Web3 leveraged trading is standing at the critical point of "breakthrough and expansion," with its future direction depending on both technological evolution and the combined push of the market and regulation.

Summary

Although traditional platforms have matured in "compliance + experience + coverage," they are constrained by centralized custody, insufficient transparency, clearing delays, and regional barriers. Web3 enters with self-custody, on-chain verifiability, and global accessibility, enhancing capital efficiency through the use of oracles, partial clearing, unified collateral, and fund reuse. The landscape is becoming multipolar: dYdX (order book), GMX (GLP pool), Hyperliquid (high-performance matching), and Avantis (multi-asset synthesis/RWA). The characteristics of Web3 leveraged trading lie in a CEX-level low-latency experience + institutional-level risk control compliance + multi-asset integration. By 2030, it is expected to grow into a hundred billion dollar-level infrastructure.

1. Industry Status and Overview

In the development of global capital markets, leveraged trading has always been an important tool for promoting liquidity and risk pricing efficiency. Since IG Group first launched Contracts for Difference (CFD) in the 1970s, and with the rise of internet platforms like Robinhood and Plus500 in the 21st century, leveraged trading has gradually shifted from institutional monopoly to widespread public access. With the help of financial derivatives such as margin, options, and futures, investors can leverage smaller amounts of capital to gain larger market exposure, thereby amplifying returns while also assuming higher risks. Over the past 50 years, traditional financial leveraged trading platforms have accumulated rich experience in product coverage, user experience, and compliance, gradually forming a highly mature business model. However, against the backdrop of rapid evolution in digital finance and blockchain technology, the deep-seated limitations of this system have become increasingly apparent, and the rise of Web3 aims to address these limitations. Looking back at the evolution path of traditional finance, its success lies in the standardization and broad coverage of product design, continuous optimization of user experience, and endorsement by regulatory compliance. IG Group offers over 19,000 tradable tools covering multiple markets such as stocks, forex, and commodities, reflecting a strategy of "comprehensive coverage"; Plus500 quickly accumulated users through over 2,800 CFD tools and its compliance status listed on the London Stock Exchange; Robinhood attracted a large number of Generation Z investors with "zero commission" and a mobile-friendly experience, pushing leveraged trading, a traditional financial tool, towards popularization. These platforms have ensured investor trust by holding multiple regulatory licenses globally, laying the foundation for the entire industry.

However, the deep-seated issues of this model have been amplified in the digital finance era. First is the risk of centralization. All traditional platforms are based on a structure of fund custody and centralized clearing, requiring users to entrust their funds to the platform. During the GME incident in 2021, Robinhood restricted users' buying permissions due to clearing pressure, directly affecting trading freedom and exposing the risk that centralized platforms can change rules at any time. The collapse of MF Global in 2011 further highlighted counterparty risk, as investors suffered significant losses when the platform used customer margin to maintain liquidity. Secondly, there is insufficient transparency. Traditional platforms lack public mechanisms for order matching, risk hedging, and price discovery, leaving investors unable to confirm whether the platform engages in "betting" behavior, forcing them to passively rely on publicly disclosed information. This black-box operation exacerbates the problem of asymmetric information, undermining market fairness. Additionally, the limitations of fund custody mean that investors lack autonomy over their assets. If a platform goes bankrupt, is hacked, or is frozen by regulators, user funds are often difficult to recover. In 2020, when oil futures fell to negative values, some platforms experienced large-scale liquidation events due to clearing delays, resulting in losses for both the platform and users, indicating structural vulnerabilities in centralized clearing mechanisms during extreme market conditions. Regulatory barriers are another major limitation of traditional platforms. Different markets have varying policy restrictions on leveraged trading; for example, Europe limits retail forex trading to a leverage of 30 times, while some emerging markets are relatively lenient, preventing users from enjoying equal financial services globally. Coupled with the high costs of maintaining compliance licenses, these costs are ultimately passed on to users, manifesting as higher spreads, fees, and minimum deposit thresholds, further restricting widespread public participation.

These structural limitations provide an entry point for Web3. Unlike traditional models, Web3 reshapes the underlying logic of leveraged trading through blockchain and smart contracts. First, the self-custody model addresses centralization risk, allowing users to complete transactions directly through their wallets without relying on platform credit. Secondly, all matching and clearing logic is publicly verifiable on-chain, reducing information asymmetry and enabling investors to audit trading rules in real-time. Furthermore, assets no longer need to be stored in platform accounts but are kept by users themselves, reducing bankruptcy and clearing risks. Regional barriers have also been significantly weakened; as long as users have a crypto wallet and internet connection, they can participate in global financial services. Compliance cost issues also have potential solutions in Web3, such as achieving modular compliance through DAO governance and protocol layer design, exploring compatibility with different regional regulatory systems. Regarding liquidity crises, decentralized protocols enhance system resilience through mechanisms like risk-sharing in liquidity pools, partial clearing, and insurance funds. Therefore, the logic of traditional financial platforms and Web3 platforms is not entirely substitutive but rather complementary and evolutionary. The former's successful experience validates the long-term market demand for leveraged trading and forms mature user habits; the latter supplements and reshapes the traditional model through technological innovation. In future developments, the two may merge to create a new generation of hybrid financial systems: traditional platforms enhance transparency and resilience by incorporating blockchain technology, while Web3 platforms draw on the mature models of traditional finance in compliance and user experience, pushing themselves towards larger-scale applications.

In summary, the development of traditional financial leveraged trading platforms over the past 50 years has provided a triad model of "compliance + user experience + product coverage," which has validated the market value of financial leverage. However, its centralization risks, insufficient transparency, custody limitations, regulatory barriers, and clearing risks have become insurmountable bottlenecks. The rise of blockchain and DeFi precisely targets these structural issues, proposing new solutions such as self-custody, on-chain verifiability, global accessibility, and dynamic clearing. In the future, the evolution path of leveraged trading may no longer be a binary opposition between traditional and emerging but rather a leap-forward integration development, pushing financial markets towards a new stage in risk control, transparency, and inclusiveness.

The value of Web3 leveraged trading is not simply about "moving traditional leveraged tools onto the chain," but rather about reshaping the operational logic and industrial division of the derivatives market with decentralized transparency and capital efficiency. The ultimate form will present a dual-driven model of "mature experience of traditional finance × decentralization of transparency and efficiency": one end will attract professional users with a smooth interaction and deep liquidity close to CEX, while the other end will reconstruct the boundaries of trust and compliance with verifiable rules of smart contracts, self-custody of funds, and global accessibility. To reach this ultimate goal, platforms must pass five dimensions simultaneously. First is user experience, where matching needs to achieve second-level speed, Gas costs should be negligible, mobile-first design should hide complexity in the background with account abstraction and one-click cross-chain access, allowing both retail and institutional users to enter the leveraged market with minimal cognitive burden. Second is multi-asset integration, truly merging crypto assets and RWA into the same trading canvas: BTC/ETH and US stocks, forex, and gold are managed under a unified margin framework, allowing positions to migrate across markets and settle net, thus providing higher capital efficiency for risk engines and margin models. Third is fund reuse, where unified collateral, multi-market reuse, and the cyclical use of staked assets and stablecoins allow the same collateral to roll and amplify efficiency between lending, staking, and perpetual contracts, combined with partial clearing, tiered maintenance margins, and incentive hedging, enhancing system resilience while reducing liquidity noise during extreme times. Fourth is the clarification of compliance pathways, providing auditable entry and exit routes for institutions and high-net-worth funds through license acquisition, regulatory sandboxes, and modular KYC/AML, achieving "front-end open inclusiveness, back-end compliance optional," and reducing institutional friction with a structured design of "protocol layer neutrality, access layer compliance" in multi-jurisdictional environments. Fifth is community and ecosystem, where DAO governance and token economics are not "airdrop-driven growth," but rather link fee sharing, market-making incentives, risk funds, and protocol revenues to drive positive games among LPs, market makers, and strategists, and connect lending, stablecoins, RWA, and clearing networks through open APIs, oracles, and cross-chain infrastructure, forming a compounding ecological momentum. According to Grand View Research, the DeFi market is expected to exceed $231 billion by 2030; if leveraged-related businesses account for 20%-25%, this corresponds to a segmented space of $50-$60 billion; considering the deep integration of multi-assets and RWA, there is still potential for external growth in the actual service market. Thus, returning to the present, Web3 leveraged trading is at a turning point of "breakthrough and expansion": the product engineering and risk control framework accumulated by traditional finance provide paradigms for on-chain replication and improvement; decentralized transparency, self-custody, and global accessibility fundamentally alleviate the issues of centralized counterparties, regional barriers, and black-box operations; and the integration of synthetic assets and RWA determines the differentiation and ceiling of platforms. The profile of the winner is already clear: leveraging performance and mobile experience close to CEX to attract professional liquidity; maximizing capital efficiency through unified collateral and cross-market net settlement; constructing institutional-level compliance barriers with licenses and sandboxes; and binding LPs, traders, and developers in a tokenized risk-return closed loop for long-term collaboration. When the two curves of technology and compliance intersect in the coming years, Web3 leveraged trading will not just be an online substitute for traditional derivatives but will serve as the "price and liquidity engine" of a new generation of global multi-asset infrastructure. This will be a systemic reconstruction from trust paradigms to capital turnover efficiency and the core battleground for the integration of DeFi and TradFi.

2. Analysis of the Web3 Leveraged Trading Track

In the rapid expansion of decentralized finance, leveraged trading, as one of the most attractive and risky financial tools, is undergoing a new round of reshaping. In the past, centralized exchanges almost monopolized the derivatives market, but with the improvement of the Ethereum ecosystem and various public chain performances, a large amount of high-frequency trading and leveraged speculation that originally relied on centralized platforms is gradually migrating to DeFi. Today, decentralized leveraged trading has formed several major camps, represented by dYdX's order book model, GMX's liquidity pool model, Hyperliquid's high-performance matching model, and Avantis's multi-asset synthesis model. The rise of these platforms not only promotes the prosperity of the DeFi derivatives market but also showcases different technological paths and competitive logics, laying the groundwork for future pattern evolution.

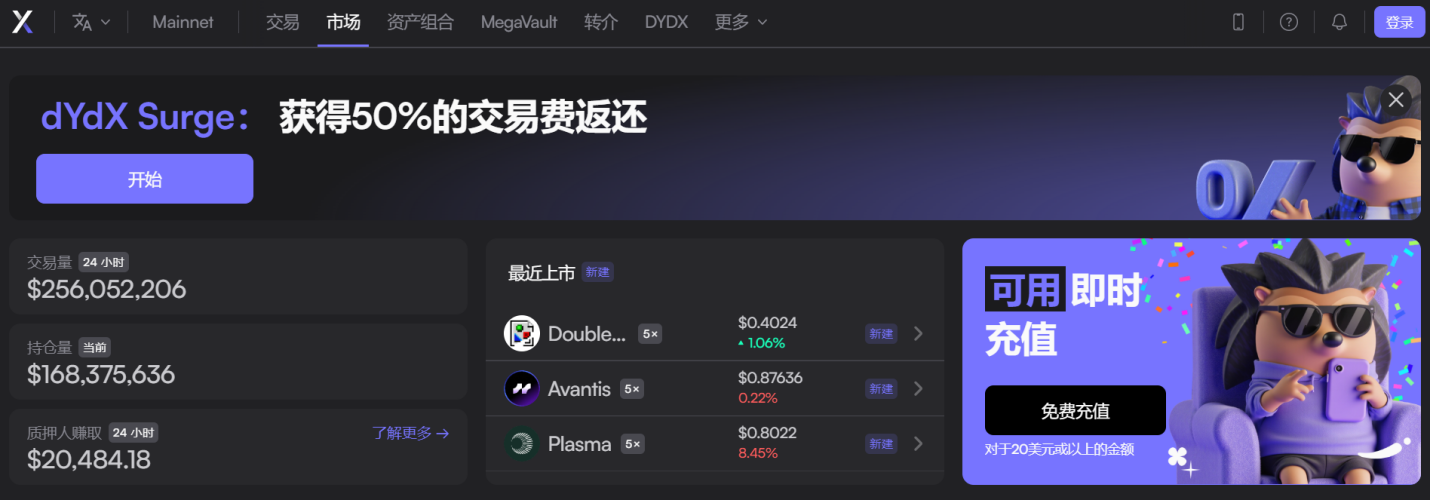

dYdX is the "pioneer" in this track, having almost redefined the possibilities of decentralized leveraged trading by the standards of centralized exchanges. The platform supports over 200 markets, with a maximum leverage of up to 50 times, and its cumulative trading volume has long surpassed $200 billion. After upgrading to version V4 in 2024, dYdX will migrate its core matching engine to the Cosmos independent chain, achieving a fully decentralized order book architecture, which is seen as a milestone transformation. Unlike the automated market maker (AMM) model, dYdX's order book design provides deep liquidity and lower trading costs for professional traders and institutional users. Its tiered fee mechanism caters to small users with a zero-threshold experience while offering discounts to large funds. For users relying on high-frequency trading and refined hedging, dYdX's model approaches a centralized experience while retaining on-chain transparency and self-custody of funds. However, this model also faces challenges. Order book matching requires extremely high performance from the chain, and even relying on the Cosmos independent chain, its speed and stability still struggle to compete with top centralized exchanges like Binance and Bybit. Additionally, the complexity of order book trading raises the learning threshold for retail users, making it less intuitive than the AMM model. Therefore, dYdX's strategic direction is to maintain professional liquidity while continuing to strengthen community governance and user education, gradually establishing its position as "an on-chain professional derivatives exchange."

In contrast, GMX has taken a completely different route. As one of the representative platforms for DeFi perpetual contracts, GMX's core innovation is the introduction of the GLP liquidity pool mechanism. Platform users form a counterparty relationship with the liquidity pool, which acts as the market maker. Traders open positions on the platform, and profits and losses are directly linked to the liquidity pool. Supported assets include mainstream tokens such as BTC, ETH, and AVAX, with leverage of up to 100 times. To date, GMX's cumulative trading volume has exceeded $235 billion, with over 669,000 users. GLP holders earn trading fees and funding rate shares by assuming counterparty risk, with annualized returns consistently maintained in the 10%-15% range, making it highly attractive. The innovation of this model lies in its effective reduction of reliance on external liquidity, allowing liquidity providers to inherently possess market-making functions while spreading risk through a multi-asset pool. However, this model also has structural vulnerabilities: in extreme market conditions, the liquidity pool may need to bear significant losses, and LPs may face the risk of capital loss. Additionally, although GMX provides a certain depth of liquidity, price impact and slippage remain noticeable during severe volatility. GMX's long-term potential lies in its community-driven token economics, where both GMX and GLP holders can share profits and participate in platform governance. This mechanism of "symbiosis between traders and liquidity providers" enhances user stickiness and drives continuous ecosystem expansion.

If dYdX represents the specialized "order book faction," and GMX represents the innovative "liquidity pool faction," then Hyperliquid is the "new hegemon" focused on speed and performance. Hyperliquid has quickly captured over 80% of the decentralized perpetual contract market, almost reshaping the industry landscape. The platform supports over 150 assets, with a leverage limit of 50 times, and boasts sub-second trading speeds, with performance approaching or even surpassing mainstream centralized exchanges. This high-performance matching engine has attracted a large number of high-frequency traders and quantitative funds, viewing it as an ideal battleground for decentralized markets. Hyperliquid's success lies in precisely addressing the performance gap between CEX and DEX, providing on-chain transparency and self-custody of funds while achieving execution speeds comparable to traditional exchanges. However, it also has clear shortcomings. Its product layout is not diverse enough, currently almost entirely focused on perpetual contracts, lacking diversified products such as options and structured derivatives; at the same time, its risk control mechanism has not been fully tested in extreme market conditions, and how to balance clearing efficiency with user safety during severe market fluctuations remains unknown. Nevertheless, Hyperliquid has already become the representative of the "speed faction" in current DeFi derivatives, and its future development direction may involve expanding synthetic assets and enhancing cross-chain compatibility to break through the boundaries of a single product.

Finally, Avantis represents the "cross-border faction," attempting to directly connect DeFi with traditional financial markets and becoming a pioneer in multi-asset synthetic trading. As the first decentralized leveraged platform supporting both crypto assets and real-world assets (RWA), Avantis sets USDC as the unified collateral, allowing users to trade cryptocurrencies, forex, gold, oil, and other assets simultaneously, with leverage of up to 500 times. This model greatly enhances capital efficiency, enabling users to achieve cross-market hedging and arbitrage on the same platform. For example, users can simultaneously go long on BTC and short on gold, utilizing cross-asset correlations to construct more complex strategies. Avantis's technological breakthrough lies in oracle integration and dynamic clearing mechanisms, designing "loss rebate mechanisms" and "positive slippage" protection to balance the interests between liquidity providers and traders. By the end of 2024, the platform has attracted over 2,000 traders, with cumulative trading volume exceeding $100 million. Although its scale is still small, its strategic significance is substantial: it not only promotes product innovation within DeFi but also bridges the gap between crypto and traditional finance. Challenges also exist; on one hand, Avantis is highly dependent on oracles, and if cross-market price inputs deviate, it may trigger systemic risks; on the other hand, derivatives trading involving traditional financial assets such as forex and commodities will inevitably face stricter regulatory scrutiny. This requires Avantis to maintain a delicate balance between compliance and innovation.

Overall, the current landscape of mainstream Web3 leveraged trading platforms can be summarized as "multipolar." dYdX represents specialization and deep liquidity in order books; GMX represents model innovation and community-driven liquidity pools; Hyperliquid represents extreme performance and speed advantages; and Avantis represents cross-border innovation and multi-asset integration. The emergence of these platforms does not replace each other but collectively drives the expansion of the decentralized derivatives market. The different technological paths they choose reflect the diversified development trend of Web3 in meeting different user needs: professional traders pursue liquidity and efficiency, retail users prefer simplicity and incentive mechanisms, high-frequency quantitative funds focus on performance limits, while cross-market investors value multi-asset integration. Future development directions are likely to involve the integration of these various models. If dYdX-style order book platforms can further enhance on-chain performance, they will compete and complement Hyperliquid's high-performance model; GMX's liquidity pool mechanism may be adopted by more platforms but will need to continuously iterate risk management tools; Avantis's cross-border attempts may inspire more platforms to explore new narratives of "crypto + traditional assets." Ultimately, whether decentralized leveraged trading platforms can truly shake the dominance of centralized exchanges depends on their ability to find new balance points between performance, liquidity, safety, and compliance. In other words, the landscape of Web3 leveraged trading is rapidly evolving, driven not by a singular vision of "decentralization," but by differentiated responses to various trading needs, market gaps, and technological bottlenecks. From dYdX's specialization to GMX's community focus, from Hyperliquid's speed to Avantis's cross-border approach, the map of decentralized derivatives is no longer a single breakthrough but a multi-path advance. In the foreseeable future, these platforms may each dominate their respective segments or, through the fusion of technology and models, drive the entire DeFi derivatives market towards greater scale and maturity.

3. Innovative Mechanisms of Web3 Leveraged Trading

The innovative mechanisms of Web3 leveraged trading fundamentally reshape the logic of traditional financial derivatives. It is not merely about moving leveraged tools onto the chain but establishing a completely new trading and clearing infrastructure based on smart contracts, on-chain transparency, capital reuse, and multi-asset derivative synthesis. This system is addressing several key bottlenecks of traditional platforms: custody risks, clearing delays, fragmentation of cross-market funds, and insufficient transparency, while further releasing the capital efficiency and global accessibility of leveraged trading. Its core innovations are reflected in three dimensions: first is the on-chaining of prices and risks. Oracle networks like Chainlink and Pyth have become the price foundation of the entire synthetic financial system, capable of updating off-chain prices of forex, commodities, indices, and crypto assets at second or even millisecond frequencies, significantly reducing manipulation and tail impact risks through multi-source aggregation, decentralized node signatures, and outlier trimming mechanisms. The greatest value brought by this is that synthetic assets can safely and reliably map real-world markets on-chain, allowing users to gain price exposure without relying on traditional brokers or market makers' black boxes. Second is the innovation of clearing and risk management mechanisms. Traditional finance employs "full liquidation," which can easily trigger liquidity cascades and chain liquidations in extreme market conditions. Web3 platforms are designed to favor partial liquidation, dynamic margining, and incentive hedging. When the risk direction of individual positions contributes to the overall risk balance of the platform, traders can receive fee rebates or positive slippage incentives; when risks become overly concentrated, the system automatically raises funding rates or executes partial liquidations to mitigate market shocks. At the same time, insurance funds and adaptive funding mechanisms are introduced as safety valves to help absorb tail risks from black swan events. This "dynamic game + risk-sharing" model is making the leveraged market more resilient in extreme environments. Third is the leap in capital efficiency. In traditional models, if investors operate forex, gold, and stocks simultaneously, they need to disperse margin accounts across different platforms, leading to inefficiencies due to capital stagnation and fragmentation. The unified collateral model of Web3 synthetic leverage allows users to only need to collateralize USDC, ETH, or LST to operate BTC perpetuals, XAU synthesis, or forex positions within a single margin framework. The risk engine enhances leverage ratios through correlation calculations and netting, with actual capital utilization rates potentially increasing two to three times compared to traditional models. At the same time, the income structure of liquidity providers (LPs) has fundamentally changed, no longer relying solely on market-making spreads but instead composed of "trading fees + funding fees + hedging incentives," with longer capital duration and more stable returns than traditional AMM pools, attracting more institutional-level liquidity injections.

On a strategic level, synthetic leverage is naturally suited for cross-market arbitrage and macro hedging. Users can construct a combination of BTC long and gold short on the same platform to hedge against inflation risks, or establish a dollar index long and risk asset short structure to respond to a strengthening dollar macro environment. This combination eliminates the need to transfer funds across platforms and does not involve additional counterparty credit risk, significantly reducing operational friction and time value loss. As cross-chain communication protocols and Layer 2 scaling mature, this integrated experience will further expand into multi-chain ecosystems, allowing price and clearing instructions to be securely transmitted across different execution layers.

More importantly, the wave of RWA (real-world assets) tokenization is providing new extensions for synthetic leverage. Boston Consulting Group predicts that by 2030, the on-chain scale of RWA could reach $16 trillion. The on-chaining of assets such as U.S. Treasuries, government bonds, gold, and commodities allows synthetic perpetual and futures products to be generated directly without the need for traditional custody and brokerage systems, providing users with standardized leverage tools. Taking Avantis as an example, its price sources based on Pyth and Chainlink incorporate forex, gold, crude oil, and other assets into on-chain synthetic assets, using USDC as unified collateral. Users can complete cross-market transactions within a single matching domain and establish a dynamic balance between trader and LP risks through the design of "loss rebates + positive slippage." This not only meets the needs of crypto-native users but also opens a pathway for traditional investors to enter on-chain derivatives. The layered demand side is also clear. Risk-averse funds are more inclined to become LPs, obtaining stable annual returns of 10-15% while using hedging modules to reduce risk exposure; while risk-seeking funds amplify returns through high leverage and cross-market arbitrage. The platform meets different user groups through layered products, thereby expanding market capacity. In the longer term, as account abstraction (AA) and gas-free experiences become widespread, the entry barrier for retail users will further decrease, driving rapid growth in the user base. From a macro perspective, the innovative mechanisms of Web3 leveraged trading are not only an upgrade of financial instruments but also a reconstruction of global capital infrastructure. At the price discovery level, oracles ensure a close coupling between on-chain markets and real-world markets; at the risk pricing level, dynamic clearing mechanisms and hedging incentives provide the system with greater resilience; at the capital turnover level, unified collateral and capital reuse significantly enhance efficiency. The integration of these three points enables Web3 leveraged platforms to not only compete with CEX in trading experience but also achieve leapfrog progress in capital efficiency and risk resistance.

Therefore, the ultimate landscape of Web3 leveraged trading will not merely be a "chain-based substitute" for traditional derivatives, but rather a multi-asset, multi-market, globally accessible infrastructure capable of simultaneously accommodating retail users and institutional funds. Whoever can establish a leading advantage in low-latency execution, strong risk control mechanisms, and compliant accessibility will hold market share and valuation premiums for the coming years. This is both a technological race and a part of the evolution of financial systems, as well as the core battleground for the integration of DeFi and TradFi.

4. Conclusion

Web3 leveraged trading stands at the critical point of "breakthrough and expansion," with its future direction depending on both technological evolution and the combined push of market and regulation. The decades of development in traditional finance have accumulated rich experience in product design, risk control models, and compliance systems, providing an important reference framework for DeFi. However, the centralized custody, regional barriers, and high compliance costs of traditional models cannot meet the demands for globalized and trustless capital flows. Web3 platforms are leveraging innovations in self-custody of funds, full-chain transparency, and borderless access to penetrate and reshape the high-frequency, high-capital-efficiency core scenario of leveraged trading.

More strategically significant is the on-chaining of synthetic assets and RWA, which is opening up a whole new market space. Incorporating U.S. stocks, forex, commodities, and other assets into the on-chain derivatives system not only meets the professional needs of cross-market arbitrage and hedge funds but also provides retail investors with unprecedented opportunities for global asset allocation. Whoever can achieve a stable oracle mechanism, unified collateral capital efficiency, and compliant accessible architecture in this track is likely to become the next Binance-level platform.

The profile of future winners is gradually becoming clear: they will be able to provide a front-end interaction experience that approaches or even surpasses the smoothness of CEX while maintaining decentralized security and transparency in backend mechanisms; they will connect multiple assets and markets while actively exploring regulatory pathways to provide institutional funds with a credible entry channel. As technology matures, user experiences are optimized, and regulatory frameworks are improved, the market scale and strategic position of Web3 leveraged trading will rapidly increase. By 2030, this track is expected to grow into a core growth engine at the billion-dollar level, representing not only an innovation in financial derivatives but also a key battleground for the integration of TradFi and DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。