Advantages lie in broader coverage, legality, mainstream adoption, and a hybrid model.

Author: Baheet

Compiled by: Deep Tide TechFlow

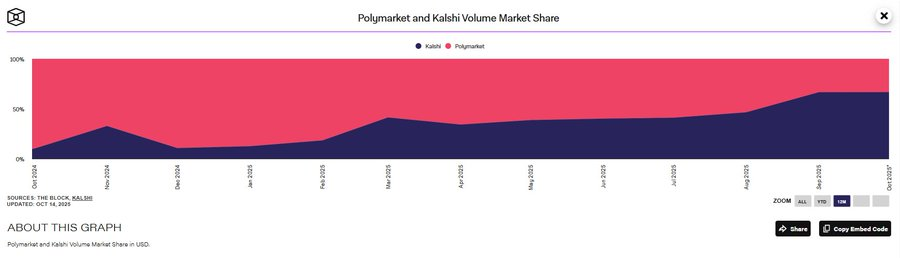

The prediction market industry is undergoing a rapid transformation, primarily driven by intense competition between Kalshi and Polymarket.

Kalshi recently completed a $3 billion funding round, with a valuation of up to $5 billion; meanwhile, Polymarket has also raised $2 billion from the Intercontinental Exchange (ICE).

This signifies one thing: we are about to witness a new round of competition between the two companies in product launches.

The stage is set, and now it remains to be seen which platform can stand out.

But the core of this article is:

Kalshi is executing its well-thought-out on-chain expansion strategy.

@Kalshi has faced criticism from crypto-native competitors for not fully achieving on-chain status. The crux of this criticism lies in Kalshi operating as a regulated centralized exchange, which has complete control over the market, user funds, and settlement processes, contrasting sharply with the decentralized ethos of blockchain.

However, Kalshi has begun to implement its on-chain expansion plan, with the first step being the recruitment of @j0hnwang as the head of crypto business.

Now, they are taking it a step further by opening Kalshi's market data to Web3 users and applications.

Let’s delve into the details;

Multiple Oracle Collaborations: Pyth and Stork

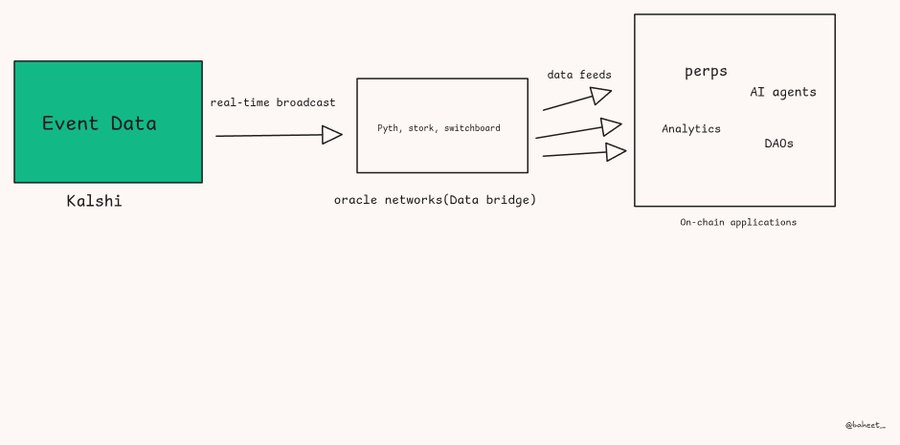

By collaborating with oracle networks such as Pyth, Switchboard, and Stork, Kalshi is distributing its federally regulated centralized prediction market data across multiple blockchains. This is a well-considered move aimed at bringing its prediction market data into the decentralized Web3 ecosystem.

- Pyth Network: The partnership with @PythNetwork enables Kalshi to stream real-time, regulated prediction market data to over 100 blockchains. Developers can now leverage Kalshi's probability data for DeFi applications, risk modeling, and other scenarios.

Original tweet link: Click here

- Stork: Kalshi's collaboration with @StorkOracle on an open data marketplace further enhances the availability of Kalshi data within the Web3 ecosystem.

Original tweet link: Click here

- Switchboard: @switchboardxyz oracle has also announced support and integration of Kalshi's data.

Original tweet link: Click here

This strategy not only helps Kalshi extend its influence beyond its own platform but also helps it maintain its regulated status, which is a key distinction from its main on-chain competitor @Polymarket.

Strategic Significance of Kalshi

Expanding Influence: By distributing data through multiple oracle networks, Kalshi ensures that its regulated data can be utilized by more Web3 developers, institutions, and decentralized applications (dApps), covering multiple blockchains.

Empowering DeFi Products: Kalshi's real-time market probability data can serve as building blocks for new DeFi tools, including derivatives, insurance markets, gaming mechanisms, and governance systems.

Acting as a "Referee": With its robust regulated data stream, Kalshi has the potential to become a trusted arbiter in decentralized prediction markets, providing trust for markets that rely on its data for settlement, enhancing the credibility of the entire ecosystem.

Maintaining Competitiveness: This strategy allows Kalshi to compete more effectively with fully on-chain platforms like Polymarket. By combining its regulated status with on-chain integration, Kalshi can offer the advantages of both.

Ecosystem Center of Solana and Base

To support applications developed based on its data and platform, Kalshi has first partnered with @solana and @base to launch the @KalshiEco ecosystem center.

This initiative provides funding, technical support, and resources to attract developers, traders, and creators into the prediction market space, driving both on-chain and off-chain innovation.

Comparison with Polymarket: What are Kalshi's Advantages?

The competition between Kalshi and Polymarket is not just about market share; both platforms clearly dominate.

Frankly, this is more of a philosophical conflict.

Kalshi's Methodology: Compliance-centric, promoting the institutional development of prediction markets. This approach has been consistent since the company's inception.

Polymarket's Methodology: Represents the experimental frontier of crypto-native, initially built on the Polygon blockchain, allowing users to trade on a wide range of topics, but ultimately banned in the U.S. due to regulatory risks associated with its non-custodial model.

While Polymarket is now also pursuing compliance and gaining institutional support, Kalshi's compliance-first strategy and long-term institutional backing give it a significant advantage in attracting mainstream users and larger capital flows.

I believe Kalshi currently has some advantages over Polymarket;

Broader Coverage and Legitimacy: By distributing data through multiple oracle networks, Kalshi's regulated data has a wider reach, enabling it to become a foundational "truth source" for real-world event data in DeFi, enhancing its legitimacy and influence.

Adoption by Mainstream Users: Kalshi has partnered with traditional brokerage firms like Robinhood, attracting a broader base of non-crypto-native users and capturing a larger market share in the prediction market space.

Hybrid Model: While discussions on CT often position Kalshi and Polymarket as opposites, both are moving towards a hybrid model. Kalshi is attracting the Web3 community through on-chain innovations, while Polymarket is drawing more institutional capital by obtaining U.S. regulatory approval. Nevertheless, Kalshi's long-standing compliance foundation remains a lasting and trustworthy advantage.

Outlook: The Next Phase for Kalshi

I believe that Kalshi's current momentum and recent funding rounds have provided a clear path for its next phase of strategic direction.

In my view, based on its strong regulatory foundation and growing on-chain presence, Kalshi's next phase should include the following aspects:

Increasing Institutional Adoption: Kalshi should further integrate its data streams into mainstream financial systems through more partnerships. Polymarket hit a key point when it secured support from the Intercontinental Exchange (ICE), and Kalshi should aim for similar or even larger-scale collaborations. This will attract more institutional liquidity and establish prediction markets as a new category of financial derivatives.

Global Expansion and Localization: Kalshi has already expanded to 140 countries, but the platform should leverage its latest funding and on-chain infrastructure to accelerate entry into more international markets, tailoring its products to local regulatory frameworks and user preferences.

Diversifying Product Offerings: Kalshi should continue to innovate within its product lineup, such as expanding parlay-style wagers, supporting scalar markets, and developing more advanced financial products based on event outcomes.

Enhancing Support for Web3 Ecosystem Development:

Kalshi should further support its ecosystem by providing more developer tools, targeted funding, and resources to encourage the development of decentralized applications (dApps) based on its regulated event data. This will solidify its role as an infrastructure provider, rather than just a market platform.

Conclusion

Kalshi's expansion provides developers with a unique opportunity. Developers can now build on a robust data source regulated by the Commodity Futures Trading Commission (CFTC), ensuring the integrity and legality of their applications.

This initiative by Kalshi instills confidence in developers, allowing them to develop products with peace of mind, as their solutions rely on a compliant and high-quality data source.

Here are some application ideas that come to mind:

DeFi Tools: Create new perpetual futures, options, and interest rate swap products using Kalshi's data, which can be triggered by economic indicators such as CPI or interest rate decisions.

Arbitrage Tools: Develop AI agents and professional data dashboards that leverage Kalshi's data to identify pricing discrepancies between different markets, providing new opportunities for informational arbitrage.

DAOs: Develop automated governance mechanisms where voting rights or proposal weights can be based on market probabilities provided by Kalshi, such as project milestones, product launches, or even internal forecasts.

The launch of @KalshiEco and its funding program sends a clear invitation to the developer community.

This moment presents a unique opportunity to build and shape the future of prediction markets, transforming them from a speculative project into a vital component of financial and informational infrastructure.

I believe that developers who seize this opportunity to innovate will be at the forefront of this transformation.

Let’s work together to create the next generation of financial applications!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。