Author: Deng Tong, Golden Finance

On October 21, 2025, Coinbase spent approximately $375 million to acquire the leading on-chain financing platform Echo. The Echo platform enables community members to more easily engage in financing and investment, whether through Echo's private placements or using Sonar's public offerings.

What is the Echo platform? Who is its founder? Why is Coinbase so fond of it? Will the initial coin offering wave return?

1. What is the Echo platform? Who is its founder?

In 2023, Echo was created by crypto OG Cobie (Jordan Fish), former fund manager Lexie, and others. It is an on-chain fundraising platform that allows blockchain projects to conduct private or public token offerings to the community or investors using platform tools, aiming to help "join private financing rounds of new startups or token projects with the professional investment community." Its focus is on "enabling projects to raise funds directly from the community," "allowing investors to participate earlier," and "making the process more transparent." In May 2025, Echo launched the Sonar product and tweeted on X: "We are making on-chain financing accessible to everyone. Introducing Sonar."

Cobie, its founder, is also a prominent figure in the industry. He entered the crypto space in 2013, initially driven by speculation and interest, having purchased assets like BTC, ETH, and DOGE early on. In 2020, he founded the crypto podcast "UpOnly," co-hosting the show with Chris Dixon. He has invited notable guests such as Elon Musk, Vitalik Buterin, CZ, and SBF, making it one of the most popular podcasts in the industry.

Cobie is also a top investor. During the bull market, he participated in several early angel rounds for projects like Lido, Arbitrum, ENS, dYdX, and Friend.tech. This laid the foundation for his subsequent creation of the on-chain fundraising platform Echo.

In response to Coinbase's recent acquisition of Cobie, he stated on X: "Echo will continue to operate as an independent platform under its existing brand, but we will integrate Sonar's public sale product into Coinbase and may introduce new ways for founders to connect with investors, providing opportunities for investors to access Coinbase."

Coinbase has indicated plans to expand Echo's infrastructure beyond cryptocurrency, ultimately supporting tokenized securities and real-world assets.

This acquisition complements Coinbase's previous acquisition of the token management platform LiquiFi. Coinbase also invested $25 million to relaunch Cobie's UpOnly podcast.

2. Echo's Star Products

In early 2024, Echo launched Private Group Investing, supporting private group fundraising, with on-chain USDC settlement and a multi-round allocation mechanism. By mid-year, it introduced the Investor Dashboard, providing investors with investment history, project tracking, and yield display features. By the end of the year, it launched the Founder Portal, a fundraising backend system for project teams, supporting token allocation, whitelist control, and smart contract deployment. In May 2025, it launched the self-custodial public sale tool—Sonar.

Among these, Private Group Investing and Sonar are Echo's two star products. Private Group Investing allows project teams to initiate private placements through a "leader + community members" structure, with Echo providing on-chain tools, smart contracts, USDC circulation, and standard processes. Sonar allows projects to "self-custody" public token sales, meaning developers can directly raise funds from the community using Sonar tools, rather than being limited to traditional private placements.

One of Echo's most notable success stories is Plasma. On May 27, 2025, Plasma officially announced it would use Echo's new token sale infrastructure Sonar for its public sale. Sonar handles KYC verification, jurisdiction screening, and other checks for Plasma, while Plasma is responsible for sales execution, including all fund and token transfers.

The case of MegaLabs also drew attention. In December 2024, MegaLabs raised $10 million through the Echo platform in less than three minutes. Co-founder Shuyao Kong revealed that the company's initial goal was to raise $4.2 million, which was achieved in just 56 seconds after launching the crowdfunding. Due to high investor demand, the project raised an additional $5.8 million, completing the fundraising in 70 seconds.

Additionally, according to Cobie, Ethena, which caused a stir in the market when USDe launched in 2024, was also an important early fundraising project for Echo, being one of the first projects Echo helped complete fundraising for.

3. Why is Coinbase so fond of Echo?

Coinbase addressed this question in its blog: to create a more complete capital market and build a full-stack solution from startup to financing to secondary markets.

The "why" is simple. We want to create a more convenient, efficient, and transparent capital market. However, founders often struggle to raise funds, and individual investors lack opportunities to invest in private token sales.

Echo solves this problem by allowing projects to raise funds directly from the community, either through private placements or by using Sonar to initiate public token sales. Integrating Echo's tools will help us achieve more direct community engagement, fully connecting projects with capital on-chain. While we will initially conduct crypto token sales through Sonar, we plan to leverage Echo's infrastructure to gradually expand support for tokenized securities and real-world assets.

Echo has made significant progress in opening the private placement market, having helped approximately 300 projects raise over $200 million since its launch. Its newly self-operated public token sale product Sonar has also achieved initial success, aiding Plasma's XPL token sale.

Through this acquisition, we are building a full-stack solution for crypto projects and investors, covering everything from startup to financing to secondary trading.

- For builders: easier access to capital and fundraising tools aligned with the community, such as Echo for private investment groups and Sonar for self-custodied public token sales;

- For investors: new differentiated opportunities that were previously inaccessible, available through trusted platforms like Echo or directly via Sonar;

- For the on-chain economy: creating a more efficient, transparent, and globally accessible capital market to drive innovation and growth.

Echo complements our recent acquisition of Liquifi, which simplified token creation and equity structure management for early teams. Liquifi enhanced our ability to provide early support to entrepreneurs, while Echo extends that support into the fundraising space. Combined with our existing strengths in listing tokens on exchanges, custody, staking, trading, and financing, we can now offer token issuers and investors lifecycle support from issuance to financing to secondary markets.

4. Will the initial coin offering wave return?

The significance of Coinbase's acquisition goes beyond corporate expansion. Under Coinbase's influence, a regulated, community-driven token sale boom may be forming, which could have profound implications for future investment models in the cryptocurrency space.

According to research from Tiger Research, platforms like Sonar, Buidlpad, Legion, and Kaito are leading a new wave of compliant launch platforms, combining accessibility with investor protection through measures like KYC and transparency.

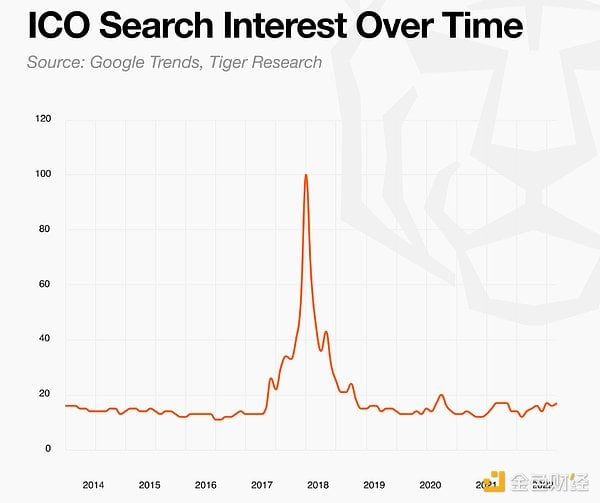

In 2017, countless blockchain projects emerged through ICOs, such as Ethereum, Chainlink, and Filecoin, but the ICO boom quickly cooled due to regulatory issues. The SEC classified many ICO projects as unregistered securities offerings.

However, the ICO model brought by Sonar is different from before—conducted transparently through self-custody. Echo's Sonar product perfectly aligns with this trend: it allows founders to conduct their public token sales directly on blockchains like Base, Solana, Cardano, and Hyperliquid.

For Coinbase, integrating Sonar can transform its exchange from a trading hub into a global financing portal, allowing verified users to access early investment opportunities that were previously only available to venture capital firms.

While solidifying its position as a leading exchange in the industry, Coinbase also offers a new possibility for the crypto financial market—perhaps the "ICO 2.0 era" is coming, and it may be compliant and transparent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。