This report is written by Tiger Research, analyzing the phenomenon of the revival of public token sales and delving into the operational strategies of four major launch platforms: Legion, BuidlPad, Sonar, and Kaito.

Key Points

- Since the ICO boom in 2017, public sales are re-emerging in a new form. Diverse launch platforms such as Legion, Buidlpad, Sonar, and Kaito are leading market development trends.

- The vast majority of platforms require KYC (Know Your Customer) compliance and adherence to relevant regulations. Each platform achieves its differentiation through unique participant screening criteria and token distribution mechanisms.

- The short-term hype surrounding public launch platforms may gradually cool down. However, due to structural demand, public launch platforms are expected to exist in the long term. They play a crucial role as tools for projects to acquire early users and liquidity.

1. Returning from Private Sales to Public Sales

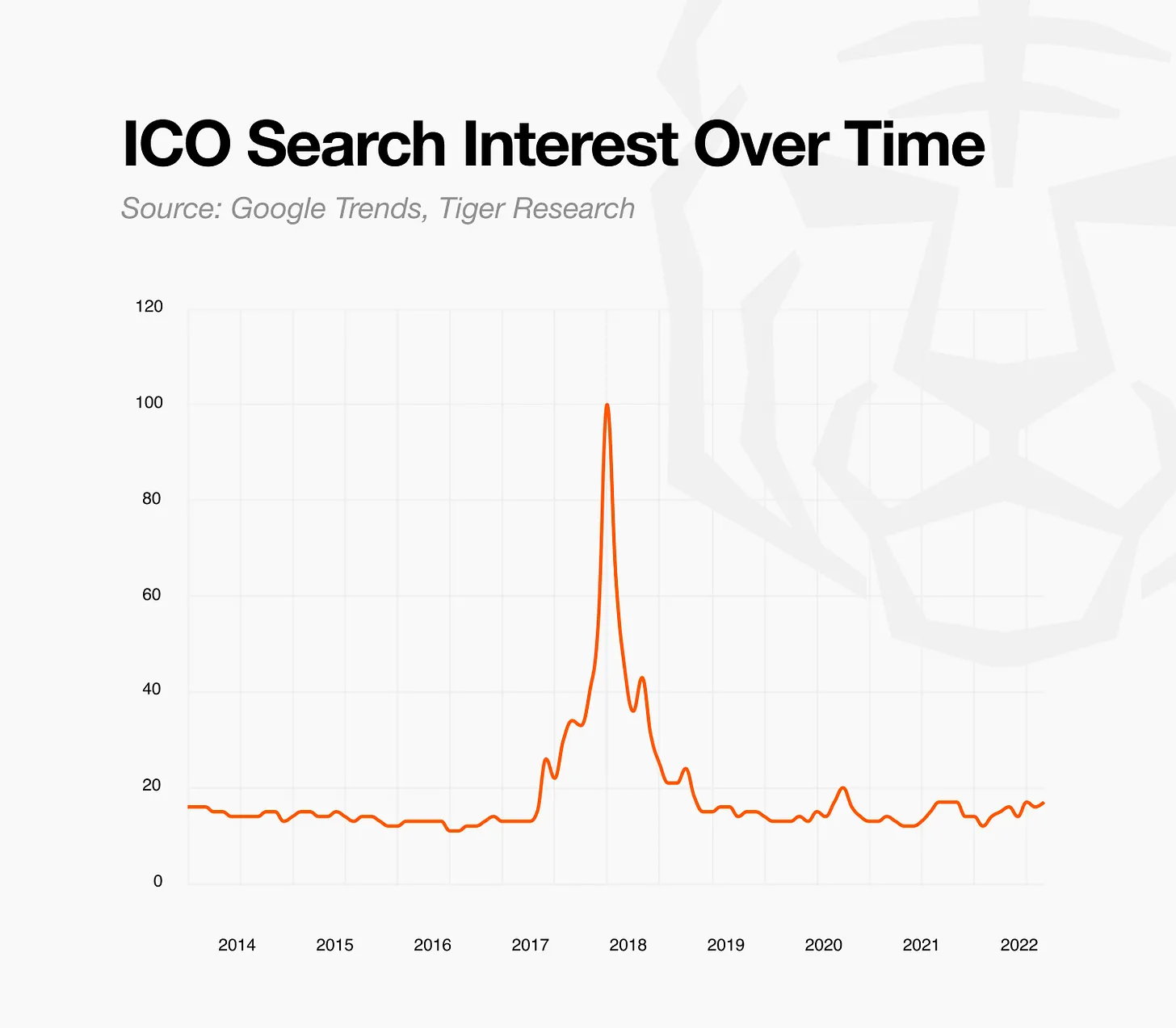

The ICO (Initial Coin Offering) boom peaked in 2017 but quickly lost market credibility due to issues such as fraud and lack of transparency, leading to a sharp market contraction. Since then, the market has shifted to a private sale model. The likelihood of retail investors gaining early participation opportunities has significantly decreased. However, public sales are recently re-emerging in a new form. This revival has occurred as various launch platforms have emerged to address the issues present in past ICOs.

Driving this change is a clearer regulatory framework. The European Markets in Crypto-Assets Regulation (MiCA) has established a clear licensing system for token issuers and fundraising platforms. This provides a solid legal foundation for selling tokens to qualified participants. Some regions in Asia and several financial centers in the Middle East now allow KYC-based token sales under local licensing frameworks. These developments collectively create a market environment where public sales can operate legally within a regulatory framework.

This report will delve into the characteristics and operational strategies of emerging launch platforms within this transformative context. Additionally, it will explore the future development direction of the public launch platform market.

2. Four Launch Platforms, Four Distinct Paths

New launch platforms continue to emerge, driving the diversification of public sales methods. All platforms consider compliance measures such as KYC as basic requirements. However, there are significant differences in participant screening mechanisms and token distribution methods across platforms. This report will closely examine four representative launch platforms, detailing the specific manifestations of these differences.

2.1. Legion: A Contribution-Based Crypto Launch Platform

Source: Legion

Legion is a public sales platform whose core philosophy is to identify investors who can genuinely contribute to project development and provide them with fair investment opportunities. The platform's goal is not merely to find investors for fundraising. Legion aims to connect participants who can create real value for projects, thereby maximizing long-term value.

Source: Legion

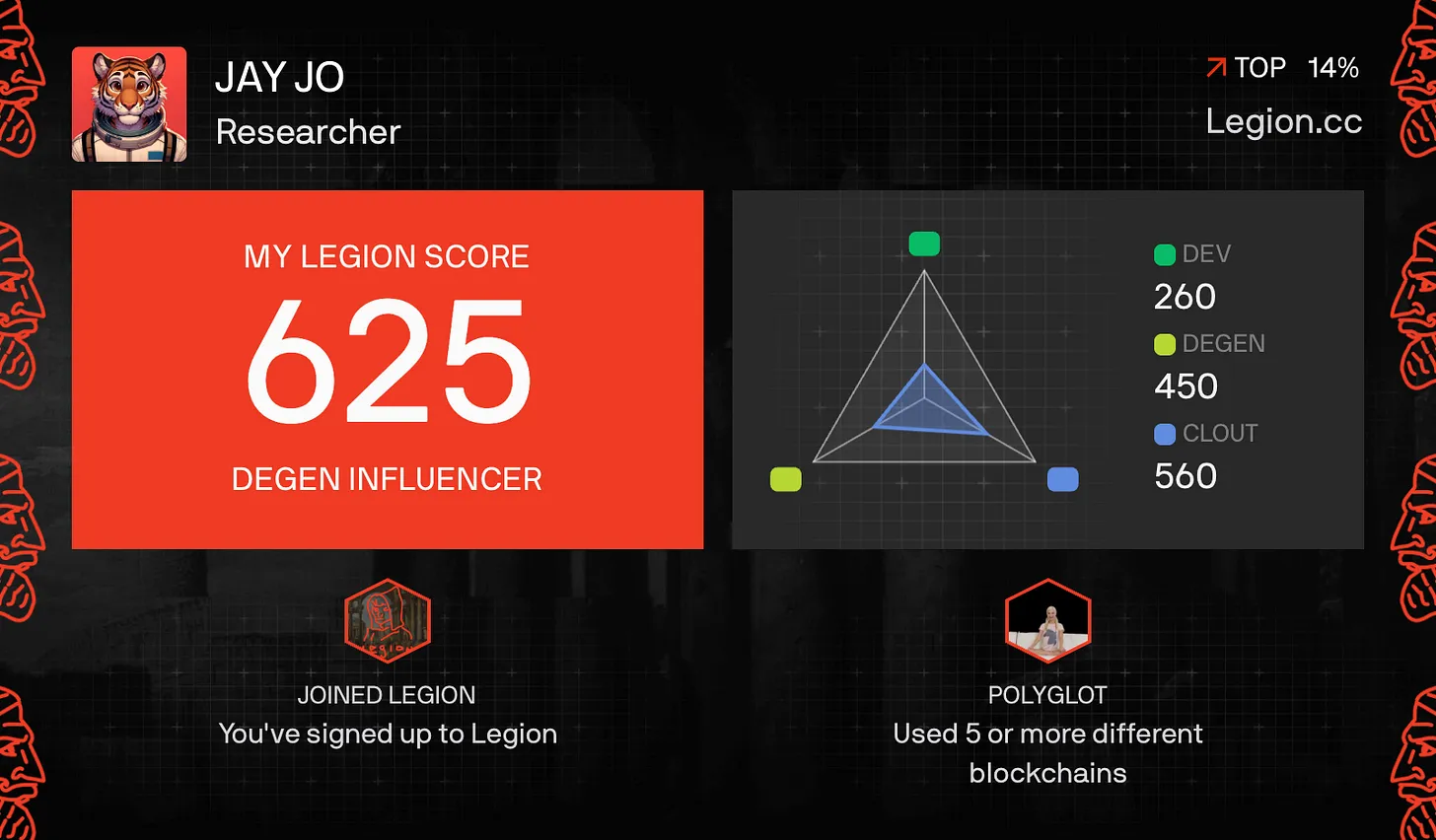

To achieve this goal, Legion has developed and operates a proprietary value assessment system called the "Legion Score." This score is quantitatively calculated by integrating multi-dimensional on-chain and off-chain data, including on-chain activity history, social media influence metrics, and GitHub development activity scores. Additionally, investors must submit an application letter detailing how they can contribute to the project when participating in funding rounds. This mechanism allows the platform to qualitatively assess subjective factors that are difficult to quantify (primarily analyzed using large language models, LLM). This approach enables a comprehensive evaluation of an investor's contribution capability to the ecosystem, rather than simply considering their financial strength.

The recent Yield Basis token sale showcased how this method operates in practice. This sale received over 67,000 applications. Legion based its selection on the Legion Score but employed a relative assessment rather than an absolute one. The platform considered multiple factors, including whether applicants had posted about Yield Basis on Twitter, their on-chain activity performance in related protocols, and their GitHub contribution history for the developer community. Manual review served as a supplementary measure throughout the process to finalize the selection decision.

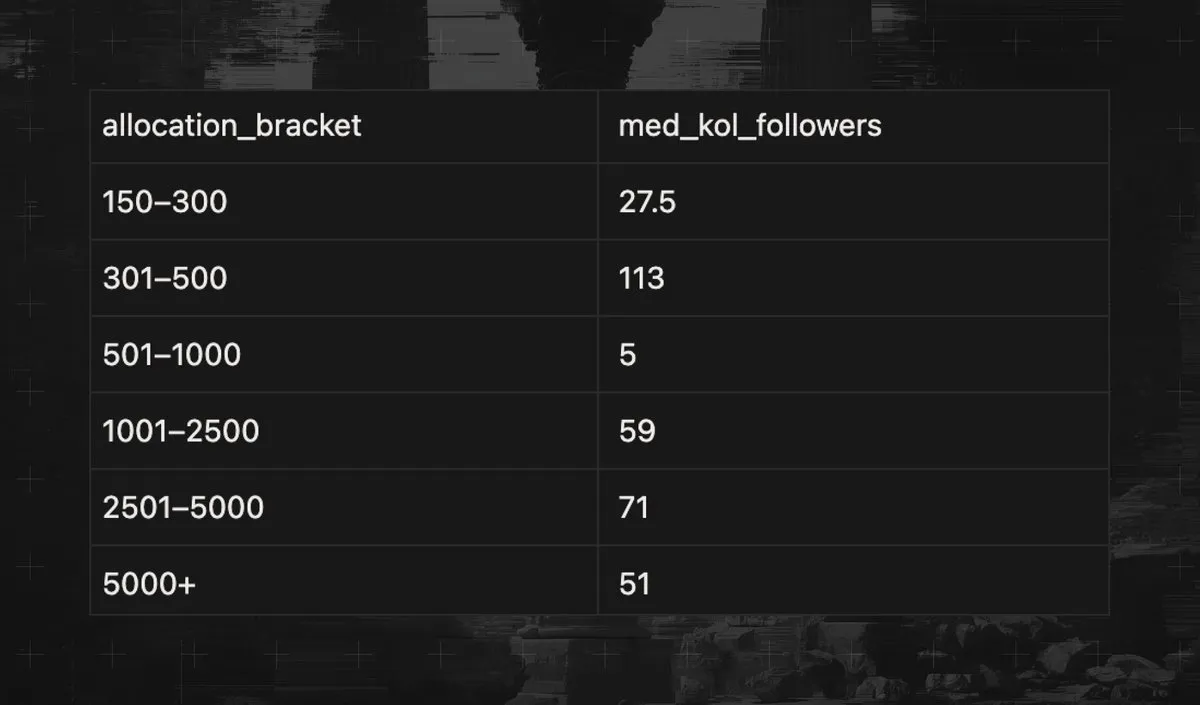

Allocation amounts per round and median smart followers—Yield Basis, Source: Legion

However, this process has also sparked some controversy. Some participants question whether token distribution is overly concentrated among a few influential individuals. In response, Legion released a transparency report detailing the distribution criteria and actual distribution results. However, this highlights the inherent fundamental dilemma of the value contribution model. Qualitative judgments inevitably intervene in the screening process. The platform cannot fully disclose the detailed criteria for evaluating different types of contribution value. Because overly detailed disclosure of evaluation standards may lead participants to manipulate the system through false participation. Some degree of opacity remains unavoidable. This model faces structural constraints in pursuing complete objectivity while maintaining transparency.

Nevertheless, Legion's exploratory approach remains significantly relevant. It presents a fundraising structure centered on contribution capability rather than simply relying on capital strength or first-come-first-served competition mechanisms. This method can connect projects with truly suitable investors. It attempts to transform public sales from pure speculative hype into long-term community participation and building. It also represents an experimental attempt to achieve the ideals of openness and accessibility that past ICOs sought through innovative methods.

2.2. Buidlpad: A Participation Mechanism-Based Crypto Launch Platform

Source: Buidlpad

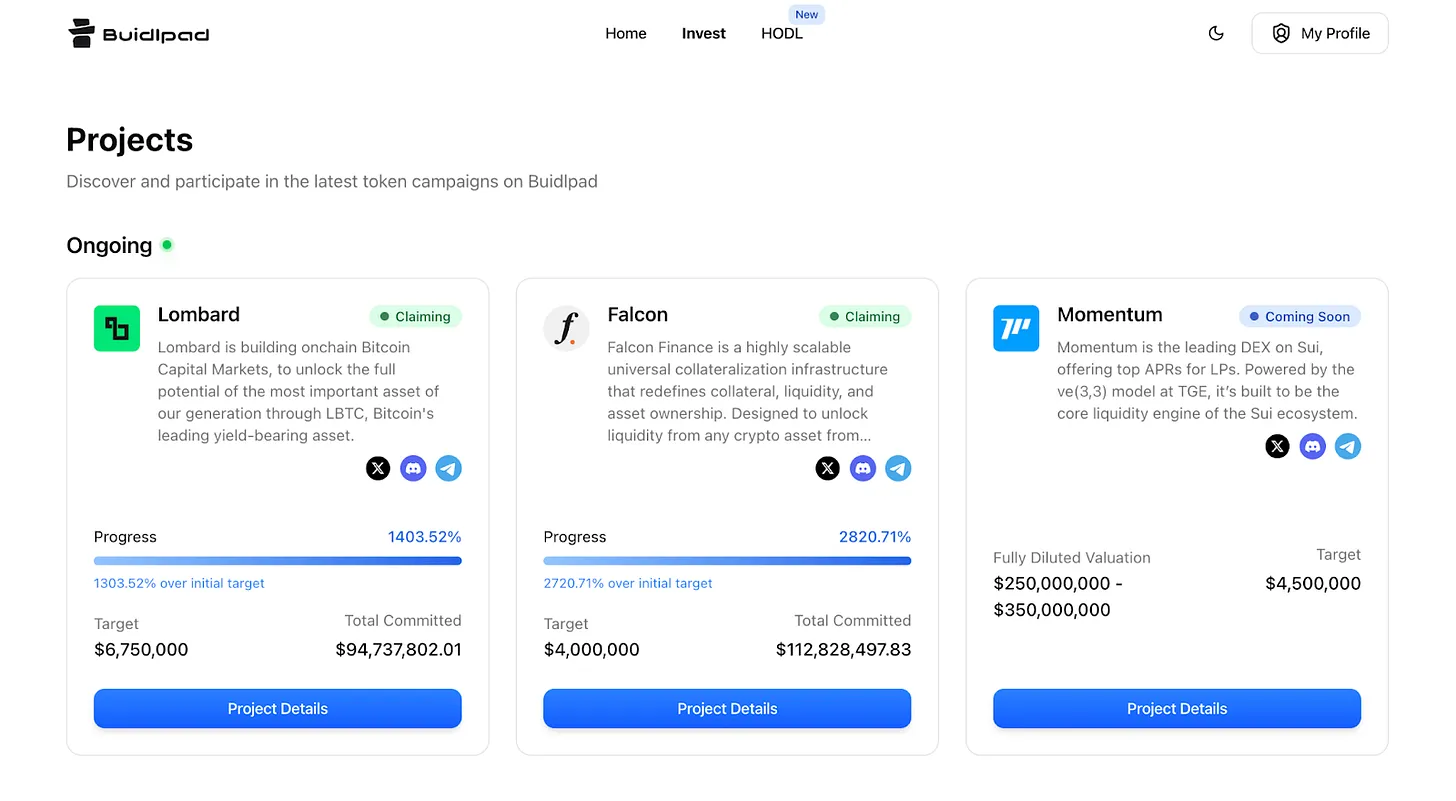

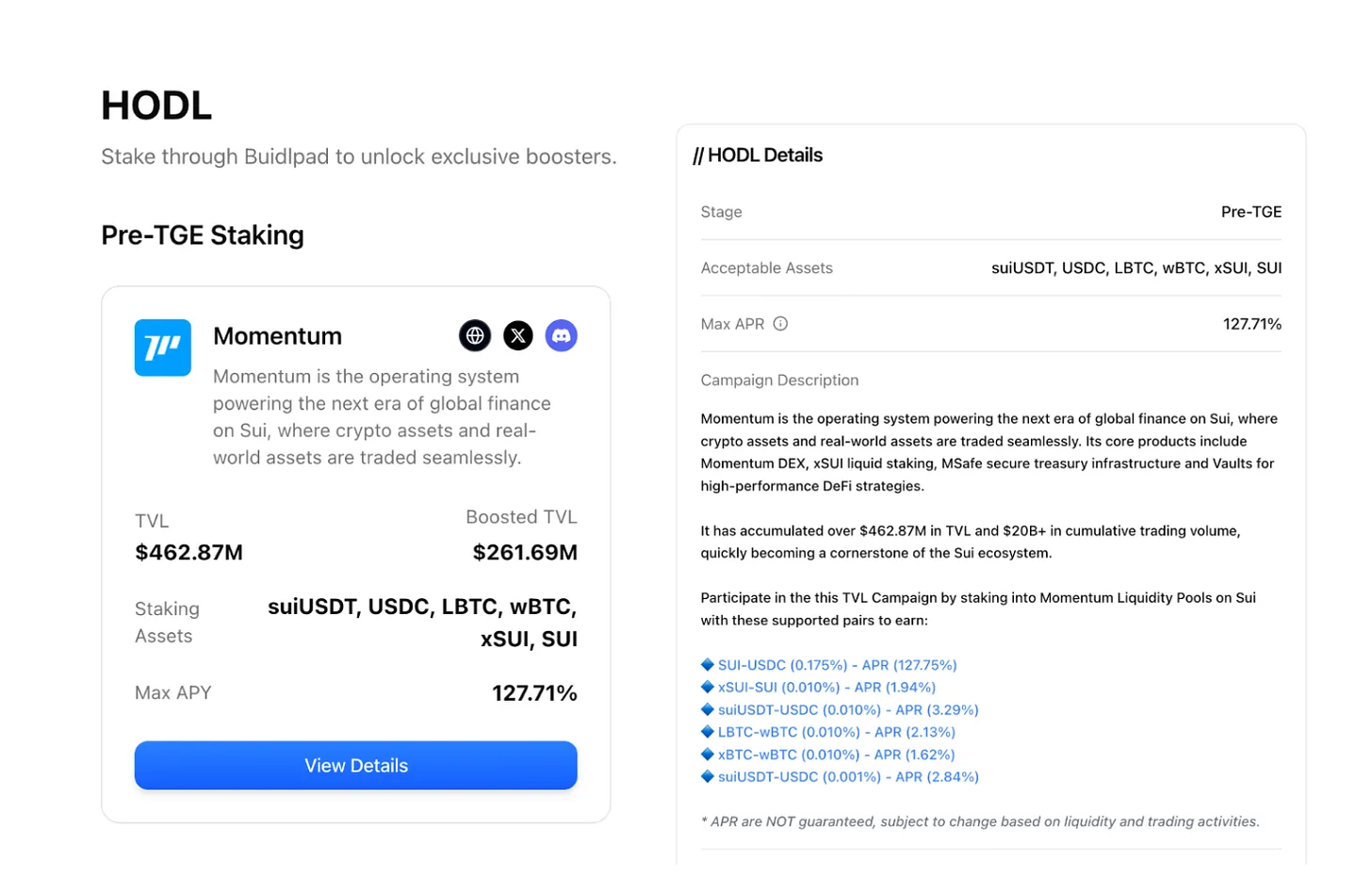

Buidlpad is a launch platform focused on the Sui ecosystem, adopting a strategy that is fundamentally different from Legion. Both platforms allow anyone who completes KYC verification to participate, but there are essential differences in participant screening criteria. Legion employs a value scoring system, while Buidlpad's screening is based on the liquidity contributions participants provide to projects. Participants need to directly stake funds into their desired project pools in the Hodl section. The level classification depends on the amount staked. Higher levels will receive more favorable token purchase prices.

Source: Buidlpad

This method has clear advantages and disadvantages. Anyone with funds can participate, creating a lower barrier to entry. Projects can obtain necessary liquidity support at an early stage. Projects like Momentum, currently being sold on Buidlpad, have successfully achieved considerable TVL (Total Value Locked). However, the scale of capital becomes a prerequisite for participation. This limits opportunities for participants who can contribute through influence or technical ability (as seen on the Legion platform).

Source: Buidlpad

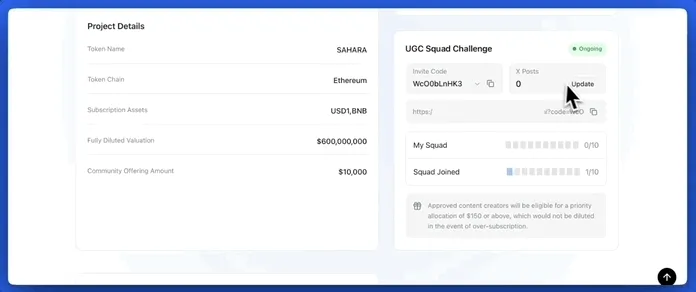

Buidlpad recently launched the "Squad" system to address the limitations of this capital-centric structure. The Squad adds gamification elements to the existing staking model. This attempt aims to break through the pure capital provision model. Participants can upload project-related content by creating social media content and conducting community activities. They will receive additional incentive rewards based on the quality of the content.

This structure fosters an active community from the launch platform stage and encourages participants to contribute more beyond capital contributions. Project teams can simultaneously obtain the liquidity needed for early guidance and promotional effects. Buidlpad's exploratory approach fully demonstrates how launch platforms can evolve from mere fundraising channels into comprehensive tools for ecosystem guidance and cultivation.

2.3. Sonar: A Public Launch Platform from the Joint Investment Platform Echo

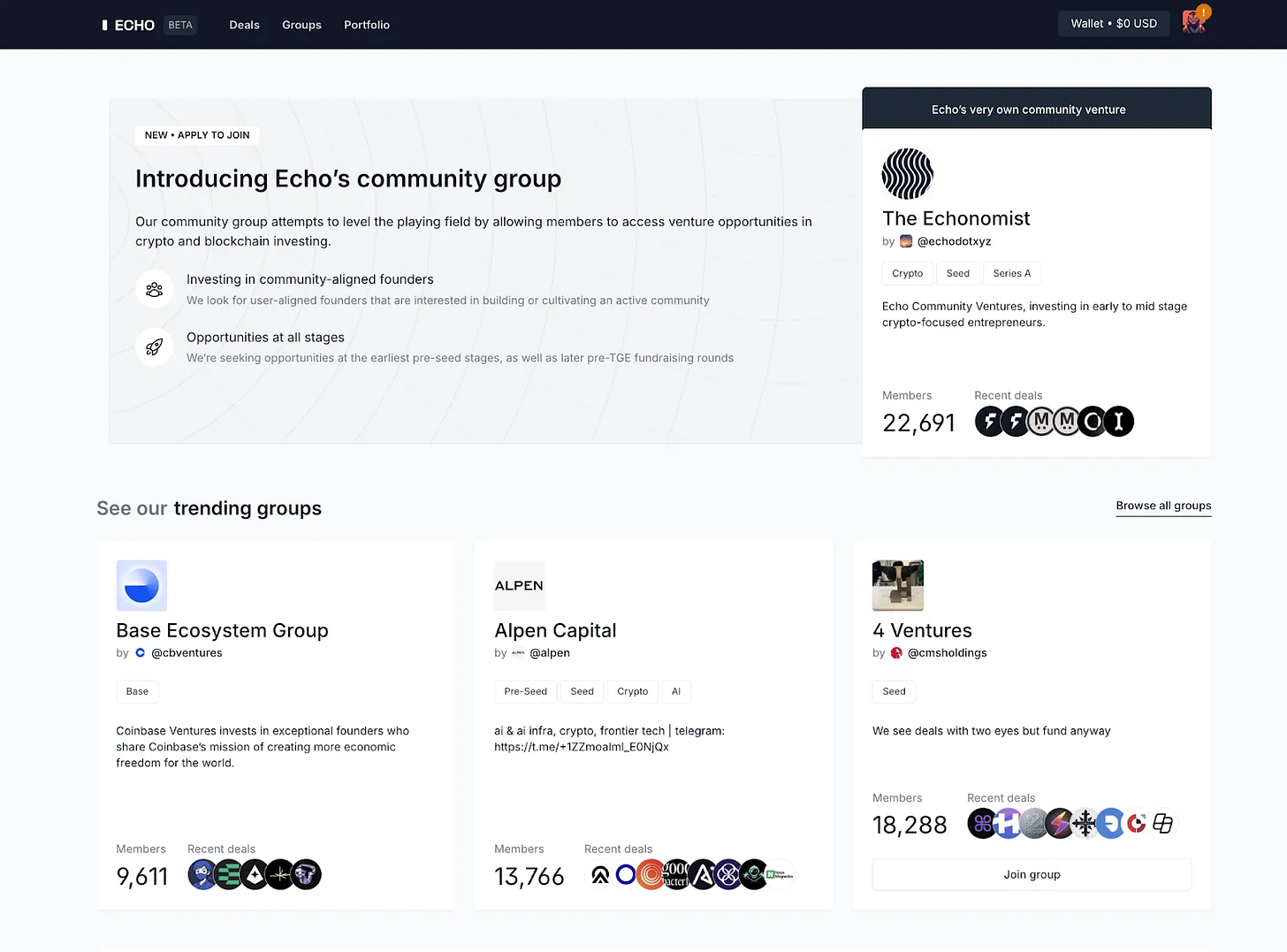

Source: Echo

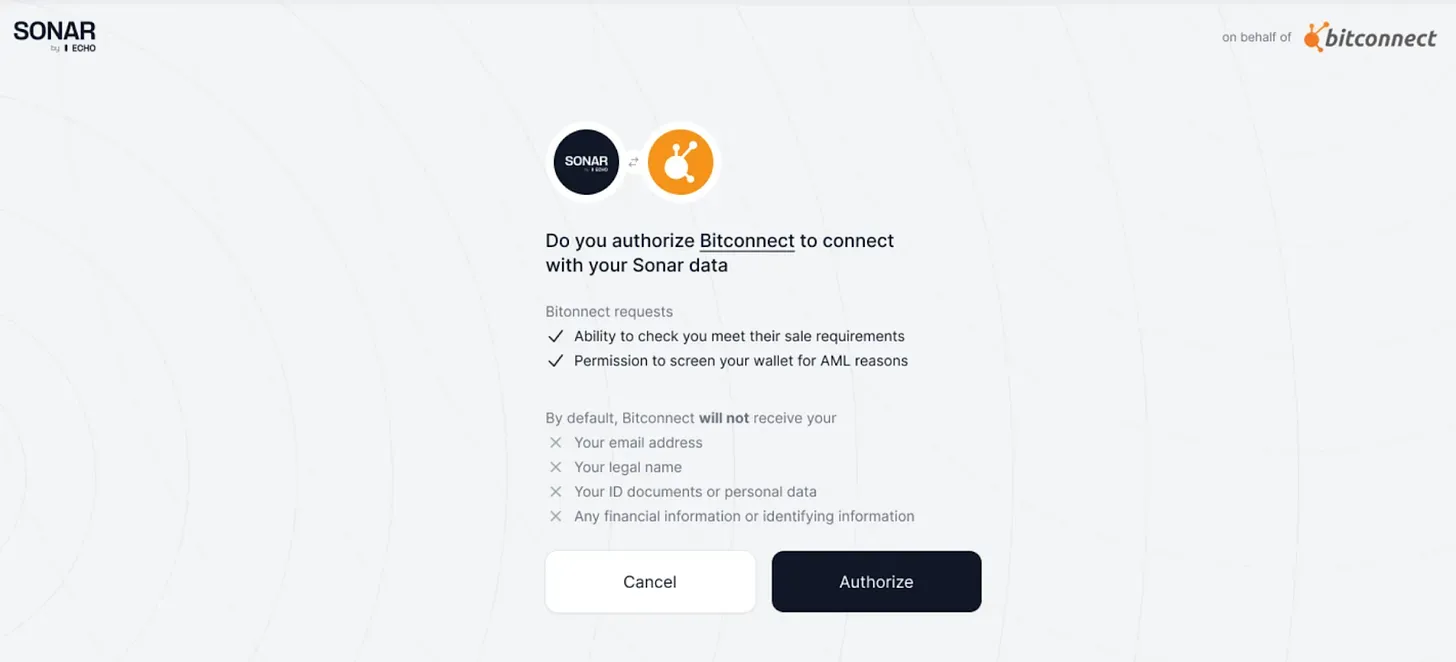

Sonar is a public launch platform developed and launched by the joint investment platform Echo. Echo itself operates on an invitation-only closed model. In addition to KYC certification, the platform conducts strict screening based on participants' investment experience and capabilities. This makes it a platform exclusively for professional investors. This closed structure sets a high barrier to entry for retail investors. The birth of Sonar aims to fill this gap, pursuing a more open token sale model.

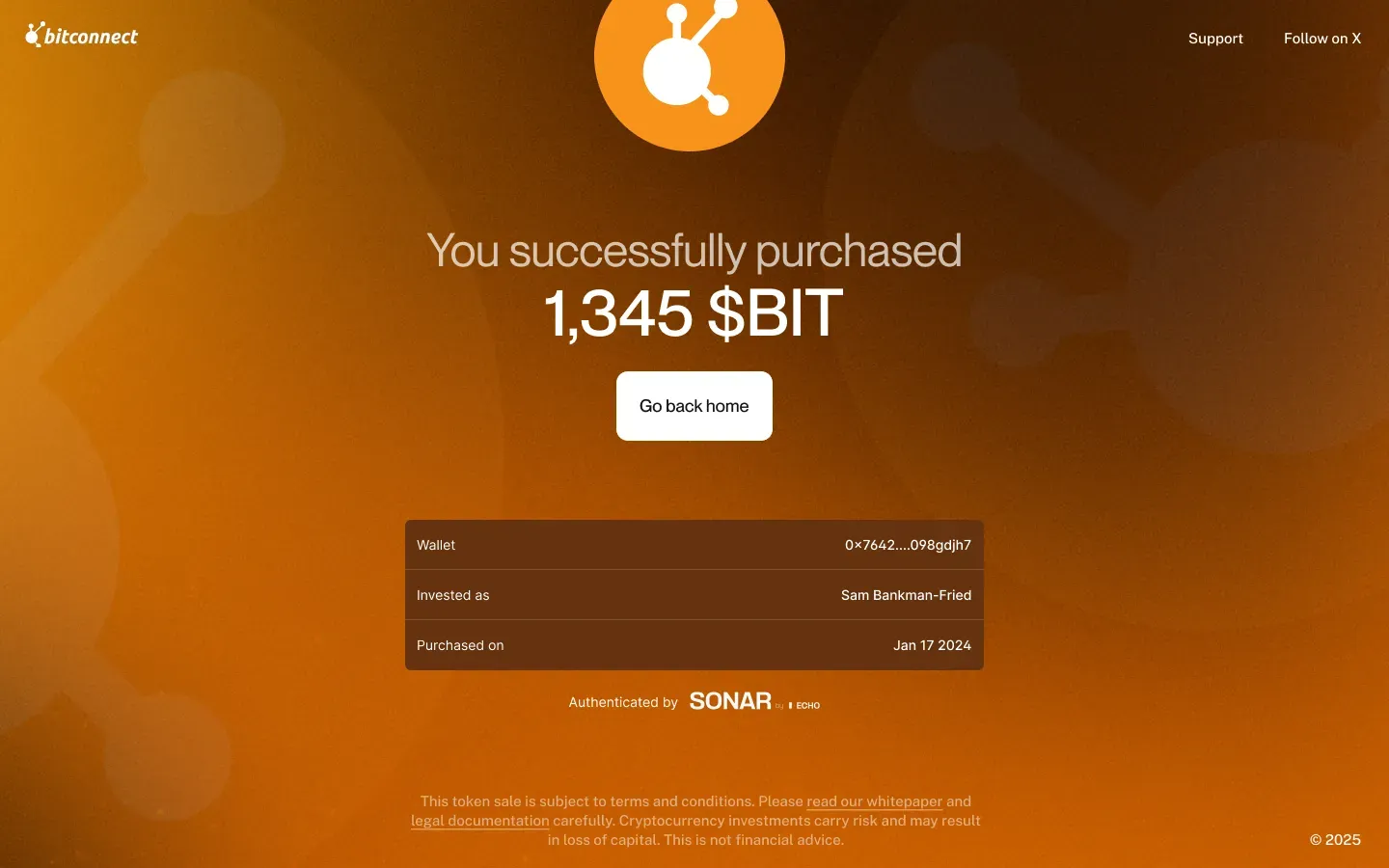

Sonar's most notable feature is its high degree of flexibility. Project teams can freely configure sales schedules, pricing strategies, and distribution methods. Sonar only provides software tool support. Throughout the process, Echo's compliance framework remains intact and effective. Participants must undergo a qualification review process that includes KYC. However, only qualification certification is transmitted to the project team, not the personal information of participants. This simultaneously meets legal compliance requirements and privacy protection needs. Projects like Plasma and MegaEther have successfully completed token sales through Sonar using this method.

Source: Sonar

However, this high degree of flexibility also brings uncertainty for investors. The sales structure varies significantly between different projects. Detailed evaluation criteria or responsible parties may not be clearly disclosed. When issues arise, the responsibility between the platform and the project may become ambiguous. This could create structural risk hazards compared to centralized platforms that operate with clear rules.

2.4. Kaito Capital Launch Platform: A Crypto Launch Platform Based on Social Data

Source: Kaito

Kaito Capital Launchpad is a value-oriented public launch platform based on reputation assessment, screening participants according to their reputation. The platform adopts a philosophy similar to Legion but differentiates itself by focusing on the dimension of social influence. Kaito initially operated as an AI-based crypto information analysis platform. It provides market insights based on on-chain data and quantifies social activities through the Yaps system. The Kaito Capital Launch Platform extends this data infrastructure into the public sales domain.

Source: Kaito

The Kaito Capital Launch Platform scores users' social influence through Yap points. It combines this score with on-chain participation history, the amount of Kaito tokens held and staked, past sales participation experience, and regional allocation limits to comprehensively determine distribution priority. Yap points are not a mandatory requirement. However, the higher a participant ranks on the leaderboard, the greater their chances of receiving a larger allocation or reward. Some projects grant priority participation rights to Yap point holders.

This structure provides clear advantages for project teams. Projects can include influential social media participants among early investors, thereby gaining natural promotional effects. This strategy is particularly effective for projects that require visibility in the early stages. However, this model also has limitations. The structure centers on activities within the Kaito ecosystem, setting a high barrier to entry for external participants. The evaluation criteria focus on social influence considerations, making it difficult for the platform to fairly assess the value of other types of contributors, such as developers.

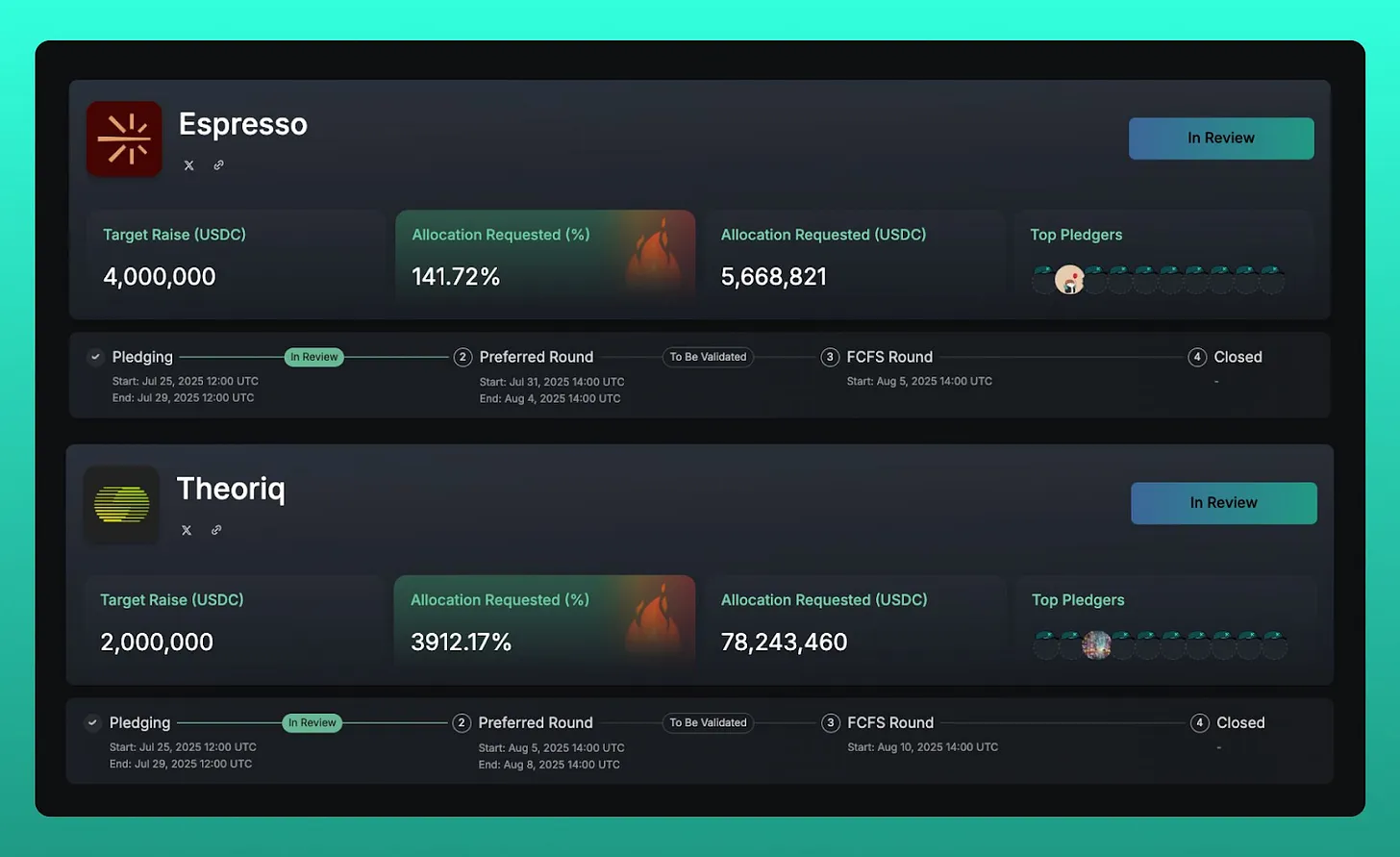

3. Will Public Launch Platforms Remain Relevant in the Future?

Recent market attention towards public launch platforms has significantly increased. Projects launched through Buidlpad have successfully listed on major Korean exchanges like Upbit and Bithumb, achieving price increases in a short period. These success stories have raised investor market expectations. Although the return rates have decreased compared to previous IDO (Initial Decentralized Exchange Offering) cycles (Star Atlas recorded astonishing returns of hundreds of times during its IDO in 2021), these investment opportunities still maintain considerable appeal given the market conditions after a prolonged downturn.

This heightened enthusiasm is unlikely to last. As high-return cases continue to emerge, investor expectations will rise to unrealistic levels. Not all projects can guarantee the same level of returns. When actual results fall short of expectations, disappointment can spread among participants, likely leading to fatigue across the entire market. Excessive market overheating can also place a heavy burden on project teams. When a large number of participants seeking only short-term profits flood in, the overall quality of the community can deteriorate. The conversion of long-term users and the ongoing maintenance of the ecosystem can become extremely challenging. As this pattern repeats, participation enthusiasm will naturally wane. Short-term market overheating is likely to ease after reaching a certain critical point.

Nevertheless, public launch platforms are likely to persist as a model based on structural demand rather than a temporary trend. Today's cryptocurrency market is far more complex than in the past and will become even more intricate. Countless projects are emerging simultaneously. They need initial fundraising methods to build communities and ensure user bases. However, conducting TGE (Token Generation Event) independently involves high costs and significant risks. In an environment rife with bot accounts and duplicate accounts, even identifying real users is a daunting challenge. Public launch platforms provide structured solutions to these problems. By utilizing a pool of screened participants, projects can efficiently obtain initial liquidity and community support.

For investors, public launch platforms offer a way to regain "early investment opportunities," which have been closed off for some time. They provide a pathway for individual investors excluded from the venture capital-centric market structure to participate in early-stage projects in a fairer and more transparent manner. This is not merely about profit realization; it represents a new structural mechanism that allows people to directly engage in the genesis of the token economy.

However, challenges remain. There is a fundamental conflict between the openness of participation and the efficiency of screening. Balancing the ideal of "anyone should be able to participate" with the reality of "screening out true actual users" is extremely difficult. Overly transparent standards may invite risks of system exploitation and manipulation, while opaque standards can undermine market trust. At this critical juncture, ongoing evolution at both the institutional and technological levels remains essential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。