Author: Frank, PANews

The token XPL of the Plasma project has attracted widespread attention in the market since its launch on the night of September 25. Unlike the previous "scattergun" airdrops in the crypto world that often cover hundreds of thousands of addresses, Plasma has adopted a completely opposite "elitist" strategy. It has created an astonishing wealth effect for a small number of early participants through a high-threshold public presale and high-value targeted airdrops.

This model not only allowed the project to achieve strong price performance and positive community reputation in the early stages of its launch but also sparked profound reflections within the industry regarding future airdrop mechanisms: will we say goodbye to "haircutters" and witch attacks, and shift towards rewarding real capital and deep contributors? PANews delves into the token acquisition methods of XPL, on-chain data performance, and the potential industry insights behind it.

According to PANews' investigation, there are three ways for users to obtain tokens on-chain during Plasma's TGE event. First, by participating in the public presale in July, which had a total allocation of 1 billion XPL tokens at a cost of $0.05 per token. Second, there are airdrop rewards similar to "sunshine" airdrops, where the conditions for obtaining these tokens are for small depositors who completed the Sonar (by Echo) verification and participated in this sale. The third method involves an unknown airdrop, where a total of 178 addresses received tokens, with allocation amounts ranging from 1,250 to 45,000 tokens, totaling approximately 3.3 million XPL distributed.

Public Offering Frenzy: A Wealth Feast Tailored for Whales

From the public offering data, a total of 3,021 public addresses received tokens, with a total amount of approximately 987 million tokens claimed, accounting for 98.7% of the total. A significant characteristic of this public offering is that it is dominated by large holders, with very few retail investors.

The average number of tokens claimed per public address is 670,000, calculated at the highest price of $1.45 after issuance. The average amount that these public addresses can claim reached $970,000, nearly approaching a million dollars per person.

Among them, 166 addresses claimed more than 1 million tokens, totaling 796 million tokens, accounting for 80% of the entire public offering scale. There are 18 addresses that received more than 10 million tokens. These 18 addresses collectively received over 377 million tokens, accounting for more than 37% of the public offering amount. The highest single address claimed 54.08 million tokens, valued at approximately $78.41 million at the highest price.

There are about 883 addresses that claimed fewer than 1,000 tokens, and this group only received approximately 246,000 tokens in total.

Based on the initial on-chain investment amount, the cost price for this public offering was $0.05 per token, with a maximum price of $1.45, resulting in a maximum increase of about 29 times. This has allowed many KOLs to earn substantial profits; for example, KOL CBB, who ranked third in this round of claims, initially invested about $1.71 million. Ultimately, he claimed over 34 million tokens, with a maximum value of $49.63 million, achieving a profit of $47.92 million. As of September 26, CBB has transferred approximately 74.6% of the tokens.

Another case is HongKongDoll, whose initial investment was $50,000, with a maximum return of $1.35 million. As of September 26, all XPL tokens in her on-chain address have been transferred.

For these large holders, this public offering of XPL seems to have become a threshold airdrop. Therefore, when KOLs showcase their token quantities on social media, they almost all receive unanimous praise and envious looks from the community.

Targeted Airdrop: "Directed Gifts" Under "Sunshine"

In addition to the public offering, the Plasma official also arranged two types of airdrops, one in collaboration with Binance to distribute 100 million tokens through subscriptions to Plasma USDT fixed products.

The other method is a direct on-chain airdrop to early users who participated in on-chain deposits. From the data, the amount of XPL airdropped is not large. The total amount distributed to users in this airdrop is 25 million tokens, with a maximum value of approximately $36.25 million.

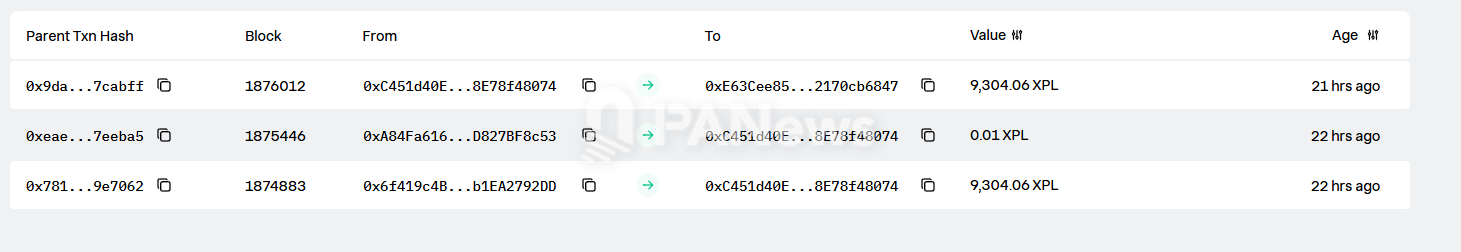

However, since each user received 9,304 tokens, with a maximum value exceeding $13,000, any user who received the airdrop would feel it was a significant income. A total of 2,687 addresses received this airdrop. Among them, 2,603 addresses also participated in the XPL public presale. This means that the actual XPL airdrop can essentially be considered an additional gift for early public offering users.

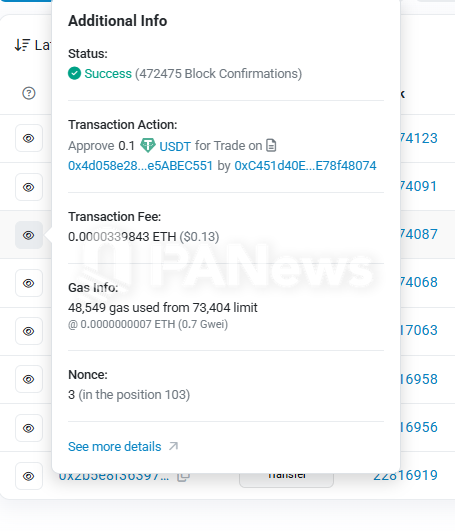

Additionally, there has been much discussion on social media about whether depositing $1 in Plasma to receive 9,304 tokens is the highest cost-performance airdrop in history. Is this situation real? From the data, there are indeed users who deposited as little as $0.1 and ultimately received 9,304 tokens in the airdrop. This results in a return rate of up to 134,000 times, which may be higher than the most hyped MEME coins.

After the public offering shares and airdrop claims, the price of XPL did not experience concentrated selling leading to a decline. Instead, it rose against the trend, leaving a deep impression on the market. Many users believe that the reason for this increase is that the main targets of this public offering or airdrop are large holders, who generally have more investment patience compared to retail investors.

However, from the actual data situation, by the afternoon of September 26, 71.9% of the claimed tokens had already been transferred on-chain, and these tokens may have been directed to exchanges, with some being organized into new wallets. There are 37 wallet addresses that not only did not reduce their holdings but chose to increase their positions, with a total increase of over 2.2 million tokens. There are 618 addresses (approximately 18.8%) that have chosen not to move, with no token transfer activities.

Mysterious Distribution and Market Insights: KOL's "Red Packet" and New Airdrop Paradigm

Compared to previous mainstream interactive airdrops, Plasma's alternative airdrop scheme has indeed received good results.

Although the number of airdrop slots claimed is significantly reduced from previous projects, dropping from millions to just a few thousand, the amount of airdrop per individual address has achieved a higher level. Without testing the interaction process, there is no longer a situation where many interactions but little funding leads "haircutters" to feel unfair. Moreover, since users who received the airdrop generally obtained public offering shares, their profit potential far exceeds the airdrop amount, making the airdrop amount feel more like a commemorative prize, where the quantity is not the core interest.

Therefore, most of the comments visible on social media are about sharing gains and regretting not participating in the interaction, with almost no complaints. Among the various airdrop interactions previously counted by PANews, perhaps only Hyperliquid's situation can be compared to this.

Looking back at the airdrop shares, the Plasma official contributed approximately 128 million tokens, with an airdrop scale of about $185.6 million, which is much less than Magic Eden, Berachain, and Hyperliquid. However, from the perspective of reputation and token performance, it has gained more.

This seems to provide a new idea for subsequent TGE projects, which is to no longer use free interactions as a condition for airdrops but to set a certain investment threshold as the standard for airdrops. This not only solves the problem of many relying on interactions to "harvest" but also achieves higher returns per individual address. Although the airdrop scale or interaction data may not be as eye-catching, it can receive more positive feedback in terms of community reputation and market performance. Perhaps this generous airdrop and strategy formulation is a reflection of the Plasma team's pain from airdrops, especially since Blast stirred the market with complex airdrop strategies but quickly failed after the airdrop.

In summary, Plasma's token issuance is a carefully planned, successful experiment that runs counter to mainstream airdrop models. By concentrating chips in the hands of a small number of capital whales and core contributors, it not only effectively avoids witch attacks and concentrated selling pressure after launch but also gains excellent community reputation and market attention through an astonishing wealth effect.

Although this "disdain for the poor and love for the rich" model raises questions about fairness, its powerful effectiveness demonstrated in the early stages of the project undoubtedly provides the entire industry with a new thought-provoking perspective—future airdrops may no longer be a free lunch but a value coronation for real capital and deep participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。