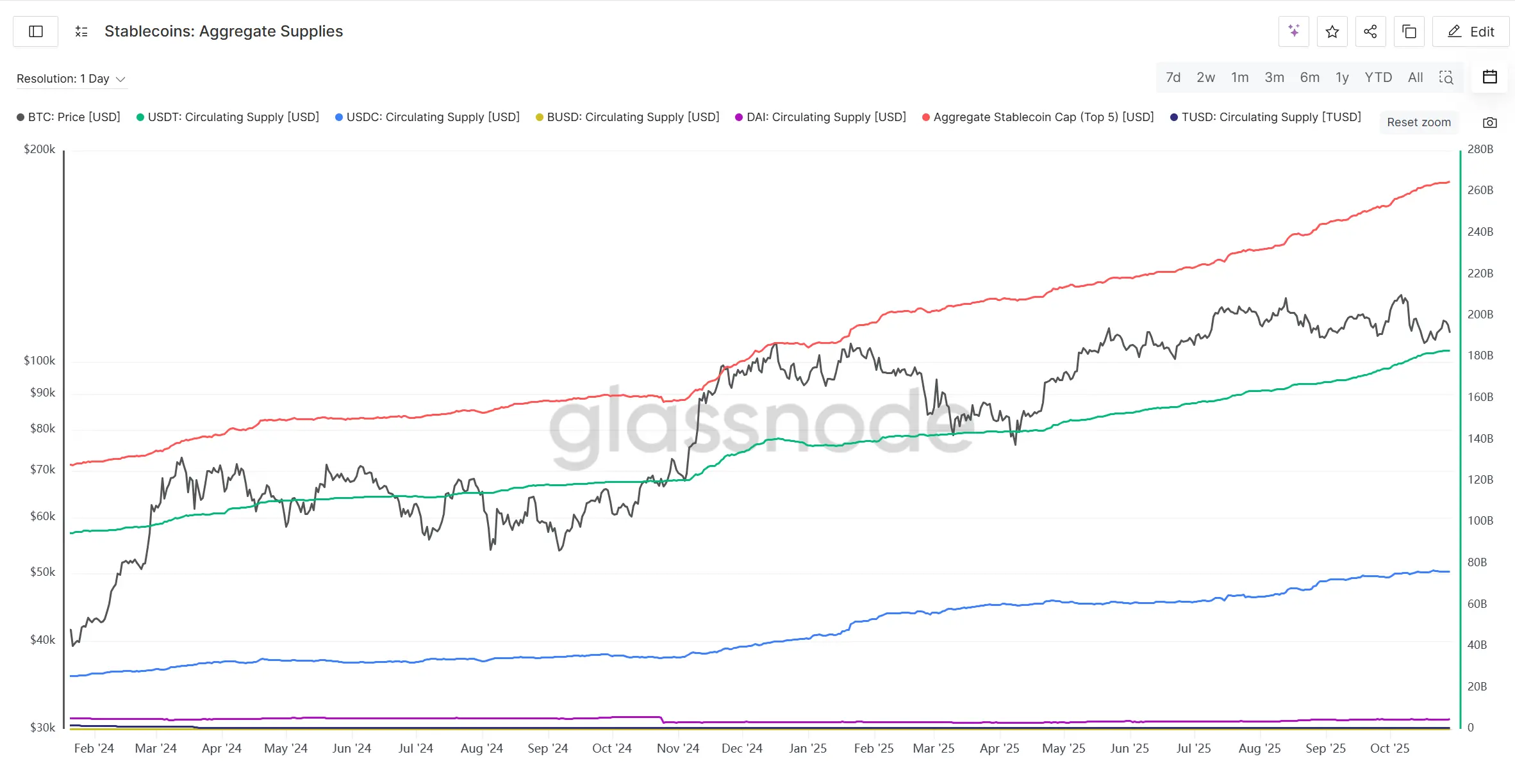

Meanwhile, the supply of mainstream stablecoins continues to rise, even showing a slight acceleration in issuance during the market correction phase, indicating that on-chain funds are still maintaining growth momentum, with potential liquidity still present.

Figure 6. Supply of the Top Five Stablecoins by Market Capitalization (Source: Glassnode)

Overall, the recent decline in the crypto market is more attributed to tightening macro liquidity rather than a depletion of internal market liquidity. The outflow from spot ETFs is manageable, and the increase in stablecoin supply remains stable, showing that there has not been a panic withdrawal of funds. The current adjustment appears more like a short-term disturbance rather than a trend reversal. If macro liquidity improves marginally, the crypto market still has the potential for recovery and upward momentum.

Market Sentiment: Pessimistic Narratives and the Return of "Cycle Theory"

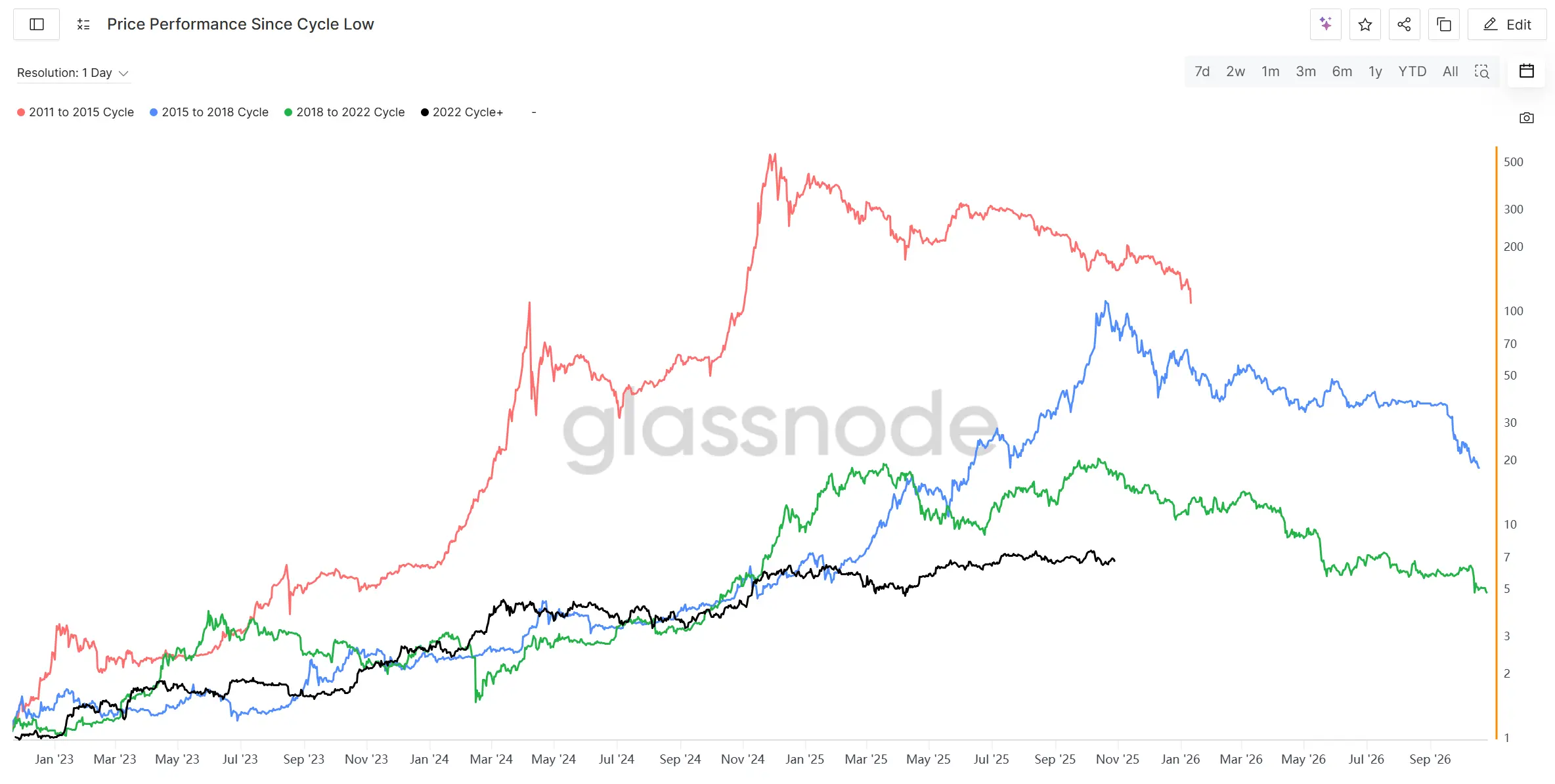

Since the October 11 liquidation event, sentiment in the crypto market has clearly turned pessimistic, with the four-year cycle concept, which was rarely mentioned during this bull market, now spreading throughout the crypto market. Looking at the performance from the lows of the last four-year cycle bear markets, the current position is at the peak of the "2015 to 2018" cycle and the last peak before entering the bear market of the "2018 to 2022" cycle. Historically, it seems that the countdown to a bear market has begun, and combined with the October 11 liquidation event, the panic surrounding the arrival of a bear market is accelerating throughout the crypto market.

Figure 7. BTC Performance Across Cycles (Source: Glassnode)

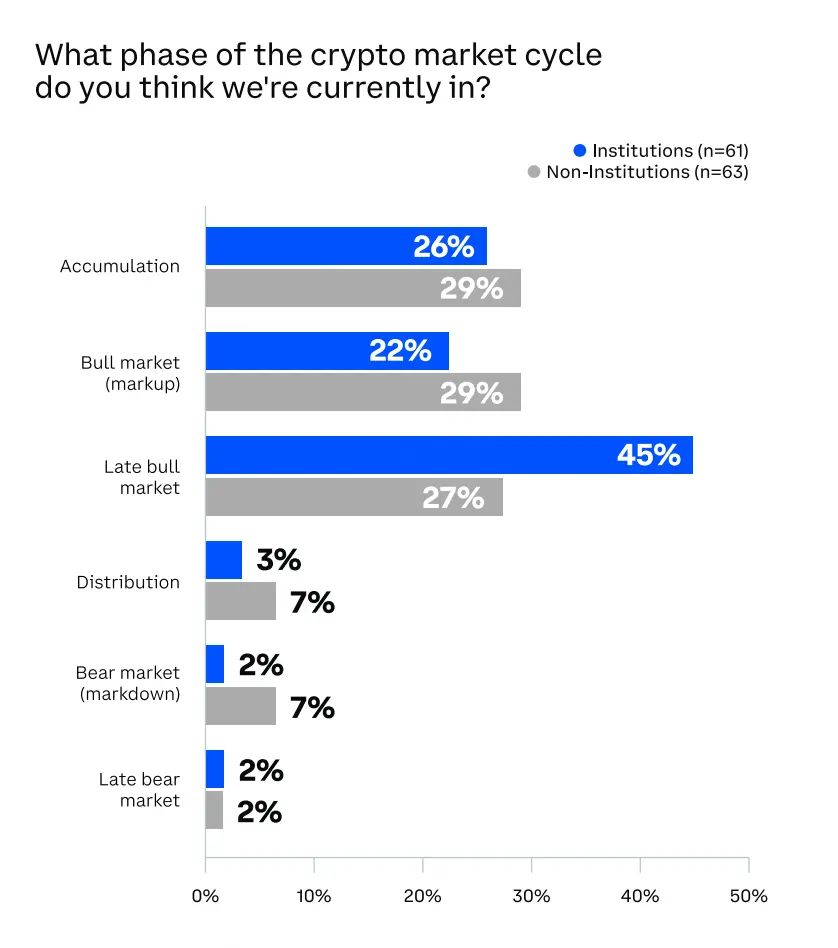

A survey conducted by Coinbase at the end of September among over 120 institutional and retail investors revealed notable insights regarding the current stage of the crypto market. A significant 45% of institutional investors believe the market has entered the late stage of a bull market, while 27% of non-institutional investors share this view. Following the October 11 liquidation event, this percentage is likely to concentrate even more towards the late bull market and peak distribution phase.

Figure 8. Coinbase Survey: Current Stage of Cryptocurrency (Source: Coinbase)

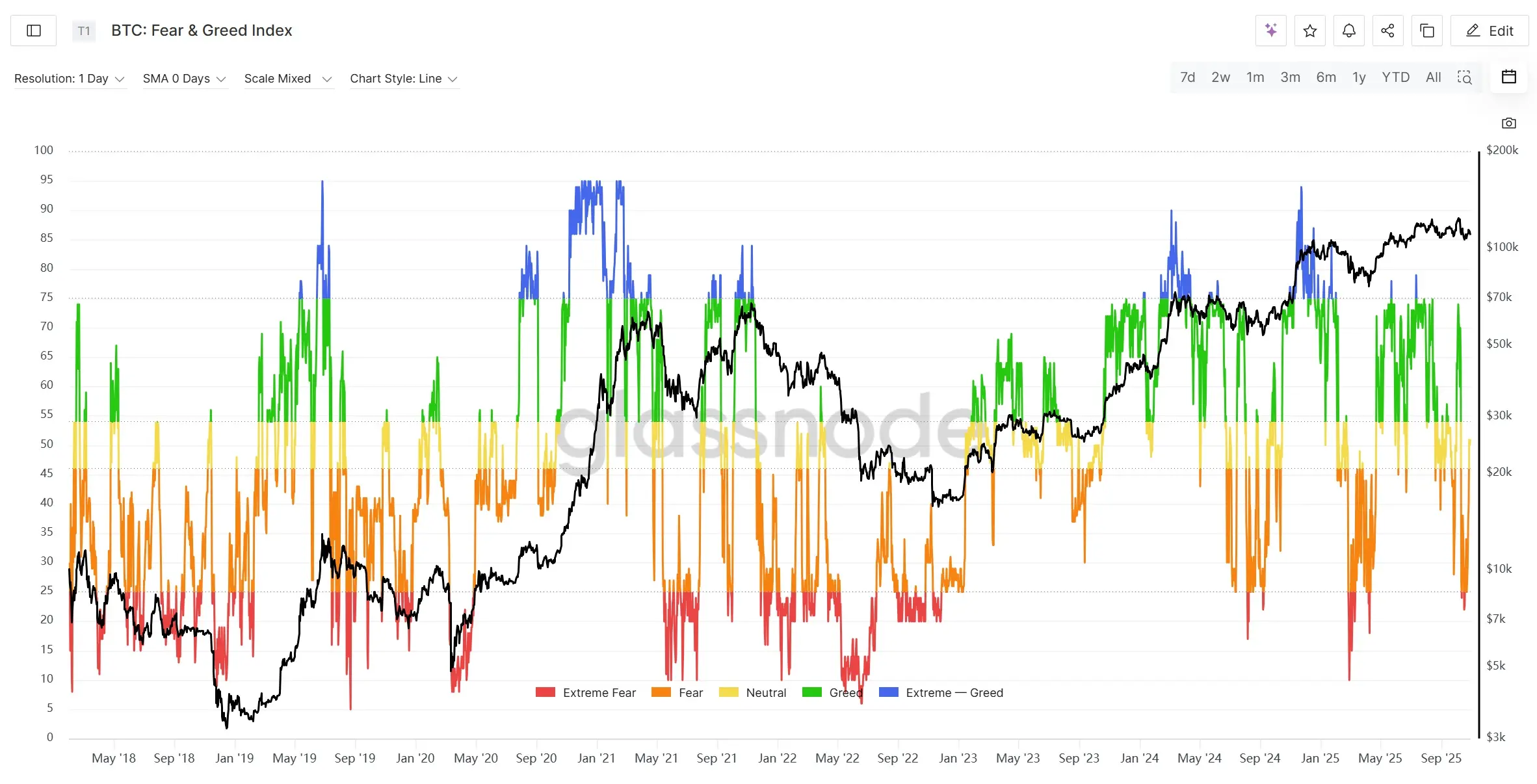

Additionally, over $20 billion in nominal value of long positions in the futures market have been liquidated, leading to a significant number of leveraged long positions being forcibly closed, making it difficult for the market to gather enough momentum to form an upward trend in the short term. Furthermore, the market's fear index (Crypto Fear & Greed Index) quickly fell to around 20 points, a relative bottom, after the October 11 event. Although BTC prices have stabilized, the overall index remains in a bottoming phase, indicating that market sentiment is in a state of extreme caution or even panic, but this also means that potential rebounds will require time to digest risks.

Figure 9. BTC Fear and Greed Index (Source: Glassnode)

In summary, overall market sentiment is gradually leaning towards the idea that the bull market has reached its end, while the October 11 liquidation event briefly plunged the entire market into a state of extreme panic. From the perspective of overall market sentiment, the short-term market may still primarily experience a volatile decline, and the recovery of liquidity and investor confidence will take time. If the market cannot reach new highs or if the upward momentum quickly stagnates, it is indeed possible to transition into a bear market. However, if the "bull market extends" or the structure differs from previous cycles, the onset of a bear market may also be slower or more moderate than in history.

Macro Black Swan Events: Rising Uncertainty

1. U.S. Government Shutdown

As of October 1, 2025, the U.S. federal government has entered a shutdown due to a funding impasse, marking the second-longest shutdown in history. Congress failed to pass a temporary funding resolution before the new fiscal year, with multiple Senate votes on Republican proposals failing to meet the 60-vote threshold, leading to a stalemate in budget negotiations. If Congress and the White House cannot reach a compromise soon, the shutdown may extend into mid-November, with subsequent negotiations focusing on healthcare subsidies, the debt ceiling, and wage guarantees.

For the crypto market, a government shutdown means a decrease in risk appetite in the short term, and volatility in traditional markets may prompt some funds to shift towards crypto assets for hedging or speculation. However, due to the high leverage and volatility in the crypto market, if risk assets are broadly sold off, crypto assets will also be hard to escape.

Due to the government shutdown, the release of several economic and employment data has been delayed, which may lead the Federal Reserve to maintain its current pace of interest rate cuts. FedWatch has fully priced in expectations for a 50 basis point rate cut on October 29. Coupled with the Fed's dovish shift and weak employment data, the market's expectations for two 50 basis point rate cuts this year have strengthened, providing underlying support for risk assets, including cryptocurrencies.

2. U.S.-China Trade War

Since October 2025, U.S.-China trade relations have once again become tense, with tariffs and technology export restrictions becoming focal points. The situation arose after China announced an expansion of export restrictions on rare earths and critical minerals, provoking a strong reaction from the U.S. Trump subsequently announced a maximum 100% tariff on Chinese goods starting in November and restricted Chinese companies' access to key components and software in the U.S. industrial chain, marking an escalation of the trade war from goods to high-tech and strategic resources, raising global concerns about supply chain restructuring and rising inflation. Recently, both sides have shown slight signs of easing. Trump and his Treasury Secretary have repeatedly stated that high tariffs are unsustainable, and there is still room for cooperation in U.S.-China relations, expressing a reluctance to decouple economically. Reports indicate that representatives from both sides have begun trade negotiations in Malaysia. November 1 is a critical date, as tariffs will take effect, and there may be a meeting between the leaders of the two countries during the APEC summit, which could bring a turning point to the situation.

Overall, the U.S.-China tariff conflict remains the biggest uncertainty for the global financial and crypto markets and was a direct trigger for the October 11 crash. Subsequent developments will need to be closely monitored.

Conclusion

Overall, October has become the month with the highest volatility and the most significant emotional turning point in this bull market.

On the macro level, the Federal Reserve's continued balance sheet reduction and the withdrawal of liquidity from the TGA account have placed the global market at a liquidity bottom. However, as the Fed slows its balance sheet reduction and the government reopens, marginal liquidity improvement is expected, with a long-term trend still leaning towards easing.

From the perspective of the crypto market, although ETFs have seen net outflows, the scale is limited, and the supply of stablecoins continues to increase, indicating that on-chain funds are still accumulating strength. Bitcoin's decline of only about 17% during the largest liquidation event in history demonstrates its resilience as a core asset. In contrast, the altcoin sector exhibits weak liquidity and extreme volatility, with the potential for frequent extreme market conditions in the future.

In terms of sentiment, discussions about the "bull market entering its final stage" have rapidly intensified, and the four-year cycle logic is being widely referenced again. If liquidity does not effectively return in the future, the crypto market may gradually revert to traditional cyclical rhythms, entering a phase of high-level consolidation or even the early stages of a bear market. However, if the Fed ends balance sheet reduction early and liquidity is injected again, there remains the possibility of extending the bull market cycle.

Overall Judgment: The current market is in a phase of consolidation and adjustment at the late stage of a bull market. Macro liquidity has reached a bottom but has not yet rebounded, and while systemic risks have not been eliminated, Bitcoin has shown strong resilience. Future trends will depend on the speed of liquidity repair and the rebuilding of market confidence. Strategically, it is advisable to maintain a high-weight allocation to mainstream assets (BTC, ETH), control exposure to altcoin risks, and pay attention to macro turning signals and the evolution of potential systemic risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。