Original Title: “Digital Cash: Making Stablecoins Private & Usable”

Translated by: Luiza, ChainCatcher

Editor's Note: Payy is a vertically integrated on-chain banking platform built from stablecoins, privacy-preserving blockchains, and fiat channels. Whether paying friends and family or making payments to merchants and business partners, Payy aims to provide a simple and convenient payment solution to meet various payment needs in daily life.

Payy’s parent company, Polybase Labs, has secured funding from companies such as Robot Ventures, DBA Crypto, 6th Man Ventures, Orange DAO, and Protocol Labs. In this article, DBA co-founder Jon Charbonneau details the pain points and trends in the stablecoin market, as well as Payy’s specific architecture and competitive advantages.

Digital Cash

“A pure peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Nearly 17 years after the release of the Bitcoin white paper, the world still lacks digital cash with the characteristics of physical cash.

For years, the main obstacle has been the asset itself. Most people want to buy coffee with dollars, not Bitcoin. Stablecoins solve this problem.

Today, payment channels have become the main barrier. Most digital protocols do not retain the core attributes of physical cash, particularly, physical cash is completely private. I can hand you a dollar directly without announcing the transaction to the world — but this is precisely the opposite of how cryptocurrencies operate today. Even payments with intermediaries (like credit cards) only require disclosure of information to specific trusted entities.

If the transparent infrastructure of cryptocurrencies were to be widely adopted, it would be a dystopian scenario; but more likely, this transparency would directly hinder most people from adopting cryptocurrencies. People will not turn to on-chain transactions because the assurances they provide are far inferior to the existing off-chain systems:

Ordinary users will not accept a system that can easily identify and expose their complete financial situation. In an industry increasingly disrupted by “wrench attacks” and data breaches, users may prefer more privacy, not less.

Institutions clearly cannot make all their operations fully transparent. A TradFi survey conducted earlier this year showed that the lack of privacy is the third largest factor hindering greater institutional participation in on-chain activities. The second is regulation, which has since turned positive. The first is perceived risk (such as security and volatility), which will naturally decrease over time. Privacy is now likely the most important barrier the industry needs to address.

The Era of Privacy Has Finally Arrived

Historically, prioritizing scalability has been the way to profit in cryptocurrencies. Just create a faster, cheaper new chain. In contrast, on-chain privacy has been attempted for over a decade with almost no product-market fit (PMF). Therefore, if you have been in the cryptocurrency space for a while, it is easy to overlook privacy. However, the reality is that privacy has a clear PMF with almost all existing off-chain finance. Stepping out of the small circle of cryptocurrencies makes it clear that to attract off-chain users to on-chain, on-chain privacy is an essential prerequisite.

This situation is finally about to change:

Regulatory Environment

In the past, developing or even using privacy technologies could face legal risks. But recently, the regulatory environment has shifted. In the past few months, the U.S. Securities and Exchange Commission (SEC) announced “Project Crypto,” Congress passed the GENIUS Act, the CLARITY Act gained bipartisan support, the Treasury lifted sanctions on Tornado Cash, and Commissioner Peirce made a strong defense for the financial privacy rights of digital cash:

“We should take concrete steps to protect people’s ability to communicate privately and transfer value privately, just as people could do with physical coins in the era when the Fourth Amendment was drafted.”

Compliant Privacy

Due to ideological and technological limitations, many early privacy technology attempts were incompatible with regulatory compliance (such as anti-money laundering checks). They provided complete privacy but lacked sufficient customizability. With technological advancements and the increasing involvement of product-focused developers, compliant privacy technologies are gradually being built. What users need is minimal, selective information disclosure.

User Profile

Frankly, so far, on-chain users have mostly been a group of geeks trading “meme coins.” Transparency is sometimes even an advantage (like showcasing NFTs or social applications centered around public trading like Zora), or less important (for example, it’s just a meme coin). More tech-savvy early users can also spend time mitigating risks to some extent (for example, managing multiple wallets anonymously while using centralized exchanges (CEX) as mixers). This is in stark contrast to the user profiles of companies managing their funds, ordinary people buying a cup of coffee, or putting grandma’s 401k pension plan on-chain. These new users inherently require practical, real privacy protection.

Based on the above points, I believe privacy is also a significant enhancement to user experience (UX). I am the kind of user who manages through multiple anonymous wallets, constantly creating new wallets, using centralized exchanges to sever fund associations, cross-chain transferring, syncing new wallets to tax software, and so on — a cumbersome and exhausting process. I do this to minimize the risk of other wallets being “doxxed” — whether for personal use (especially in a social application where identity leaks are increasingly easy, and I don’t want my daily spending activities exposed) or for professional purposes (where others can easily mark and guess the scale of large fund holdings).

Thus, these efforts may yield little effect. Mistakes are easy to make, and on-chain analysis tools excel at tracking and associating behavioral patterns, and their capabilities are continually improving. This often hinders me from engaging in more activities directly on-chain; I won’t use on-chain payments to split dinner bills with friends if it means exposing the entire financial history associated with that wallet. For such scenarios, I often end up using TradFi channels (like Venmo, Zelle) or custodial crypto channels (like sending through Coinbase CEX). What I truly want is peer-to-peer electronic cash.

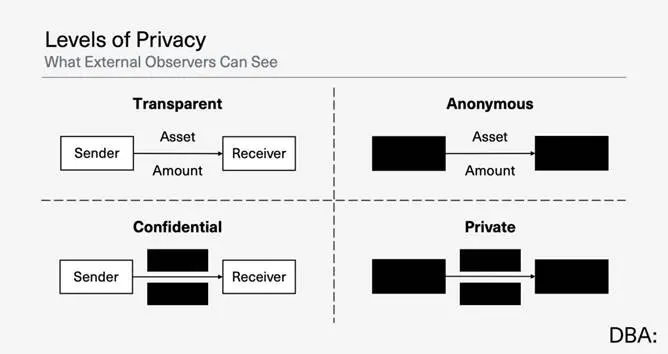

Levels of Privacy

Now we need to clarify some important terms:

Transparent

Most on-chain transactions today are completely transparent. You can query the balance of each address, all historical transactions, and complete transaction details.

Anonymous

Anonymous transactions hide the parties involved (sender and/or receiver). The transaction content (assets and amounts) remains transparent. Directly hiding the parties involved in a transaction is not common. However, for similar purposes, mixers provide unlinkability, obscuring the final sender and receiver across multiple transactions. For example, when you deposit into Tornado Cash, anyone can see the transaction content and the parties directly involved (you as the sender + the Tornado Cash contract as the receiver). For withdrawals, anyone can see your address receiving funds from Tornado Cash. However, external observers cannot directly link which deposits correspond to which withdrawals from the Tornado Cash smart contract.

Confidential

Confidential transactions hide the transaction content (assets and/or amounts). The parties involved (sender and receiver) remain transparent. Most implementations only disclose the assets involved while hiding the transaction amount (and the resulting user balance). We see “Alice sent USDC to Bob,” but we do not see how much USDC was sent. This may be sufficient for scenarios like sending salaries to employees who are publicly known and comfortable with their addresses being known. There are increasingly more experiments in this area. For example, Solana’s token extension supports confidential transfers, and Arc’s litepaper describes plans for providing selective confidential transfers through trusted execution environments (TEE). However, adoption rates have been low so far.

It is important to emphasize that “confidential” and “private” are vastly different. Some even argue that chains offering only confidentiality features “should stop using the term ‘privacy’ because everything on-chain is unrelated to privacy; it is merely an excellent financial monitoring tool.”

Having only confidentiality is insufficient for many (possibly most) financial scenarios. This is clearly worse than the status quo we are accustomed to off-chain. Most people would never publicly broadcast all the recipients of their payments. This is most evident in embarrassing transactions (like paying for OnlyFans, gambling, drugs), but even normal transactions clearly have issues (for example, they can be used to monitor someone’s financial situation and physically locate them).

Private

Many scenarios require true privacy, where both the transaction content and the parties involved are hidden. This is how we are accustomed to operating in TradFi. The important nuance here is who this information is kept confidential from:

TradFi – Transactions are confidential to the ordinary observer, but you allow your intermediaries (like banks) to view them. They ensure compliance with applicable laws and wish to maintain data privacy (for example, not disclosing your data).

Crypto – Non-custodial cryptocurrencies lack similar intermediaries, so the degree of disclosure of transaction information is often unclear. Compliant privacy requires a certain degree of minimal disclosure (for example, proving that funds did not come from a hack without revealing complete transaction details to anyone) or selective disclosure (allowing authorized parties to obtain more information than ordinary observers).

There is no one method that is absolutely superior to others. The required level of transparency or privacy will vary depending on the use case and will evolve over time. There are practical limitations here:

Technology – Different types of transactions have varying levels of complexity in maintaining their privacy. For example, establishing private transfers is usually easier than private transactions. Programmability and shared state complicate matters. Different styles of cryptography (such as zero-knowledge proofs (ZK), fully homomorphic encryption (FHE), secure multi-party computation (MPC), trusted execution environments (TEE), etc.) each have their own limitations and trade-offs. There is no one-size-fits-all solution.

Society – Setting technology aside, there is a fundamental trade-off between privacy, practicality, and threat resistance. Complete privacy sounds great for personal freedom, but it poses problems for preventing societal malfeasance (such as laundering funds from North Korean hacking). We need to determine a reasonable balance for different scenarios at both the user level and the societal level.

Payy

DBA invested in Payy last year because they have created the easiest-to-use on-chain privacy solution we have seen. It is even the most convenient cryptocurrency application I have used — I use it almost every day, regardless of its privacy features.

Payy is a vertically integrated on-chain banking platform that has built both a “killer app” and the dedicated infrastructure needed to support that app:

Payy Network: The first public chain with built-in compliant privacy features for stablecoins.

Payy Wallet: The first non-custodial banking application built on Payy Network.

Both are live and currently providing real value to thousands of users worldwide.

Payy’s ultimate goal is to enable everyone to be their own bank: replacing the core services of traditional personal banking — saving, spending, investing, and lending — while maintaining self-custody. Building it on-chain globalizes it and reduces overhead (resulting in faster and cheaper services).

Payy Wallet

Private Stablecoin Payments

The first product of Payy Wallet is an application similar to Venmo, but with all the advantages of cryptocurrency. With Payy, you can privately, freely, and instantly save and send dollars to anyone in the world.

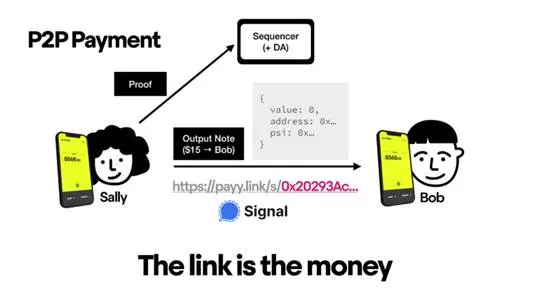

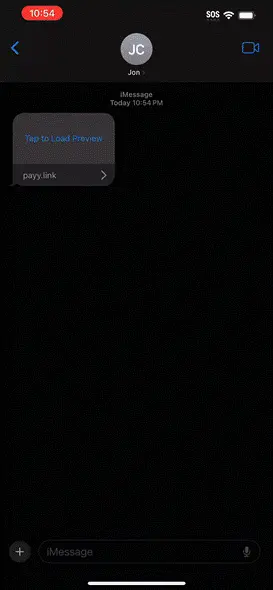

Its core design innovation is that it supports private transfers via traditional links (which can be sent through any platform, such as iMessage, Signal, Telegram, etc.). For example, the first person to click the link can privately claim $10 within seconds.

The specific operation process is as follows:

When initiating a payment, Sally generates a ZK proof on her phone, proving that she has created a valid transaction. Sally sends the proof to the sequencer, but the complete transaction data (such as sender, receiver, asset, amount) never leaves her device.

The sequencer confirms the transaction and transfers Sally’s funds to a new temporary wallet.

Payy Wallet generates a link containing the private key of that new wallet. Sally sends the link to Bob.

Bob clicks the link, generating a transaction that transfers funds from the temporary wallet to his own wallet.

The entire end-to-end process is extremely smooth, with transfers to anyone taking about 10 seconds:

The recipient can click the link to instantly claim the funds. If the recipient has not yet installed Payy Wallet, the link will guide them through the setup process — even so, downloading the app, creating a wallet, and claiming the funds takes only about 20 seconds:

This transaction process solves the “cold start” problem of establishing a new payment network.

This transaction process solves the “cold start” problem of establishing a new payment network.

In TradFi, any setup process is challenging due to KYC. Custodians and intermediaries must complete identity verification to provide you with financial services. This entry complexity poses a meaningful adoption barrier for users and imposes heavy costs and time requirements on service providers.

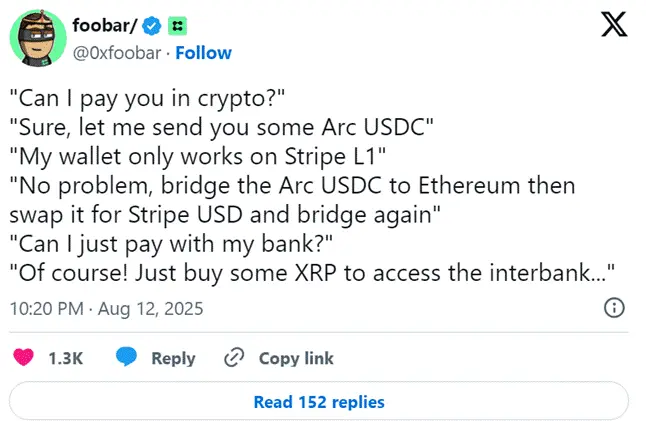

Non-custodial crypto services alleviate KYC barriers because there are no intermediaries. However, a simple crypto payment setup brings the same poor user experience issues due to inherent fragmentation standards. You want to split the dinner bill, but you only have USDC on Base, your friend has USDC on Solana, and the restaurant owner only accepts USDT on Tron. This problem does not seem to be improving.

Payy addresses both of these barriers:

Non-custodial – Registration is simple. No KYC. Just a few seconds to download the app.

Link Payments – Utilizing existing distribution platforms to overcome the lack of shared standards. Just send a link to anyone, anywhere, and they can claim the funds within seconds. Payy also allows you to send payment request links (the same as the sending process, just in the opposite direction) or via QR codes.

Payy also has several other notable features that will become standard for attracting ordinary users:

$USD: Currently using USDC as the underlying asset, but balances are displayed directly as $USD.

Free Transfers: Hides the concept of “Gas fees” from users. Users can complete registration, receive funds, and make transfers without needing to understand any cryptocurrency knowledge.

This is the only cryptocurrency application I frequently show to ordinary people that they can successfully use.

Payy Card

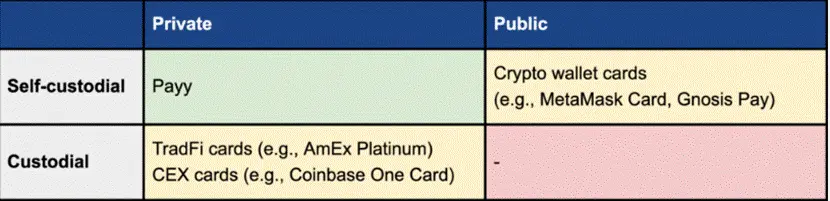

Payy has recently gone beyond being a “crypto version of Venmo” by launching the Payy Card — the first private non-custodial stablecoin card. Now, you can privately use stablecoins for purchases anywhere Visa cards are accepted globally. The card offers a digital version (which can be added to Apple Pay, etc.) and a physical version (which lights up when swiped).

Whenever you use the Payy Card, a proof is generated, and the Payy Network confirms the transaction on-chain, deducting the purchase amount in real-time from your Payy Wallet balance.

It is important to clarify the level of privacy here:

Link Payments: Completely private. The transaction sender, receiver, and amount never leave the user’s device. Everyone else (even the sequencer/prover) can only see the ZK proof and a partial hash.

Payy Card Transactions: Closer to TradFi privacy levels. External parties see nothing, but providers (such as Visa and Polybase Labs) still collect some key data (such as KYC and card payment information). This is legally required. When using the card for payments, this is unavoidable.

Importantly, unlike other self-custodial crypto cards, you cannot see any information from on-chain data. No one, except the user themselves (not even Visa or Polybase Labs), can link the user’s TradFi Visa payment data with their on-chain address and activities on the Payy Network, as on-chain transactions are completely private.

In contrast, many mainstream cryptocurrency cards currently on the market have their on-chain transactions fully public. Card providers can clearly see users’ KYC data, payment data, and associated on-chain history; even ordinary observers can link users’ card spending records with their on-chain addresses (for example, if you see someone making a card transaction, you can just check the timestamp on a block explorer). This poses a very high and unnecessary risk.

Fiat Ramps

Crypto-native users can easily deposit and withdraw funds through CEX (just send/receive Polygon USDC). Apple Pay deposits are also fast and free, but there are limits and they cannot be used for withdrawals. Bank transfers for Payy Wallet have launched in Argentina, but most countries (like the U.S.) have not yet opened this feature.

Even for crypto-native users, direct integration through ACH (Automated Clearing House) into Payy Wallet would be more convenient, so they wouldn’t need CEX. More importantly, the real breakthrough is that everyone should be able to use Payy, but ordinary users do not have CEX. Unless my 80-year-old landlord can withdraw instantly and for free via ACH without knowing she is dealing with cryptocurrency, I cannot expect her to accept my Payy payment for rent. Fortunately, Payy will soon launch this feature in the U.S. and will gradually expand to other countries. This will make the entire process seamless for anyone, even without knowing they are using a crypto channel.

Future Products and Revenue Model

Payy has replaced two core pillars of traditional banking — dollar savings and spending. Next, it will expand into investment and lending: developing yield products (such as U.S. Treasury-related products) and planning to add privacy smart contracts to support broader DeFi functionalities. Stay tuned for updates.

The latter will also provide a more attractive revenue path. Digital cash is an excellent product for the world, but payment fees are not an exciting business model — this is also why Payy transfers are free. Charging commissions on more complex transactions (such as trading fees and MEV, or maximum extractable value) and yield products is a mature and profitable model.

As Payy expands into a platform model, revenue opportunities will increase. Payy Wallet is currently the only application on the Payy Network, but this is about to change. The Payy Network will soon open to external developers, and several launch partners are already lined up to join. Developers will gain access to compliant privacy, a valuable user base, and even built-in fiat deposit and withdrawal channels through Polybase’s API (as well as reusable KYC from Payy, which is a necessary condition for fiat channels). Projects typically need to embed separate deposit and withdrawal channels for different countries and conduct KYC for users for each channel.

Payy Network

Tailored for Private Stablecoins

Most public chains today are general-purpose platforms that lack a clear product-market fit (PMF), with no distinct positioning or differentiation.

However, the most successful public chains are often those built for specific scenarios. Hyperliquid optimizes on-chain trading through small collaborative positioning validators, prioritizing the cancellation of orders; Bitcoin optimizes for autonomous currency and payments through proof of work and a minimalist UTXO model.

Similarly, the Payy Network aims to optimize the provision of on-chain consumer banking services. Specifically, replacing banks requires building around stablecoins with privacy considerations from the very beginning — this is the core positioning of the Payy Network. It is not built in a closed environment but is developed in sync with the first "killer app" (Payy Wallet), as such infrastructure is essential for the functionality of Payy Wallet.

Therefore, the Payy Network adopts a highly targeted architecture, with several core features that are consistent with other privacy-focused public chains (such as Zcash, Aztec, etc.):

UTXO Model: While the UTXO model itself does not provide privacy protection, achieving strong privacy typically requires building on this model. The account model has poor adaptability for privacy protection due to information leakage issues.

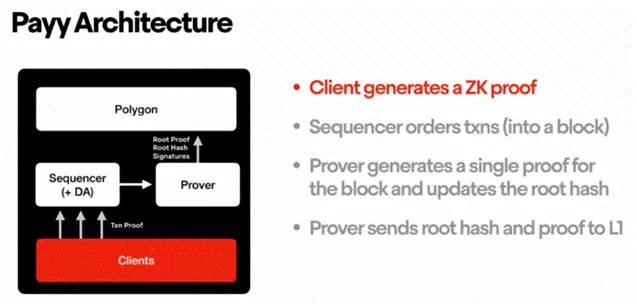

Client-side ZK (Zero-Knowledge Proof): Users generate ZK proofs on their local devices to create fully private transactions.

Other components include:

Cross-chain Bridge: The $USD displayed in Payy Wallet currently comes from USDC via Polygon cross-chain. The choice of Polygon is similar to why Arbitrum became Hyperliquid's USDC cross-chain bridge — it is cost-effective and supported by most CEXs for USDC.

Operator: Currently, Polybase Labs is responsible for running the sequencer, prover, and maintaining data availability (DA). In the coming weeks, DA will migrate to Celestia.

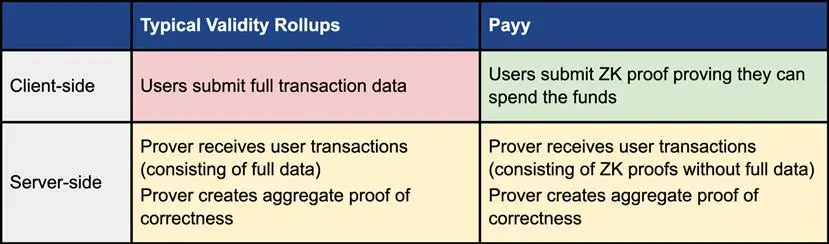

Client-Side ZK

Every time a user makes a transaction on the Payy Network, a ZK proof is generated on their local phone (client). This proves that they have the right to consume the input note and generate the output note without disclosing all underlying transaction data.

In this way, Payy truly leverages the "zero knowledge" characteristic of zero-knowledge proofs. This sharply contrasts with most public chains referred to as "ZK-rollups" (such as StarkNet, ZKsync Era, Scroll) — the more accurate positioning for the latter is "validity rollups."

Currently, the Payy Network employs the Halo2 circuit technology pioneered by Zcash.

UTXO Model

Payy's state model is based on UTXO (like Bitcoin), unlike most smart contract chains (like ETH) that use an account model.

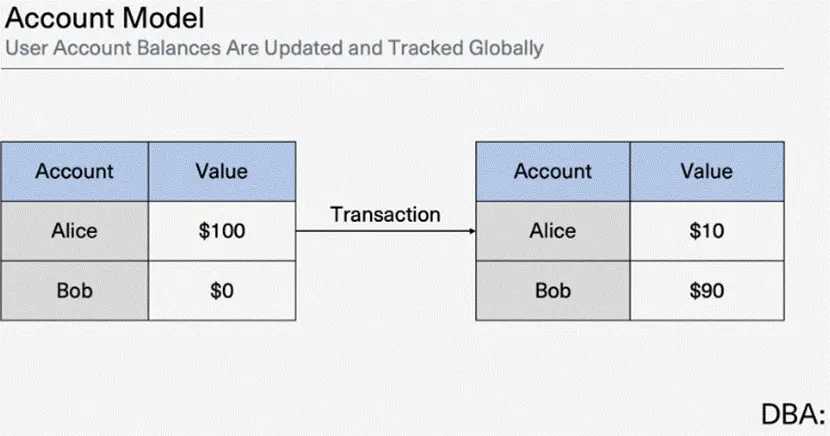

In the account model, the global state tracks the current set of accounts and their balances. It resembles a bank ledger, where transfer records are debits and credits that modify user account balances (e.g., Alice's account -90, Bob's account +90).

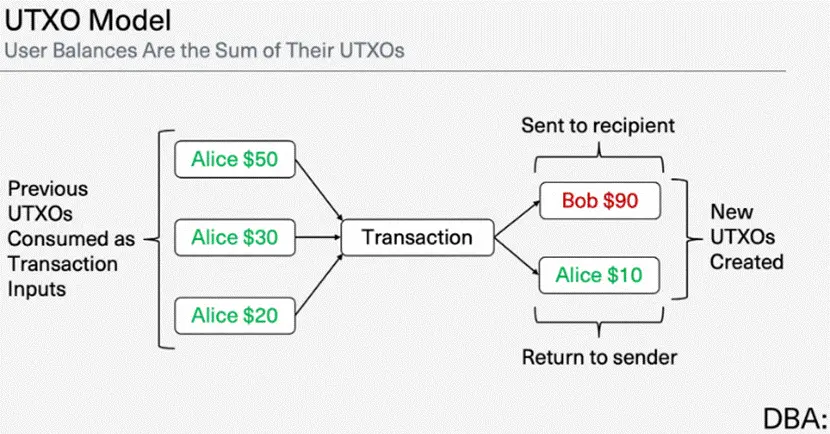

In the UTXO model, there is no global account value mapping to track and update. It only tracks individual transaction receipts. For example, when Alice sends $90 to Bob:

Alice's transaction references a previous transaction where she received ≥$90 (in this case, $100).

These referenced transactions are consumed as "inputs" and generate new "outputs" — where $90 is output to Bob, and $10 is returned to Alice as change.

Each newly generated unspent transaction output (UTXO) explicitly states the amount and recipient. The recipient can use it as an "input" for new transactions in the future. Each UTXO can only be spent once and must be spent in full.

The global state tracks the current set of UTXOs. Users calculate their balance as the sum of UTXOs whose public keys correspond to their current address.

As mentioned earlier, building on the UTXO model is often necessary for achieving strong privacy. The account model leads to information leakage (as you can see the global account of a user being modified), while the UTXO model does not (as users are simply destroying and creating new UTXOs).

Private Notes

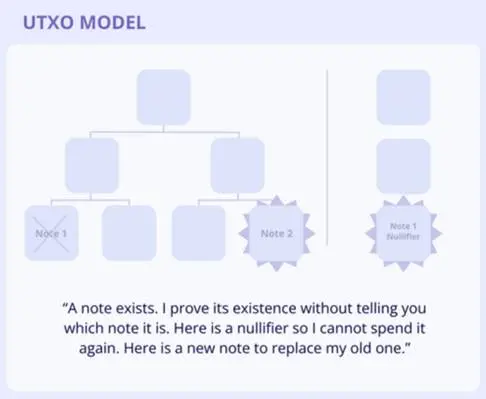

Relying solely on the UTXO model is still insufficient for privacy protection; therefore, privacy-focused public chains also introduce "notes," which function similarly to standard UTXOs but with key differences:

Similar to UTXOs: Notes explicitly state the amount and owner, and the owner can spend the note in full once.

Different from UTXOs: Users must keep notes confidential, and nodes only store the commitments (hash values) of the notes that form a public tree.

In transparent UTXO chains like Bitcoin, ownership of funds can be verified through links to previous transactions. Anyone can see which UTXOs were consumed and created by a transaction.

However, private chains like Zcash aim to hide these links. Spending a note requires publicly revealing its corresponding nullifier. This is a unique data bit that can be generated by its owner for each note. Nodes maintain the set of revealed nullifiers as part of the public chain state. When processing new transactions, they check that the included nullifiers are not in the existing nullifier set, thus preventing double spending of notes.

Importantly, only the transaction sender knows which input note corresponds to the revealed nullifier. Nodes validating the transaction never know which note was spent. They only know that a new note commitment (encrypted for its owner) is valid and can be added to the tree. There is no public link between the consumed input note and the created output note.

Transaction Lineage

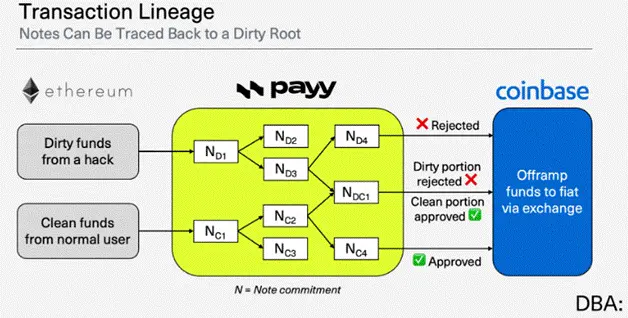

How can we meet compliance requirements while ensuring privacy? For example, fiat withdrawal channels need to confirm that deposits comply with local anti-money laundering (AML) regulations. Payy's solution is "transaction lineage":

Before Optimization: When spending a note, users must publicly disclose the nullifier and output note commitment, but there is no public association between the input (spent) and output (newly generated) notes.

Transaction Lineage Mechanism: When spending a note, users must specify the input note commitment and output note commitment. The input note commitment is removed from the public tree, and the output note commitment is added to the tree. Nullifiers are no longer used, and the public tree only tracks unspent notes.

Through this mechanism, observers can see the flow path of notes, but the transaction itself remains private — users do not need to publicly disclose the sender, receiver, asset type, or amount, only the flow map between note commitments (hash values).

This allows withdrawal channel providers to trace "problematic notes" (such as funds originating from North Korean hacking) through the network without needing to view transaction details along the way. Other transactions of the user will not be associated; if a user receives a "problematic note" (such as being maliciously transferred a small amount to mark the address), they can isolate it and prove the legitimacy of their other funds. Payy Wallet will also add simple user experience features to help ordinary users avoid such risks (for example, maintaining a list of problematic notes that users can reject or isolate).

This design protects user privacy while providing the possibility to track money laundering activities, similar to the unique serial number of physical cash — you can determine if a banknote comes from illegal channels (such as stolen bank robbery money) without knowing all the transaction details before it came into your hands (such as the identities of intermediaries).

It is important to reiterate that there is no perfect solution for compliant privacy; there are fundamental trade-offs at both the technical and social levels. Transaction lineage is a promising direction, but its specific implementation needs to be adjusted dynamically based on applicable regulations and scenarios (for example, we covered simple payments, but as Payy introduces programmability, other considerations are expected). The world is evolving, and Payy will continue to iterate.

A Truly Meaningful Stablecoin Public Chain

A Crowded Field

Stablecoin chains have recently become all the rage. The list of players emerging in the market is growing longer, but frankly, most of them lack real significance. They are merely new chains marketing around stablecoins. Compared to existing public chains (such as Solana, Base, Tron, Ethereum, etc.), I currently do not see any substantial technical unlocks or unique improvements from them.

Arc, Plasma, Stable, Codex, and Noble AppLayer are all default public EVM chains, mostly focusing on performance and stablecoin-denominated gas fees as their core selling points. However, "fast and cheap" has now become a basic capability; gas abstraction can be achieved on most public chains, making these selling points difficult to differentiate. The core motivation for most projects launching public chains is profit (such as capturing market share from existing projects like siphon) and control (such as achieving on-chain transaction rollbacks through PoA mechanisms). While these motivations are reasonable, they are not the key to success — success requires user distribution channels and substantial technical breakthroughs over existing public chains.

The most common strategy currently is "issuer binding": obtaining investments from Circle or Tether, building ecosystems around USDC or USDT, and even adopting similar logo color schemes. However, Circle has recently gone public and announced plans to launch its own public chain, which poses challenges for Circle-bound projects like Noble and Codex; meanwhile, Tether-bound projects like Plasma and Stable have a competitive advantage — Tether has no publicly traded assets and no plans to launch its own public chain. Investors are highly focused on stablecoins, and "stablecoin public chains" have even become an important narrative driving up ETH prices. Sometimes, the token itself becomes the "product."

However, mere popularity cannot drive real user activity, and these projects lack unique technology. Their core differences may lie in business development (BD) capabilities and target market positioning. Existing players like Solana and Base adopt a comprehensive layout strategy, while if these issuer-bound projects can focus on specific verticals (such as consumer payments outside the U.S., B2B payments, stablecoin yield products, etc.), they may have a chance to carve out a niche.

Circle's Arc public chain is a project truly launched by an issuer, but it also lacks substantial technological breakthroughs. Circle itself lacks user outreach capabilities and mainly relies on partners like Coinbase, which requires paying high fees to these partners. However, Circle has certain advantages at the infrastructure level, such as fast fiat-to-crypto deposits and withdrawals, as well as potential cross-chain interoperability based on the CCTP protocol.

Additionally, there are rumors that Stripe will launch a public chain called Tempo. Although no technical details have been disclosed yet, Stripe has strong distribution channels and is fully committed to stablecoins — leveraging its existing service ecosystem, Stripe is expected to bring a large number of users to Tempo, but it is still unclear how it will expand into new scenarios.

Payy = Distribution + Technological Unlock

I believe Payy is a truly meaningful stablecoin public chain, primarily because it possesses the following two major advantages:

Distribution: Payy Wallet is a killer app that brings distribution. They have already launched payment and stablecoin cards, with broader financial services (such as treasury yields and private DeFi) coming soon. They are already live, with thousands of real users and still growing.

Technological Breakthrough: Payy Network is the only stablecoin chain here that is not just another transparent EVM fork. It is a privacy-preserving chain optimized for stablecoin finance. You gain privacy (client-side ZK + UTXO-based), compliance (transaction lineage), availability (gas abstraction), and of course, scalability.

Today, privacy has become the last differentiating track at the infrastructure level of public chains. High performance has become a basic requirement, while the lack of privacy remains a core issue that the cryptocurrency industry urgently needs to address. Therefore, building with privacy as a core goal from the very beginning is meaningful.

In contrast, most other stablecoin public chains view privacy as an "afterthought," which presents obvious problems. Default transparent public chains like Ethereum and Solana have proven that adding optional confidentiality or privacy features post-factum through tools like Railgun and Tornado Cash leads to a series of drawbacks:

User Experience: Optional protocols are difficult for ordinary users to understand and can lead to cumbersome wallet operations.

Privacy: Most application-layer protocols only implement confidentiality features and cannot meet actual needs; even if privacy protection can be technically achieved, optional modes will reduce the anonymity set, weakening the actual privacy effect (for example, most transactions on Zcash are still transparent transactions).

Complexity: Placing privacy features outside the core protocol increases the complexity and fragmentation of the infrastructure.

Compliance: A unified privacy technology at the core protocol level can support the industry in sharing compliance standards, while application-layer privacy solutions struggle to achieve this.

Stablecoin public chains that have not perfected privacy features from the outset will ultimately face the above obstacles. Many teams are currently attempting to add user-friendly privacy features to default transparent public chains, and their progress is worth watching, but they have not yet achieved mature implementation.

The impact of the lack of privacy on stablecoin public chains may be more severe than on existing public chains. Privacy needs vary by scenario, and as mentioned earlier, core target users of stablecoins, such as institutions and ordinary consumers, are accustomed to privacy protection in traditional finance — if their privacy is compromised when transitioning to on-chain, they will not accept it. Therefore, privacy is crucial for stablecoin public chains, and Payy is the only stablecoin public chain that has made default privacy a core feature from the very beginning.

Moreover, there are many privacy-focused public chains in the market (such as Zcash, Monero, Aztec, Miden, Aleo, Penumbra, Namada, Secret Network, etc.) that have achieved excellent results at the technical level, and their progress is also promising. Compared to these projects, Payy has relatively minor technical differences, but its key advantage lies in having the first "killer app" and adopting a market strategy focused on stablecoins. In an over-saturated cryptocurrency industry, this advantage becomes increasingly important.

Payy's strategic evolution path is very similar to that of Hyperliquid:

Build a minimally viable public chain specifically for the first "killer app" — because only in this way can the core functionality of the application be realized.

Acquire users through the "killer app."

Gradually transition to a platform model: open up to external developers, upgrade technology to support more scenarios, and promote operational decentralization.

The effectiveness of this strategy has been fully validated.

Conclusion

The reason I am excited about Payy is simple — I have indeed been using it.

As a fortunate individual in the top 1% of financial convenience (a U.S. citizen living in New York), even so, my life would be more convenient if I could shift more financial activities on-chain. For example:

The hassle of wire transfers would make anyone a staunch supporter of cryptocurrency.

Zelle's daily transfer limit is only a few hundred to a few thousand dollars (depending on the bank), and there are monthly limits — I am already tired of splitting rent payments over multiple days.

Venmo arbitrarily bans users it deems to be engaging in "improper behavior" (I have friends who have experienced this).

I recently bought a car and learned what a bank draft is — this absurd concept.

The less KYC, the lower the risk of data breaches. Many of my friends and I have unfortunately become users of Coinbase's "less than 1%" sensitive data breach.

There are many more examples. For the vast majority of people in the world, similar troubles are more prevalent and have far-reaching impacts. Payy addresses not only "inconvenience" but also provides core support for those who cannot access basic financial services. It solves real problems for real people.

Digital cash is the "killer app" of cryptocurrency. We should not sacrifice the excellent attributes of physical cash to achieve digitization; if on-chain finance does not surpass traditional finance in these attributes, people will be even less likely to turn to on-chain solutions. Therefore, the cryptocurrency field is bound to witness an explosive development in privacy protection — as the industry competes for broader and more serious application scenarios, privacy will become a core competitive advantage.

The real question is "how to achieve privacy protection." One viable path is for trusted intermediaries to lead privacy protection, using the blockchain solely as backend infrastructure — users entrust their funds to custodians like Coinbase, which manage user assets through a pool, with only the main wallet activities of the custodian visible on-chain.

While this model has its value, I firmly believe that real digital cash with self-custody and privacy protection capabilities will ultimately achieve large-scale implementation. Users crave the low fees, convenience, and sovereignty that this model brings; service providers favor its lower structural costs, operational expenses, faster product delivery speeds, and reduced risk of data breaches.

To achieve this goal, we need digital cash that combines the privacy of physical cash with the usability of traditional finance. Payy is building the "killer app" and infrastructure needed to realize this goal. Long before "stablecoin public chains" became a hot topic, Payy began building such a public chain from scratch — because only in this way can it meet its core scenario needs. Looking ahead, innovation knows no bounds. User demand for privacy and related regulatory policies will continue to evolve, and the industry must adapt continuously. I believe Payy will continue to lead in the full-stack domain, consistently delivering innovative results.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。