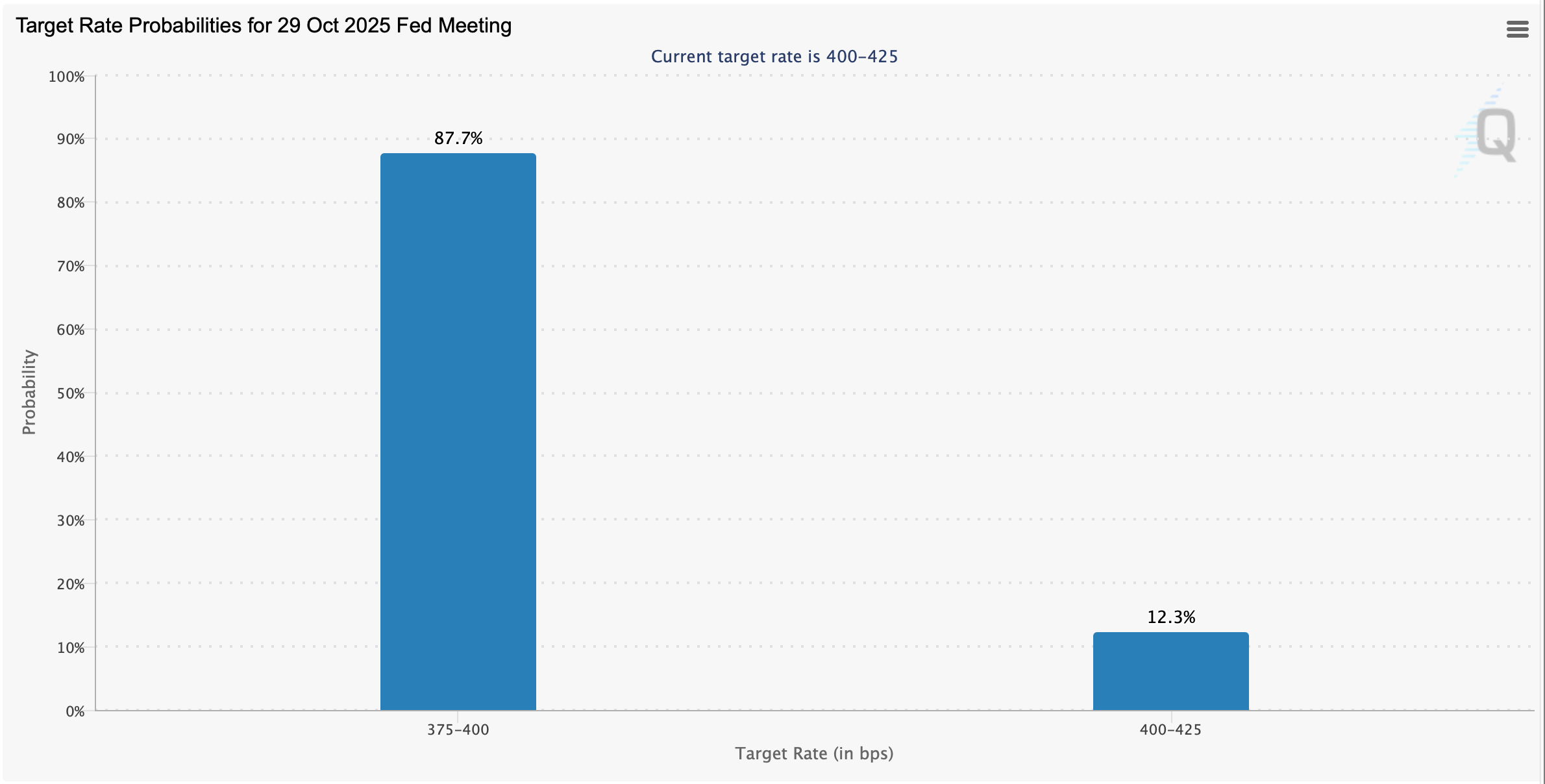

CME’s Fedwatch tool puts numbers to the hunch: with the target currently at 4.00% to 4.25%, the Oct. 29 path most favored is a trim to 3.75% to 4.00%, priced at 87.7%.

Holding steady at 4.00% to 4.25% sits at 12.3%. Translation: CME futures odds overwhelmingly favor a 25-basis-point cut during the next Federal Open Market Committee (FOMC) gathering. The Fedwatch chart’s two blue bars tell the story at a glance—big bar for a cut, short bar for a hold, nothing else getting airtime.

CME Fedwatch tool on Sept. 28, 2025.

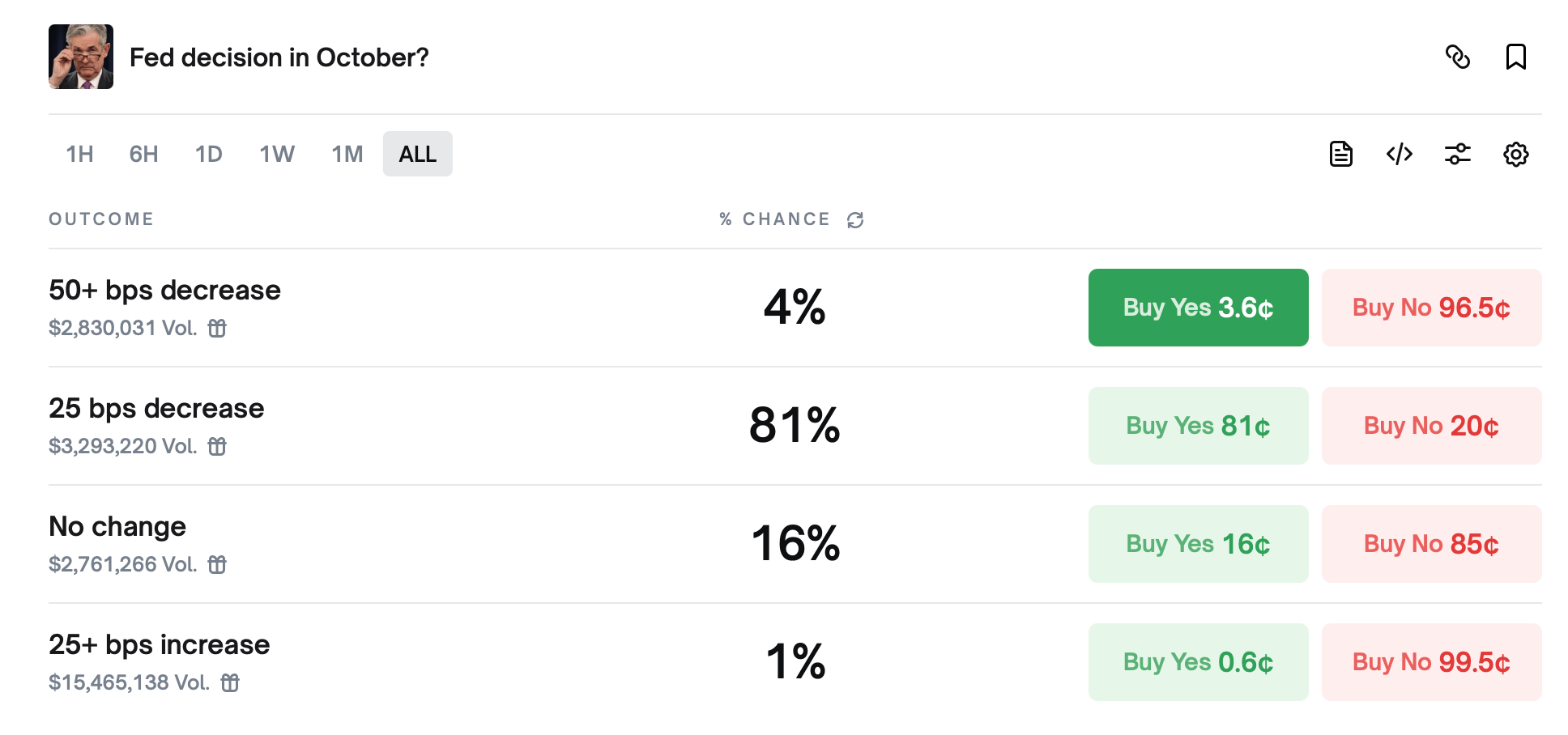

Prediction markets on Sept. 28 rhyme with that view. On Polymarket, traders assign 81% to a 25-basis-point decrease, 16% to no change, 4% to a 50-plus basis-point cut, and 1% to a hike. The market’s vibe: the cut is base case, a larger slice is fringe, and tightening is a museum piece. Yes shares hover near 81¢ for the quarter-point line, a tidy shorthand for crowd conviction.

Polymarket stats on Sept. 28, 2025.

Kalshi echoes the chorus. Its contract shows 81% for a 25-basis-point cut, 17% for holding the line, and 4% for something deeper than 25. Different venues, different bettors, same punchline: the quarter-point trim owns the stage unless data or guidance torpedoes it.

For rate-sensitive corners of the market, like bitcoin (BTC), that setup matters. A small cut would ease funding costs at the margin, flatter risk appetite, and keep optionality open for later moves. Still, probabilities are not promises; a hot print or hawkish press conference can flip the board faster than you can say “dot plot.” Liquidity optics aside, forward guidance will likely steer cross-asset moves more than mechanics this time.

Bottom line: positioning heavily favors a gentle step down, but the Fed writes the script on Oct. 29. All eyes in the financial world are fixated on the Fed’s next move. Still, it’s early, and consensus can still be wrong.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。