Author: Chloe, ChainCatcher

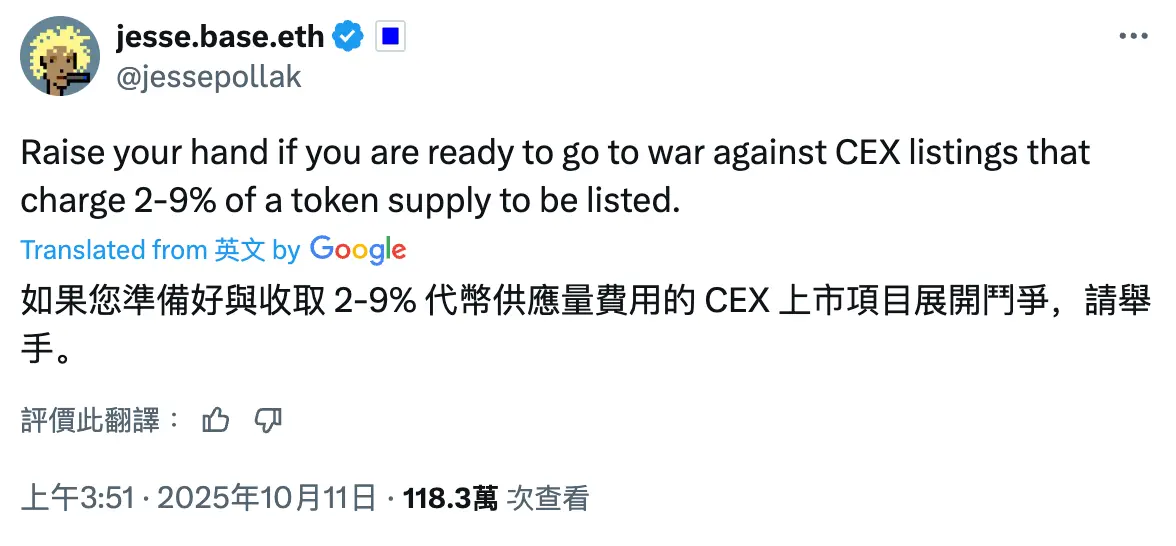

On October 11, Base founder Jesse Pollak posted multiple messages on X, criticizing some centralized exchanges for charging project teams a listing fee of 2% to 9% of the token supply.

The post garnered over a million views, and Zerebro founder Jeffy Yu retweeted, stating, "When we were building Zerebro, Binance asked for a $1 million listing fee, Bybit took a large number of tokens and $250,000, and accused the market maker Wintermute of demanding 10% of the token supply (100,000,000 tokens), later selling them for profit."

Although Binance later responded that there was no related information about Zerebro after checking with the listing team, it is possible that Jeffy encountered a scam. However, Jesse's comments have kept the topic of listing fees for centralized exchanges alive in the community, with many industry insiders revealing that some centralized exchanges charge unreasonable listing fees.

Divergence in Listing Strategies Between East and West: Why Did Jesse Initiate a Protest?

Web3 independent researcher Haotian commented that listing fees are just a facade; the logic of using listing fees as a quality screening mechanism is sound. CEXs provide traffic and exit channels, while market makers provide liquidity support, making it reasonable to charge listing fees.

"But Jesse's real anxiety is not about this 9%, but rather about the mysterious Eastern forces constructing the entire 'platform' + 'exit mechanism' combo."

The "Alpha Observation Zone" mechanism launched by Binance provides many small projects with a fast track for listing; as long as a project has a certain level of popularity, it can quickly enter this observation zone to gain traffic. Users earn Alpha points by participating, and in return, they receive a certain proportion of airdrop incentives, effectively taking on some of the market makers' risks.

Once the project goes live with contract trading, it can hedge through short contracts, allowing for quick withdrawal and exit. The entire process forms a highly interconnected cycle of rapid price increases and hedged exits, seemingly becoming the "optimal strategy" for many projects.

"To some extent, Binance's monopoly is not just about attention and liquidity, but about changing the entire industry's rules of the game, replacing 'long-term building' with 'quick exit.' This is the core of Jesse's true anxiety."

Users Rush to Earn Points, Projects Rush to Cash Out: Incentive Design for "Quick In and Out"

Jesse has repeatedly emphasized slogans like "permissionless token launches" and "continuously cultivating long-term holders," hoping to create a decentralized market mechanism that allows developers to operate projects together with the community from day one, rather than viewing exchanges as short-term exit points.

Senior secondary analyst @JunShao_666 believes that what truly irritates Jesse is that his piece of the cake is being threatened; this mechanism is quietly rewriting the "value magnetic field" of Crypto.

According to historical data from DeFiLlama, over 70% of the TVL of projects launched on Binance Alpha was halved within three months. The incentive design leans towards "quick in and out": users earn points for airdrops, while project teams hedge and cash out.

The development path of Base and Coinbase is "on-chain cold start," where projects first launch permissionlessly on DEXs, establishing a real and closely bound holder community, and then distribute on centralized exchanges. This Day 1 rooting concept has allowed Base's TVL to soar from zero to over $10 billion during the 2024-25 cycle.

However, Binance's fast-food mechanism has left project teams wondering why they should slowly cultivate on Base when they could directly list on Binance and cash out within a month.

Jesse believes that his platform has invested significant resources to build advanced infrastructure, such as flashblocks that improve trading efficiency and transparency, as well as deep integration with DEXs, aiming to provide project teams with a fair, open, and efficient on-chain development environment.

Currently, however, this infrastructure faces the risk of being "hitchhiked" by other centralized exchanges that primarily operate on quick exits and high listing fees.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。