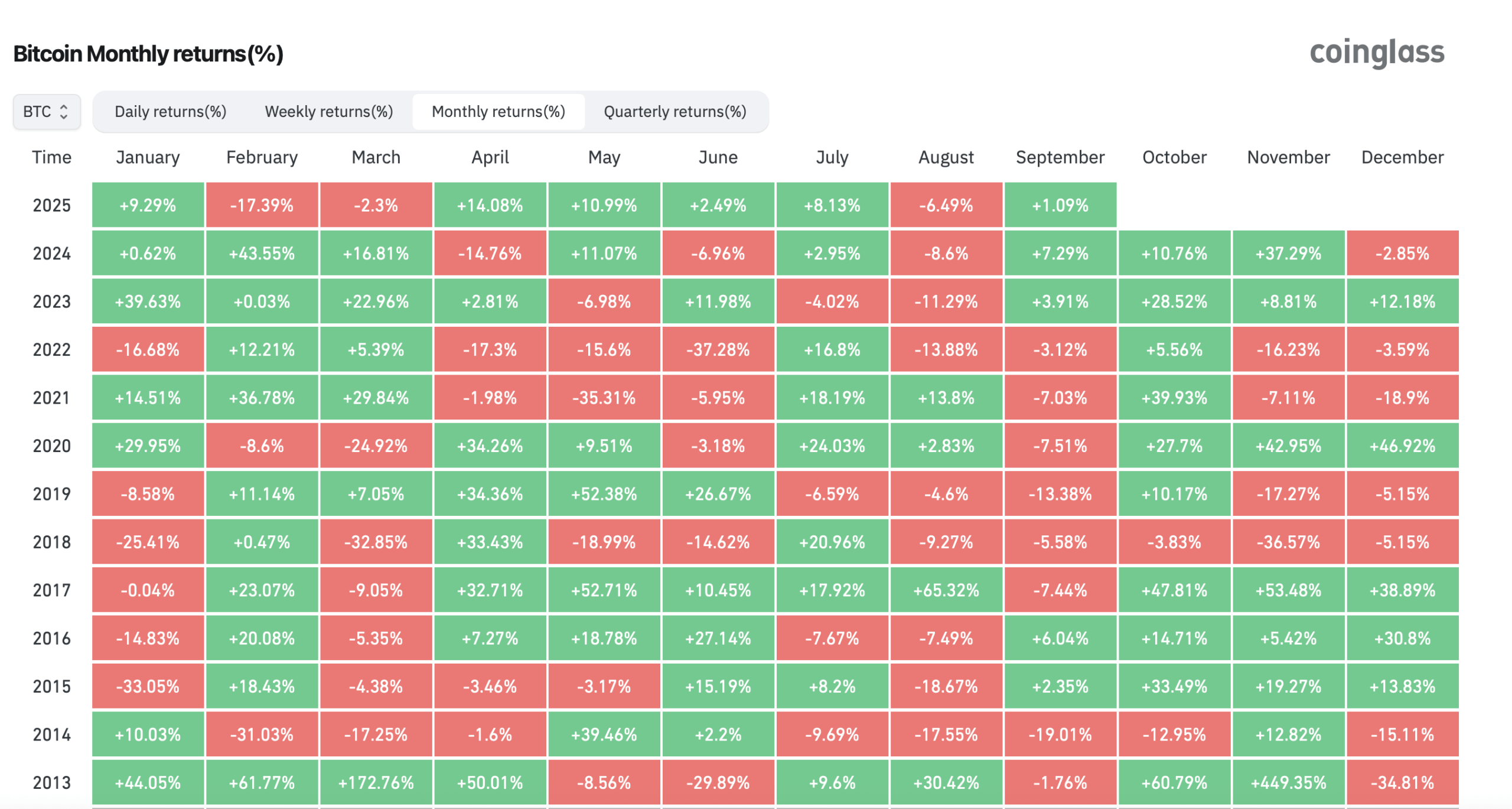

September hasn’t been a disaster, but it hasn’t been a joyride either. Over the past two weeks, bitcoin has been off about 5.5%, a reminder that even late-cycle optimism has to slog through chop. Yet with roughly a percentage point gain penciled in so far for September, according to coinglass.com’s historical figures, the community’s attention is already drifting to the month that launched a thousand green candles over the last 12 years.

Enter “Uptober,” the tongue-in-cheek shorthand for bitcoin’s historically friendly October. The term isn’t a guarantee of anything—no month is a vending machine for profits—but it’s rooted in seasonality that traders know by heart: October has often delivered, and sometimes delivered big. The result is a feedback loop—anticipation breeds positioning, positioning can breed momentum, and momentum begets more Uptober talk.

The chart you’re looking at tells the story cleanly. Since 2013, October has printed green in 10 of the last 12 years. Big years leap off the Coinglass chart: 2013 (+60.79%), 2015 (+33.49%), 2017 (+47.81%), 2020 (+27.7%), 2021 (+39.93%), and 2023 (+28.52%). Even the “modest” wins—2016 (+14.71%), 2019 (+10.17%), 2022 (+5.56%), and 2024 (+10.76%)—delivered tidy Q4 tailwinds.

There are exceptions worth remembering: 2014 (-12.95%) and 2018 (-3.83%) prove October can bite. If September often plays the villain in bitcoin folklore, 2025 is more of a gray hat. The chart’s September cell for 2025 sits around +1.09%, a low-drama finish that leaves neither bull nor bear with total bragging rights. But to Uptober fans, that’s a workable hand: no blow-off top to cool, no capitulation hangover to heal—just a market that feels reset enough to attempt a push.

Why does October tend to shine? Seasonality won’t hand you a single tidy cause, but a few patterns recur. Q4 appetites rise, crypto discourse gets louder, and traders rotate from summer’s lull into allocations with a little more heat. The meme matters, too: when enough desks expect October to lean green, liquidity often meets the narrative halfway. That doesn’t make it fate; it does make it a setup.

Context, of course, still rules. Today’s bitcoin spot price, around $109,394, sits 11.9% below the year’s highs but nowhere near panic. Open interest (OI), funding, and breadth will decide whether Uptober acts like a trampoline or a treadmill. Bulls will argue that past Octobers frequently launched multiweek advances, and the historical cells back their optimism. Bears will counter that history is descriptive, not prescriptive, and that a single macro wobble can knock the calendar off script.

The other important lesson from historical metrics: even “good” Octobers vary wildly in magnitude. A +5% month (see 2022) feels very different from a +30% heater (see 2015 or 2021). That range alone should keep risk managers humble. If you enter October expecting fireworks every session, the quiet days may feel like failure and the red days like betrayal. If you enter with a plan, Uptober’s variability becomes an ally instead of a trap.

For bitcoin traders, that plan usually means letting the market confirm the story. Breakouts that hold on expanding participation, constructive retests, and higher lows on pullbacks—those are the Uptober checkpoints that matter more than the meme. If bitcoin can defend support while buyers press into early-month resistance zones, the case for a sustained October climb improves. If it can’t, Uptober can turn into “Octover” fast.

Remember, there were two red Octobers since 2013 up until today. In 2014, bitcoin was decisively lower, and 2018 dribbled negative—neither cared that the month had a special nickname. Seasonality is a nudge, not a safety net. If September’s late-month softness persists into early October, the first order of business will be absorption, not acceleration. The history book won’t catch your stops.

Still, it’s easy to see why the crowd is excited. Ten green Octobers out of 12 since 2013, multiple double-digit climbs, and a habit of kick-starting Q4—all of it gives Uptober its charm and legacy. Pair that history with a price that’s cooled from summer peaks and you have a narrative traders can work with: cautious optimism, not blind faith; tactical aggression, not reckless bets.

So yes, Uptober is almost here, and the calendar is on the bulls’ side—statistically speaking. But markets don’t rally because a meme asks nicely; they rally because bids outgun offers in real time. If bitcoin can turn that +1% September foothold into higher highs next month, Uptober will earn its nickname yet again. If not, chalk it up as another chapter in crypto’s favorite seasonal guessing game—and keep your risk sane while the internet posts pumpkin emojis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。