Wall Street, meanwhile, was in a better mood—Nasdaq, Dow, and S&P 500 all posted gains ahead of the Federal Open Market Committee (FOMC) meeting. But once the closing bell rang, crypto called it a day. The total digital asset market now sits at $3.78 trillion, down 2.23% in 24 hours.

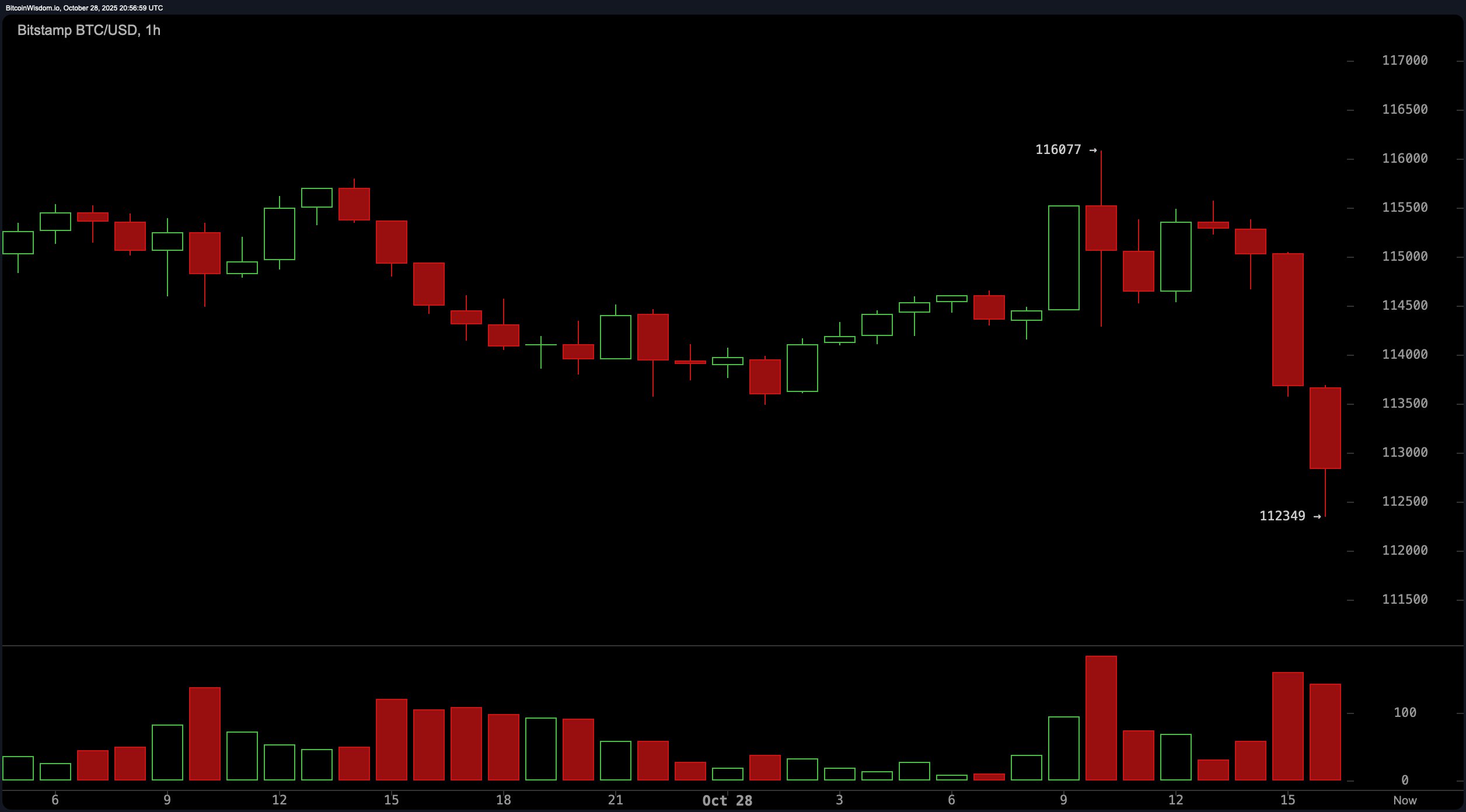

Earlier in the day, bitcoin even flirted with $116,077 before gravity took over around 4:30 p.m. Volume spiked to $62.67 billion, but it’s mostly sell orders hitting the tape. That wave of red ink triggered chaos in the derivatives arena, where $552.27 million in positions were liquidated across 150,568 traders.

Ethereum ( ETH) and bitcoin took the brunt of it— ETH longs got vaporized to the tune of $122 million, while BTC longs saw $88.82 million go poof, per Coinglass data. SOL, TRUMP, ZEC, LTC, ENA, and a few others joined the liquidation graveyard. By day’s end, BTC was down 1.8%, ETH off 3.9%, and XRP down 1.3%.

In the shiny metal department, gold slipped 0.69% to $3,955 per ounce, while silver managed to glimmer just a bit, up 0.38% at $47.12. Not exactly a rally, but hey—at least someone’s still shining. In short, Tuesday was one of those days where bitcoin reminded everyone it still knows how to throw a tantrum. By 5 p.m. on Oct. 28, BTC was exchanging hands for $112,851 per unit.

With the Fed’s rate decision looming, the market’s acting like a caffeinated squirrel—jittery, unpredictable, and definitely not sitting still. The liquidations were brutal, the nerves were fried, and the charts looked like modern art. But if history’s any guide, bitcoin’s favorite party trick is making a comeback right after everyone declares it dead—so grab popcorn, the next act’s probably already loading.

- Why did bitcoin drop today?

Bitcoin fell to $112,349 as traders positioned for the Federal Reserve’s expected rate cut and a volatile pre-FOMC session. - How much was liquidated in the crypto market?

Roughly $552 million in crypto positions were liquidated over the past 24 hours across 150,000+ traders. - Which cryptocurrencies saw the biggest losses?

Ethereum ( ETH) led with a 3.9% drop, followed by bitcoin ( BTC) down 1.8% and XRP off 1.3%. - What’s next for bitcoin’s price?

Traders are watching the Fed’s rate decision closely, with volatility likely to stay high through the week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。