China and the U.S. are now embroiled in an all-out trade war and it appears bitcoin has taken the brunt of the impact, more so than stocks. U.S. Treasury Secretary Scott Bessent announced the implementation of price floors for American rare earth companies on Wednesday as part of a strategy to combat China’s protectionist policies. Stocks were mostly up, but bitcoin fell on the news, down 1.74% at the time of writing.

The East Asian manufacturing giant quietly expanded export controls on rare earths last week, prompting threats of a “massive increase of tariffs” from U.S. President Donald Trump. The president’s public chastening of China triggered the largest liquidation in crypto history, more than $19 billion was wiped out, Coinglass data shows. The crypto market went into crisis mode, losing more than $410 billion in market value in a matter of days.

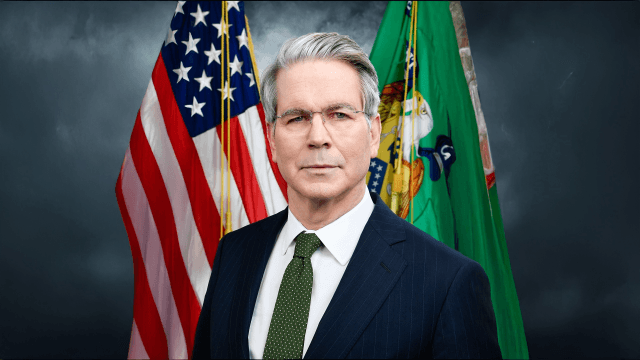

(U.S. Treasury Secretary Scott Bessent said China wants to “pull everybody else down with them.”)

Then on Tuesday, China sanctioned five U.S. subsidiaries of South Korea’s Hanwha Ocean, a shipbuilder with alleged ties to the U.S. government, prompting the U.S. to slap tariffs of up to 150% on Chinese maritime products.

And now, after telling Americans that China wants to “pull everybody else down with them,” Bessent will place price controls on multiple industries, starting with rare earths, to prevent the Chinese, who already produce 90% of global rare earth minerals, from expanding their dominance.

“When we get an announcement like this week with China on the rare earths, you realize we have to be self-sufficient, or we have to be sufficient with our allies,” Bessent told CNBC in an interview. “So we’re going to set price floors and the forward buying to make sure that this doesn’t happen again and we’re going to do it across a range of industries.”

Price controls are when governments set a minimum price for a product or service. Minimum wages are the most popular form of price control. Some governments will also make advance purchases of the goods in question, a practice known as “forward buying,” and even take equity stakes in the target firms. Bessent says all of the above is on the table.

The prospect of the Feds rescuing rare earth mineral companies boosted their stocks, which may explain the mostly positive movement seen in equities today. Bitcoin, however, was not so lucky.

BTC’s slump is likely because shrewd economists understand that price controls come at a cost. Higher prices will cause demand to drop, potentially causing production to fall, unless the government is willing to purchase excess supply, which it probably will, but even then, it’s a fine line between success and failure. “We do have to be very careful not to overreach,” Bessent explained.

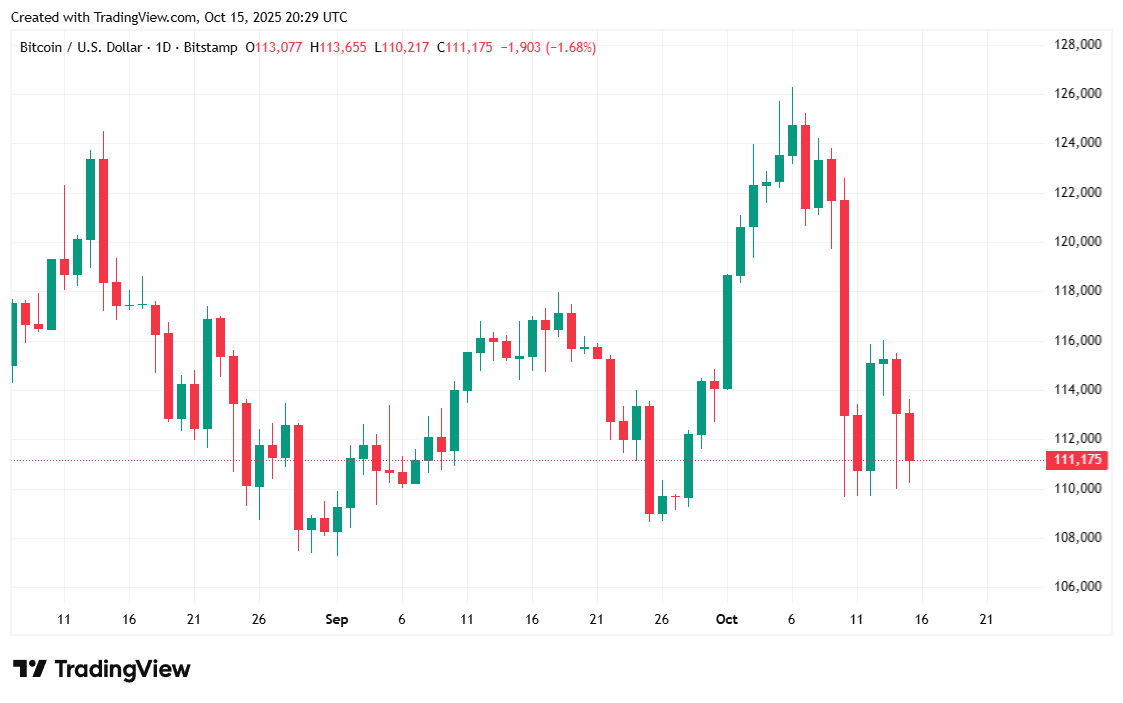

Bitcoin was trading at $111,013.79 at the time of writing, down 1.74% over 24 hours. The digital asset’s price was also down 10.27% over seven days and has fluctuated between $110,235.84 and $113,622.38 since Tuesday.

( BTC price / Trading View)

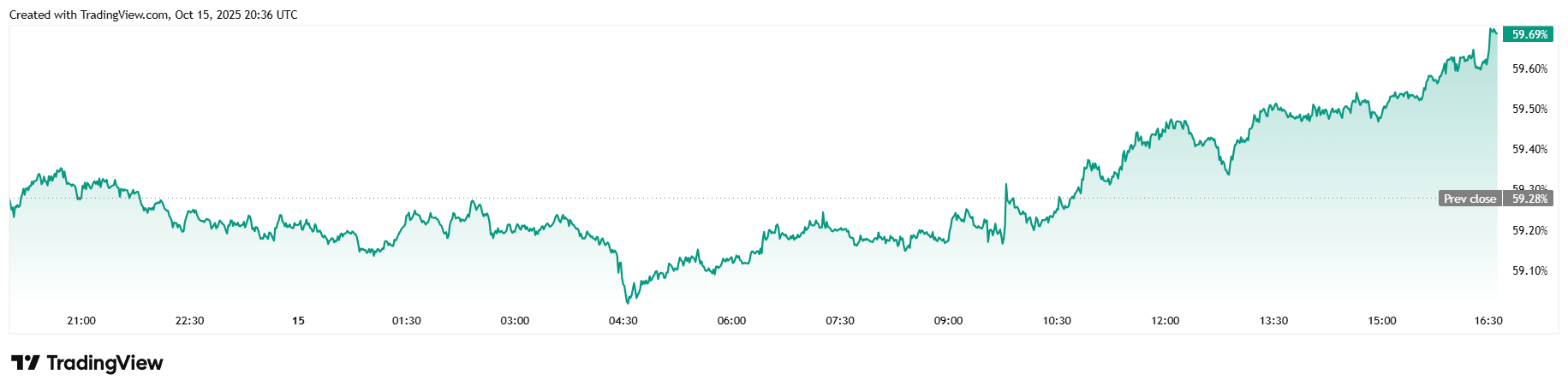

Twenty-four-hour trading volume fell 22.97% to $70.76 billion and market capitalization was down 1.7% at $2.2 trillion. Bitcoin dominance climbed 0.78% to reach 59.70% as BTC still outperformed altcoins despite the price decline.

( BTC dominance / Trading View)

Total futures open interest was down 1.73% at $72.15 billion according to Coinglass data. Liquidations for the day were relatively tame at $85.05 million. Most of that figure came from today’s $56.30 million in long liquidations, with the remainder coming from $28.76 million in shorts that were wiped out.

- Why did Bitcoin drop to $111K?

Bitcoin fell as the Trump administration imposed price floors for U.S. rare-earth firms to counter China’s trade dominance. - What are price floors?

They are government-set minimum prices meant to protect domestic producers from “non-market” rivals like China. - How did markets react?

Rare-earth stocks jumped, but Bitcoin and the broader crypto market declined as traders feared economic distortion. - Who announced the move?

Treasury Secretary Scott Bessent said the controls were vital to ensure U.S. self-sufficiency in critical industries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。