Author|Sam @IOSG

Introduction

The Artemis 2025 research report indicates that the economic scale settled through stablecoins reached approximately $26 trillion in 2024, matching the level of mainstream payment networks. In contrast, the fee structure in traditional payment sectors resembles an "invisible tax": about 3% in transaction fees, additional foreign exchange spreads, and ubiquitous wire transfer fees.

Stablecoin payments compress these costs to just a few cents or even lower. When the cost of transferring funds drops sharply, business models will be completely reshaped: platforms will no longer rely on transaction fees for survival but will compete on deeper value propositions—such as savings yields, fund liquidity, and credit services.

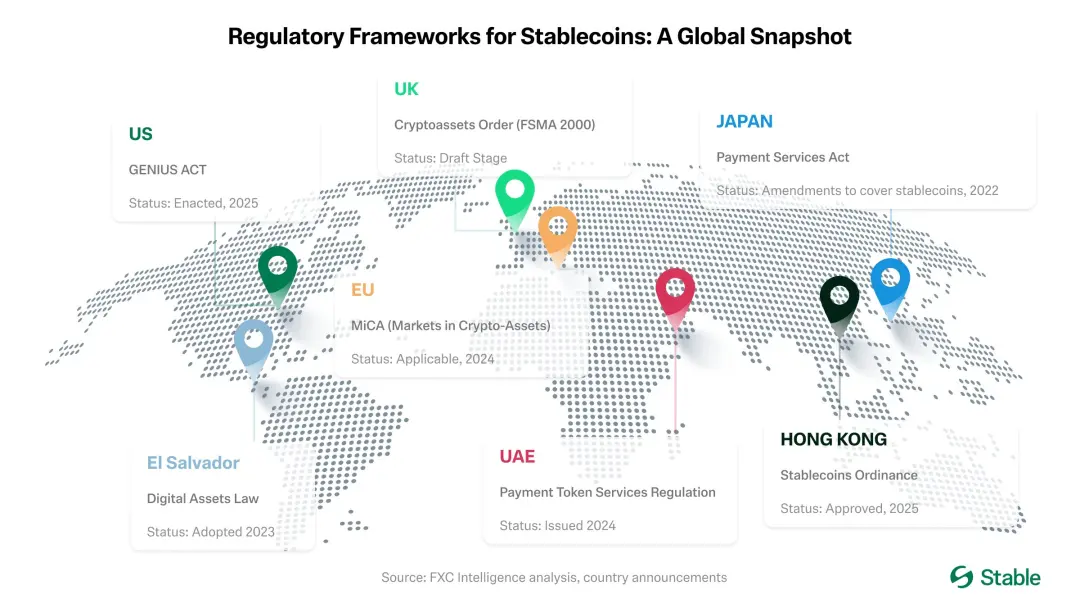

With the enactment of the U.S. GENIUS Act and the Hong Kong Stablecoin Regulation providing a similar regulatory framework, banks, card organizations, and fintech companies are moving from pilot phases to large-scale production applications. Banks are beginning to issue their own stablecoins or establish close collaborations with fintech companies; card organizations are incorporating stablecoins into their backend settlement systems; fintech companies are launching compliant stablecoin accounts, cross-border payment solutions, on-chain settlements with built-in KYC, and tax reporting features. Stablecoins are transforming from collateral within exchanges to standard payment "infrastructure."

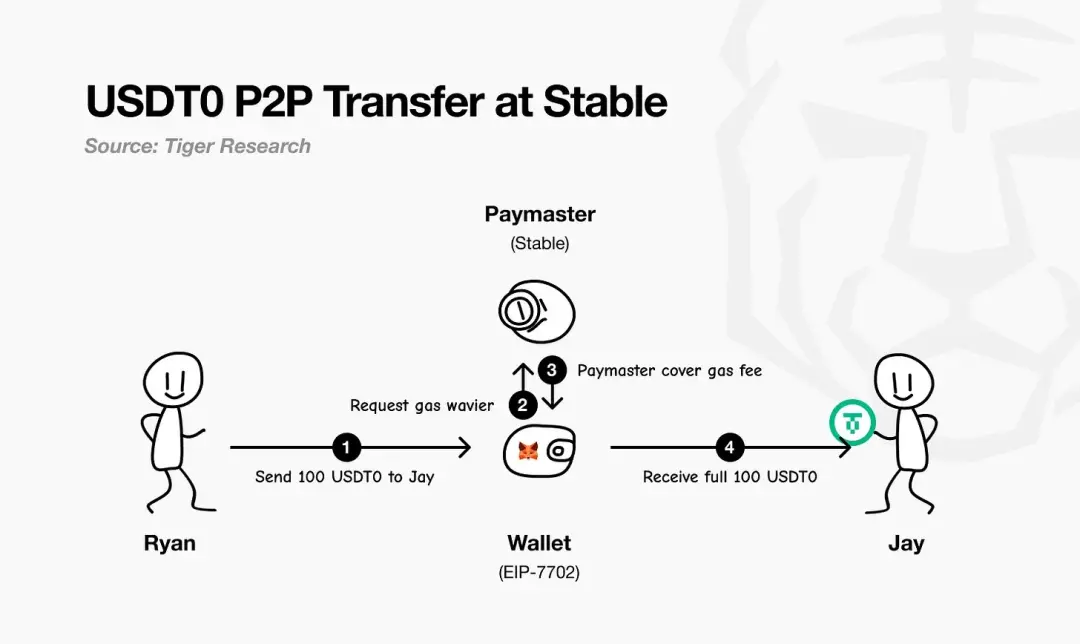

▲ source: Stable

The remaining shortcoming lies in user experience. Current wallets still assume users are well-versed in cryptocurrency knowledge; the fee differences across different networks are significant; users often need to hold a highly volatile token to transfer stablecoins pegged to the U.S. dollar. The "no Gas fee" stablecoin transfers achieved through sponsored fees and account abstraction will completely eliminate this friction. Coupled with predictable costs, smoother fiat exchange channels, and standardized compliance components, stablecoins will no longer feel like "cryptocurrencies"; their experience will truly converge with that of "currency."

Core Point: Public chains centered around stablecoins have already achieved the necessary scale and stability. To become everyday currency, they still need: consumer-grade user experience, programmable compliance, and transaction fees that are imperceptible. As these aspects—especially no Gas fee transfers and better fiat exchange channels—are gradually improved, the focus of competition will shift from "charging for transferring funds" to "the value that can be provided around fund transfers," including: yields, liquidity, security, and simple, trustworthy tools.

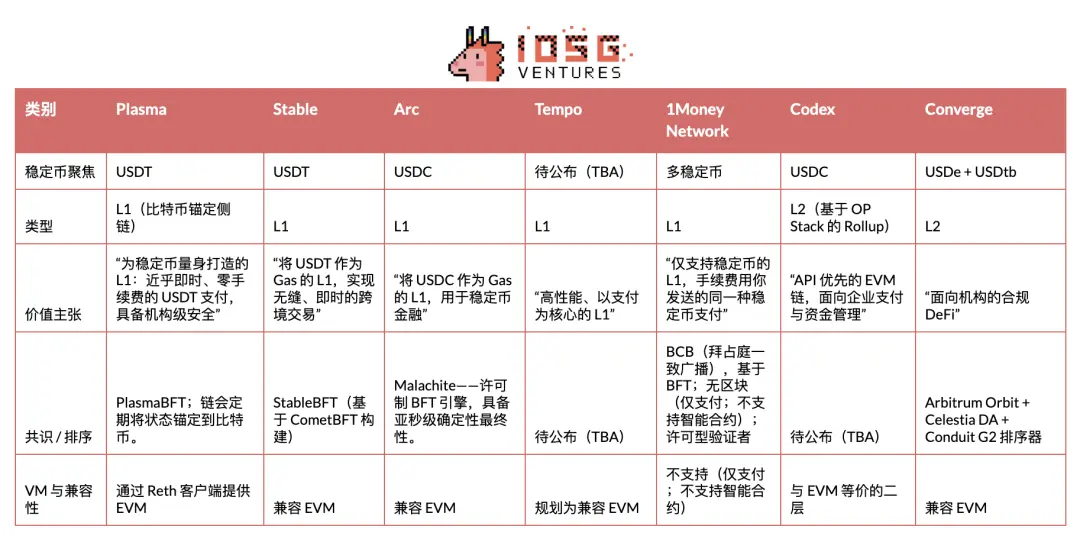

The following will provide a quick overview of outstanding projects in the stablecoin/payment public chain space. This article will primarily focus on Plasma, Stable, and Arc, delving into the issuers, market dynamics, and other participants behind them, painting a panoramic view of this "stablecoin orbital war."

Plasma

Plasma is a blockchain specifically designed for USDT, aiming to become its native settlement layer and optimized for high throughput and low-latency stablecoin payments. It entered the private testnet in late May 2025, transitioned to the public testnet in July, and successfully launched its mainnet test version on September 25 of the same year.

In the stablecoin payment public chain space, Plasma is the first project to conduct a TGE and has completed a successful market launch: capturing significant mindshare, setting records for first-day TVL and liquidity, and establishing solid partnerships from the outset.

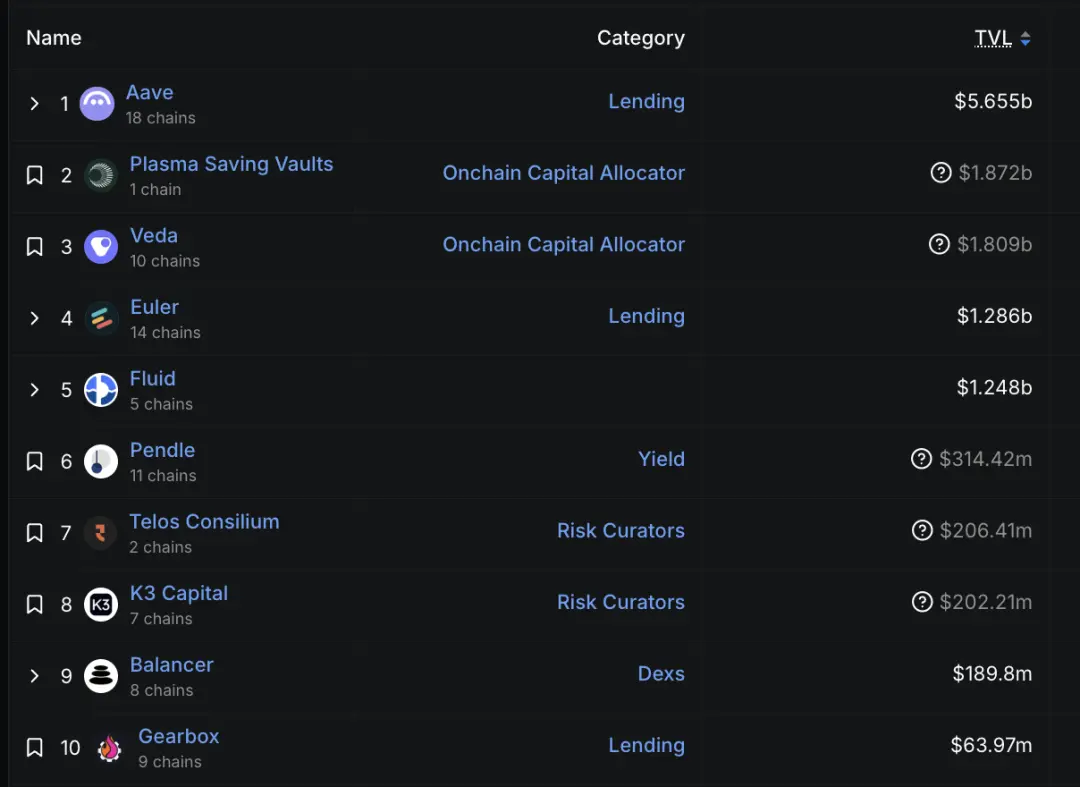

Since the launch of its mainnet test version, its growth momentum has been evident. As of September 29, deposits on the Plasma chain's Aave have surpassed $6.5 billion, making it the second-largest market; by September 30, over 75,000 users had registered for its ecosystem wallet, Plasma One. Currently, according to DeFiLlama data, the Aave TVL on Plasma stands at $5.7 billion—though it has retreated from its peak, it still ranks second (only behind Ethereum's $58.7 billion and Linea's $2.3 billion). Projects like Veda, Euler, Fluid, and Pendle have also achieved objective TVL, thanks to mainstream DeFi projects successfully deploying on their first day.

▲ source: DeFiLlama

Of course, there is also commentary from the outside suggesting that its early growth is primarily driven by incentives rather than being entirely organic. As its CEO Paul emphasized, relying solely on crypto-native users and incentives is not a sustainable model; the real test will be the actual application situation in the future—this will be a key focus of our ongoing close observation.

Go-To-Market Strategy

Plasma focuses on USDT, targeting emerging markets, particularly Southeast Asia, Latin America, and the Middle East. In these markets, the network effect of USDT is already strong, and stablecoins have become essential tools for remittances, merchant payments, and everyday peer-to-peer transfers. Implementing this strategic vision means solid grassroots distribution: advancing payment corridors one by one, establishing agent networks, localizing user guidance, and accurately grasping regulatory timing in various regions. This also means delineating clearer risk boundaries than those of Tron.

Plasma views developer experience as a moat and believes USDT needs to provide a friendly developer interface, similar to what Circle has done for USDC. In the past, Circle invested heavily to make USDC easy to integrate and develop, while Tether has fallen short in this area, leaving a significant opportunity for the USDT application ecosystem—provided that the payment track can be properly packaged. Specifically, Plasma offers a unified API on top of the payment tech stack, allowing developers in the payment field to avoid assembling the underlying infrastructure themselves. Behind this single interface are pre-integrated partners, serving as plug-and-play foundational modules. Plasma is also exploring confidential payments—achieving privacy protection within a compliance framework. Its ultimate goal is very clear: "to make USDT extremely easy to integrate and develop."

In summary, this payment corridor-driven market entry strategy and API-centric developer strategy ultimately converge on Plasma One—this is the consumer-facing front-end entry point, the product that brings the entire plan to everyday users. On September 22, 2025, Plasma launched Plasma One, a "stablecoin-native" digital banking and card product that integrates the functions of storing, spending, earning, and sending digital dollars into a single application. The team positions it as providing that missing unified interface for hundreds of millions of users who already rely on stablecoins but are still dealing with localized frictions (such as cumbersome wallets, limited fiat exchange channels, and dependence on centralized exchanges).

Access to the product is being gradually opened through a waitlist. Its key features include: direct payments from stablecoin balances that earn continuous interest (target annualized over 10%), up to 4% cashback on spending, instant zero-fee USDT transfers within the app, and card services usable at over 150 countries and approximately 150 million merchants.

Business Model Analysis

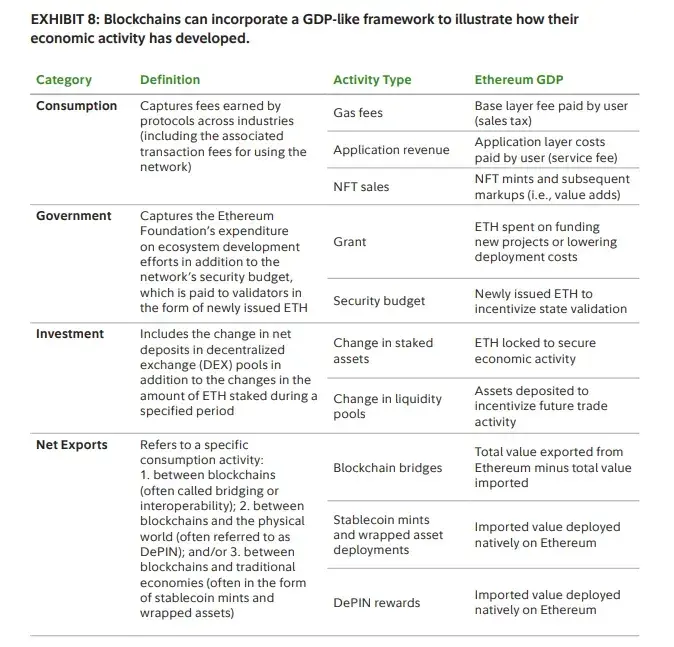

Plasma's core pricing strategy aims to maximize everyday use while maintaining economic returns through other channels: simple transfers between USDT are free, while all other on-chain operations incur fees. From the perspective of "blockchain GDP," Plasma intentionally shifts value capture from a "consumption tax" (i.e., the Gas fee for basic USDT transfers) to application layer revenue. The DeFi layer corresponds to the "investment" section of the framework: aimed at nurturing liquidity and yield markets. While net exports (i.e., cross-chain bridging in/out of USDT) remain important, the economic focus has shifted from consumption fees to service fees for applications and liquidity infrastructure.

▲ source: Fidelity

For users, zero fees not only save costs but also unlock new use cases. When sending $5 no longer requires a $1 fee, small payments become feasible. Remittances can arrive in full without being deducted by intermediaries. Merchants can accept stablecoin payments without giving up 2-3% of their revenue to invoicing/billing software and card organizations.

On the technical side, Plasma operates a paymaster that complies with EIP-4337 standards. The paymaster sponsors Gas fees for the transfer() and transferFrom() function calls of the official USDT on the Plasma chain. The Plasma Foundation has pre-funded this paymaster using its native token XPL and employs a lightweight verification mechanism to prevent abuse.

Stable

Stable is a Layer 1 optimized for USDT payments, aiming to address the inefficiencies of current infrastructure—including unpredictable fees, slow settlement times, and overly complex user experiences.

Stable positions itself as a "payment-specific L1 born for USDT," with a market strategy of directly establishing partnerships with payment service providers (PSPs), merchants, business integrators, suppliers, and digital banks. PSPs favor this approach because Stable eliminates two operational challenges: managing volatile Gas tokens and bearing transfer costs. Given that many PSPs face high technical barriers, Stable is currently operating in a "service workshop" model—completing various integration tasks independently—while planning to solidify these models into an SDK for self-service integration by PSPs in the future. To provide production-level guarantees, they have introduced "enterprise-grade block space," a subscription service that ensures VIP transactions are prioritized for packaging at the top of blocks, thus guaranteeing certain and first-block settlements, while achieving smoother cost predictions during network congestion.

In terms of regional strategy, its market entry closely follows the existing usage trajectory of USDT, implementing a "Asia-Pacific first" approach—after which it will expand to other USDT-dominant regions such as Latin America and Africa.

On September 29, Stable launched a consumer-facing application (app.stable.xyz) aimed at new, non-DeFi users. The app is positioned as a simple USDT payment wallet that meets everyday needs (P2P transfers, merchant payments, rent, etc.), offering instant settlement, zero Gas fee for peer-to-peer transfers, and transparent, predictable fees paid in USDT. Currently, the app can only be accessed through a waitlist. Promotional activities in South Korea have initially demonstrated its market appeal: Stable Pay attracted over 100,000 user registrations directly through offline booths (as of September 29 data).

Stable has implemented Gas-free USDT payments using EIP-7702. This standard allows users' existing wallets to temporarily transform into "smart wallets" for a single transaction, enabling them to run custom logic and settle fees without any separate Gas tokens— all fees are priced and paid in USDT.

As illustrated in the flowchart by Tiger Research, the process is as follows: the payer initiates the payment; the EIP-7702 wallet requests a Gas fee waiver from Stable's Paymaster; the Paymaster sponsors and settles the network fees; ultimately, the payee receives the full amount without any deductions. In practice, users only need to hold USDT.

▲ source: Tiger Research

In terms of business model, Stable adopts a strategy of prioritizing market share expansion in the short term, with revenue as a secondary goal, leveraging Gas-free USDT payments to win users and build payment traffic. In the long run, profitability will primarily come from within its consumer application, supplemented by select on-chain mechanisms.

In addition to USDT, Stable also sees significant opportunities from other stablecoins. With PayPal Ventures investing in Stable at the end of September 2025, as part of the deal, Stable will natively support PayPal's stablecoin PYUSD and promote its distribution, allowing PayPal users to "directly use PYUSD" for payments, with Gas fees also paid in PYUSD. This means that PYUSD will also be Gas-free on the Stable chain—extending the operational simplicity of the USDT payment track that attracts PSPs to PYUSD as well.

▲ source: https://x.com/PayPal/status/1971231982135792031

Architecture Analysis

The architecture of Stable begins with its consensus layer—StableBFT. This is a proof-of-stake protocol custom-developed based on CometBFT, designed to provide high throughput, low latency, and high reliability. Its development path is pragmatic and clear: the short-term goal is to optimize this mature BFT engine, while the long-term roadmap points towards a shift to a Directed Acyclic Graph (DAG) design for higher performance scalability.

Above the consensus layer, Stable EVM seamlessly integrates the core capabilities of the chain into developers' daily work. Its dedicated precompiled contracts allow EVM smart contracts to securely and atomically call core chain logic. In the future, performance will be further enhanced with the introduction of StableVM++.

Throughput also depends on data processing capabilities. StableDB effectively addresses the storage bottleneck issue after block generation by separating state submission from data persistence. Finally, its high-performance RPC layer abandons a monolithic architecture, adopting a sharding path design: lightweight, specialized nodes serve different types of requests, avoiding resource contention, improving long-tail latency, and ensuring real-time responsiveness even during significant increases in chain throughput.

The key point is that Stable positions itself as L1 rather than L2. Its core philosophy is that real-world business applications should not have to wait for upstream protocol updates to launch payment functionalities. By maintaining full-stack control over the validator network, consensus strategy, execution layer, data layer, and RPC layer, the team can prioritize ensuring the core guarantees needed for payment scenarios while retaining EVM compatibility, allowing developers to easily migrate existing code. The end result is an EVM-compatible Layer 1 blockchain that is fully optimized for payments.

Arc

On August 12, 2025, Circle announced its Layer 1 blockchain focused on stablecoins and payments—Arc—which will enter a private testnet in the coming weeks and launch a public testnet in the fall of 2025, aiming for a mainnet test version in 2026.

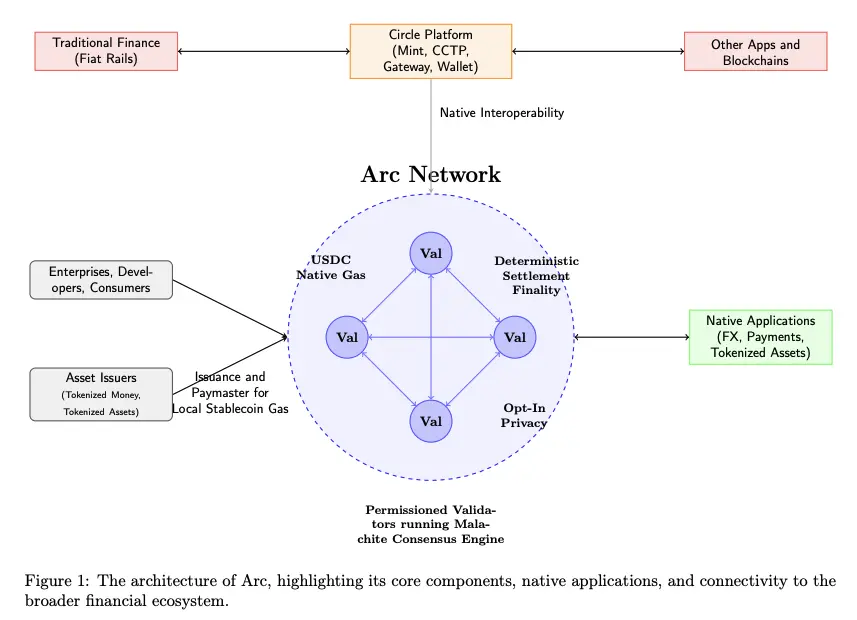

The core features of Arc include: it operates with a permissioned set of validators (running the Malachite BFT consensus engine) that provide deterministic finality; its native Gas fees are paid in USDC; and it offers an optional privacy layer.

▲ source: Arc Litepaper

Arc is directly integrated into Circle's entire ecosystem platform—including Mint, CCTP, Gateway, and Wallet—allowing value to flow seamlessly between Arc, traditional fiat payment tracks, and other blockchains. Enterprises, developers, and consumers will transact through applications on Arc (covering payments, foreign exchange, asset tokenization, etc.), while asset issuers can mint assets on Arc and act as Paymasters to sponsor Gas fees for their users.

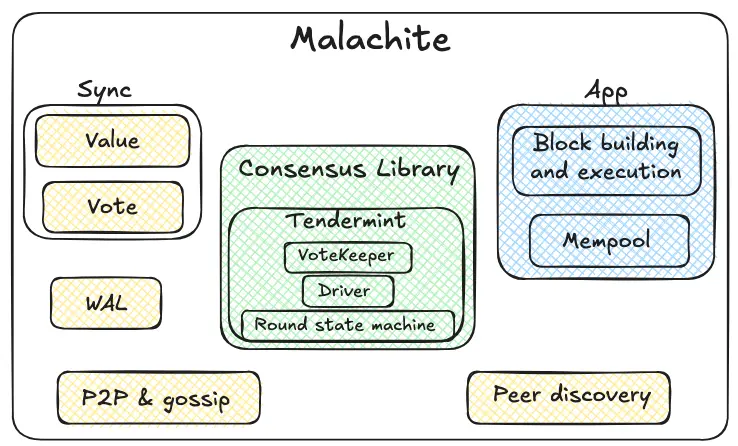

Arc utilizes a consensus engine called Malachite and employs a permissioned Proof-of-Authority mechanism, with validator nodes held by known authoritative entities.

▲ source: Circle

Malachite is a Byzantine fault-tolerant consensus engine that applications can embed to achieve strong consistency protocols and finality among numerous independent nodes.

The consensus library marked in green is the core of Malachite. Its internal round state machine adopts a Tendermint-style round mechanism (propose → pre-vote → pre-commit → commit). Voting guardians are responsible for aggregating votes and tracking the legal vote count. The driver coordinates these rounds over time, ensuring that the protocol continues to make decisions even if some nodes are delayed or fail. This consensus library is deliberately designed for generality: it handles "values" in an abstract manner, allowing different types of applications to connect.

Surrounding the core modules are the reliability and network infrastructure components marked in yellow. Peer-to-peer and gossip protocols transmit proposals and votes between nodes; the node discovery mechanism is responsible for establishing and maintaining connections. Pre-written logs locally persist key events, ensuring security even when nodes crash and restart. The synchronization mechanism features dual paths for value synchronization and vote synchronization—lagging nodes can achieve data synchronization by obtaining already finalized output results (values) or by completing missing intermediate votes needed for ongoing decisions.

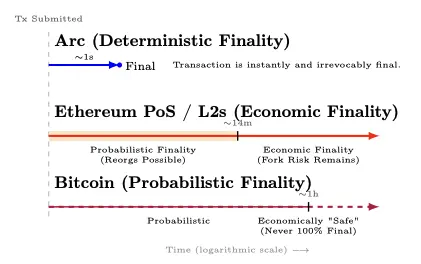

Arc provides approximately 1 second of deterministic finality—once ≥2/3 of validators complete confirmation, transactions are immediately irreversibly finalized (with no risk of reorganization); Ethereum's proof-of-stake and its layer 2 solutions achieve economic finality after about 12 minutes, transitioning through an initial probabilistic phase that may experience reorganization to an "economic final" state; Bitcoin exhibits probabilistic finality—confirmation counts accumulate over time, reaching an "economically secure" state after about 1 hour, but mathematically, it can never achieve 100% finality.

▲ source: Arc Litepaper

Once ≥⅔ of validators confirm a transaction, it transitions from "unconfirmed" to 100% finalized (with no "reorganization probability tail"). This feature aligns with Principle 8 of the Principles for Financial Market Infrastructures (PFMI) regarding clear final settlement.

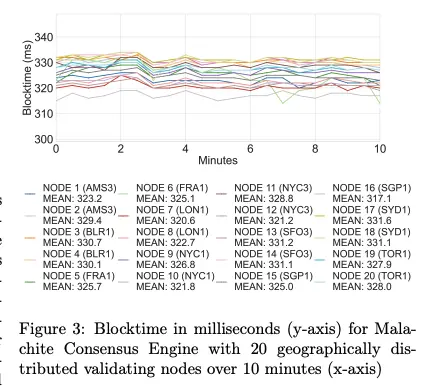

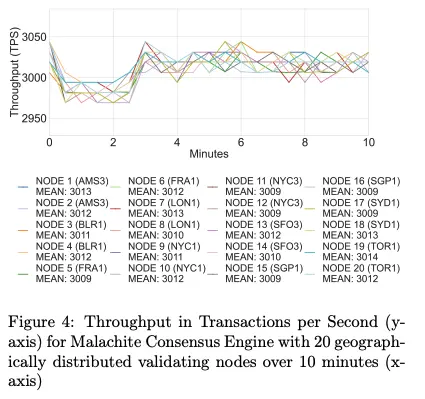

In terms of performance, Arc achieves approximately 3000 TPS throughput and less than 350 milliseconds final confirmation latency across 20 geographically distributed validator nodes; with 4 geographically distributed validator nodes, it achieves over 10,000 TPS throughput and less than 100 milliseconds final confirmation latency.

▲ source: Arc Litepaper

▲ source: Arc Litepaper

Upgrade plans for the Malachite consensus engine include: supporting a multi-proposer mechanism (expected to increase throughput by about 10 times) and an optional lower fault tolerance configuration (expected to reduce latency by about 30%).

At the same time, Arc has introduced an optional confidential transmission feature for compliant payments: transaction amounts are hidden while addresses remain visible, and the authorizer can obtain transaction values through a selectively disclosed "view key." Its goal is to achieve "auditable privacy protection"—suitable for banks and enterprises that require on-chain confidentiality without sacrificing compliance, reporting obligations, or dispute resolution mechanisms.

Arc's design choices focus on the predictability required by institutions and deep integration with Circle's technology stack—but these advantages come with corresponding trade-offs: the permissioned PoA-style validator set centralizes governance and oversight among known entities, and BFT systems tend to stop operating rather than fork in the event of network partitions or validator node failures. Critics argue that Arc resembles a walled garden or consortium chain aimed at banks rather than a public network with credible neutrality.

However, this trade-off is clear and reasonable for corporate needs: banks, payment service providers, and fintech companies prioritize deterministic finality and auditability over extreme decentralization and permissionless characteristics. In the long run, Circle has revealed plans to evolve towards permissioned proof of stake, opening participation to qualified stakers under forfeiture and rotation rules.

With USDC as the native fuel currency, equipped with institutional-grade pricing/foreign exchange engines, featuring sub-second deterministic finality, supporting optional privacy functions, and deeply integrated with Circle's full-stack products, Arc encapsulates the foundational capabilities that enterprises truly need into a complete payment track.

Stablecoin Rail Wars

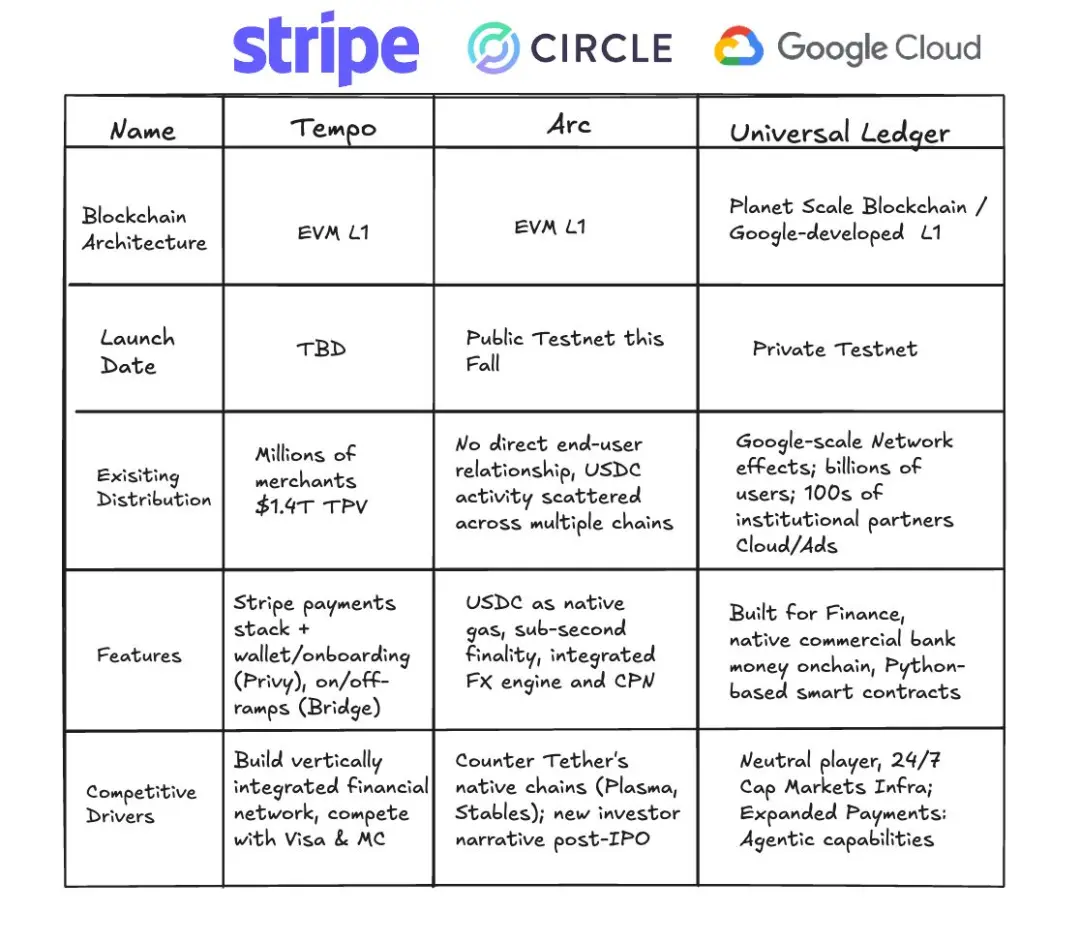

Plasma, Stable, and Arc are not merely three competitors in a simple race; they are different paths toward the same vision—allowing the dollar to flow as freely as information. Looking at the big picture, the real competitive focus emerges: the issuer camp (USDT vs. USDC), the distribution moats on existing chains, and the permissioned tracks that are reshaping enterprise market expectations.

Issuer Camp: USDT vs. USDC

We are witnessing two races simultaneously: competition between public chains and competition among issuers. Plasma and Stable are clearly USDT-focused, while Arc belongs to Circle (the issuer of USDC). With PayPal Ventures investing in Stable, more issuers are entering the fray—each vying for distribution channels. In this process, issuers will shape the market entry strategies, target regions, ecosystem roles, and overall development directions of these stablecoin public chains.

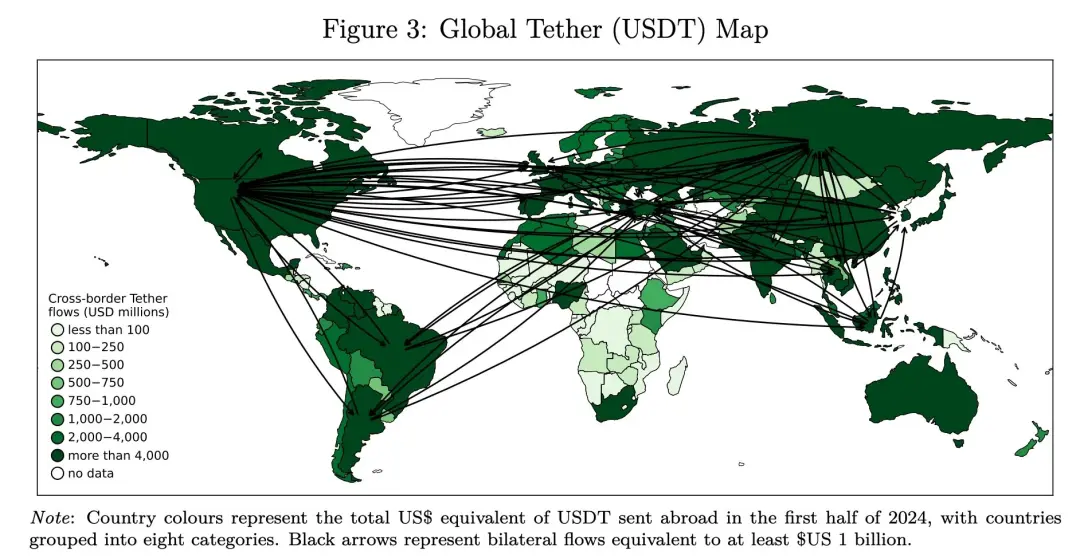

While Plasma and Stable may have chosen different market paths and initial target regions, their ultimate anchor point should be the market dominated by USDT. The following chart shows the global flow of USDT in the first half of 2024. The darker the country, the more USDT is sent overseas; the black arrows indicate the main flow corridors. The image reveals a hub-and-spoke network, with routes across Africa, the Middle East, Asia-Pacific, and Latin America being particularly dense.

▲ source: DeFiying gravity? An empirical analysis of cross-border crypto flows—not from Decrypting Crypto

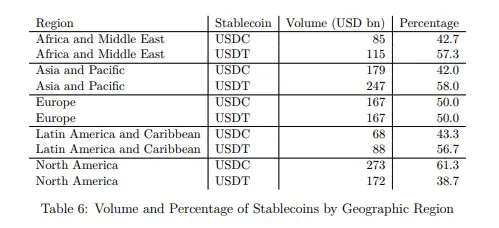

A similar pattern is observed in another study: Tether's USDT performs stronger in regions with more emerging markets, while Circle's USDC is more prevalent in Europe and North America. It is important to note that this study only covered EVM chains (Ethereum, BNB Chain, Optimism, Arbitrum, Base, Linea) and did not include the Tron network, where USDT usage is significant, so the actual footprint of USDT in the real world is likely underestimated.

▲ source: Decrypting Crypto: How to Estimate International Stablecoin Flows

In addition to differing regional focuses, the strategic choices of issuers are also reshaping their roles within the ecosystem—thereby influencing the priorities of stablecoin public chains. Historically, Circle has built a more vertically integrated tech stack (wallets, payments, cross-chain), while Tether has focused on issuance/liquidity and relied more on ecosystem partners. This differentiation now creates space for public chains focused on USDT (such as Stable and Plasma) to build more value chain segments independently. Meanwhile, to facilitate multi-chain expansion, the design of USDT0 aims to unify USDT liquidity.

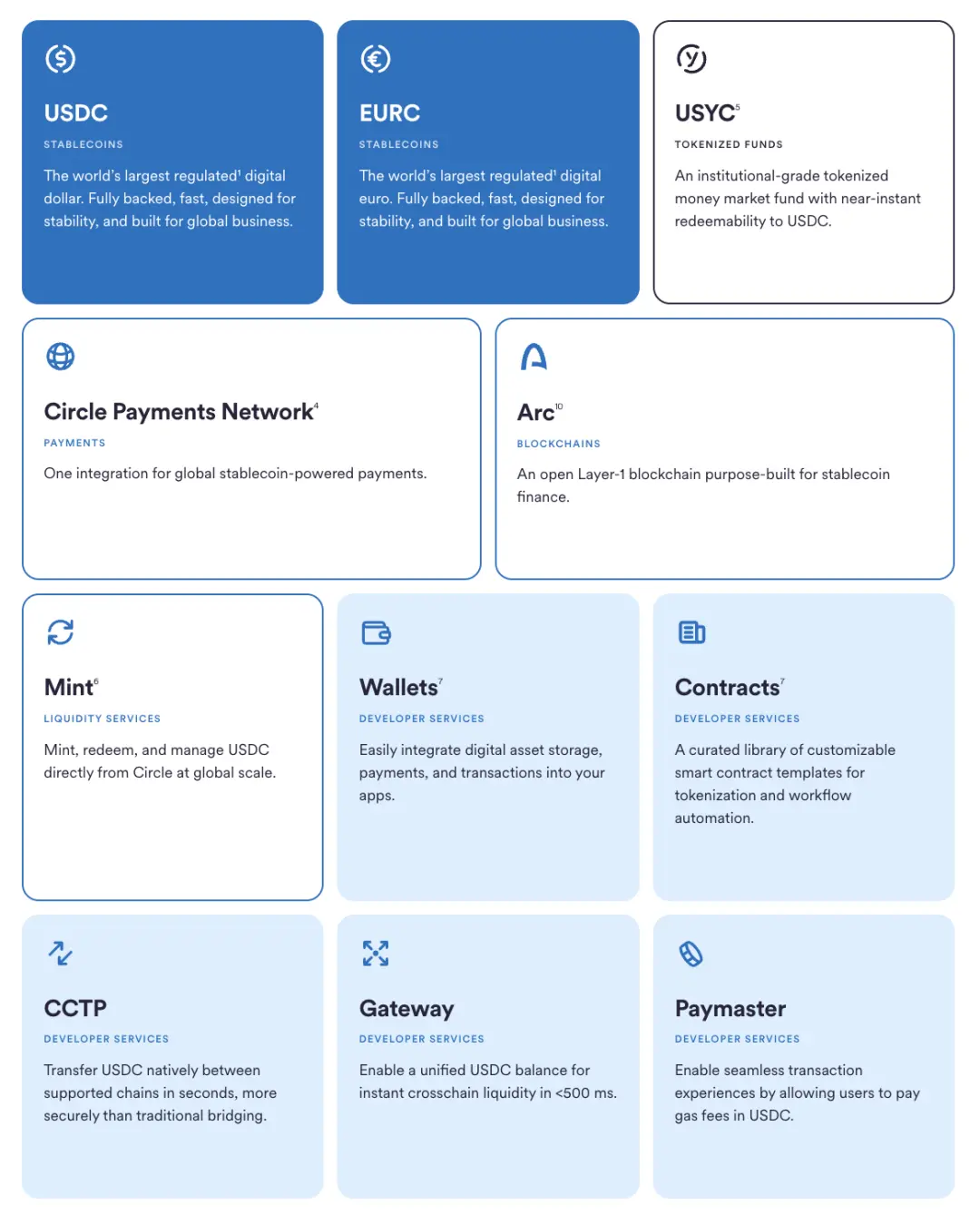

At the same time, Circle's ecosystem development has been cautious and cumulative: it started with the issuance and governance of USDC, then regained control by dissolving Centre and launching programmable wallets. Next came CCTP, which transformed its reliance on cross-chain bridges into a native burn-mint transfer method, thereby unifying cross-chain USDC liquidity. By launching the Circle Payments Network, Circle connects on-chain value with off-chain commerce. And Arc is the latest move in this chess game. Flanking these core pillars are services aimed at issuers and developers—Mint, Contracts, Gateway, and Paymaster (with Gas fees priced in USDC)—which reduce reliance on third parties and tighten the feedback loop between products and distribution.

▲ source: Circle

Strategies of Existing Public Chains

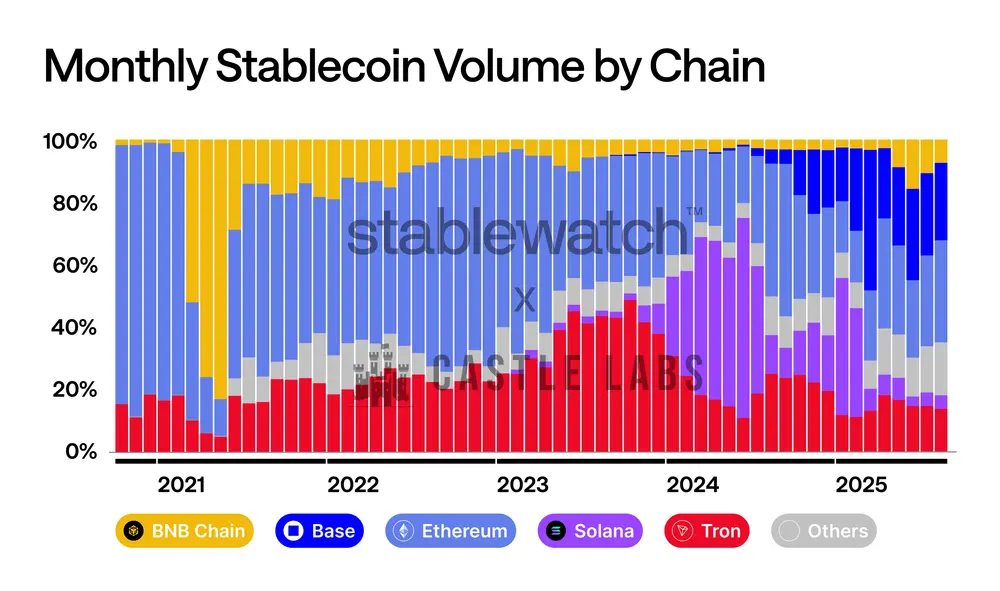

The competition for stablecoin transaction volume has always been fierce. The dynamic changes in market structure are evident: initially dominated by Ethereum, then the strong rise of Tron, followed by Solana's emergence in 2024, and recently, Base chain is gaining momentum. No single chain can maintain a top position for long—even the deepest moats will face monthly share battles. As public chains specializing in stablecoins enter the fray, competition will inevitably intensify, but existing giants will not easily relinquish market share; it is foreseeable that they will adopt aggressive strategies in transaction fees, finality, wallet user experience, and fiat exchange channel integration to defend and expand their stablecoin transaction volumes.

▲ source: Stablewatch

Major public chains have already taken action:

BNB Chain launched a "zero-fee carnival" at the end of Q3 2024, collaborating with multiple wallets, centralized exchanges, and bridges to completely waive users' USDT and USDC transfer fees, with the event extended to August 31, 2025.

Tron has a similar direction, with its governance body approving a reduction in the network's "energy" unit price and planning to launch a "Gas-free" stablecoin transfer program in Q4 2024, further solidifying its position as a low-cost stablecoin settlement layer.

TON takes a different approach by completely hiding complexity through the Telegram interface. When users transfer USDT to contacts, the experience is "zero-fee" (the actual cost is borne or absorbed by the Telegram wallet within its closed-loop system), with normal network fees only applicable when withdrawing to an open public chain.

The narrative core of Ethereum L2 is structural upgrades rather than short-term promotions. The Blob space introduced by the Dencun upgrade significantly reduces the data availability costs for Rollups, allowing them to pass on the savings to users. Since March 2024, transaction fees across major L2s have significantly decreased.

Permissioned Rails

Parallel to public chains, a track is rapidly developing: permissioned ledgers built for banks, market infrastructure, and large enterprises.

The most notable new member is Google Cloud Universal Ledger—a permissioned Layer 1. Google states its target applications are wholesale payments and asset tokenization. Although public details are limited, its head positions it as a neutral, bank-grade chain, and CME Group has completed initial integration testing. GCUL is a non-EVM chain, developed independently by Google, running on Google Cloud infrastructure, using Python smart contracts. It is far from a public chain, as its model is based on trust in Google and regulated nodes.

▲ source: https://www.linkedin.com/posts/rich-widmann-a816a54b_all-this-talk-of-layer-1-blockchains-has-activity-7366124738848415744-7idA

If GCUL is a single cloud-hosted track, then Canton Network adopts a "network of networks" model. It is built around Digital Asset's Daml smart contract stack, connecting independently governed applications, allowing assets, data, and cash to synchronize across different domains while providing fine-grained privacy and compliance controls. Its participant list includes numerous banks, exchanges, and market operators.

HSBC Orion (HSBC's digital bond platform) has been online since 2023 and hosted the European Investment Bank's first pound-denominated digital bond—issued through a combination of private and public chains under the Luxembourg DLT framework, totaling £50 million.

In terms of payments, JPM Coin has been providing value transfer services for institutions since 2020, supporting programmable intraday cash flows on the track operated by JPMorgan. By the end of 2024, the bank will restructure its blockchain and tokenization product line into Kinexys.

The core of these efforts is pragmatism: retaining regulatory guardrails and clear governance structures while drawing on the essence of public chain design. Whether achieved through cloud services (GCUL), interoperability protocols (Canton), productized issuance platforms (Orion), or payment tracks operated by banks (JPM Coin/Kinexys), permissioned ledgers converge on the same commitment: achieving faster, auditable settlements under institutional control.

Conclusion

Stablecoins have crossed the threshold from a niche area of crypto to the scale of payment networks, and the resulting economic impact is profound: as the cost of transferring one dollar approaches zero, the profit margins from charging for fund transfers disappear. The market's profit center shifts to the value that can be provided around stablecoin transfers.

The relationship between stablecoin issuers and public chains is increasingly evolving into an economic tug-of-war over who captures the reserve income. As seen in the case of Hyperliquid's USDH, its stablecoin deposits generate approximately $200 million in Treasury yields annually, which flow to Circle rather than its own ecosystem. By issuing USDH and adopting the 50/50 revenue-sharing model of Native Markets—half for repurchasing HYPE tokens through a support fund and half for ecosystem growth—Hyperliquid has "internalized" this portion of income. This could be another development direction beyond "stablecoin public chains," where existing networks capture value by issuing their own stablecoins. A sustainable model would be an ecosystem where issuers and public chains share economic benefits.

Looking ahead, auditable privacy payments will gradually become the standard configuration for payroll, treasury management, and cross-border fund flows—not by creating a "completely anonymous privacy chain," but by hiding specific amounts in transactions while keeping counterparty addresses visible and auditable. Stable, Plasma, and Arc all adopt this model: providing enterprises with user-friendly privacy protection and selective disclosure features, compliance interfaces, and predictable settlement experiences, thus achieving "hidden when confidentiality is needed, transparent when verifiable."

We will see stablecoin/payment public chains launch more features tailored to corporate needs. Stable's "guaranteed block space" is a typical example: a reserved capacity channel that ensures payroll, treasury, and cross-border payments can settle with stable latency and cost even during peak traffic. This is akin to reserved instances in cloud services, but applied to on-chain settlements.

With the emergence of the next generation of stablecoin/payment public chains, this will unlock more opportunities for applications. We have already seen strong momentum for DeFi on Plasma, as well as consumer-facing fronts like Stable Pay and Plasma One, but a larger wave is ahead: digital banking and payment applications, smart agent wallets, QR code payment tools, on-chain credit, risk grading, and a new category of interest-bearing stablecoins and the financial products built around them.

The era of allowing the dollar to flow as freely as information is coming.

Sources

https://www.visaonchainanalytics.com/transactions

https://app.stablewatch.io/blog/stablecoin-chains

https://x.com/justinsuntron/status/1961310821541458034

https://research.kaiko.com/insights/usdc-outpaces-rivals

The Future of Finance Belongs to Stablechains

The Infrastructure Revolution: Gas-Free USDT Transfers and the Future of Digital Payments

https://reports.artemisanalytics.com/stablecoins/artemis-stablecoin-payments-from-the-ground-up-2025.pdf

https://docs.stable.xyz/

https://docs.stable.xyz/en/introduction/technical-roadmap

https://docs.stable.xyz/en/architecture/usdt-specific-features/overview

https://docs.usdt0.to/

How Stable Powers The Real-World Wallet Stack

: : Stable: A Digital Nation of USDT, by USDT, for USDT

https://dune.com/layerzero/layerzero?OFT+Analyzer+OFT+Name_e3f7ef=USDT0-USDT0

https://defillama.com/protocol/usdt0

https://layerzeroscan.com/oft/USDT0/USDT0

: : [Issue] How Stable Can Be the Next Growth Catalyst of Tether

DeFiying gravity? An empirical analysis of cross-border Bitcoin, Ether and stablecoin flows

Rich Widmann’s post: https://www.linkedin.com/posts/rich-widmann-a816a54b_all-this-talk-of-layer-1-blockchains-has-activity-7366124738848415744-7idA/

https://cloud.google.com/startup/beyond-stablecoins?hl=en

https://www.ccn.com/news/crypto/gcul-google-layer-1-payments-tokenization-settlement-everything-to-know

https://www.cmegroup.com/media-room/press-releases/2025/3/25/cmegroupwill_introducetokenizationtechnologytoenhancecapitalma.html

https://www.plasma.to/faq

0xResearch Plasma interview: https://www.youtube.com/watch?v=8Zd_MTSFojQ

Bitfinex Plasma interview: https://www.youtube.com/watch?v=xIpw_ODiMkc

Plasma: The Stablecoin Singularity: https://x.com/Kairos_Res/status/1932453898402292171

https://gasfeesnow.com/

https://testnet.plasmascan.to/

Plasma MiCA whitepaper: https://drive.google.com/file/d/1kw2CfXp0SLPGkitm6v814vmTtWOQTYBw/view

https://x.com/TigerResearch/status/1967950793392394457

https://x.com/PineAnalytics/status/1968074503973429388

https://x.com/rongplace/status/1968025055985606704

https://dune.com/asxn_research/plasma-vault-deposits

https://www.plasma.to/insights/introducing-plasma-one-the-one-app-for-your-money

https://assets.dlnews.com/dlresearch/DLResearchReportPlasmaRedefiningStablecoinSettlement_v3.pdf

https://www.arc.network/

https://6778953.fs1.hubspotusercontent-na1.net/hubfs/6778953/Arc Litepaper - 2025.pdf

https://x.com/ConorRyder/status/1975567685086744841

https://x.com/i/spaces/1zqKVdndgMpJB

https://github.com/circlefin/malachite/blob/main/ARCHITECTU

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。