Written by: Web3 Farmer Frank

Why has Based Rollup, regarded as the "orthodox" solution for Ethereum's scalability, always been "praised but not adopted"?

On one hand, it achieves the most thorough alignment of security and decentralization with the mainnet by returning the ordering rights to L1, but on the other hand, it has to endure a confirmation delay of up to 12 seconds, which almost deters high-frequency trading and real-time financial scenarios.

This is why Preconfs has been proposed as a necessary patch for Based Rollup, attempting to smooth out the delay with sub-second transaction commitments, but for a long time, Preconfs has mostly remained in a small-scale, non-standardized exploratory phase, lacking a unified mechanism and stable returns, and has never truly scaled.

Recently, Puffer Finance launched the Ethereum security infrastructure product "UniFi AVS," which finally attempts to upgrade Preconfs from a temporary performance patch to a reusable standardized infrastructure, aiming to provide sub-10ms confirmation speed and introduce institutional design at the security and economic incentive levels.

This article will analyze the core capabilities, technical pathways, and ecological impacts of UniFi AVS from the perspective of an industry observer, and discuss whether it can truly become a key variable for Based Rollup—and even the broader Ethereum Rollup ecosystem.

1. UniFi AVS: Preconfs, No Longer Just a "Patch"

To understand the significance of this upgrade, we need to revisit the core logic of Based Rollup.

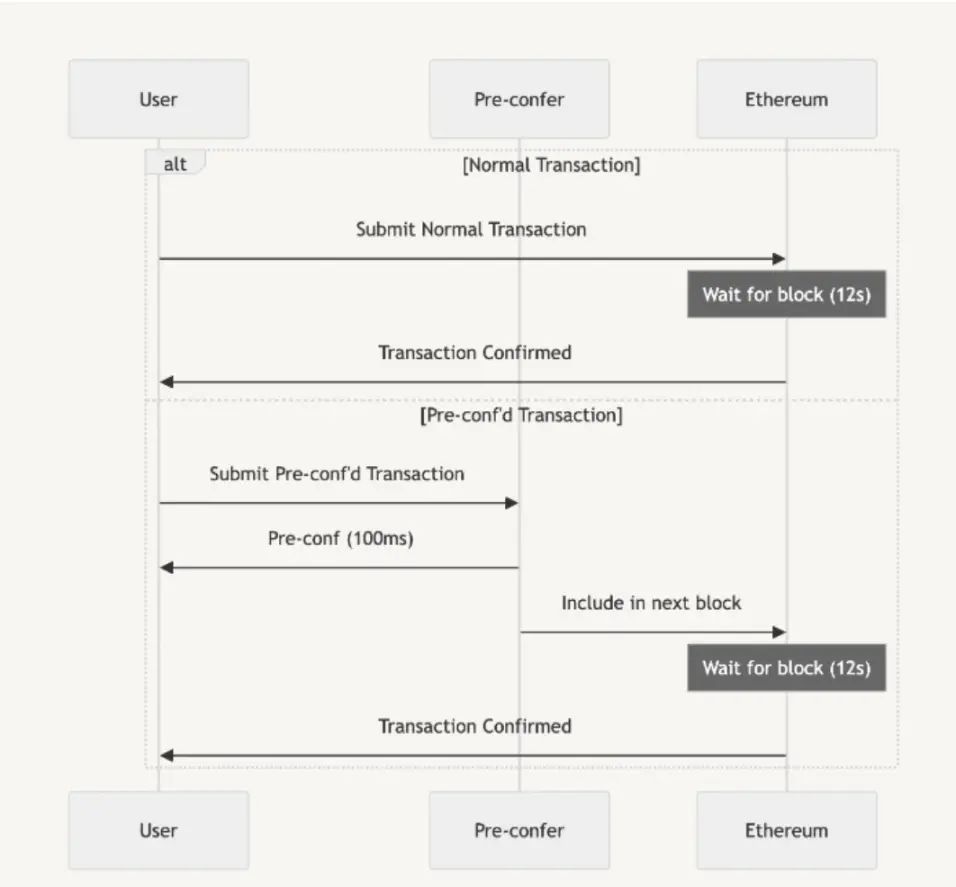

In the narrative of Ethereum's scalability, Based Rollup completely aligns with the mainnet in terms of security and decentralization by returning the ordering rights to L1 validators, but it also brings an unavoidable trade-off—while inheriting the mainnet's security, it also incurs about 12 seconds of block confirmation delay.

To address this, Preconfs has become a necessary patch for Based Rollup, responsible for providing users with transaction execution commitments before the transaction is actually submitted to L1 (see further reading: “Understanding Puffer UniFi AVS: From Preconfs to the Next Decade of Ethereum?”). It can be said that to fully realize the potential of Based Rollup, a permissionless, neutral, and flexible pre-confirmation service must be achieved.

However, for quite a long time, Preconfs has mostly remained in a "small workshop" stage (non-standardized, peer-to-peer solutions), typically run by a few nodes or project parties, lacking unified standards and stable revenue models. If the nodes responsible for pre-confirmation go offline or act maliciously, transactions may fail or even suffer from MEV attacks, leading to serious reliability and sustainability issues.

The UniFi AVS launched by Puffer is a systematic solution to this dilemma. It no longer treats Preconfs as a temporary patch but upgrades it to a callable infrastructure layer, with the core idea being to reconstruct Preconfs as a standardized cloud service akin to AWS.

Specifically, UniFi AVS starts from three main lines, not only allowing Based Rollup to run faster but also ensuring sustainable returns and institutional guarantees in security mechanisms:

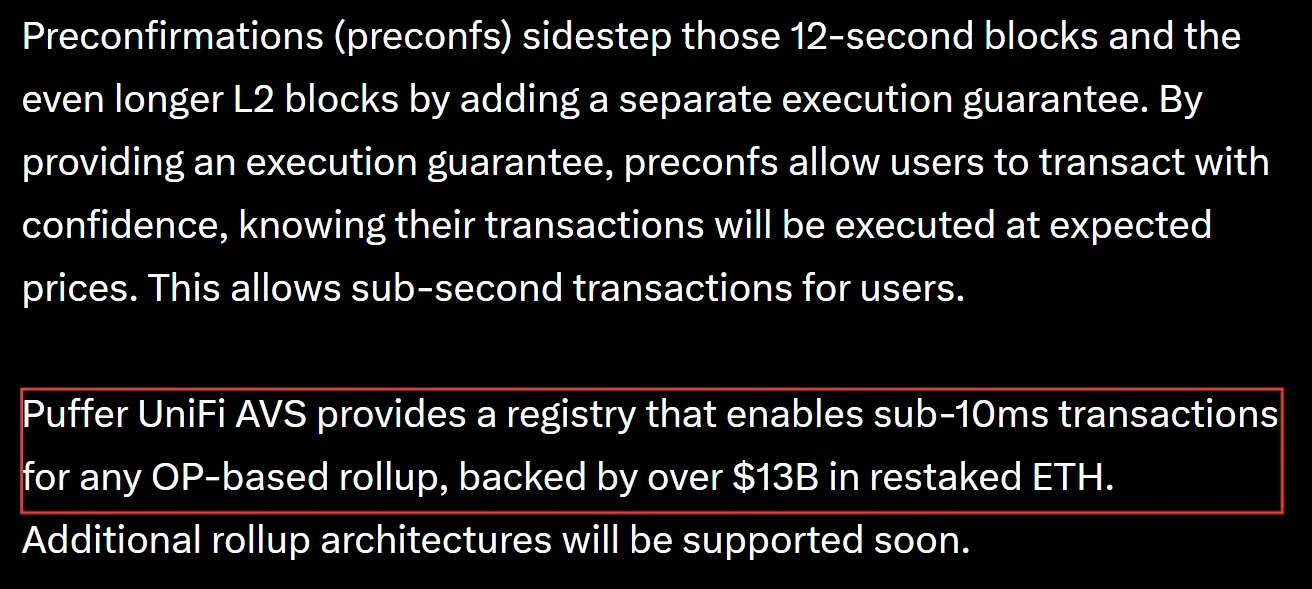

- Performance-wise, it compresses transaction confirmation to sub-10ms, providing an instant user experience comparable to Solana or even centralized exchanges;

- Economically, through a profit-sharing mechanism at the protocol level, it allows Rollup to no longer "work for L1" but to share profits with validators and gateways;

- In terms of security, relying on the collateral of up to $13 billion in Restaked ETH and a slashing mechanism, it transforms "verbal commitments" into "costly contracts," creating institutional constraints;

For developers and Rollup projects, the emergence of UniFi AVS means they no longer need to design and maintain complex ordering and confirmation logic themselves, but can directly access a verified pre-confirmation infrastructure like calling AWS cloud services—plug-and-play, on-demand scaling, allowing them to focus more on products and users.

This modular design also makes it possible for Preconfs to be further productized and generate spillover effects—not only can Rollup project parties avoid reinventing the wheel, but in the future, wallets, DApps, and upper-layer protocols can also access it through standardized APIs, uniformly enjoying the capabilities of "instant confirmation + economic alignment + security guarantees," truly turning "speed and stability" into a public foundational service of the Ethereum ecosystem.

From this perspective, UniFi AVS allows Preconfs to transcend the positioning of a mere performance patch, standardizing performance, returns, and security all at once, promoting its transition from an additional feature to a middle-layer infrastructure for Ethereum's scalability, paving a more sustainable path for the large-scale implementation of Based Rollup.

It is worth noting that Puffer also emphasizes that the applicability of UniFi AVS is not limited to Based Rollup; from a design perspective, its registry mechanism can also provide sub-10ms instant confirmation capabilities for any OP Stack Rollup and plans to support more Rollup architectures in the future. In other words, it is positioned as a universal pre-confirmation infrastructure with cross-architecture potential.

Of course, whether all Rollups are willing to cede Sequencer profits to AVS remains uncertain, and it can even be asserted that it will be difficult to achieve in the early stages—after all, the sequencer is never just a technical issue but a deeply intertwined problem of interest distribution:

In the L2 economic system, who is responsible for dividing the cake, who is planned to receive it, and how should it be divided?

Therefore, whether Preconfs will ultimately evolve into a public standard for the entire Rollup ecosystem or primarily serve the Based path is not only a choice of technical route but also a game of business models and interest distribution, which will undoubtedly be a question that needs continuous observation in the coming years.

2. How is Preconfs Reconstructed as Standardized Infrastructure?

Objectively speaking, since the concept of Rollup was proposed, Ethereum's scalability has lacked not the concept but the engineering implementation capability.

After all, for a technology to evolve from a clever "function" to a robust "infrastructure," it usually needs to meet three core conditions: clear service commitments, reliable security guarantees, and sustainable economic models.

In other words, it must transition from a technical concept to "engineering" implementation, which is the only way to truly meet the conditions for large-scale operation. Puffer's UniFi AVS approach is largely similar—reconstructing Preconfs from scattered small-scale attempts into reusable, scalable infrastructure with economic incentives.

In other words, how to make Preconfs no longer a "temporary commitment" of certain nodes but designed as a standardized network service.

1. Execution Preconfs: From "Inclusion Guarantee" to "Execution Guarantee"

The first step is to achieve the upgrade from Inclusion Preconfs to Execution Preconfs.

In the traditional Inclusion Preconfs model, users are only promised that their transactions will be included in a block, but the state during transaction execution cannot be guaranteed, so users may still encounter price slippage or even MEV front-running.

Execution Preconfs further upgrade to "execution guarantees," ensuring that transactions will be executed in the state at the time of user submission—once a user places an order, the state will be locked, and the transaction will only execute under that state; otherwise, it will not be valid.

For example, if you place an order to buy ETH at a price of 4400 USDC:

- In the Inclusion model, by the time the transaction is executed, the market price may have changed to 4410 USDC, and it will still be executed, but the execution price is not what you expected at 4400;

- In the Execution model, regardless of market fluctuations, the system will guarantee the execution price of 4400 USDC, and the transaction will only execute if this condition is met;

This upgrades Preconfs from a "pre-entry ticket" to "deterministic execution," significantly enhancing user experience and providing stronger reliability for price-sensitive financial applications such as DeFi, derivatives, and payments.

2. Gateway Architecture and Frags Technology: Compressing Delay to Below 10 Milliseconds

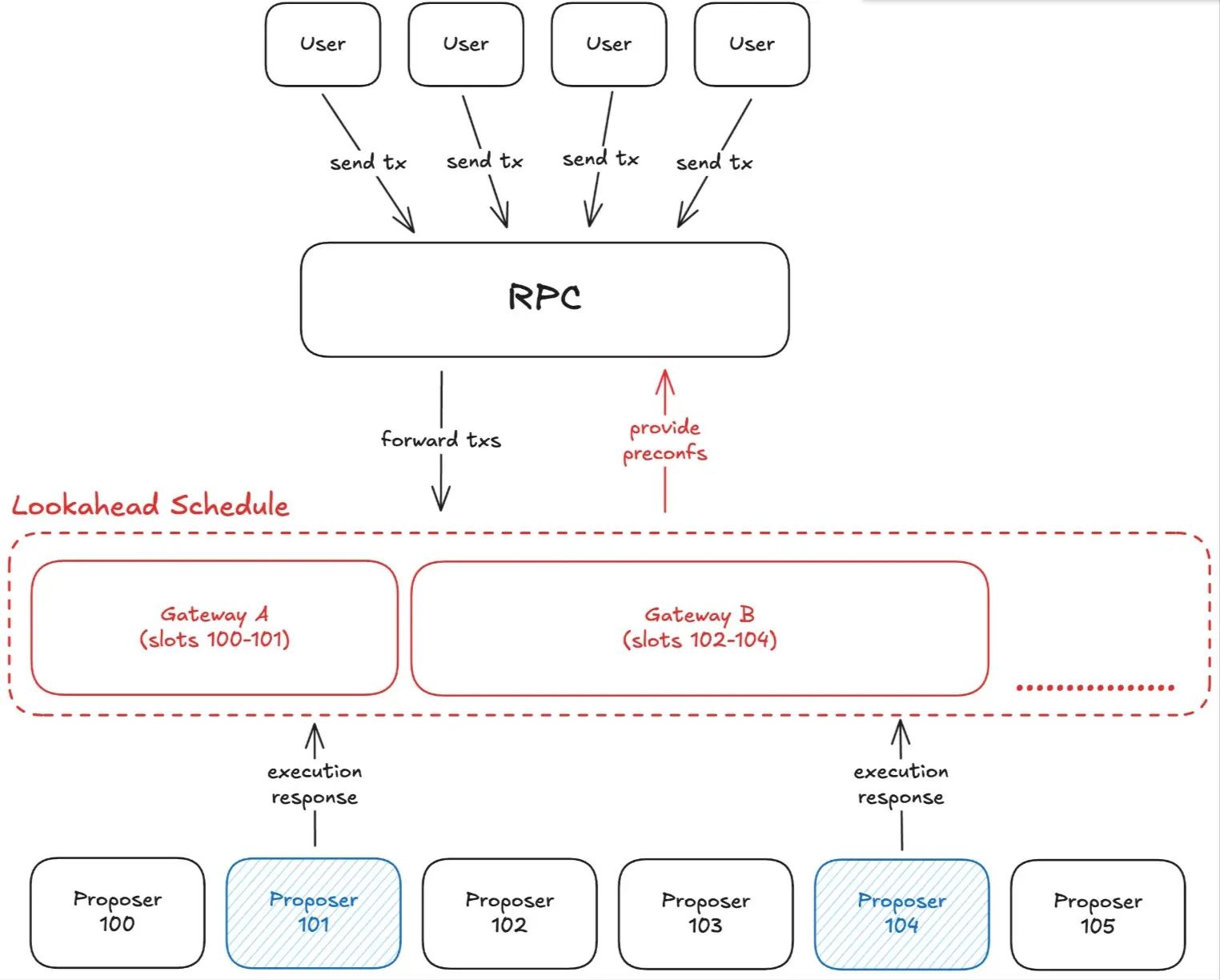

Puffer also introduces a Collateral-backed Gateway architecture (pioneered by the Gattaca team), allowing L1 proposers to delegate pre-confirmation execution rights to more specialized Gateways.

By leveraging frags (block fragments) technology and a lookahead mechanism, Gateways can process transactions in advance before the actual block is created, shortening the window of state transition. Theoretically, under optimal configurations, transaction delays can be reduced to below 10 milliseconds (sub-10ms).

This results in a user experience that can theoretically reach the level of high-performance public chains like Solana.

3. Restaked ETH Security Endorsement: Making Commitments "Costly"

Past Preconfs largely relied on the "self-discipline" of nodes; once they went offline or acted maliciously, users had almost no compensation mechanism.

The upgraded version by Puffer utilizes EigenLayer's restaking mechanism, allowing each Gateway to be backed by staked ETH from validators (phased implementation)—if a node becomes inactive, it may be penalized 1 ETH; if it maliciously extracts MEV or violates commitments, it may trigger slashing at the level of 1000 ETH.

Unlike PoS penalties, the slashed ETH from Preconfs will compensate users who utilize the Preconf service, directly enhancing economic alignment. This transforms the previously soft commitments that relied on node reputation into hard commitments constrained by a clear slashing mechanism, significantly increasing institutional constraints.

At the same time, Puffer has established the Canonical Preconf Gateway Registry to ensure that all Gateways enter an orderly, public, and verifiable registration system.

4. Programmable Revenue Sharing: Institutionalized Multi-Party Value Distribution

Having speed and security alone is not enough; for Preconfs to become infrastructure, they must also operate sustainably.

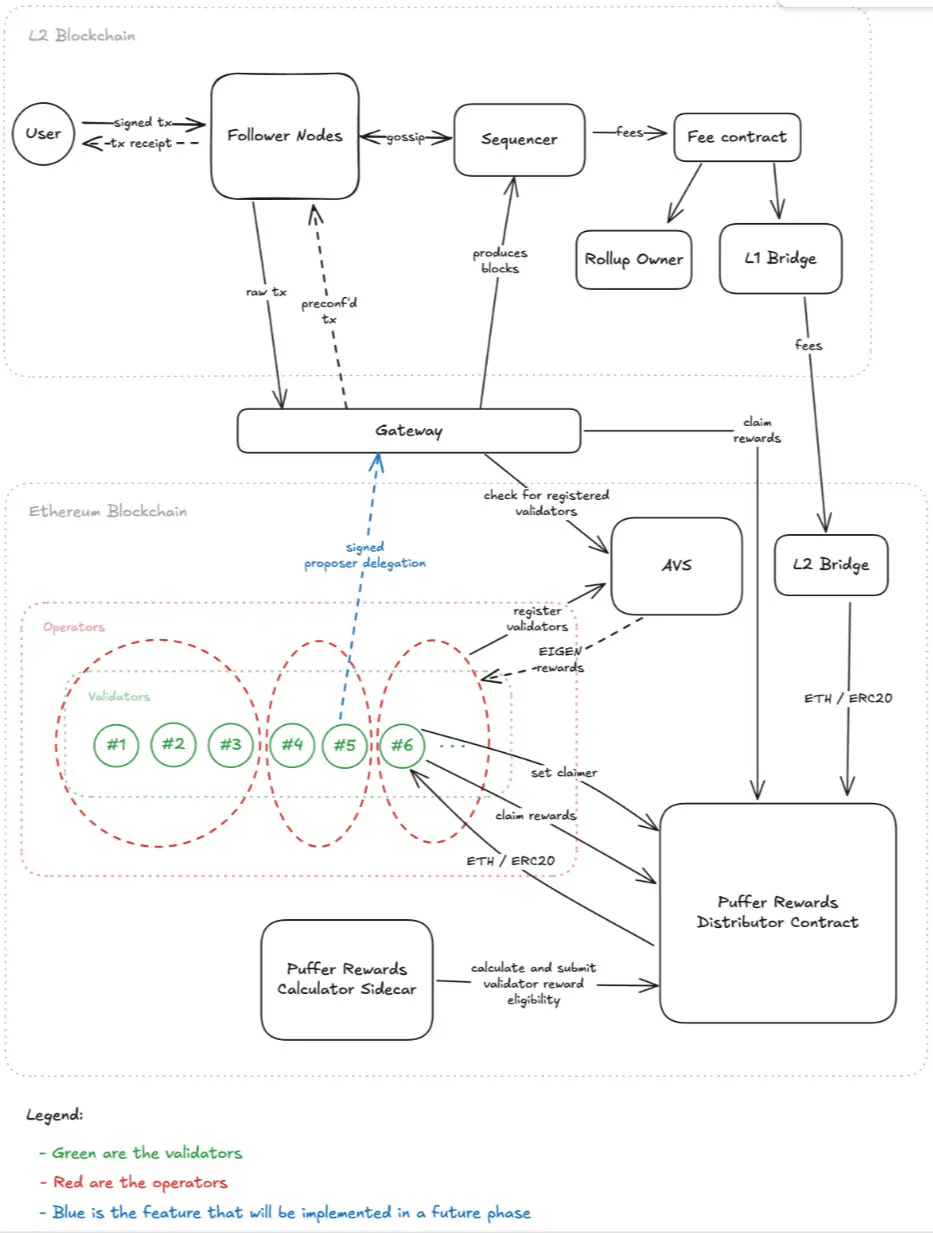

To this end, the upgraded UniFi AVS includes a Rewards Distributor that allows for flexible revenue distribution among Rollup teams, Ethereum proposers, and Gateway providers, achieving programmable revenue sharing at the protocol level:

- Rollup Teams: Retain a portion of transaction fees, no longer "working for L1";

- Ethereum Proposers (Validators): Earn additional income by providing Preconfs;

- Gateway Providers: Receive incentives for running the network, ensuring service stability;

Thus, revenue sharing is no longer a temporary agreement but a system written into the protocol and executed automatically, forming a long-term closed loop of economic alignment among Rollups, validators, and Gateways.

This multi-dimensional mechanism design is key to Preconfs transitioning from a single-point solution to a scalable and reliable public infrastructure.

3. The Beneficiary Landscape Under Multi-Party Game Theory

Any infrastructure upgrade is not just a technical evolution but also a redistribution of interests.

What makes UniFi AVS special is that it binds performance, security, and economic incentives together, allowing multiple ecological roles to find value within the same mechanism—from Rollup project parties to Ethereum validators, developers, and end users. It transforms Preconf from a patch into a sustainable modular service, enabling all participants to benefit from a stronger vessel.

First and foremost are the Rollup project parties, who gain a dual unlock of performance and revenue.

In the past, Based Rollup was often criticized for being "slow and unprofitable," especially as its economic model almost entirely favored L1 validators. With the Execution Preconfs of UniFi AVS, Rollups can plug and play to achieve sub-10ms confirmation speeds, significantly enhancing user experience.

At the same time, the revenue-sharing mechanism at the protocol level allows Rollup teams to retain some economic benefits without relying entirely on external subsidies. For project parties, this represents a dual dividend of speed enhancement and revenue sharing.

Next are the Ethereum validators/Restakers, who reap new sources of income.

Since L1 validators are the direct executors of Preconfs, by participating in UniFi AVS, validators can earn new Preconf service revenue in addition to traditional block rewards.

Moreover, Restaked ETH not only provides security backing but also increases the profit opportunities for validators, which in turn enhances the attractiveness of staking ETH, thereby strengthening Ethereum's overall economic security. This transforms validators from merely running nodes into "providing value-added services and obtaining additional income."

Additionally, Gateway providers have had their roles formally institutionalized in this upgrade.

Puffer has established the Canonical Gateway Registry, making Gateways standardized nodes within the network rather than temporary roles. Once they obtain delegation rights, Gateways can achieve pre-confirmation below 10 milliseconds by running frags technology and lookahead mechanisms;

Their services are directly linked to economic incentives and are subject to slashing mechanisms, which means they have both revenue and costs, transforming Gateways from "volunteers" into genuine infrastructure service providers.

Meanwhile, developers can enjoy lower barriers and greater composability.

In the past, developers often had to build complex mechanisms themselves to achieve instant confirmation on Rollups, which was time-consuming and difficult to standardize. The upgraded UniFi AVS, through modular APIs, allows developers to access instant confirmation capabilities as easily as calling cloud services.

Whether for DEXs, derivatives protocols, or high-frequency GameFi applications, they can quickly enjoy the experience improvements brought by sub-10ms confirmations. This not only reduces the costs of building infrastructure but also minimizes the risk of MEV theft, allowing developers to focus more on application-layer innovation.

Finally, ordinary users are the most direct beneficiaries, experiencing for the first time a Solana-level or even close to CEX-level smooth experience on Ethereum Rollups:

- In terms of speed, transaction confirmation time is reduced from 12 seconds to 10 milliseconds, rivaling centralized exchanges;

- In terms of certainty, Execution Preconfs guarantee price locking at the protocol commitment level, avoiding slippage and front-running;

- In terms of security, the Restaked ETH backing and slashing mechanism make commitments "costly," allowing users to receive compensation in case of default;

From a higher perspective, the upgrade of Puffer UniFi AVS is not just a product evolution but also establishes industry standards for Preconfs, transforming them from patches to infrastructure, and even into standardized middle-layer services for Ethereum.

This not only enables Based Rollup to genuinely achieve the possibility of being fast, profitable, and secure but also reinforces Ethereum's long-term narrative as a Security Settlement Layer.

In Conclusion

Looking back at Ethereum's scaling process over the past five years, Rollup has undoubtedly been the main storyline, but finding a truly feasible balance among performance, economics, and security—the "impossible triangle"—has always remained unresolved.

Especially for Based Rollup, the "orthodox scaling path" of Ethereum has been stuck on the last piece of the puzzle for scaling and commercial operation. Therefore, objectively speaking, the launch of UniFi AVS by Puffer can be seen as one of the highly feasible explorations to complete this puzzle.

The deeper significance lies in its potential to outline a clear "endgame" for the future of modular blockchains: any emerging Rollup can build directly on top of UniFi AVS without reinventing the wheel, quickly achieving performance experiences comparable to Solana, security at the level of Ethereum's mainnet, and a self-consistent economic model.

However, whether it can ultimately become an industry consensus depends not only on the robustness and openness of its design but also on its ability to find the optimal balance in the complex Rollup ecosystem and multi-party interest games.

Thus, for the industry, it serves as a key observation window in the next one to two years to measure whether the Based Rollup narrative can truly mature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。