Controversial addresses have emerged during the airdrop, including individuals related to insider trading scandals and unusually active large holders, further exacerbating the community's trust crisis and putting the project at risk of collective lawsuits.

Author: Frank, PANews

The important DeFi project Meteora in the Solana ecosystem welcomed its TGE and airdrop event on October 23, which was supposed to be a "redemption" for the protocol after early scandals. The team touted it as a revolutionary, community-first "fair distribution." However, this highly anticipated airdrop quickly turned into a storm of distrust.

In response to the airdrop activity of Meteora, PANews analyzed over 70,000 on-chain claim activities to unveil the full picture of the Meteora airdrop.

48% "High Circulation" Experiment's Immediate Impact

Meteora's TGE plan is uniquely designed, with its core being "high liquidity" and a points-based distribution model.

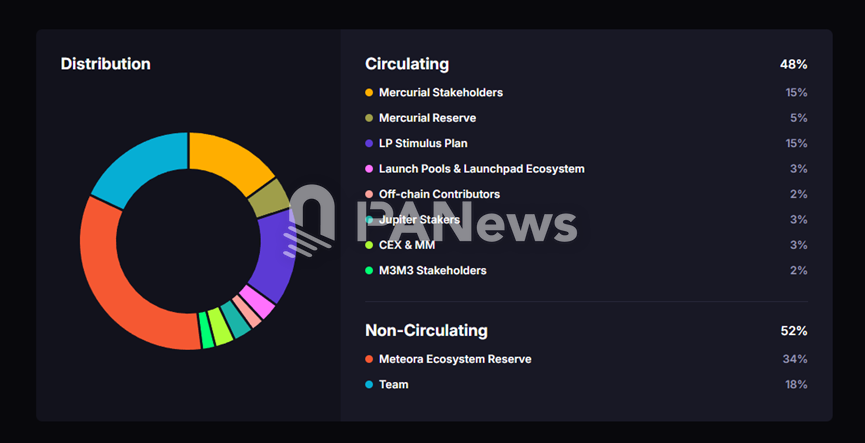

The total supply of MET tokens is 1 billion. On the day of the TGE, 48% (i.e., 480 million tokens) were fully unlocked and entered circulation all at once. The team claimed this move was "intentional," aimed at eliminating "artificial scarcity" and achieving "real market price discovery."

This airdrop was based on an activity snapshot taken on June 30, 2025, with claims opening on October 23. The eligibility criteria used a points system, rewarding liquidity providers (LPs), Jupiter (JUP) stakers, and previously controversial M3M3 Memecoin stakers.

This radical model almost immediately triggered a "shock therapy" in the market. The massive supply of 48% created "overwhelming immediate selling pressure." After the TGE launched, the MET price quickly fell from about $0.90 at opening to a low of $0.51 within hours, revealing the market's "harsh" reaction and setting the stage for the storm.

Four Whales Claim Over 28% of Airdrop, 60,000 Retail Investors Only Claim 7%

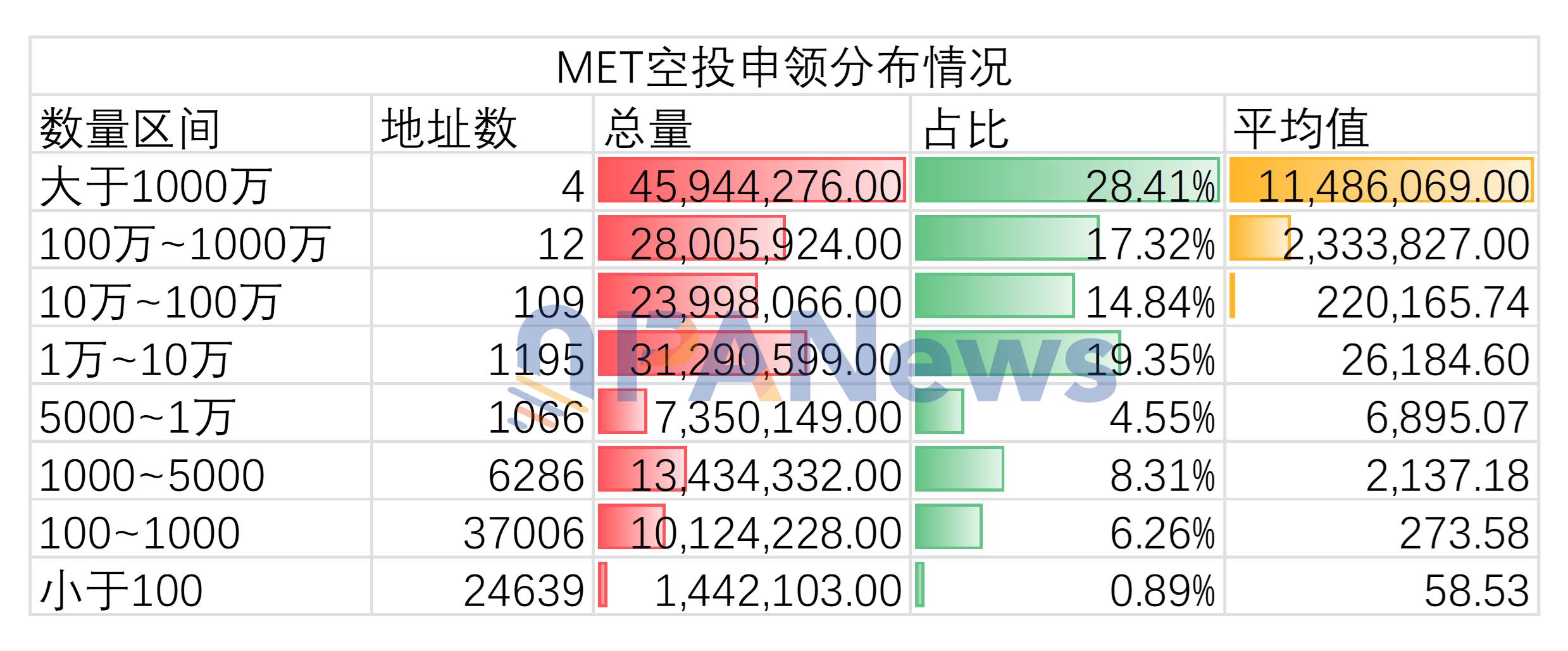

According to PANews statistics, as of October 24, approximately 161 million MET tokens had been distributed in the airdrop, with around 71,000 transaction claims. The average claim amount was 2,277 tokens.

In terms of airdrop scale, the current claimed amount is approximately $83.7 million, with an average claim value of about $1,180 per address. On average, it seems that the MET airdrop was a decent reward; however, further examination of the data reveals a concentrated and stark "wealth gap" among large holders.

Among all claiming addresses, the address that claimed the most received 12.15 million tokens, valued at about $6.31 million. A total of four addresses claimed over 10 million tokens, with these four large holders receiving approximately 45.94 million tokens, accounting for 28.5% of the currently claimed airdrop amount.

Among the remaining addresses, there are 12 addresses that claimed over 1 million tokens, collectively receiving over 28 million tokens, accounting for 17.32%; the number of addresses claiming between 100,000 and 1 million tokens is 109, claiming 23.99 million tokens, accounting for 14.84%. The number of addresses claiming between 10,000 and 100,000 tokens is 1,195, claiming a total of about 31.29 million tokens, accounting for 19.35%; the most numerous are the addresses claiming between 100 and 1,000 tokens, totaling 37,000, claiming 10.12 million tokens, accounting for about 6.26%; there is also a large number of addresses claiming fewer than 100 tokens, totaling 24,600, claiming a total of 1.44 million tokens, accounting for about 0.89%.

These data reveal a harsh reality: the MET airdrop was not a "sunshine" community reward but rather a feast of extremely unequal distribution for the top holders.

Four Whales Each Unusual

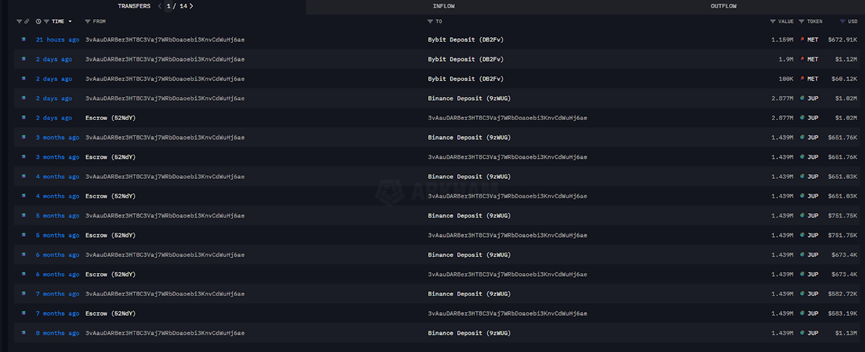

The address that claimed the most is 3vAauDAR8er3HT8C3Vaj7WRbDoaoebi3KnvCdWuHj6ae, which claimed over 12.15 million tokens in one go, currently valued at about $6.31 million. From discussions on social media, this address had previously participated in the airdrop for the MER token (the predecessor of Meteora, MercurialFinance) and holds a large amount of JUP tokens, which have been frequently transferred to exchanges for sale. Some analysts believe this is an associated address of the Meteora team.

In the past eight months, over 30 million JUP tokens have been sold through this address.

Currently, this selling tactic has been applied again to MET, and as of October 25, this address has transferred over 3 million MET tokens to the Bybit exchange.

The second and third addresses with the highest claims appear to have a strong correlation. From simple behavior, both addresses are large holders of JUP and are frequently active in adding liquidity to the Jupiter pool. Coincidentally, the number of JUP transfers from these two addresses has repeatedly remained the same, both being 2,622,632.41, and the activity times often coincide on the same day.

From various activity trajectories, these two addresses should belong to the same group.

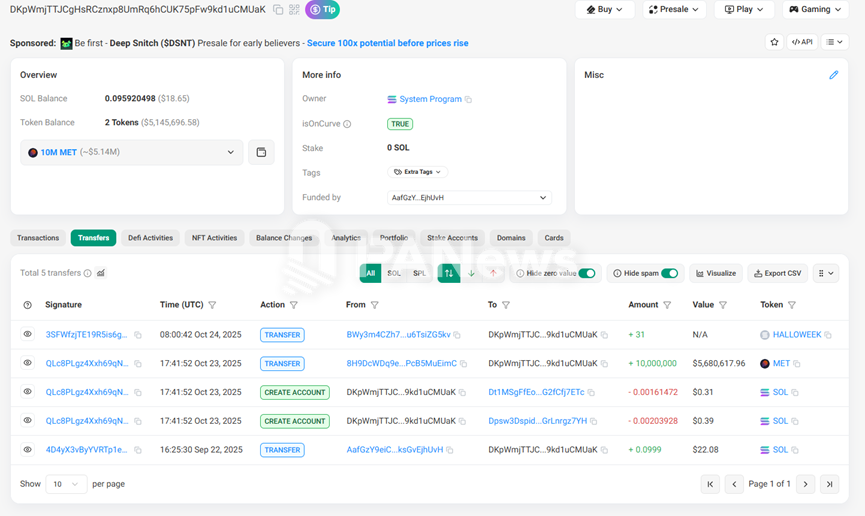

Additionally, the fourth-ranked address DKpWmjTTJCgHsRCznxp8UmRq6hCUK75pFw9kd1uCMUaK is also unusual, having claimed exactly 10 million tokens. This amount does not seem like a normal points claim, and this address was created a month ago, which should have already missed the snapshot time for Meteora. Moreover, this address has never engaged in any liquidity addition or JUP staking or other activities related to airdrop eligibility. As of now, the tokens from this address have not been transferred. The eligibility and ownership of this address remain unknown.

"Insider Trading" Receives Millions in Airdrop, Team Deep in Collective Lawsuit Crisis

In addition to several unusual large holders, there are many controversial aspects of the MET airdrop.

For instance, Arkm pointed out that three addresses related to insiders of the TRUMP token collectively received MET airdrops worth $4.2 million. After receiving the airdrop, these addresses immediately deposited all MET into the OKX exchange.

Additionally, Hayden Davis, a core figure in the LIBRA scandal, also received tokens worth about $1.5 million in the MET airdrop.

These airdrop actions have sparked strong criticism from the community, with users on social media stating, "Why did Hayden Davis receive the MET airdrop? You must be joking… Thanks to Meteora for giving Hayden Davis another $1.5 million."

In fact, this is not the first time Meteora has found itself in a trust crisis. In December last year, Meteora launched the M3M3 platform and its eponymous token, claiming to aim to change the dynamics of meme coins. However, the project quickly collapsed, with the token value plummeting 98% from its peak, leading to subsequent collective lawsuits. After the LIBRA scandal in February this year, the Meteora team again faced accusations of insider trading.

In summary, the grand TGE and airdrop event of Meteora not only failed to become the "community redemption" it claimed but instead evolved into a disaster that exacerbated the trust gap. From the price flash crash triggered by the radical 48% high circulation model to the millions of dollars in airdrops received by individuals related to "insider trading" and the core figures of the LIBRA scandal, every step taken by Meteora seems to be questioned as straying far from the original intention of "community first."

What should have been a "redemption" event ultimately only added new wounds to the old scars left by the M3M3 and LIBRA scandals, plunging the team into a new round of trust storms and collective lawsuit crises. For Meteora, the road to regaining community trust is clearly much more difficult than it had envisioned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。