Author: Chloe, ChainCatcher

Since the end of last year and into this year, the long-dormant ICO market has revived. With the approval of Bitcoin ETFs, the Trump administration's crypto-friendly policies, and the push of a new bull market, public token sale platforms have once again become the focus of attention for project teams and retail investors.

In this new cycle, the once-leading ICO platform CoinList has gradually faded, replaced by emerging platforms like Buidlpad, Echo, and LEGION. Taking Buidlpad as an example, it has helped four projects complete public offerings and all have listed on Binance's spot market within just a year, with participants achieving nearly 10 times returns, effectively replacing CoinList's position as the king of the track.

In this article, ChainCatcher provides a detailed analysis of the development background and rise of Buidlpad, interviewing several deep players from public offering platforms to interpret from multiple perspectives why it is Buidlpad that has emerged.

Filling the Void Left by CoinList

@PandaZeng1, a long-time user of multiple Launchpad platforms, has a systematic observation of ICO/IDO/IEO platforms. He points out that the gameplay across all platforms is quite similar; the key lies in the performance of the initial projects. If the first or second project ends in failure, it can have a significant negative effect on the platform, leading to user reluctance to participate.

Regarding CoinList's decline, he believes another major issue is the poor user experience: for users in the Asia region, there is a queue, and the time difference is with the US time zone, requiring Asian users to stay up late, and they may not even get a spot. Although CoinList later introduced a Karma points system (requiring participation in trading or swaps to earn points), it could not recover the loss of users.

In contrast, the success of new platforms like Echo and Buidlpad stems from the outstanding performance of their initial projects, which successfully built a reputation. He emphasizes that the crypto market is filled with expectations; when rational, it is valuation-driven, and when irrational, it is dream-driven, ultimately looking at "this dream compared to that."

@0xhahahaha shares similar insights regarding the factors behind CoinList's decline, noting a vicious cycle of the failure of wealth creation effects. She has participated in 5 or 6 CoinList presales and points out that the core issue is the decline in the quality of projects launched on the platform, with projects becoming mediocre. Some less popular projects do not get listed on major exchanges (like Binance, Coinbase) but only on smaller ones, leading to weak liquidity, with only sell orders and harsh sales conditions, possibly requiring a one-year lock-up, and even immediate TGE may not guarantee profits.

During the 2023-2024 period, most tokens from projects that conducted public offerings on CoinList saw significant price drops after listing, with declines generally between 70% and 98%, such as ARCH (-98%), FLIP (-73%), ZKL (-93%), NIBI (-78%), etc., with FDV mostly below $100 million.

The success of Filecoin in 2017 established CoinList's image of "high returns," and just as investors were expecting CoinList to continuously replicate this success, the overall market cycle, regulatory changes, and evolving user demands made it difficult to sustain.

Now, due to unresolved issues such as an unfriendly platform experience, poor project quality, and low returns—factors that amplify community dissatisfaction—user numbers have declined, leading to the emergence of platforms like Echo, LEGION, MetaDAO, and Buidlpad, which fill the market gap left by CoinList's decline.

Exceptional Performance

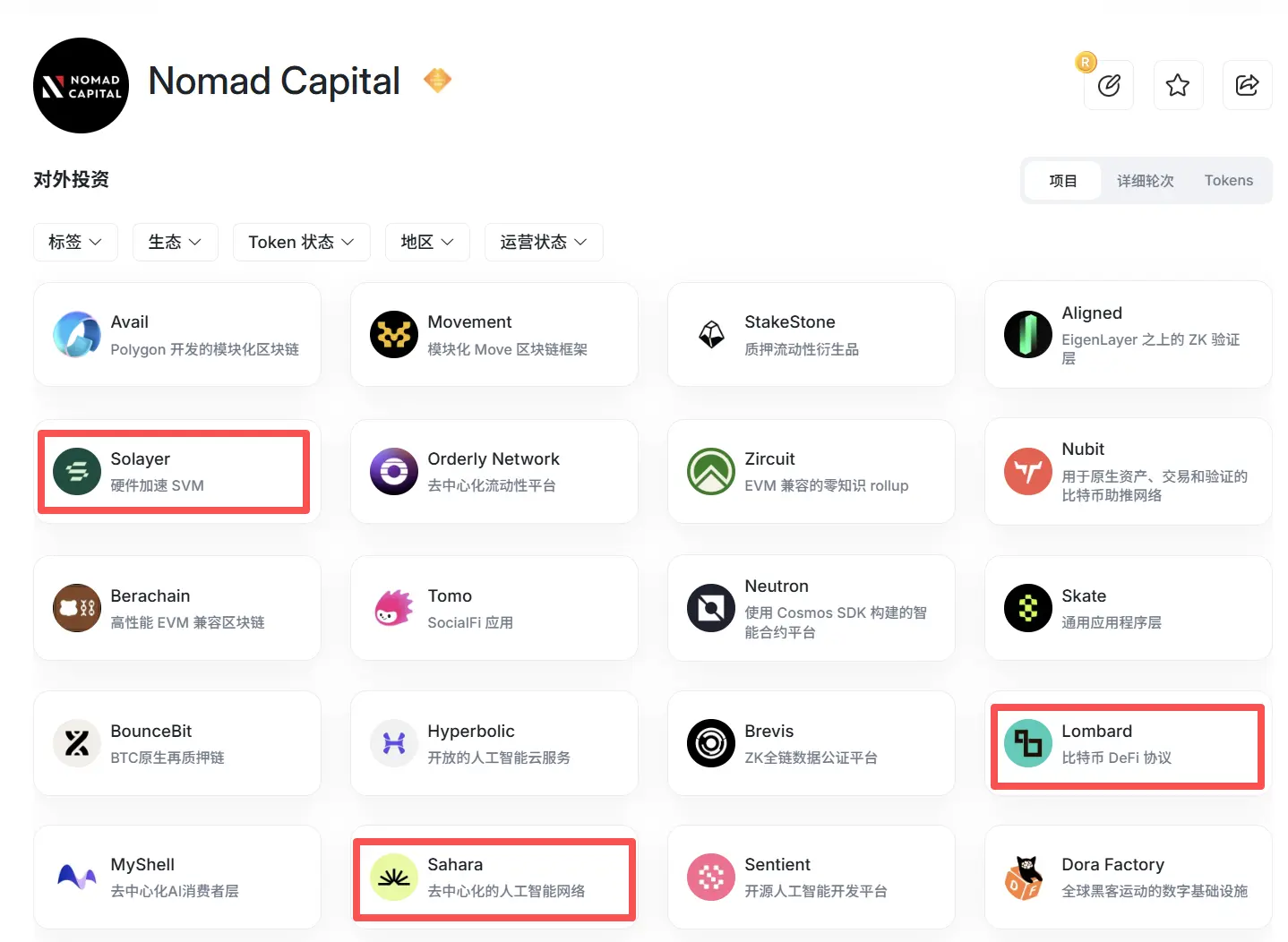

Taking the Buidlpad platform as an example, Buidlpad has assisted four major projects—Solayer, Sahara AI, Lombard Finance, and Falcon Finance—in completing public offerings and listing on Binance's spot market. Looking at Buidlpad's achievements, the first project, Solayer, was publicly sold at a valuation of $350 million, with a single token cost of $0.35, peaking at $3.43, bringing early participants nearly 9.77 times investment returns. Sahara AI raised funds at a valuation of $600 million, with a token cost of $0.06, peaking at $0.15, achieving 2.68 times returns, with an oversubscription of 8.8 times and total subscriptions of $75 million.

@0xhahahaha started engaging with Buidlpad through Falcon Finance, adopting a strategy similar to that of general players: "Wherever there is an opportunity to make money, go there." She believes Buidlpad's success can be attributed to its strict project selection, with all projects successfully listed on major exchanges (like Binance's spot market), creating a stable wealth creation effect that attracted users from CoinList to Buidlpad.

Regarding Buidlpad's rise, @PandaZeng1 summarized several key factors. Firstly, the projects selected by Buidlpad tend to have high valuations, with projects generally being major successes, listed on Binance and Upbit, excelling in user value acquisition, with projects typically having 2-10 times return potential, and being less strict compared to Echo, making it easier for retail investors to get involved.

It can be said that Buidlpad has its own narrative rhythm and selection criteria in terms of project selection, quality control, and distribution mechanisms. In addition to conducting comprehensive due diligence and research on each project to assess the feasibility of its business model and execution capabilities, Buidlpad has also deployed anti-witch attack technology, implementing KYC verification, compliance checks, and security measures to prevent false accounts and studio bulk participation, ensuring the fairness of token distribution.

As of September 2025, the platform has secured over $320 million in subscription commitments across its first four events, attracting more than 30,000 verified real users. The latest Momentum Finance project has also launched its public sale on the platform in October, planning to raise $4.5 million.

Additionally, Buidlpad has introduced a Squad system, allowing participants to earn extra incentive rewards through content creation based on the existing staking model. This not only helps projects cultivate communities in the early stages but also incentivizes participants to contribute more beyond capital.

When discussing the projects that Buidlpad has issued, all have listed on Binance's spot trading, making it the best launchpad for project teams to directly access Binance and other major exchanges, which brings attention to the background of founder Erick Zhang.

The Clear Background of Binance

According to Erick Zhang's LinkedIn information and updates, he holds a master's degree from Carnegie Mellon University and a bachelor's degree from the University of Macau. His early career experience is not well-documented, with his first job being as a vice president at Citibank from 2013 to 2015. Shortly after Binance was established, he joined the company as an executive, showcasing his sharp professional judgment.

During his tenure at Binance, he served as the head of Binance Research and Binance Launchpad, accumulating rich experience in project research and selection, especially being well-versed in the process and standards for listing tokens on Binance. Under his leadership, Binance Launchpad successfully helped over 20 projects complete ICOs, raising over $100 million in total, including many industry giants today, such as Polygon and Axie Infinity. The wealth creation effect of Launchpad tokens also made Binance Launchpad a benchmark product in the industry. Later, he became the new CEO of CoinMarketCap, a subsidiary of Binance, upgrading from a vertical business leader to the head of an independent business.

After accumulating extensive data analysis, team management experience, and industry resources, Erick Zhang left in December 2022 to establish Nomad Capital. A few months later, Binance Labs announced an investment in the crypto venture fund Nomad Capital, maintaining a close relationship with Binance. At the end of last year, Erick launched Buidlpad.

It is noteworthy that among the four projects that Buidlpad has launched so far, three have received investment from Nomad Capital. After these projects' tokens listed on the Binance spot market, Binance Labs, as a major LP of Nomad Capital, also stands to benefit significantly.

It is clear that the close relationship formed through the interest ties with the Binance ecosystem is one of the key factors for Buidlpad's current success. Additionally, the market dividend period left by CoinList's decline and its unique project selection mechanism have paved the way for Buidlpad.

With Buidlpad's main competitor Echo being acquired by Coinbase a few days ago, and Binance also deeply binding with Buidlpad, token public offering platforms have become a new battleground for primary market pricing power. The decline of CoinList and the rise of Buidlpad and Echo essentially reflect the changes in the ICO structure. As the short-term speculative effects of platforms gradually cool down, public token sales are bridging the gap between user demand and platform mechanisms.

On one hand, as an important channel for projects to acquire early users and initial liquidity, and on the other hand, solidifying the platform's position as the preferred place for investors to seek profits, even as the market enters a prolonged downturn, such investment opportunities remain quite attractive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。