Uptober Rally Gain Strength with SEC ETF, Fed Meeting, Market Recovery

October is an exciting month for crypto. Traders often call it “Uptober” because Bitcoin tends to rally after a volatile September.

With the Bitcoin price around $65,000, many investors are asking: will the Uptober Rally happen this year, or will bigger economic factors decide the outcome?

Fed Cuts Could Boost Liquidity

The U.S. Federal Reserve recently cut interest rates by 25 basis points, bringing them to 4.00–4.25%. Officials also suggested more cuts could come before the end of the year to help the slowing job market.

Low rates mean additional capital entering the market. BTC also reacts quickly to such changes. In the past, when the Fed reduced rates, crypto saw heavy inflows.

Should there be more rate cuts, the Uptober Rally could get further boost, propping up both Bitcoin and altcoins.

SEC ETF Shifts Would Help the Market

On the regulatory side, the SEC is streamlining crypto ETF approvals . In late September, it asked issuers of Solana, XRP, Litecoin, Cardano, and Dogecoin ETFs to resubmit prior filings.

Originally, this alarmed some investors, but analysts said it's mostly a procedural action. New rules now allow more expedient approvals through S-1 filings.

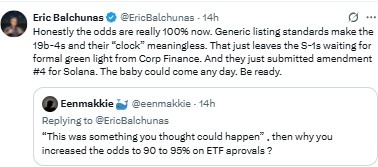

This means fewer delays and quicker launches for ETFs. Bloomberg analysts Eric Balchunas say several altcoin ETFs could be approved in this month.

Source: X (formerly Twitter)

If that happens, it could give the Uptober Rally a boost and increase market confidence.

October History Shows Strong Trends

Looking at history, check out how October has long favored Bitcoin over September . BTC has averaged a +21.8% gain for the month of October since 2013, with a median of +10.8%.

During year-end blowout sessions such as 2017 and 2021, it rose +47.8% and +39.9% in October, respectively, which also helped the larger crypto marketplace.

Source: Coinglass

October has long been seen by traders as a month of market bounce-back, especially after redemptions in September. This seasonality adds more credibility to the current bullish outlook.

Bitcoin Price and ETF Demand

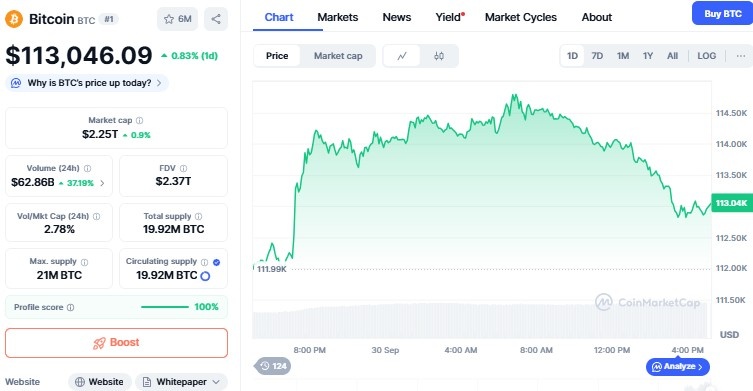

Bitcoin price increased 0.8% in the last 24 hours, on top of a 4% gain so far this month.

ETF inflows are fueling the price rise. Spot BTC ETFs saw $521 million on September 29, headed by Fidelity, while BlackRock's IBIT had small outflows.

BTC bounced back from the $110K–$111K support level, with resistance around $115K–$116.3K.

Source: CoinMarketCap

The total crypto market cap rose 1.4% to $4 trillion, and BTC dominance hit 58.1%.

This new ETF appetite shows institutions are bullish, and this can support the Uptober Rally.

Ethereum and Altcoins Can Drive Next

While Bitcoin dominates the news, Ethereum and other altcoins could do even better in this quarter. Ethereum can lead the next altcoin season alongside ETF news and SEC guidance for liquid staking tokens.

Dominance still well over 58% can have funds flow into altcoins next, fueling the Uptober Rally and wider market bounce.

Conclusion

It all suggests a strong October. Fed relief, streamlined SEC ETF approvals, and seasonality in Bitcoin all suggest bullishness.

There are dangers of derivatives unwinds and suspect economic data, but trends remain bullish. If history was to rhyme, the Uptober Rally could be the start of a strong Q4 for crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。