Ethereum treasury is not just about "buying ETH," but about amplifying ETH exposure through financial engineering.

Compiled by: Deep Tide TechFlow

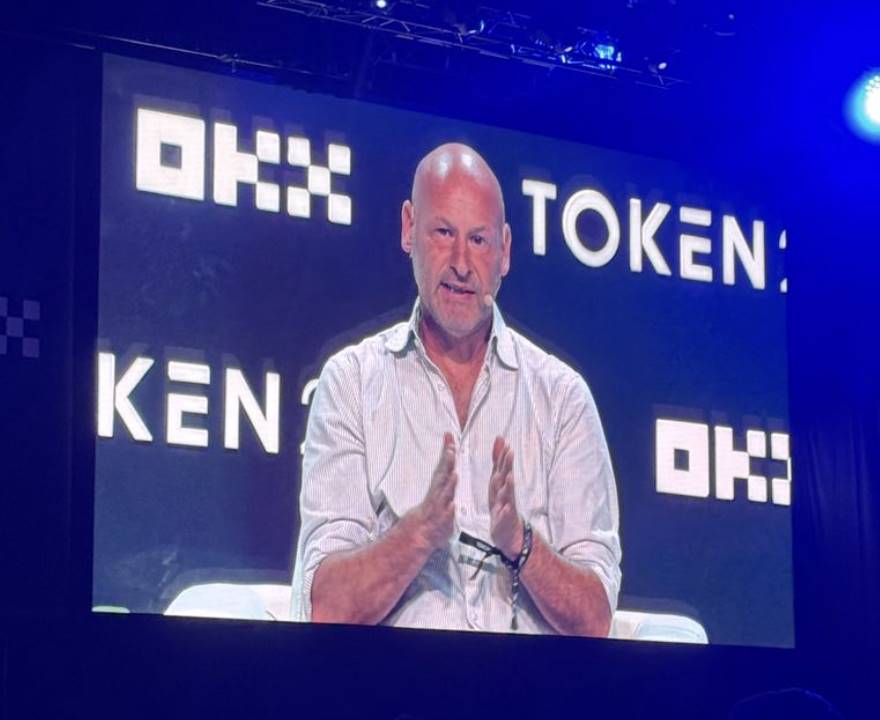

At the Token 2049 summit in Singapore, Pantera Capital partner Cosmo Jiang hosted a roundtable discussion themed "The Rise of Digital Asset Treasury."

Tom Lee, Chief Investment Officer of Bitmine, Joseph Lubin, Founder of ConsenSys and Chairman of Sharplink, and Sam Tabar, CEO of Bit Digital shared their views on the future cycles of Ethereum, institutional adoption, and the development path of Digital Asset Treasuries (DAT). This dialogue not only revealed the unique positioning of each company but also provided investors with key perspectives to understand this emerging asset class.

Deep Tide TechFlow reporters also listened to this discussion and summarized the viewpoints as follows.

Key Points Summary

The starting point of Ethereum's "super cycle"

The differentiated path of DAT

The core competitiveness of future DAT lies in capital structure innovation

Ethereum treasury is not just about "buying ETH," but about amplifying ETH exposure through financial engineering

Future DAT will diversify into multiple types

DAT should trade at a premium (>2× NAV)

Why Ethereum? Answers from the three guests

Highlights of the Discussion

Tom Lee (Chief Investment Officer of Bitmine)

Ethereum is at the starting point of a super cycle.

In the first phase, the primary task of any Ethereum treasury is to acquire ETH, which is still undervalued. In the second phase, the focus should be on education and infrastructure to support larger-scale on-chain finance. The third phase involves the tokenization process connecting traditional finance, making the treasury a core node. Currently, less than 0.1% of institutions hold ETH, and we are at a critical moment similar to 2017.

Our core goal is simple: to continuously increase the amount of Ethereum held per share (ETH per share).

I believe Ethereum-like DAT should indeed trade at a premium. Fundamentally, they should at least trade at 1× NAV.

I think Ethereum is in a super cycle because both Wall Street and artificial intelligence (AI) are migrating to a neutral and open blockchain network, which is Ethereum.

Joseph Lubin (Founder of ConsenSys and Chairman of Sharplink)

Sharplink's long-term strategy is to create excess wealth growth for shareholders by building infrastructure that deeply aligns with Ethereum technology and ecosystem.

I believe that in the short term, these DAT companies will have considerable strategic overlap, but will also demonstrate differentiation in various ways, especially in how they utilize their held Ethereum to generate returns.

We believe that the mission of DAT is not just short-term arbitrage, but to participate in a long-term project of "civilization-building technology."

From a macro perspective, I think we are entering a phase similar to the early internet. Initially, "internet companies" were a new concept, but a few years later, all companies became internet companies. I believe DAT will follow the same path. Soon, almost every company will realize they must do something on-chain.

The global economy is gradually moving towards decentralization, and Ethereum technology will become the trust layer of Web3 and the next-generation economic system. For any company or builder, the biggest risk is not participating in Ethereum, but being absent from it.

Sam Tabar (CEO of Bit Digital)

We are exposed to the two strongest growth curves of this era through our dual-line layout of White Fiber and Ethereum treasury: digital assets (especially Ethereum) and artificial intelligence (AI).

Michael Saylor is a "financial magician" in capital structure management, showing the entire industry how to turn balance sheets into strategic weapons through innovative leverage.

In the future, only those treasury companies that dare to innovate in capital structure will truly survive in the long term.

Many DAT will emerge in the future, but honestly, most of them should not exist, and many will ultimately fail. The key lies in differentiation.

I believe humanity is currently experiencing two of the greatest transformations: Ethereum is rewriting the financial system, while artificial intelligence is rewriting society. Both are already happening. Therefore, positioning ourselves to engage with both grand narratives is the most important strategic direction for us at Bit Digital.

Tom Lee: Ethereum is at the starting point of a super cycle

Focusing on the core thread of "Why Ethereum is the axis of the institutional cycle," Bitmine Chief Investment Officer Tom Lee made the first judgment: Ethereum is at the starting point of a super cycle.

In his view, this cycle is not merely a price story, but a structural turning point triggered by the simultaneous migration of Wall Street and artificial intelligence to an open, neutral blockchain. Along this logic, Ethereum's Digital Asset Treasury (DAT) will undergo three phases.

"In the first phase, the primary task of any Ethereum treasury is to acquire ETH, which is still undervalued. In the second phase, the focus should be on education and infrastructure to support larger-scale on-chain finance. The third phase involves the tokenization process connecting traditional finance, making the treasury a core node. Currently, less than 0.1% of institutions hold ETH, and we are at a critical moment similar to 2017."

Treasury companies first accumulate severely undervalued ETH, then use education and infrastructure to support larger-scale on-chain finance, ultimately deeply coupling with the tokenization process of traditional finance, becoming the core node connecting the two systems.

This means that Ethereum treasuries that can clearly differentiate themselves will become key vehicles for institutional funds to allocate on-chain assets.

Who is Defining the Next Generation of Ethereum Treasuries?

Host:

I appreciate that everyone shares the same "North Star," which is to support Ethereum. In my view, the primary task of these Digital Asset Treasuries (DAT) is to voice for their underlying tokens. However, when we broaden our perspective, it is clear that there must be distinctions between different DAT. I believe many in the audience are wondering how to choose among the many DAT, such as BMNR, SBET, or BTBT?

As an investor, I am pleased to see this healthy competition. Here, I would like to ask each guest how you differentiate yourselves? What makes your project unique?

Sam:

Bit Digital's positioning is very unique for several reasons. To obtain capital for purchasing Ethereum, there are typically three avenues: business revenue, equity financing, or debt financing.

First, Bit Digital recently successfully listed its AI business company. This company is called White Fiber, in which we hold a 71.5% stake. White Fiber is a pure AI infrastructure company.

Tom is right; the ongoing "super cycle" focuses on two areas: Ethereum and artificial intelligence. Therefore, our positioning strategy is to hold both growth lines simultaneously: accumulating Ethereum on one hand, and on the other hand, gaining the growth dividends of AI infrastructure through White Fiber's IPO.

This means that Bit Digital's balance sheet has two core assets: AI (White Fiber) and crypto business. We can gradually reduce our holdings in White Fiber at the right time, providing us with a source of funds that does not dilute existing shareholder equity. At the same time, the rising valuation of White Fiber will directly drive Bit Digital's overall valuation, achieving a win-win situation.

The second avenue is equity financing. This is very straightforward; the company can obtain cash by issuing equity, which is a traditional path.

The third way is debt financing, which is quite interesting. Michael Saylor has already shown us a classic example of this type of operation. To successfully operate a treasury-type business, the capital structure must be designed very creatively. Selling equity is certainly fine, but debt financing deserves more attention. Because so far, no Ethereum treasury company has truly adopted a "leverage strategy" to amplify its exposure to Ethereum.

We noticed this. So this week, we issued unsecured convertible bonds. This is very important because the "secured debt" commonly seen in the crypto industry is extremely risky. After experiencing multiple crypto winters, we know that if you use crypto assets as collateral, once the market drops, lenders will directly seize your crypto assets, leading to the company's forced bankruptcy.

So we chose unsecured debt financing. This is not only safer but also provides us with flexible capital leverage. As of this week, we have become the first company to operate an Ethereum treasury using unsecured debt.

In summary, Bit Digital's three differentiation strategies are:

Obtaining Ethereum capital sources through actual business (AI + crypto);

Flexibly utilizing equity financing mechanisms;

Innovatively using unsecured debt financing as a leverage tool.

We are exposed to the two strongest growth curves of this era through our dual-line layout of White Fiber and Ethereum treasury: digital assets (especially Ethereum) and artificial intelligence (AI).

Joseph:

I believe that in the short term, these DAT companies will have considerable strategic overlap, but will also demonstrate differentiation in various ways, especially in how they utilize their held Ethereum to generate returns.

Sharplink's greatest advantage, and what makes us unique, lies in our deep partnership with ConsenSys. ConsenSys is the most comprehensive and profound company in the Ethereum ecosystem, making it one of the world's leading blockchain companies. We have a complete technology stack and have been building the Ethereum protocol itself for many years. We developed the Ethereum client, helping to maintain the operation of the entire Ethereum network; we also built the later Layer 2 technology and developed it into one of the leading Layer 2 solutions today, Linea (ZK-EVM Layer 2).

In addition, ConsenSys has created the world's largest non-custodial wallet, MetaMask. Currently, there are over 100 million users worldwide using MetaMask each year, with monthly active users ranging from 20 million to 30 million. This means we have a huge user distribution channel.

We are also about to launch a rewards program that will continuously distribute Linea tokens, MetaMask tokens, and other related tokens in the future. This program will closely connect the usage behavior of the entire ConsenSys ecosystem with the reward mechanism, forming a positive feedback loop that allows Sharplink's ecological activities, community engagement, and token economy to create a mutually supportive growth cycle.

Tom:

For Bitmine, our differentiation strategy is primarily based on three core principles of the company.

First, we always maintain an extremely healthy balance sheet, which we call a "fortress sheet." Currently, Bitmine holds approximately $600 million in cash reserves, which you can see in our weekly public reports. This allows us to respond flexibly in two scenarios:

When the price of ETH drops significantly, we can actively buy;

When stock prices are weak, we can protect shareholder interests.

This dual strategy is the reason we maintain a strong cash position.

Second, we adhere to a shareholder-oriented model. For us, any investor purchasing Bitmine stock should clearly understand the logic behind their investment. To this end, we publish company reports and a letter from the chairman every month, clearly presenting the company's phased strategy. As you know, the first phase is to accumulate 5% of the total global Ethereum supply. The focus of the second and third phases is on "seeding the ecosystem" to build infrastructure for Wall Street's future on-chain financial system.

Third, we place a high value on stock liquidity. Bitmine currently has a daily trading volume of about $2.5 million, ranking 26th in the U.S. stock market and being the 518th largest publicly traded company in the U.S. This high liquidity attracts a large number of institutional investors, as they can gain pure exposure to Ethereum through Bitmine. We expect to be included in the rebalancing list of major stock indices next June, which will bring about 15,000 large institutional funds passively allocating Bitmine stock.

Additionally, as we enter the native Ethereum staking phase, the $12 billion worth of ETH held by Bitmine will generate nearly $400 million in annual pre-tax income. At that time, we will rank among the top 800 most profitable companies in the U.S.

In summary, our differentiation strategy is to keep the story simple and clear, execute transparently, and always ensure that shareholders understand what we are doing and why we are doing it.

When Ethereum Goes Mainstream, Who is Buying the Next Generation of Treasuries?

Host:

Let me summarize my observations and turn them into a more specific question. Tom, I want to ask you. From an investor's perspective, I often see which patterns are effective, which are ineffective, and how people are constantly evolving. It seems to me that for DAT, the key appears to be attracting the attention of mainstream retail investors and traditional financial media, not just the native players in the crypto space. So, I want to ask, who do you think the new batch of buyers you are attracting is? How are you reaching them?

Tom:

Good question. In fact, our investor base is very broad.

If you look at the traditional stock market, the composition of retail funds can actually be divided into four main groups, which are the most stable buying forces in the stock market:

The first group is institutional investors, accounting for about 30% of the market.

The second group is U.S. retail investors, which includes users of platforms like Robinhood as well as clients of traditional brokerages, so there are actually two subgroups within retail.

The third group is institutional investors like family offices and pension funds, which are different from mutual funds or hedge funds.

The fourth group is international investors.

At Bitmine, we have conducted in-depth research on these four groups. Currently, we have a very large and growing group of institutional investors. For example, Cathie Wood's ARK fund is one of our top ten holdings, and she is also the largest shareholder of Bitmine. We are very proud of this because she is a visionary investor. Initially focused on Bitcoin, but now she also recognizes that Ethereum and Bitcoin are "friends walking side by side."

In addition, we have a large retail base, with the number of Bitmine shareholders exceeding 330,000. At the same time, we have noticed that more and more family offices are starting to pay attention to Bitmine, because our model provides them with a leveraged and direct exposure to Ethereum that was previously difficult for them to obtain. Finally, our international investor base is also rapidly expanding. In some countries, Bitmine's stock trading volume even ranks third locally, only behind popular companies like Tesla.

In summary, we have successfully reached four major investor ecosystems—institutions, U.S. retail, family offices, and international investors. This excites us because it means Bitmine is no longer just a "stock in the crypto space," but has become a vehicle for Ethereum exposure that is actively participated in by global mainstream capital markets.

The Maturity Moment of Digital Asset Treasuries

Host:

Next, I want to ask Joseph. When I observe Sharplink, one thing that excites me is that you have hired Joe Shalone, a former executive at BlackRock. This, in my view, symbolizes the maturation of the DAT industry, moving from crypto-native to professional institutional-level management. How do you view the establishment of a management team? What are your thoughts and experiences in recruiting top talent for DAT?

Joseph:

Yes, Joe comes from BlackRock, and he understands how to build an efficient platform system very well. His greatest characteristic is rigor, especially in cost control. He places great importance on not wasting a penny and ensuring that the company's operating expenses are streamlined and efficient. At Sharplink, our current primary goal (whether short-term or mid-term) is to protect and enhance shareholder value. This not only means focusing on potential dilution effects but also on stock price performance. If necessary, we will repurchase company stock and be able to do so without selling any Ethereum assets.

This rigorous financial and governance culture is the valuable experience that Joe brings from BlackRock. We are building our own infrastructure based on this philosophy so that all core business can be completed internally in an efficient and low-cost manner. In the long run, our goal is to serve retail investors, institutional investors, family offices, and sovereign wealth funds well.

Sharplink's long-term strategy is to create excess wealth growth for shareholders by building infrastructure that deeply aligns with Ethereum technology and ecosystem.

We believe that this model, which combines institutional-level discipline with a long-term belief in Ethereum, will be the most effective way to achieve this goal.

Host:

Yes, that's right. When assessing the value of a publicly traded company, I always pay special attention to the team's experience. Many newly established DAT companies have team members who lack experience in managing publicly traded companies. But Bit Digital has been operating as a publicly traded company for some time. Sam, what do you think is the most important capability to become a qualified and mature publicly traded company? What aspects of capability or experience might other DAT companies be lacking?

Sam:

I believe this is not something one person can do, and it is not just me. The founding team around me is key; each of them brings unique skills like superheroes: one is a business developer, one is responsible for institutional process building, another focuses on risk management, and I mainly handle market and strategic direction. This team combination is like the Avengers, where everyone can play a role at critical moments.

I feel very fortunate to work with them.

They are not just buying Ethereum; they are rewriting the rules of the financing game.

Host:

That's great. After all, for me, the core of DAT lies in achieving strategic goals through capital structure management and financial engineering. So I want to ask further, how do you view financing at the company level? Are you considering mergers and acquisitions or continuing to issue bonds or convertible bonds in the future? I would like to hear your respective views on capital management.

Sam:

I resonate deeply with this question. I have mentioned it before, but it is worth emphasizing again: we must be as creative as possible in our capital structure.

Existing shareholder capital is just one of many financing levers. For example, the convertible bonds we just issued this week surprised me because we are the first Ethereum treasury company to do so. I originally thought other teams would also try similar operations. Michael Saylor is a "financial magician" in capital structure management; he has shown the entire industry how to turn balance sheets into strategic weapons through innovative leverage.

Convertible bonds are one of the powerful financial engineering tools. If you rely solely on issuing stock as a means of financing, that is fine, but it is just a single method. In the future, only those treasury companies that dare to innovate in capital structure will truly survive in the long term.

In other words, traditional methods are no longer sufficient; creatively utilizing financial structures is the core competitiveness of DAT.

Joseph:

Yes, we are indeed researching some structured financing tools like forward contracts and convertible bonds.

However, for these tools to be effective, the prerequisites are sufficient trading volume and volatility, and these conditions are gradually maturing. We will release relevant announcements at the appropriate time in the future.

**In addition, the stability of long-term capital is also crucial. Therefore, we are engaging with family offices, institutional investors, and sovereign wealth funds. Because we believe that the mission of DAT is not just short-term **arbitrage, but to participate in a long-term project of "civilization-building technology."

Tom:

We at Bitmine have also studied MicroStrategy's operational model very carefully.

They have executed 21 different financing transactions, many of which are innovative. It can be said that they are almost a textbook case of "financializing" a company's balance sheet. These phased operations not only raised the price of Bitcoin but also enhanced shareholder returns.

Our core goal is simple: to continuously increase the amount of Ethereum held per share (ETH per share). When the first PIPE (private placement) transaction was completed on July 8, our ETH holding per share was approximately $4. By August 27 (the last reporting date), the ETH holding per share had grown to nearly $40. In other words, our strategy is to continuously enhance the asset value per share through capital market operations.

The key to achieving this goal is the high liquidity of our stock. Bitmine is currently the 26th most actively traded stock in the U.S., with a daily trading volume of about $260 million, which makes institutional investors very eager to gain Ethereum exposure through Bitmine.

Of course, this also comes with several characteristics:

The volatility of Ethereum is about 50% higher than that of Bitcoin;

The implied volatility (IV) of Bitmine stock is as high as 120, far exceeding the 60 when Saylor issued convertible bonds back in the day.

Because of this, we currently choose to keep our financing structure simple and do not wish to introduce any capital instruments that would dilute shareholder equity or compete with common stock. Our goal is always to maximize common shareholder returns, allowing every investor holding BMNR to benefit.

In the future, we do not rule out exploring structured financing methods such as convertible bonds, especially the composite structure of "staking yields and convertible bonds" that Sam mentioned, which is indeed logically feasible.

But for now, Bitmine's strategy is to prioritize utilizing market liquidity rather than volatility for financing. As long as market conditions remain supportive, we will continue along this path.

From Crypto Experiment to Corporate Norm: The Future Landscape of DAT

Host:

Thank you very much for your sharing. As someone who has long invested in this industry and even participated in the early stages of promoting the development of the DAT ecosystem, I often have to "take the blame" and face many questions and concerns from investors. They keep asking me: What risks do these DAT companies really have? Why are there suddenly so many in the market? I certainly have my own answers, but I would like to invite the "leaders" present to discuss these questions together.

Let's take a look one by one, starting with Joseph. One of the most common questions from investors is: "Why should I hold stock in a DAT company instead of directly buying Ethereum spot?"

You obviously hold a large amount of ETH spot, so how do you view this question?

Joseph:

Great question. In my view, investing in DAT is more like a "leveraged" way to invest in Ethereum. If you are willing to put your funds in an Ethereum treasury company and hold for a while, you will ultimately gain more Ethereum exposure (more ETH per dollar) for the same amount of investment.

In other words, for retail investors, this is actually a **more efficient investment path: DAT will gradually amplify the amount of ETH behind each dollar through asset management, capital structure optimization, and reinvestment of returns. So, the longer the time, the more pronounced the *compound effect* of the DAT model becomes.**

Host:

Good. Then I will extend a related question. There are now more and more DAT companies in the market, and many investors question, "Why are there so many DATs? What are the differences between them?"

Sam, how do you view this phenomenon of "DAT explosion"? How do you think the final landscape will evolve?

Sam:

Many DATs will emerge in the future, but to be honest, most of them should not exist, and many will ultimately fail.

The key is differentiation.

If you do not have a clear positioning, unique strategy, and real execution capability, then you are just a noise point in the crowd. We at Bit Digital have done our utmost to create our own differentiated advantages, not just by saying slogans, but by proving it with actual capital structure design and strategic execution.

Joseph:

I have a slightly different view on this issue. I understand Sam's point and agree with his idea of "survival through differentiation," but I believe that future DATs will not only take one form. In the Ethereum ecosystem and even the broader crypto world, different categories of DATs will emerge:

Some will focus on short-term returns, creating returns through staking, liquidity mining, or financialization methods;

Some will be long-term ecosystem builders, focusing on supporting the Ethereum protocol, developing infrastructure, and nurturing developers;

Others will engage in Ethereum-related ancillary businesses, allowing their value to grow in sync with Ethereum's growth;

There may even be multi-token treasuries that manage ETH, L2 assets, and other ecosystem tokens simultaneously.

Ultimately, only a few will truly stand out. Only top-tier DATs will become the core of the industry, but at the same time, some regional DATs will emerge to provide services and liquidity for local capital and communities.

From a more macro perspective, I believe we are entering a stage similar to the early days of the internet. Remember when the internet first emerged, there were "Internet companies" everywhere: they helped traditional businesses build websites, develop e-commerce platforms, and later shifted to mobile.

Initially, "internet companies" were a new concept, but a few years later, all companies became internet companies. I believe DATs will follow the same path. Soon, almost every company will realize that they must do something on-chain, whether on the Ethereum mainnet (L1) or on L2. To do this, they will need to hold tokens, as the only way to participate in the protocol is often to hold and use tokens.

So, in the future, every company will manage its own token treasury. This is the direction that ConsenSys is currently focusing on: we are building a decentralized MetaMask infrastructure for everyone to build upon. Whether it is the consumer-facing MetaMask Consumer, the institutional-facing MetaMask Enterprise, or the future MetaMask Bank.

By then, the term "DAT company" will no longer be a special identity but will become the norm for all companies, just like "internet companies" did back in the day.

Why Ethereum Treasuries Should Trade at a Premium

Host:

Okay, next is the third commonly mentioned risk. Many people believe that the stock prices of these DAT companies will long anchor to net asset value (NAV), or even trade below 1 times net value (trade below NAV). Tom, I really liked the analytical framework you mentioned earlier. Could you explain, from a fundamental perspective, why DATs should theoretically trade at a premium rather than a discount?

Tom:

I believe that Ethereum-related DATs should indeed trade at a premium. First, at a fundamental level, they should at least trade at 1 times net value (1× NAV), although short-term market fluctuations or funding sentiment may cause temporary deviations.

But if we consider staking yields, which are currently around 3%, we can introduce the concept of a valuation multiple. If we apply the traditional financial market's S&P (Standard & Poor's) valuation multiple model, assuming a yield multiple of 20×, then this 3% yield is equivalent to an additional 0.6 times valuation premium.

For example, MicroStrategy does not have staking yields, but its stock still trades at 1.6 times net value (1.6× NAV). That extra 0.6 largely comes from its inclusion in the Russell 1000 index, which attracted a large amount of passive institutional fund flows.

Therefore, when Ethereum DATs are eventually included in similar large index components (major indices), such as the Russell 1000 or other mainstream market indices, their reasonable premium level may exceed 2 times net value (>2× NAV).

Of course, there are some short-term factors that may cause individual DAT stock prices to fall below net value, but I believe this is temporary. **In the long run, there is a whole set of "operational checklists" that can help companies optimize their valuations, such as transparent disclosures, enhancing liquidity, and strengthening *asset yield* management, etc.** This does not require relying on mergers and acquisitions to achieve; each DAT can enhance its valuation through internal self-optimization.

Joseph:

I completely agree with Tom's point. In fact, at this stage, mergers and acquisitions may not be the most effective means. Because ultimately, we DATs will accumulate a large pool of Ethereum assets, which means that merging may not necessarily bring additional value. Maintaining independence while collaborating in key areas may actually allow the entire ecosystem to develop faster and more steadily.

Why Choose Ethereum?

Host:

As someone in the capital markets, I personally prefer industry consolidation because it usually means higher capital returns.

Our conversation is also coming to an end, and before we finish, I want to throw out one last question. Returning to today's theme, one of the core missions of DAT is to advocate for the underlying token. If I were to ask each of you to answer in one sentence, why choose Ethereum? What would your answers be? Of course, I leave the length of "one sentence" up to you to decide.

Tom:

I believe Ethereum is in a super cycle because Wall Street and artificial intelligence (AI) are migrating to a neutral and open blockchain network, and that network is Ethereum.

Joseph:

The global economy is gradually moving towards decentralization, and Ethereum technology will become the trust foundation of Web3 and the next generation of economic systems. For any company or builder, the biggest risk is not participating in Ethereum, but being absent from it.

Sam:

I believe humanity is currently undergoing two of the greatest transformations: Ethereum is rewriting the financial system, while artificial intelligence is rewriting society. Both of these things are already happening. Therefore, positioning ourselves to engage with both of these grand narratives is the most important strategic direction for us at Bit Digital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。