Written by: Glendon, Techub News

Today, a report from Bloomberg has revealed the current policy resistance faced by Digital Asset Treasuries (DAT). The three major stock exchanges in the Asia-Pacific region, including the Hong Kong Stock Exchange (HKEX), are resisting the trend of listed companies hoarding cryptocurrencies as a core business. The HKEX has recently questioned the strategic plans of at least five companies transitioning to DAT companies, citing violations of regulations prohibiting the holding of large amounts of liquid assets. Similarly, exchanges in India and Australia have taken a similar stance, providing greater resistance to listed companies transforming into DAT companies.

In response to this situation, HK01 reported that a spokesperson for the HKEX provided a clear response: "The HKEX framework ensures that the business and operations of all applicants seeking listing and those already listed are viable, sustainable, and substantive." In short, Hong Kong has explicitly prohibited listed companies from transforming into companies that purely hoard cryptocurrencies.

Although the slowdown in the DAT market growth is not new, the restrictions imposed by exchanges like the HKEX undoubtedly apply a "brake" on the continued expansion of this market. As a significant driving force in this bull market, DAT companies are one of the most notable features of the current cryptocurrency market. What predicament is the DAT market facing now, how long can its flywheel effect be maintained, and where will it head in the future? These questions are becoming the focus of market attention.

The DAT model is highly homogeneous, and the premium is "collapsing"

The rise of the DAT market originated from Strategy (formerly MicroStrategy), and its development trajectory reflects the overall development path of the DAT market to some extent. In 2020, Strategy pioneered the initial DAT model, using Bitcoin as a corporate reserve asset, continuously purchasing Bitcoin in bulk through various financing methods such as stocks, convertible notes, preferred shares, and secured debt issuance.

At that time, the regulatory environment in the United States was gradually loosening. With the U.S. Securities and Exchange Commission (SEC) approving Bitcoin spot ETFs, market recognition and acceptance of cryptocurrencies significantly increased, and Strategy's stock price rose accordingly. Notably, in November 2024, Strategy (MSTR) saw its stock price soar to $543, setting a historical high.

As the flywheel effect took shape, the success of the Strategy DAT model attracted many companies to replicate its strategy, including Metaplanet, known as "MicroStrategy of Japan," Tesla, and traditional gaming retail giant GameStop, among others. Driven by these companies, the DAT narrative continued to strengthen, and more listed companies began to enter the DAT market by financing to purchase Bitcoin. Thus, a major pillar of the "institutional era" officially took off, with listed companies continuously accumulating Bitcoin while also pushing Bitcoin to new highs.

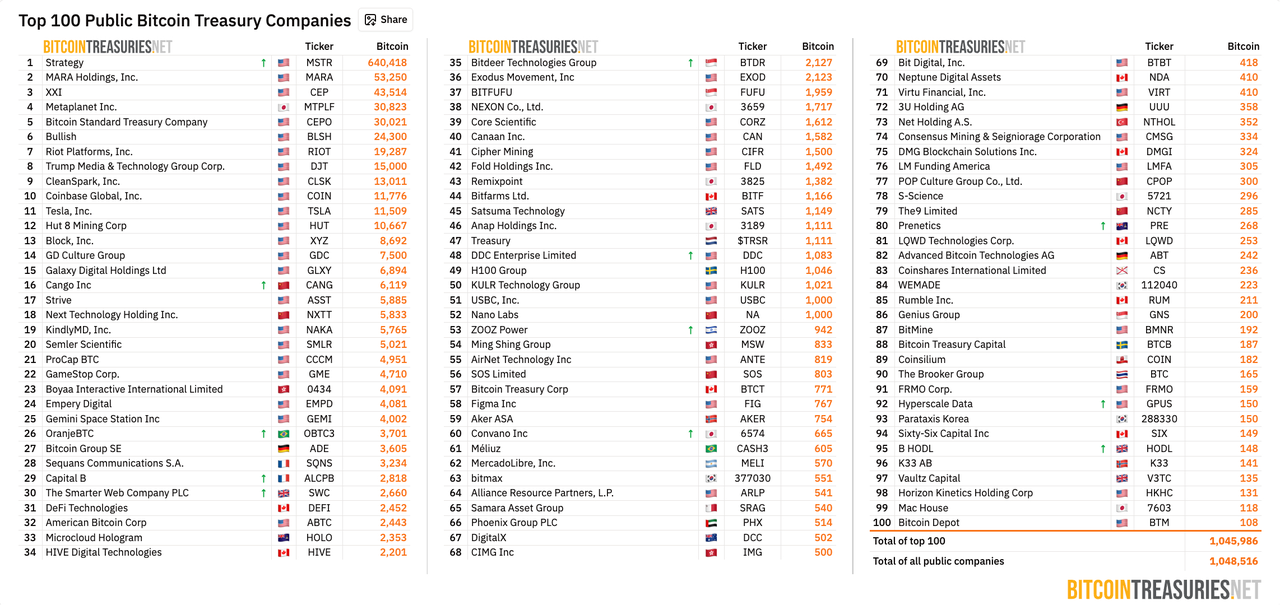

According to BitcoinTreasuries, there are currently 205 publicly traded companies holding Bitcoin, with over 170 companies still holding Bitcoin, totaling 1,048,500 coins, valued at approximately $11.2955 billion at current prices. During this period, Strategy's stock price also rebounded after a volatile decline since last December, reaching a high closing price of $423 by mid-July.

However, market rules are harsh and realistic, and the saying "prosperity must decline" is quietly proving true in the DAT market. As a large number of listed companies followed suit in buying Bitcoin, a phenomenon of high homogeneity emerged in the market, and the premium of the DAT model gradually collapsed. Currently, most listed companies find it difficult to drive their stock prices up through simple purchases. Meanwhile, the stock price trend of Strategy also confirms this trend. After reaching a peak in mid-July, the stock price fell again, and as of the time of writing, the MSTR stock price had dropped to $301.91, a decline of about 29%. Similarly, Metaplanet's stock price has plummeted over 75% since hitting a historical high in mid-June.

Especially after the "10.11" flash crash, most DAT companies' stock prices fell sharply, and their mNAV (market net asset value) indicators have dropped close to 1, with many companies even falling below 1. (Note: mNAV is an indicator that measures the relationship between a listed company's market value and the net value of its held crypto assets.)

The slowdown in the DAT market growth is a direct consequence of the aforementioned market changes. This can also be confirmed by Strategy's Bitcoin accumulation; from September to October 20, Strategy only accumulated 3,914 Bitcoins, in stark contrast to the 21,021 Bitcoins it accumulated in just one week at the beginning of August. The market's confidence in the DAT model has undoubtedly sounded the alarm for DAT companies.

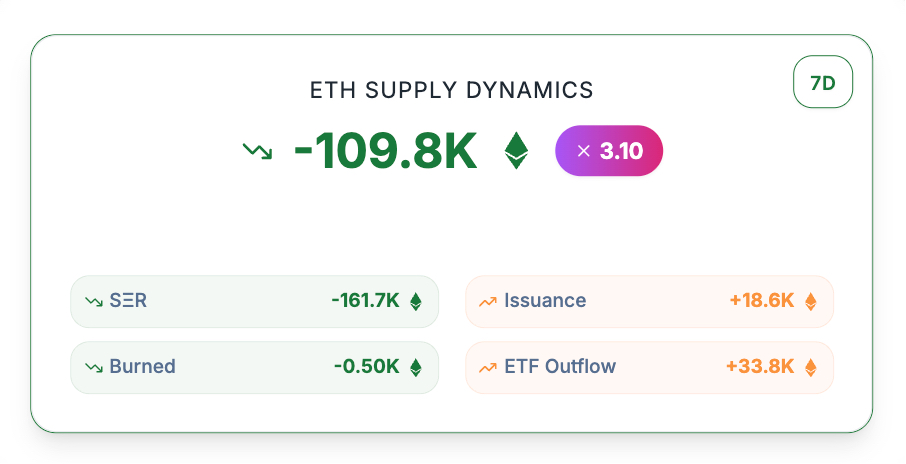

It is worth noting that the phenomenon of slowing growth initially concentrated in the Bitcoin sector but has now spread to the Ethereum DAT market. Currently, the Ethereum DAT market is also facing severe issues, with the total holdings of Ethereum by DAT companies showing a downward trend.

Data from StrategicETHReserve.xyz shows that as of the time of writing, the total Ethereum holdings of listed companies amount to 5.74 million coins, a decrease of approximately 161,700 coins in the past seven days. Even with Ethereum treasury companies like BitMine and SharpLink continuously increasing their holdings, the total holdings still show a decline. On-chain monitoring data indicates that since the "10.11" market crash, BitMine has increased its holdings by nearly 380,000 Ethereum, while SharpLink purchased 19,271 Ethereum at an average price of $3,892 on October 19. Based on this, the decrease in Ethereum holdings indicates that more small and medium-sized enterprises are choosing to sell Ethereum.

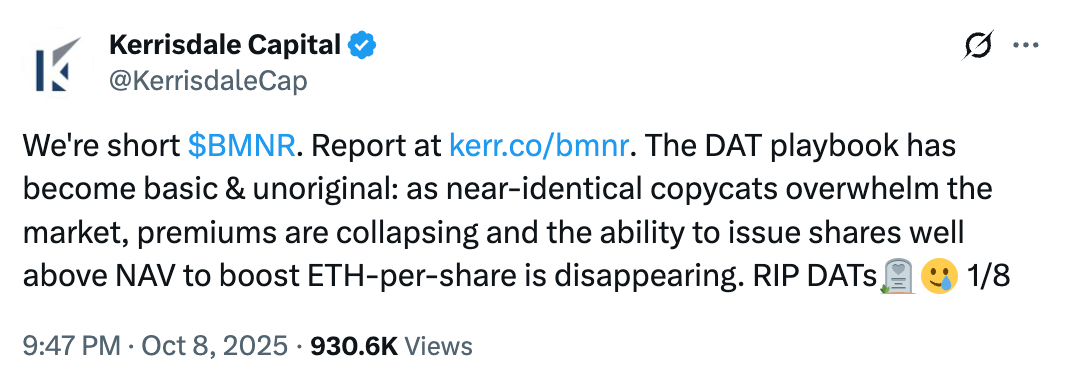

Notably, the well-known short-selling firm Kerrisdale Capital has publicly stated its intention to short BitMine. They believe that the current DAT model is gradually becoming mediocre, with intensified market competition leading to a rapid decline in premiums, making it difficult for issuers to raise shares above net asset value (NAV) to increase per-share ETH holdings. Companies that once pursued the "crypto asset treasury strategy" originally planned to raise over $100 billion but have broken the scarcity that supports high premiums. Now, many of these companies' stock trading prices are close to or below net asset value, and their self-reinforcing mechanisms have come to a standstill, making the logic of premium trading no longer valid, causing the entire model to begin to collapse.

Worryingly, the Bitcoin DAT market is also showing signs of decline.

Bloomberg reported today that some large Bitcoin holders are currently exchanging their Bitcoin holdings for ETF shares through "physical delivery." Robbie Mitchnick, head of digital assets at BlackRock, revealed that BlackRock has facilitated over $3 billion in such conversions. Bitwise Asset Management stated that investors are now consulting them daily on how to transfer their holdings to wealth management platforms, reflecting investors' unease about the market and urgent demand for asset allocation adjustments.

From these phenomena, it is not difficult to see that some institutional investors have keenly sensed the shift in the DAT market's direction, believing that its peak has passed and even beginning to hold a pessimistic view of its prospects. Meanwhile, critics warn that with the surge in the number of DAT companies, DAT could become the latest "collapse" risk in the crypto industry. Additionally, a recent report from Singapore's 10 X Research indicates that retail investors have incurred losses of approximately $17 billion in DAT trading.

In this environment of rising pessimism, investors inevitably begin to worry about whether DAT companies will start to flee this market. So, how will the DAT market develop in the future?

Where will the DAT market head in the future?

In fact, from the perspective of objective market rules and development trends, when the market shows a bearish trend, most DAT companies seem unlikely to escape the fate of failure.

This can be seen from the stock price trends of most DAT companies. Buying cryptocurrencies is not a universal key to driving up their stock prices; only a few companies can achieve perfect financing issuance and flywheel effects to realize stock price increases.

Specifically, for DAT companies to establish a foothold in this market, they need to meet a series of conditions: their stock trading volatility must be higher than that of the underlying cryptocurrencies (such as Bitcoin, Ethereum, etc.), and the liquidity options market must provide strong support to hedge potential risks. Additionally, there must be sufficient trading volume to avoid market impact. Without the crucial support of the options market, listed companies will find it difficult to replicate the successful models of companies like Strategy and SharpLink. On this basis, DAT companies must maintain a long-term positive premium on mNAV to issue stocks or raise funds, buy cryptocurrencies, and subsequently drive up stock prices, achieving a perfect "positive feedback loop."

This cycle also creates a structural advantage that accumulates over time. This can also be seen from stock performance; for example, despite MSTR's recent stock price decline, it remains significantly higher than its price level before investing in Bitcoin. From the perspective of unrealized gains, as of October 19, Strategy has achieved a 26.0% BTC return rate for 2025, showing a stable growth trend. Based on the current price of Bitcoin, Strategy's unrealized gains still amount to approximately $22 billion.

Analyst Saurabh Deshpande believes that the future DAT market will form a hierarchical structure. Leading companies (like Strategy), with their strong market position and reputation, can issue convertible bonds at 0% interest rates and increase premium equity. This cheap capital from convertible bonds allows for more value-added issuances, further driving up stock prices. The rise in stock prices will promote more trading activity, increase the liquidity of stocks and options, and attract the next round of convertible bond buyers, creating a virtuous cycle of continuously compounding advantages.

On the other hand, the development of DAT companies also depends on the underlying assets. Few assets like Bitcoin, Ethereum, and Solana, with their stability and broad market recognition, can support long-term reserve management strategies, while most altcoins struggle to maintain their value over the long term and do not meet this standard. This is also why institutional investors favor assets like Bitcoin.

Currently, leading DAT companies like Strategy, BitMine, and SharpLink remain major buyers in the crypto market, playing a crucial role. However, as the crypto market continues to decline and the prices of underlying assets fall, these companies' purchasing power may also decrease. Meanwhile, some small and medium-sized DAT companies may be forced to liquidate these crypto assets due to operational survival needs. In this process, how to cope with potential bear markets and manage risks will become a significant test for DAT companies.

Ultimately, from a long-term development perspective, the gap between leading DAT companies and small to medium-sized DAT companies will continue to widen. As the DAT market begins to shrink, investors' choices will lean more towards the former. In the end, the winners who survive and dominate the market may still be these leading companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。