VanEck Lido Staked Ethereum ETF Shows Big Demand for Staking

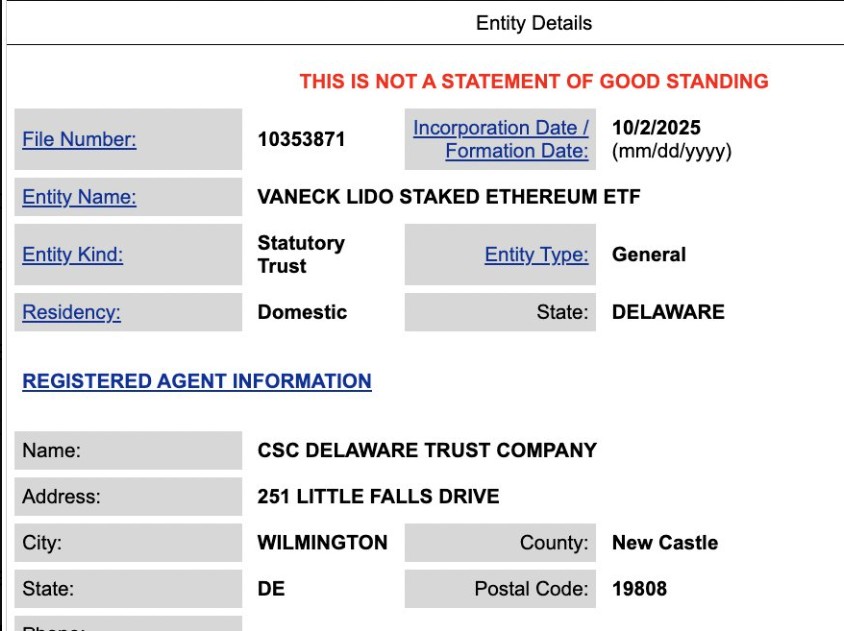

The firm has quietly registered a new fund in Delaware called th e VanEck Lido Staked Ethereum ETF. T he registration shows the trust was set up as a Delaware statutory trust on October 2, 2025, with CSC Delaware Trust Company listed as the registered agent. This move is a clear signal that big asset managers are racing to offer products tied to Ethereum staking.

VanEck Registers Lido Staked Ethereum ETF in Delaware

According to registration notices circulating today, the company formed the entity that would hold Lido-staked ETH exposure. The structure used a Delaware statutory trust which is common for ETFs and gives fund managers legal clarity when they later file with the SEC. The focus on liquid staking (via Lido) aims to give investors yield while keeping tradability.

Source : X

The Delaware filing is an early corporate step. It does not mean the filing is already approved by the SEC, but it does show the company is preparing the legal vehicle it would use if and when they submit a formal application or prospectus.

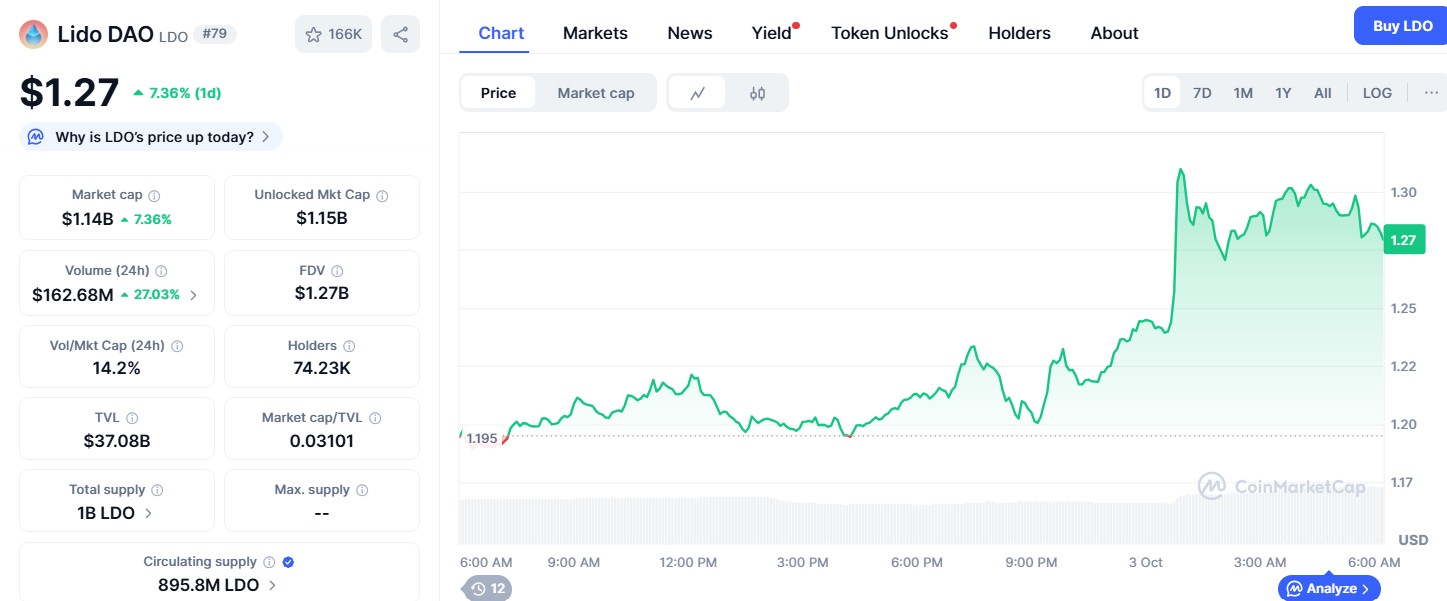

Lido DAO Token (LDO) Jumps 7% After News

Markets reacted fast. The token LDO rose about 7% on the news of VanEck’s registration. The coin is trading at $1.27, gaining 7.36% in the past 24 hrs. VanEck’s Staked ETH ETF Filing news has shown a bullish effect on token’s price. Now, the traders are raising questions: can LDO hold above $1.28 if broader markets pull back?

Traders often buy tokens tied to a project when big institutional interest appears. Short-term buying like this reflects optimism that ETFs tied to staking could lift demand for staked assets and their native tokens. Price moves can be volatile and tied to headlines more than long-term fundamentals.

Source : Coinmarketcap

Why the firm is targeting Ethereum staking products

Asset managers want new ways to give investors yield and crypto exposure inside familiar wrappers like ETFs. Lido is the largest liquid staking provider; using its pooled stake ETH lets a fund offer staking rewards without forcing investors to run validators or lock ETH directly.

How the U.S. shutdown affects ETF and SEC filing:

A U.S. government shutdown typically forces the SEC to curtail normal operations — reviews, comment letters and effectiveness determinations are delayed. That will likely slow any formal VanEck ETF filing and prolong regulatory uncertainty, increasing short-term market volatility for tie up products until appropriations and SEC staffing resume.

Final Thoughts

The VanEck Lido Staked Ethereum ETF registration is an important early step, not a green light. It shows where big managers see demand: yield plus liquidity. Expect more filings, more price reactions for LDO and staked ETH tokens, and clearer regulatory debates in the weeks ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。