Author: Frank, MSX Research Institute

How do you view cycles and drawdowns?

If you have been in the Crypto market for a long time and have experienced extreme stress tests like "9·4", "3·12", "5·19", and the latest "10·11", you might conclude a hard rule: every crisis and drawdown often marks the starting point of a cycle restart.

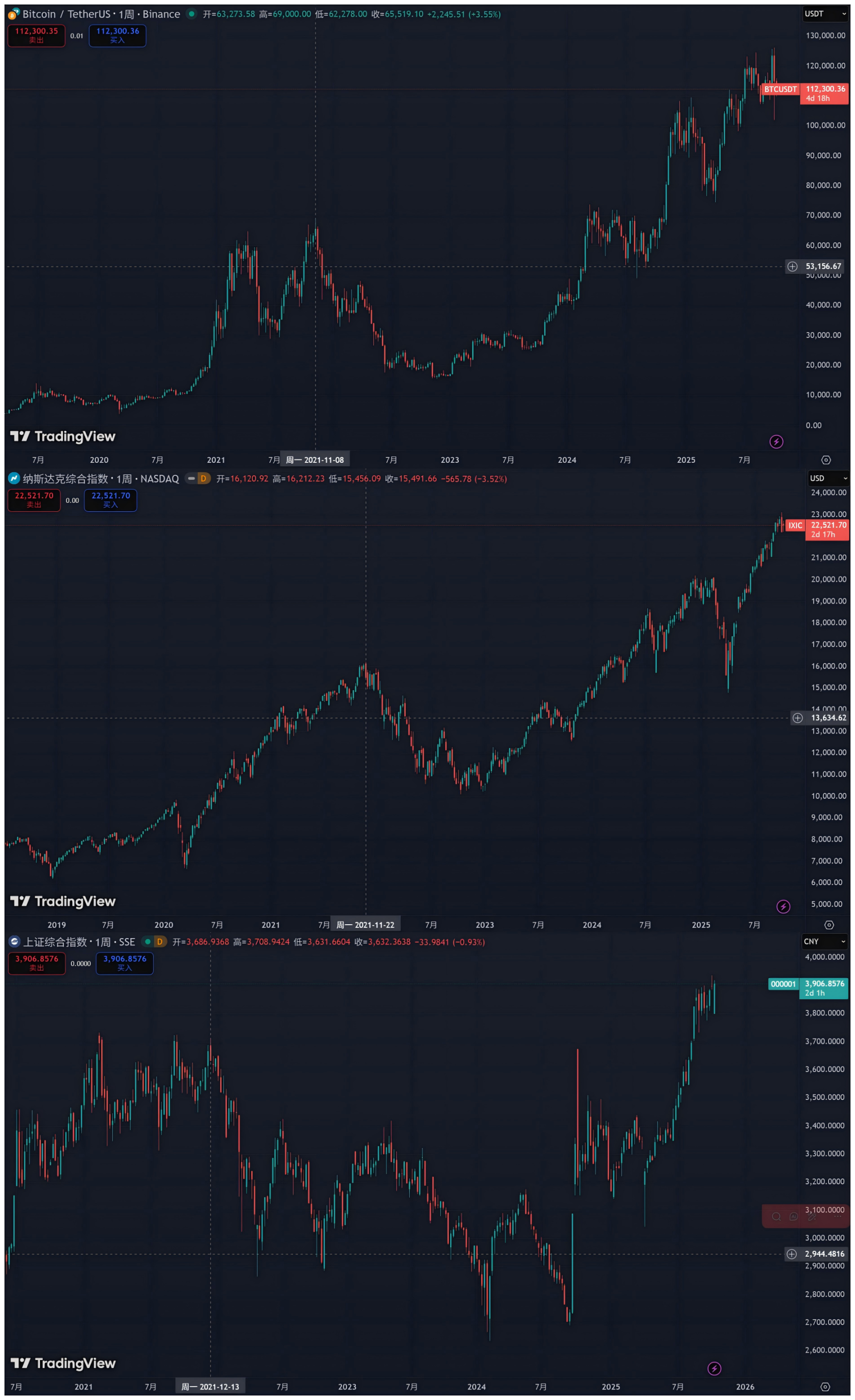

Although the time scale of Crypto is still too short and the volatility is more intense, if you observe it alongside the massive markets of US stocks and A-shares, you will find a commonality among markets—from the peak of the bubble, to violent liquidation, and then to differentiated recovery, the script of the cycle always repeats.

The past four years serve as the best example. In October 2021, global assets began to retreat from their peaks, and gradually recovered during the AI wave and new interest rate cycle from 2023 to 2025. Today, US stocks and Crypto have reached new highs again, while A-shares linger on the threshold of recovery.

It can be said that these four years have been a pressure test concerning global capital flows, risk pricing, and market psychology. Today, we will attempt to delve into this vivid "market cycle lesson" from the perspective of "drawdowns."

I. Cross-Market Cycle Lesson: Drawdowns Are Never a Distant Story

"In the long run, we are all dead" — John Maynard Keynes.

However, in capital markets, what everyone is most obsessed with is still the long-term macro narrative: cycles.

Taking the Crypto market as an example, over the past decade, Bitcoin has almost formed a widely recognized "four-year cycle" pattern, including about three years of upward trends, followed by roughly one year of adjustments and liquidations, and then the next cycle begins. So far, this cycle has been fully played out four times.

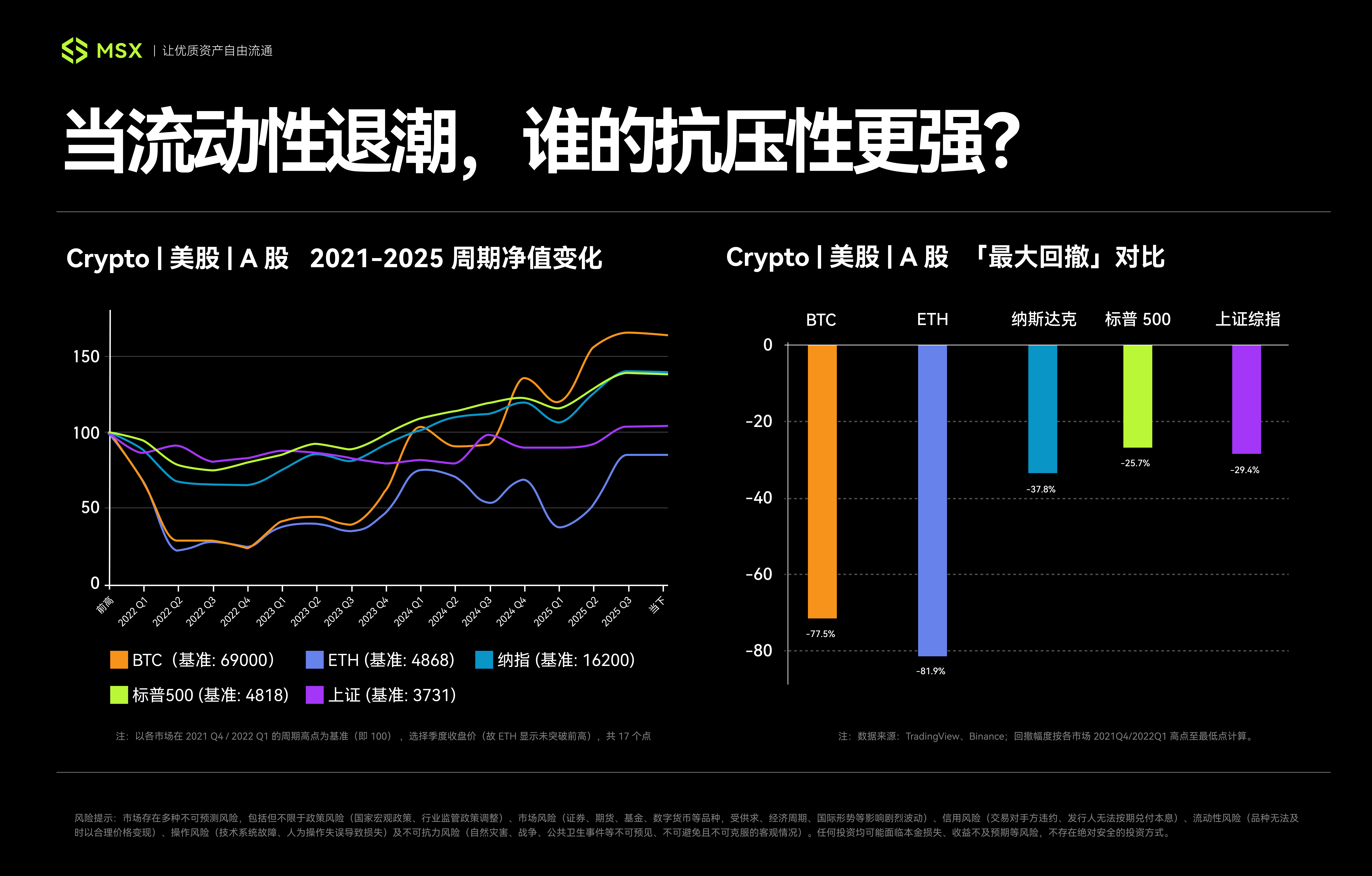

However, from Q4 2021 to Q4 2025, we have witnessed a broader and more profound resonance of macro liquidity and risk assets. This time, whether it is emerging Crypto or mature US stocks and A-shares, they have all been inevitably swept into it, with a path so clear that it can be considered a textbook example of the "prosperity peak - drawdown liquidation - differentiated recovery" cycle:

- Q4 2021: The last carnival of global liquidity flooding, Bitcoin, Nasdaq, and S&P 500 (Q1 2022) successively reached historical highs, while A-shares were at the tail end of a collective rally;

- 2022-2023: The fastest interest rate hike cycle in the history of the Federal Reserve led to a sudden tightening of dollar liquidity, and risk assets were not spared, US stocks, Crypto, and A-shares experienced a brutal wave of liquidation;

- 2023-2025: Inflation peaked, AI concepts rose, and expectations for interest rate cuts reignited, different markets began to emerge with completely different recovery curves according to their underlying logic;

Therefore, the complete cycle experienced by the global market from 2021 to 2025 is the most suitable for retrospective comparison, raising a core question: when a macro tsunami strikes, all boats will sink, but why can some assets quickly rise and reach new highs while others remain submerged, struggling on the edge of recovery?

Ultimately, drawdowns are the true face of asset risk, pointing directly to the real quality of the supporting system behind the assets. After all, investment cannot only focus on returns; one must also ask—"Can you endure it?"

The long-term fate of the market is often determined by the recovery after drawdowns, which is where the real story of each cycle begins.

II. 21-25, A Complete "Three-Market Resonance" Cycle

If one were to choose a time frame to summarize the true fate of global assets over the past four years, Q4 2021 to Q4 2025 would undoubtedly be the ideal sample.

This is not a typical bull-bear transition but a rare "three-market resonance cycle": global liquidity shifted from extreme easing to rapid tightening, and then returned to stability. In this intense macro variation, both emerging Crypto and mature US stocks and A-shares experienced a complete three-act play of "prosperity → liquidation → recovery."

This provides us with a perfect laboratory for observing the true performance of different assets in the same storm.

1. Q4 2021: The Peak of the Bubble

First, 2021 marked the final chapter of the global liquidity frenzy spurred by the pandemic, with overflowing cheap funds pushing the valuations of risk assets to unprecedented heights.

The most direct signal was the historical highs reached by US stocks from the end of 2021 to the beginning of 2022, where the Nasdaq index broke through 16,200 points on November 22, 2021, and the S&P 500 index surged to 4,818 points on January 4 of the following year, with high valuations and the bubble in the tech sector becoming the market's main theme.

Interestingly, Crypto resonated almost synchronously with the Nasdaq, reaching its peak moment—Bitcoin hit a high of $69,000 on November 10, 2021 (Binance spot data, same below), and Ethereum also set a historical high of $4,868 on the same day, with the wealth myths of NFTs and DeFi virally spreading on social media, attracting the last batch of latecomers.

For A-shares, although the CSI 300 index did not reach a historical high simultaneously (its peak was in early 2021), the market still maintained a local frenzy at high levels of 3,500 - 3,700 points, driven by structural trends such as "carbon neutrality," "new energy," and "core assets in liquor."

2. 2022-2023: Violent Liquidation

However, the end of the feast was swifter and more violent than anyone expected. Faced with inflation not seen in 40 years, the Federal Reserve initiated the fastest interest rate hike cycle in history, leading to a sudden depletion of global market liquidity, with risk assets being no exception.

Especially for the Crypto market, 2022 was a devastating "black swan year": from the death spiral of Terra/LUNA to the bankruptcy liquidation of Three Arrows Capital, and then to the collapse of FTX, liquidity, confidence, and valuations collapsed almost simultaneously, creating a perfect "Davis double whammy" of internal leverage liquidation and macro liquidity depletion.

Bitcoin experienced a snowball effect, hitting a cycle low of $15,476 on November 21, 2022, while Ethereum reached its cycle bottom of $881 slightly earlier on June 18, with a maximum drawdown of 77.5% for BTC and 82% for ETH from their peaks, which was truly devastating.

As the pricing anchor for global assets, the drawdown of US stocks was comparatively more orderly, with its decline logic clearly revolving around "anti-inflation" and "tightening expectations." The S&P 500 index bottomed out at 3,491 points (intraday) on October 13, 2022, with a maximum drawdown of about -27.5%, while the Nasdaq also hit a low of 10,088 points (intraday) on the same day, with a maximum drawdown of about 38%.

Although the absolute decline was far smaller than that of Crypto, considering its massive scale, the evaporated market value was still astronomical, officially declaring the global entry into a technical bear market.

The decline process of A-shares was even more complex, being a combination of "global tightening" and "domestic factors." Over a span of two years, the market underwent repeated bottom-testing processes, with the Shanghai Composite Index touching lows around 2,860 points multiple times in April and October 2022, and even setting a new cycle low of 2,635 points on February 5, 2024.

From the absolute high point of 3,731 points on February 18, 2021, the maximum drawdown of the Shanghai Composite Index was nearly 30%. Although the depth was similar to that of US stocks, the recovery process was extremely lengthy, posing an ultimate test of confidence and patience for investors.

3. 2023-2025: Differentiated Recovery

As we entered 2023, with global inflation peaking and the interest rate hike cycle nearing its end, the market began to brew recovery, especially as the AI boom ignited US stocks and ETF expectations boosted Crypto. This round of recovery began to diverge rather than synchronize.

First was the recovery of US stocks, undoubtedly driven by the AI narrative as the new growth engine—tech giants like Nvidia surged ahead, and their explosive earnings became a booster, leading the Nasdaq and S&P 500 to emerge from the mire first.

The S&P 500 officially reclaimed lost ground on January 19, 2024, followed by the Nasdaq Composite Index on March 1, 2024, both reaching historical highs. As of October 14, 2025 (closing), the S&P 500 closed at 6,644 points, and the Nasdaq at 22,521 points, representing increases of 38% and 39% respectively compared to the previous cycle peaks in 2021/2022.

Crypto, on the other hand, attracted mainstream capital's attention again with the internal risk clearance in the industry and the approval of Bitcoin spot ETFs, a "compliance" milestone event. BTC's price experienced a V-shaped reversal, breaking through the 2021 high, reaching $126,199, nearly an 83% surge compared to the historical peak, while ETH also set a new high of $4,956 in August this year.

However, altcoins experienced a stark contrast; aside from leading public chains like Solana, Sui, and TON benefiting from ecological revival or narrative dividends, entering a partial bull market, the vast majority nearly perished in the environment of liquidity contraction, with the alt market gradually splitting into "mainstream asset pools" and "speculative islands."

The recovery path for A-shares appeared particularly tortuous. Despite frequent policy tailwinds, market confidence recovered slowly, with the Shanghai Composite Index lingering at low levels for a long time, forming a stark contrast with the performance of major global markets. It wasn't until August that it officially crossed the 3,800-point mark, beginning its arduous recovery journey.

Note: Data is sourced from TradingView and Binance, with drawdown magnitudes calculated from peak to trough, and cycle performance represented as new high / previous high, with percentages rounded to one decimal place.

It is worth noting that although the peak of A-shares occurred in February 2021, earlier than the starting point we defined for the cycle (October 2021), this article still calculates from that absolute high point based on the "triple top" structure and from the perspective of drawdown calculations, as it better reflects its complete downward cycle.

Thus, a complete cycle has been completed, and the three major markets have delivered distinctly different results after experiencing similar macro shocks.

III. Cross-Market Comparison: Who Can Withstand the Cycle Drawdown?

Overall, the drawdowns in the US stock market, Crypto, and A-shares share a clear commonality, which is their strong correlation with the dollar liquidity cycle. For instance, all three peaked around Q4 2021 and resonated to the bottom around Q4 2022, indicating that the dollar liquidity cycle remains the "master valve" hanging over the global market.

However, under the opening and closing of this valve, a closer look at the underlying logic of the three reveals that they each represent different cyclical paradigms:

- The US stock market relies on institutions and profits, making it the most standard "liquidity-profit" dual-cycle market;

- Crypto relies on narratives and liquidity supply, making it a "high-elasticity cyclical asset" with built-in leverage;

- A-shares depend on policies and confidence, representing a typical "structural recovery market";

In other words, the depth of the US stock market's drawdown is determined by liquidity, but the speed of recovery is driven by corporate profits. Therefore, during the tightening storm of 2022, the decline in US stocks was dominated by macro logic leading to valuation compression, but as liquidity fears receded, the market's focus quickly returned to fundamentals.

Especially with the enormous productivity expectations brought about by the subsequent AI revolution, which directly translated into tangible profit growth and profit statement expansion for tech giants, this powerful "profit-price" positive feedback mechanism, combined with its mature financial system (such as the long-term allocation needs of institutional investors), formed a resilient recovery loop, making US stocks a model of "orderly declines and quicker recoveries."

On the other hand, Crypto largely acts as an amplifier of risk appetite for US stocks (especially the Nasdaq)—when liquidity is abundant, its gains are more astonishing; when liquidity is depleted, its declines are also more severe. It can be viewed as a "cyclical offensive target" with built-in high leverage.

However, the other side of high elasticity is severe differentiation. As Bitcoin ETFs deeply bind this market to Wall Street, the vast majority of altcoins have nearly perished in the liquidity contraction, and the "altcoin broad-based rally" that ordinary people expect is becoming increasingly scarce, with the market gradually differentiating into "mainstream asset pools" and "speculative islands."

To put it bluntly, as Crypto assets gradually become "Wall Street-ized" and "institutionalized," what they represent is no longer the excess returns of the wild era, but a market with extremely high volatility and diminishing marginal returns. The liquidity dividend is beginning to give way to structural opportunities, which also means that US stocks have, in fact, become a more cost-effective choice.

After all, compared to altcoins, US stocks have higher certainty, information transparency, and institutional maturity. Quality assets experience smaller drawdowns and quicker rebounds, and since corporate profits can be verified and policy cycles are predictable, the logic of news can always be unearthed—there are rarely "unexplained surges and crashes," so from an investment perspective, this certainty is precisely the most scarce value in the current liquidity environment.

The recovery logic of A-shares neither fully relies on global technological waves nor has an endogenous supply mechanism. The core driving force resembles a long game between the "policy bottom" and the "market bottom," essentially a restoration of confidence and expectations.

In summary, from this perspective, one can consider US stocks as core assets, view Crypto as a cyclical offensive asset with built-in leverage, while A-shares belong to structural strategy targets.

In Conclusion

Looking back at this global market experiment from 2021 to 2025, it becomes clear that enduring drawdowns is the only way to grasp the cycle.

However, there is no standard answer for how to endure drawdowns peacefully, but understanding their risk-return characteristics, especially their drawdown performance under extreme pressure, is the first step toward making informed decisions.

After all, in this long-distance race of investment, what determines how far we can go is never how fast we run in tailwinds, but how much drawdown we can withstand in headwinds.

Let us encourage each other.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。