US-China Tariff Shock and ETF Outflows Trigger Crypto Market Crash

Can one political statement trigger a trillion-dollar storm? The crypto world is finding out the hard way. October — known historically as a month of wild swings — has once again lived up to its reputation. From record highs to a sudden crypto market crash, investors have witnessed a breathtaking turnaround within 24 hours.

The global cryptocurrency market cap plunged from $3.96 trillion to $3.78 trillion, now stabilizing at $3.87 trillion , marking a sharp 3.9% drop in a single day. Total trading volume stands at $244 billion, with Bitcoin dominance at 57.3% and Ethereum at 12.4%. But, why crypto market is down today? Let’s find out.

US-China Tariff War Sparks Panic Across Markets

The biggest trigger behind today’s crypto market crash is the China US Tariff News . On October 14, 2025 , China issued a fierce warning that it was prepared to “fight to the end” if the US moved ahead with a 100% trade tariff . This came in response to Trump’s recent decision targeting Chinese rare earth exports — a move he called “hostile” and “an attempt to hold the world captive.”

Source: X

Source: X

“If you wish to fight, we shall fight to the end,” said a Chinese commerce ministry spokesperson, adding that the US cannot “seek dialogue while threatening new restrictive measures.”

This bold stance rattled global lansdcape. Traders, fearing escalation, rapidly de-risked — rotating capital out of altcoins and pushing Bitcoin price crash into motion.

Bitcoin fell 3.34% , dropping from $115,924 to $111,271 , with $77.08B in 24h trading volume. Ethereum slumped 4.46% to $3,977 , and BNB price nosedived 11% to $1,194.35 , just a day after touching an all-time high of $1,370.55 .

ETF Outflows and Metaplanet Collapse Add Fuel

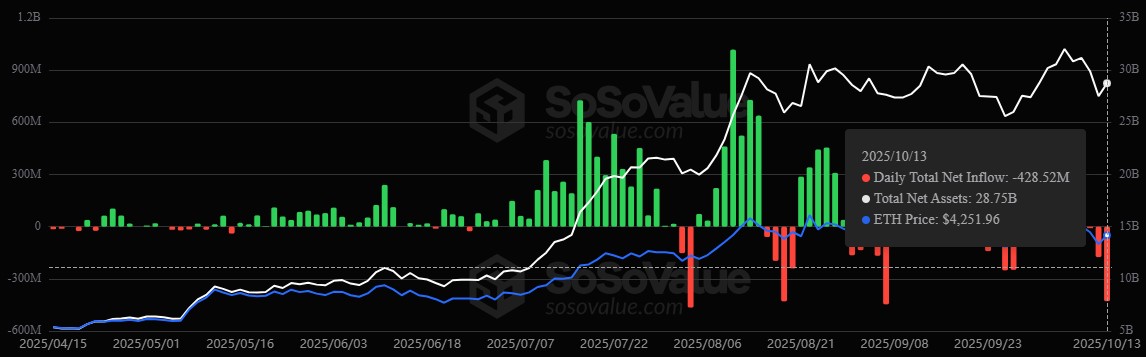

The tariff shock wasn’t the only factor behind the crypto market crash . Spot Bitcoin and Ethereum ETFs recorded massive outflows , reflecting investor panic.

-

Bitcoin ETFs saw $326.52M in net outflows, despite BlackRock IBIT logging $60.36M inflows.

-

Ethereum ETFs fared worse, with $428.52M in outflows. BlackRock ETHA alone lost $310.13M.

Source: SoSoValue

Source: SoSoValue

Meanwhile, Metaplanet stock price fell below the value of its own Bitcoin holdings — a stunning reversal for Japan’s “MicroStrategy.” The firm’s shares have collapsed 70% since June , popping what analysts like Mark Chadwick call “a Bitcoin treasury bubble.” Its mNAV slipped to 0.99 , signaling it now values the company less than the BTC it holds.

Fear Index Turns Red: What’s Next for Investors?

The Fear and Greed Index shifted dramatically to 38 (Fear) , from 70 (Greed) just a week ago. This sharp sentiment reversal reflects shaken confidence after the crypto market crash .

Source: Fear and Greed Index

Source: Fear and Greed Index

With the US government shutdown , its impending reopening, and the crucial FOMC meeting on October 29 , macro catalysts will dictate the next move. If the US-China tariff tensions escalate further, or ETF outflows persist, volatility may rise even more.

Conclusion

This sudden crypto market crash serves as a powerful reminder that global politics, institutional flows, and sentiment can collide overnight. October has always been a month of surprises — and 2025 is no exception. Investors now face gripped by fear, where the next headlines from Washington or Beijing could define the road ahead.

Disclaimer: This is for educational purposes only. Always do your own research before any investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。