Author: Zhao Qirui

Editor: Zhao Yidan

In 2025, the global digital finance sector witnessed the rise of smoke signals in the Western Pacific.

Japan, a country where government departments are still stuck with floppy disks and fax machines, rapidly launched such a bold and systematically integrated national digital strategy that it immediately triggered shockwaves in the global financial system.

On October 17, Mitsubishi UFJ (MUFG), Sumitomo Mitsui (SMFG), and Mizuho, the three major banks, announced a joint issuance of stablecoins.

A comprehensive and coordinated financial mobilization, led by the country's three largest megabanks, approved by its most powerful regulatory agency, and clearly aimed at one goal: to execute a "Meiji Restoration" in the digital age, reclaim its monetary sovereignty, and reinvigorate its stagnant economy.

Still Waters Run Deep

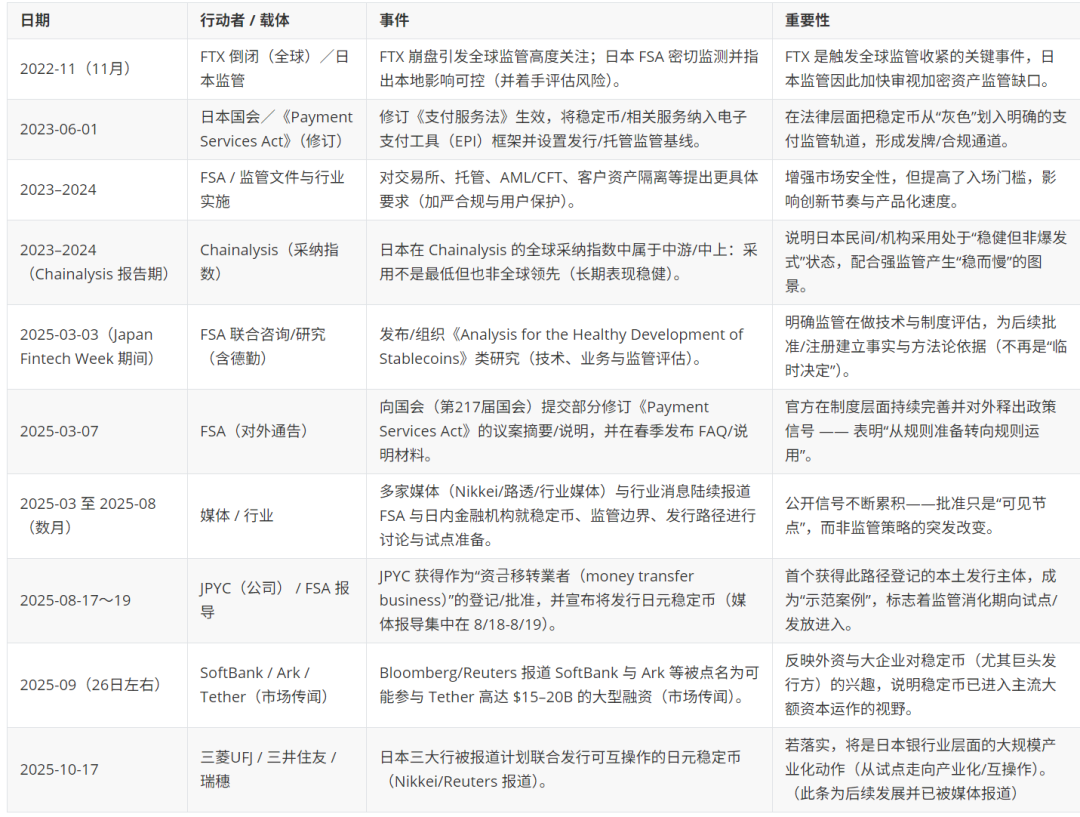

Let's go back to 2022. In Asia, the FTX incident not only profoundly affected Singapore's regulatory landscape, as we previously analyzed, but also prompted a swift response from Japan, which revised the Payment Services Act in June 2023, defining stablecoins as "Electronic Payment Instruments" (EPI) rather than "crypto assets." At the same time, it quickly established detailed requirements for exchanges, custody, and anti-money laundering, maintaining a long-term position in the upper-middle range of Chainalysis's global adoption index.

However, Japan subsequently gave the world the impression of "many restrictions, slow innovation" due to its conservative regulatory attitude, especially regarding productization and taxation, which has been a long-standing issue tied to its economic decline and poor innovation atmosphere. It had already fallen behind in high-tech areas like chips and AI, and as it watched its Asian counterparts venture forth into the "new world of exchange" brought by cryptocurrencies, it felt a sense of "waking up early but arriving late."

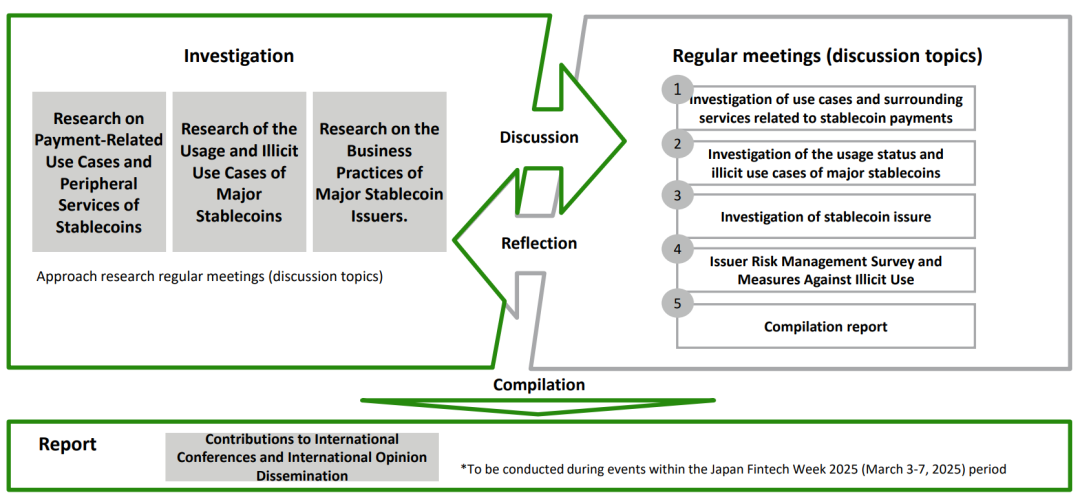

However, in the spring of 2025, things took a turn as Japan released numerous signals. First, the FSA collaborated with Deloitte to publish a study on the healthy development of stablecoins on March 3, 2025, indicating that regulation was conducting technical and institutional assessments; then, on March 7, 2025, the FSA submitted a partial revision of the Payment Services Act to the National Diet and continued to release related explanations/FAQs in the spring of 2025, indicating that the regulatory body was promoting institutional improvement; in the following months, media outlets like Reuters reported that the FSA was discussing further clarifying the status and regulatory boundaries of crypto assets.

Then, in August 2025, the Financial Services Agency (FSA) officially approved JPYC as the first fund transfer service provider planning to issue a yen stablecoin. SoftBank was rumored to participate in Tether's $20 billion financing in September, marking the end of Japan's years-long "regulatory digestion period" and the official entry into the "strategic execution period."

Everything culminated in the news on the 17th, where Mitsubishi UFJ (MUFG), Sumitomo Mitsui (SMFG), and Mizuho—giants controlling the vast majority of the country's corporate banking business—issued a joint statement that was unimaginable just months ago. They are forming an alliance to launch a unified, interoperable yen stablecoin, setting an astonishing goal of achieving a circulation of 1 trillion yen (approximately $66.4 billion) within three years.

For Japan, this has been a long-term plan, so it is highly likely that this is not just a story about cryptocurrencies; we prefer to understand it as a story of a nation fighting for survival against economic marginalization.

If we consider Japan's recent difficulties, it becomes clear that it concerns leveraging the profound world of blockchain to solve a massive, real-world problem: a national debt bomb of up to 1,280 trillion yen is about to explode.

In this context, Japan's stablecoin strategy has become one of the 21st century's important macroeconomic experiments, a high-risk attempt aimed at transforming a potential sovereign debt crisis into a source of national rejuvenation. Therefore, it is understandable that countries around the world, especially the United States, which enjoys an unconstrained dominant position through the stablecoin ecosystem pegged to the dollar, would be foolish not to pay close attention.

How Are They Doing It?

The actions on the 17th immediately demonstrated a high level of coordination on three fronts:

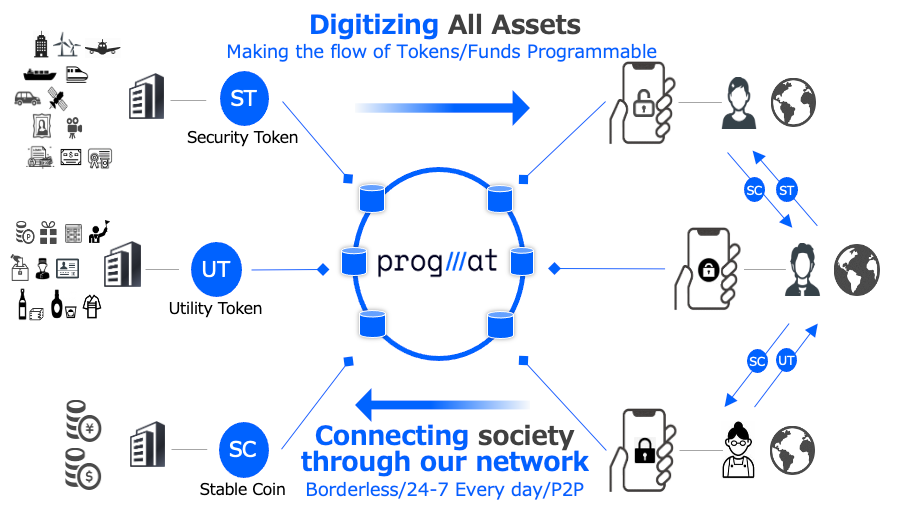

- Unified Technical Foundation: The alliance will use the "Progmat" platform launched by Mitsubishi UFJ Trust Bank in 2023 as its core infrastructure. This platform supports the issuance of tokens on multiple mainstream public blockchains such as Ethereum, Polygon, Avalanche, and Cosmos, technically addressing the key challenge of cross-chain interoperability for future stablecoins.

Unified Business Scenarios: The three banks' goal is not to directly target the retail market but to focus on their vast network covering over 300,000 corporate clients. The first pilot scenario will be executed by Mitsubishi Corporation, using stablecoins to handle dividend payments, merger fund transfers, and customer transactions for its more than 240 global subsidiaries, choosing a pragmatic path that is high-value, low-risk, and can immediately generate scale effects.

Unified Strategic Goals: The alliance has set an ambitious target of achieving a circulation scale of 1 trillion yen (approximately $66.4 billion) within three years. This figure clearly indicates that this initiative is not a small-scale technical experiment but aims to reshape Japan's commercial and financial strategy for its payment and settlement system.

The foundation of this coordination is the projection of Japan's top-level design regulatory philosophy. The revision of the Payment Services Act, defining stablecoins as "Electronic Payment Instruments (EPI)," is quite clever; this fundamental positioning removes stablecoins from the category of high-risk speculative products and reclassifies them as payment infrastructure similar to electronic money, clearing the legal and cognitive core barriers for deep integration into the banking system and large-scale enterprise adoption.

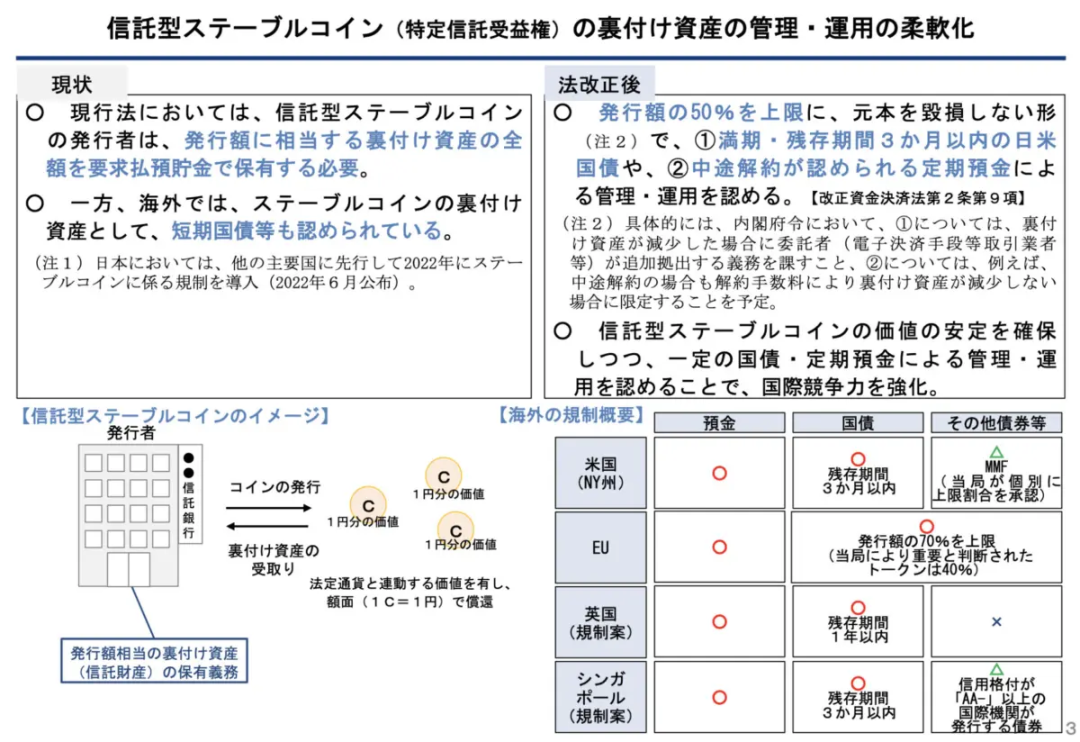

Based on this, Japan can form a unique "orderly radical" strategy, starting from the highest financial stability in risk control design, and has preemptively rehearsed future collaborative actions within banking institutions, so that strategies such as limiting issuing entities to licensed banks, trust companies, and fund transfer service providers; requiring 100% reserves to consist of yen deposits and highly liquid Japanese government bonds (JGB); and ensuring that reserve assets are custodied onshore with domestic financial institutions, with asset replenishment clauses to address value fluctuations can seamlessly connect, utilizing system-level trust endorsement and clear compliance pathways to build certainty, reflecting a "re-intermediation" approach: not using blockchain technology to mediate, but rather reversing the trend, bringing value that might flow into the chaotic on-chain world back into the risk control and balance sheets of banks, achieving a controllable digital transformation.

While regulatory and financial main forces are advancing, the ecological side's concert has also begun. Tech capital giant SoftBank announced on October 9 that its payment app PayPay, which has over 70 million users, has acquired a 40% stake in Binance Japan. This move aims to connect the national-level "payment gateway" with the world's largest "crypto asset pool," creating a closed loop of "payment-trading-asset accumulation."

On the cultural front, a series of events, from the IVS Crypto 2025 held in Kyoto in July, attracting over 10,000 participants, to the upcoming Bitcoin Japan 2025 scheduled for November 24, themed "Make Japan Great Again as a Bitcoin Nation," are generating consensus for the large-scale social application of digital assets through a "lifestyle-first" strategy that combines with fashion and youth culture.

The Hidden Engine

No matter how fast the actions are, merely looking at the surface does not capture the urgency of Japan's strategy; one must shift focus from blockchain to the national balance sheet.

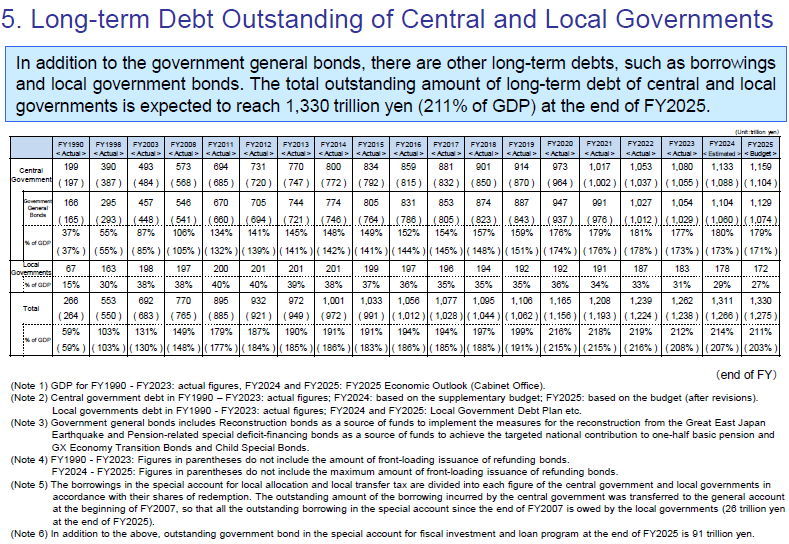

Japan bears a staggering national debt of over 1,330 trillion yen, which is more than 211% of its GDP.

The problem lies not only in the scale but also in its ownership structure. The Bank of Japan (BOJ), through decades of quantitative easing, has become the last buyer standing, now holding more than half of all outstanding Japanese government bonds (JGB).

This has created a severely dysfunctional market. With the central bank acting as an almost monopolistic buyer, the JGB market has lost its price discovery function. Trading volumes have evaporated, and liquidity has disappeared. The Bank of Japan is in a bind; it cannot allow the market to collapse and the government to go bankrupt without selling its holdings, but its continued purchases further distort the financial system and render its own monetary policy ineffective.

This is the context behind JPYC CEO Noritaka Okabe's famous remark: "If we hesitate any longer, we will miss a new source of demand in the bond market."

This is not a casual comment; it directly points to the core economic engine of Japan's stablecoin strategy.

Its mechanism is a model of financial engineering, aimed at creating a virtuous cycle between the new digital currency and old government bonds:

Reserve Requirements: According to the FSA's EPI framework, issuers of yen stablecoins must provide a 1:1 backing of high-quality liquid assets for each token issued. These reserves are primarily composed of yen deposits and—crucially—short-term Japanese government bonds (JGB).

Creating a New, Market-Based Buyer: For every 1 trillion yen of stablecoins issued by the banking alliance, they must purchase and hold an equivalent 1 trillion yen in reserve assets. Assuming a conservative allocation of 50% to JGBs, this alone would inject 500 billion yen of new market demand into the stagnant bond market. This demand does not stem from the central bank's money printing machine but arises from real commercial activities—specifically, the demand for efficient digital payment tools.

Reducing Dependence on the Central Bank: This new, continuous demand flow from stablecoin issuers creates a crucial alternative buyer for government debt. It allows the Treasury to issue new bonds to a more diversified group of holders, gradually reducing its dangerous reliance on the Bank of Japan. It helps restore market liquidity and functional price discovery, bringing a glimmer of hope for the central bank to normalize its policies for the first time in years.

Essentially, Japan is leveraging global demand for digital currencies to create a dedicated audience for its government bonds. It is using 21st-century blockchain technology to address the 20th-century sovereign debt backlog. This is a strategy aimed at transforming its potentially catastrophic tool—JGBs—into the foundational assets of its future digital economy. The United States inadvertently benefits from a similar dynamic, as dollar stablecoin issuers like Circle and Tether have become major buyers of U.S. Treasury bonds. Japan has observed this phenomenon and is now deliberately weaponizing it as a core pillar of national policy.

Geopolitics

Japan's strategy primarily faces not the United States but fierce competition among Asia's financial centers to establish the regulatory framework that will dominate future currencies.

At this time, it is important to note that Hong Kong, operating under the "one country, two systems" framework, is actively positioning itself as a world-leading digital asset center, particularly focusing on connecting capital from mainland China with global markets. Its stablecoin regulations came into effect in August 2025, aiming for openness and competition, inviting diverse participants from around the world to apply for licenses within its regulatory sandbox. We have previously expressed our view that Hong Kong's strategic goal is clear: to leverage the dual linkage of Shanghai and Hong Kong to compete and solidify its role as the primary gateway for digital finance into and out of China.

Far away in Southeast Asia, city-state nations have chosen a more institutionally focused path. The MAS has implemented a framework where compliant stablecoins can obtain the "MAS-regulated" label, aimed at attracting quality and safety signals from global asset management firms, family offices, and institutional DeFi participants. Its "Project Guardian" initiative explores the tokenization of a wide range of financial assets, viewing stablecoins as the foundational settlement layer for the future tokenized economy.

In this context, Japan's strategy of "building certainty" through a bank-led consortium stands in stark contrast. While Hong Kong and Singapore are conducting open, competitive experiments to observe what innovations may emerge, Japan has decided from the outset on its national team and core infrastructure.

Japan believes that for foundational utilities like national payment rails, the trust, scale, and compliance infrastructure of the existing banking system provide a more robust and faster adoption path than a "let a hundred flowers bloom" approach. This is a bet on a controllable, systematic evolution rather than a potentially chaotic, bottom-up disruption. This is the essence of Japan's "re-intermediation" strategy—using decentralized technology to strengthen the central role of its regulated financial institutions.

This is also why we often see the presence of the private sector or private enterprises in Japan's strategy, as they are building the bottom-up ecosystem necessary for mass adoption, with SoftBank Group currently being the most critical participant.

Rather than simply establishing a direct pipeline between PayPay's 70 million mainstream Japanese users and the world's largest cryptocurrency liquidity pool, SoftBank is simultaneously addressing the notoriously tricky user acquisition and KYC/AML compliance issues faced by cryptocurrency exchanges. At the ecological level, it is also leveraging Oasys, a blockchain designed specifically for the gaming industry, to foreseeably collaborate with institutions to create an end-to-end digital ecosystem, from consumer payments and entertainment to the core infrastructure of global finance. All of these will serve as the cornerstone of Japan's stablecoin strategy.

The good news is that the outcome of Japan's development, in our view, points towards a win-win situation. Ultimately, if a "non-dollar digital currency zone" can be created in Asia, we will see a future where yen stablecoins, Hong Kong's renminbi stablecoins, and Singapore dollar stablecoins can be instantly exchanged and settled on-chain, which could fundamentally change regional trade. It would allow Asia's economic powerhouses to conduct business with each other without ever touching the dollar-based SWIFT system, representing the most significant challenge to dollar hegemony in decades.

Numerous Obstacles

Despite its promising vision, Japan's digital strategy is fraught with dangers, facing at least five existential challenges.

The Tyranny of Dollar Giants and Network Effects: The dollar's dominant position in the stablecoin world (98% market share) is not coincidental. Currency is the ultimate network commodity; its value is proportional to the number of people who accept it. The yen stablecoin faces a huge uphill battle in countering the dollar's existing position, liquidity, and global acceptance. Direct competition is futile. Its only hope lies in an asymmetric war, dominating a specific niche market of yen-denominated B2B transactions where it has home-field advantage, becoming the preferred tool for a new wave of "Digital Arbitrage Trading 2.0." Global funds could borrow low-interest digital yen to invest in higher-yield digital assets, serving as the native currency when Japan's globally popular games and IP content enter the blockchain.

The Heavy Shackles of "Technical Debt": The irony of Japan's "Restoration" plan is that it is being launched from an extremely outdated technological foundation. The "floppy disk problem" is a chronic ailment for Japan, with its digital infrastructure notoriously fragmented and outdated. The "leapfrog" development plan—skipping over a generation of internet-era technology to directly enter the value internet era—is a high-risk gamble. It requires national-level coordination and rapid skill enhancement, which will test the limits of its bureaucratic and corporate culture.

The Profitability Puzzle: Strict 100% reserve requirements, while ensuring safety, create a challenging business model for issuing banks. The profits from managing a pool of low-yield deposits and short-term bonds are minimal. The long-term viability of the project will depend on the banks' ability to upsell high-margin services on top of the foundational stablecoin rails, such as tokenized securities trading, automated fund management, and enterprise financial solutions integrated with DeFi.

Regulatory Cage: The same regulations that provide stability may also stifle innovation. The FSA's stringent requirements for "resilience," such as the need for offline functionality during natural disasters, could impose significant technical burdens and slow development cycles, making it difficult to compete with more flexible, less regulated offshore rivals.

Political Turmoil: It is difficult to say whether, in the 21st century, a national strategy driven largely by the private sector is sanctioned by the state or if it is a case of "pulling the thief's boat." This question may still have room for discussion under a moderate, consensus-oriented prime minister like Fumio Kishida, but the situation is likely to undergo a fundamental reversal with the rise of a determined economic nationalist like Sanae Takaichi, a spiritual successor to "Abenomics." It is highly likely that Japan's "Galapagos Syndrome" will once again intensify. If it becomes isolated from the globally open DeFi ecosystem due to an excessive emphasis on "national security," it will never achieve true network effects and will ultimately repeat past mistakes.

Conclusion

The road ahead for Japan is a tightrope. The success of its digital Meiji Restoration is not a foregone conclusion. It is a bold, perhaps all-or-nothing attempt to harness disruptive technology for national objectives.

The outcome will depend on its ability to execute this complex, multifaceted strategy with precision and speed. However, considering various aspects, whether Japan possesses this capability remains to be seen; we prefer to call it a gamble.

The whole world is watching to see whether this bold gamble will become the blueprint for sovereign finance in the 21st century or a cautionary tale of a nation's digital ambitions ultimately shackled by its bygone era. But we strongly sense that Japan has once again reached a pivotal moment for a "Meiji Restoration."

Only this time, the stakes are higher than ever.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。