Minsheng Securities analysis believes that this time will not become a turning point for the market.

Written by: Ye Zhen, Wall Street News

On Monday morning in the Asian market, risk assets rebounded across the board, reversing the pessimistic atmosphere from last Friday. Investors flocked back to assets such as stocks, oil, and digital currencies, while gold continued its upward trend.

After the opening of the Asian market on Monday, U.S. stock index futures rose in response, with S&P 500 index futures climbing nearly 1%;

The performance of the Asia-Pacific stock markets was mixed, with Australia's S&P/ASX 200 index down 0.3% and Hong Kong's Hang Seng index futures down 0.5%. The Japanese market was closed for a holiday;

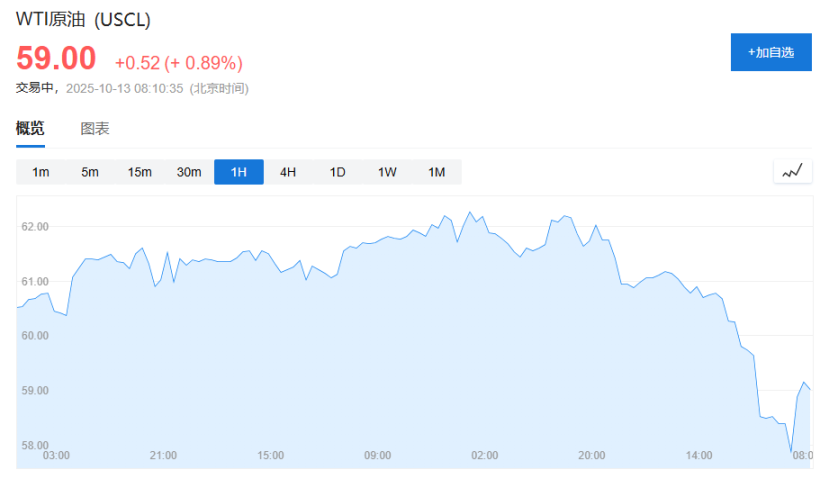

Oil prices rebounded by more than 1%;

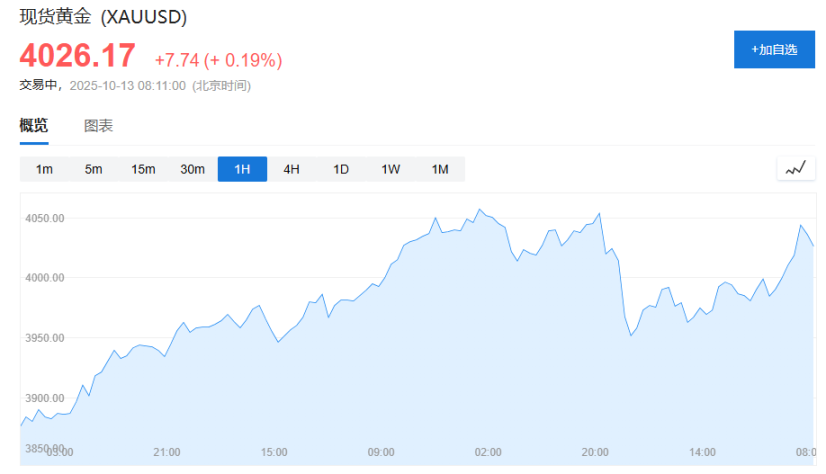

Spot gold rose 0.7% to $4045 per ounce;

Digital currencies rebounded, with Bitcoin returning above $115,000;

According to the Global Times, a spokesperson for the Ministry of Commerce answered reporters' questions on the recent relevant economic and trade policy measures from China on the 12th. In response to the U.S. threatening to impose a 100% tariff on China under the pretext of "China's export controls on rare earths and other related items" and to implement export controls on all key software, the spokesperson stated: Threatening with high tariffs is not the correct way to interact with China.

The Ministry of Commerce stated that China's position on the tariff war has been consistent; we are unwilling to fight, but we are not afraid to fight. China urges the U.S. to correct its erroneous practices as soon as possible, guided by the important consensus reached during the conversation between the two heads of state, to maintain the hard-won results of consultations, continue to utilize the China-U.S. economic and trade consultation mechanism, and resolve respective concerns through dialogue based on mutual respect and equal consultation, properly manage differences, and maintain the stability, health, and sustainable development of China-U.S. economic and trade relations. If the U.S. insists on its own way, China will also resolutely take corresponding measures to safeguard its legitimate rights and interests.

In this regard, Minsheng Securities analysis believes that this time, combined with the restraint reflected in Trump's responses to reporters over the weekend and China's rational response, still believes that the tone between the two sides has not changed and will not become a turning point for the market.

Risk Assets Rebound, Gold Continues to Rise

At the beginning of the Asian trading session, prices of various assets generally warmed up. As of the time of writing, S&P 500 index futures rose over 1%.

In the commodities market, WTI crude oil rose 0.9% to $59 per barrel.

As a safe-haven asset, gold continued its upward trend, with spot gold rising 0.19% to $4026.17 per ounce as of the time of writing.

The foreign exchange market remained relatively stable, with the Bloomberg Dollar Spot Index showing little change, and the Japanese yen falling 0.5% to 151.93 against the dollar. The offshore yuan exchange rate remained basically flat.

However, the performance of the Asia-Pacific stock markets was mixed. Australia's S&P/ASX 200 index fell 0.3%, and Hong Kong's Hang Seng index futures dropped 0.5%. The Japanese market was closed for a holiday.

After experiencing a historic large-scale liquidation, the digital currency market welcomed a strong rebound over the weekend. According to CoinGecko data, as of October 12, Bitcoin rose 4.2% in 24 hours, trading around $115,180; Ethereum rose 10.8% in 24 hours to $4143.

Other mainstream tokens also generally rose, with Solana up 6.3% and Dogecoin soaring 7.6%. The total market capitalization of cryptocurrencies rebounded to $3.85 trillion, up nearly 10% from the low two days ago.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。