Why the Bitcoin Bear Market May Be Stronger Than Investors Realize

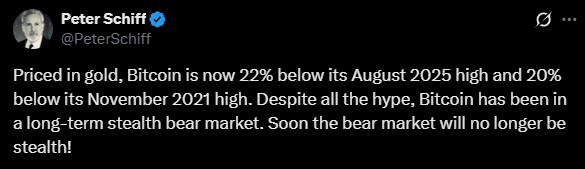

Is Bitcoin truly in a bull run, or has the crypto king been hiding in a long-term bear market all along? New data priced in gold suggests that the excitement may have overshadowed a deeper reality: ₿ -coin has been quietly declining in strength for years. Putting pressure on Bitcoin Bear Market side, chief economist and global strategist Peter Schiff, expresses his views through social media handle on X.

Source: X

Why Is The Analyst Calling This a “Stealth Bear Market”?

Schiff placed this term as the coin is currently 22% below its August 2025 high when measured in gold, and 20% below its November 2021 peak. While dollar prices above $100K sound impressive, in terms of real value preservation, Bitcoin-has losing grounds.

This raises an important question: If BTC is supposed to be a hedge against inflation, why is it underperforming against gold, the classic safe-haven asset?

Current Market Snapshot: Where Does BTC Stand?

The “Golden Asset” is currently trading around $109,646 with a market-cap of $2.18 trillion. Around the clock volume shows a good sign with 26.5% up.

Source: CoinMarketCap

Despite a trillion-dollar market-cap, bitcoin’s current performance suggests that traders are cautious, with volumes rising but price momentum stuck in a narrow band.

What Could Affect BTC’s Future Price?

1. Regulator Decisions

Regulators globally are stepping up their focus on crypto. SEC probes, ETF approvals, and new regulations may have a direct effect on Bitcoin's demand.

2. Institutional Adoption

Large asset managers such as Vanguard are considering crypto ETFs that may introduce multi-billion inflows. Conversely,ETF outflows recently imply some of the large players still are apprehensive.

3. Macroeconomic Factors

Central bank actions, U.S. rate decreases, and Japanese monetary policy decisions may influence the coin's position as a risky asset.

4. Technology & Upgrades

Future Stacks "Satoshi Upgrades" will enable DeFi on Bitcoin, which should boost its overall utility.

5. Market-Sentiment

The Fear & Greed Index sits at 34 (Fear), indicating investors are cautious. Historically, this fear has tended to pave the way for accumulation, but also indicates short-term vulnerability.

Historic Market-Trends: How Bitcoin Dominance Shifted

-

2017 ICO Boom: BTC dominance dropped to 38% as Ethereum and ICOs grabbed the focus.

-

2018 Bear-Market: Bitcoin-dominance recovered to 70% as altcoins collapsed.

-

2020–21 Bull Run: BTC hit $63K, but DeFi and NFTs lowered dominance below 50%.

-

2022 Crash: Terra and FTX crashes reduced dominance to 45%.

-

2024-25: Spot ETFs and U.S. Bitcoin Reserve lifted dominance to ~55%.

Looking at these flows the question is sure: Will BTC repeat history and bounce back stronger, or stay stuck in prolonged bear phase?

Conclusion: The Bear Market Can No Longer Be Ignored

Bitcoin’s long-term weakness against gold signals that the bear-market is no longer hidden. With regulatory battles, ETF flows, and global macro factors shaping its path, the next chapter of the golden asset will depend on whether investors see it as a true hedge or just another risky asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。