Source: Global Rails For The Future Of Money Movement

Compiled by: Hu Tao, ChainCatcher

Money is rarely static, and the way we move money is no different.

Few things are as simple and timeless as the transfer of value between individuals. Ancient herders would exchange cattle for grain or tools when they needed them. Medieval farmers would bring a bushel of wheat to the local village market when they needed a pair of shoes. Over time, people found it inconvenient to carry bulky items and livestock while traveling, so they began using precious metals like gold and silver bars. But soon, people realized these precious metals were neither practical nor convenient, leading to gold bars being melted into coins, which were eventually replaced by paper money, promissory notes, and banknotes. As technology has become increasingly important in daily life, the way money circulates has accelerated accordingly.

Today, Americans can send digital dollars to friends in Peru or Thailand in seconds for just a penny. They cannot do this through local banks or Western Union. This borderless, low-cost, near-instant flow of funds is made possible through stablecoins.

Stablecoins are digital dollars issued and transferred on blockchain rails. They provide a stable unit of transaction in digital form: just as anyone with an email address or WhatsApp can communicate instantly worldwide, stablecoins enable anyone with internet access to transfer funds globally.

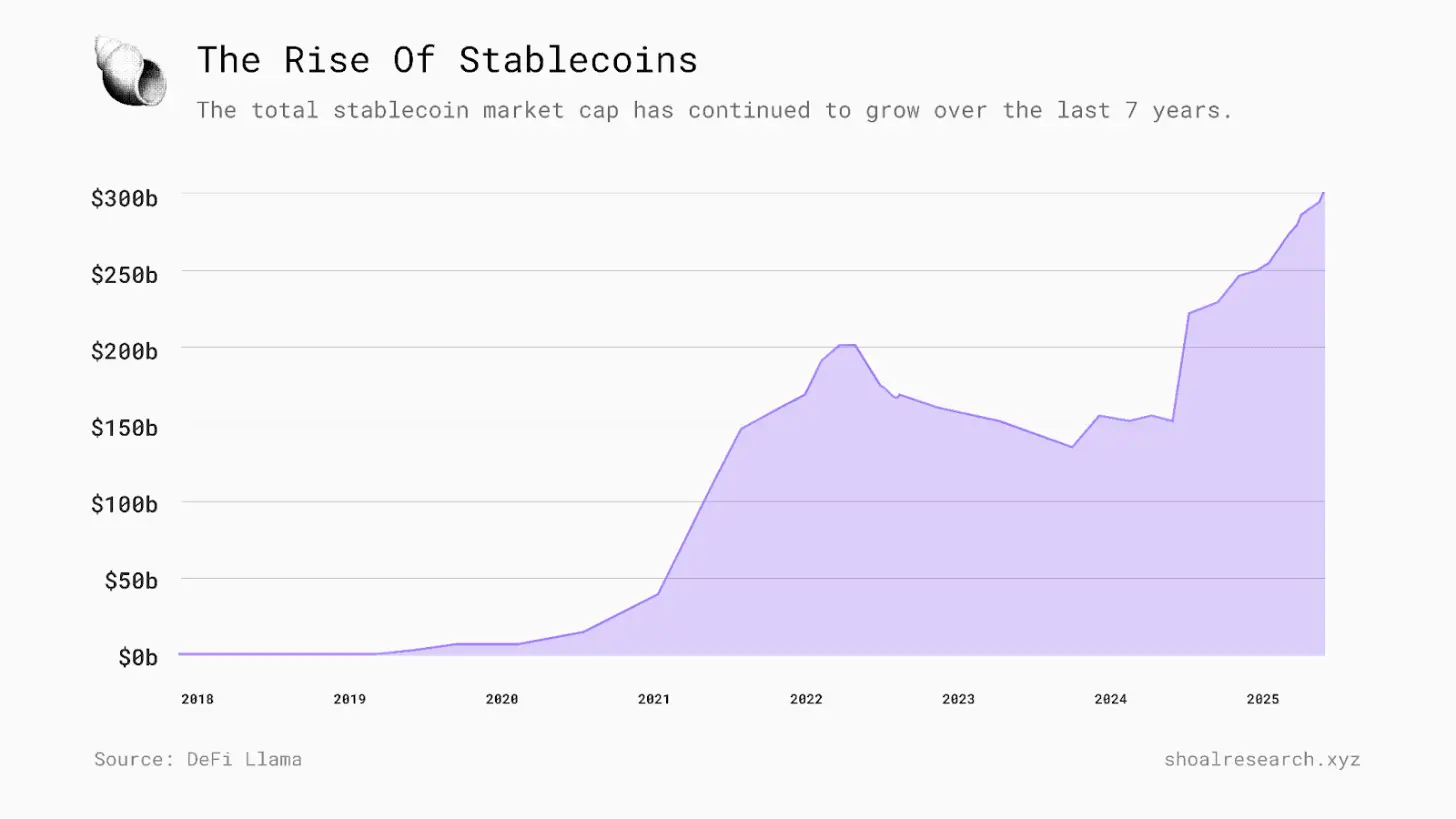

Trillions of dollars have already flowed through stablecoins. Their supply continues to grow and has reached all-time highs. Although not a new concept, the adoption of stablecoins has recently accelerated unexpectedly.

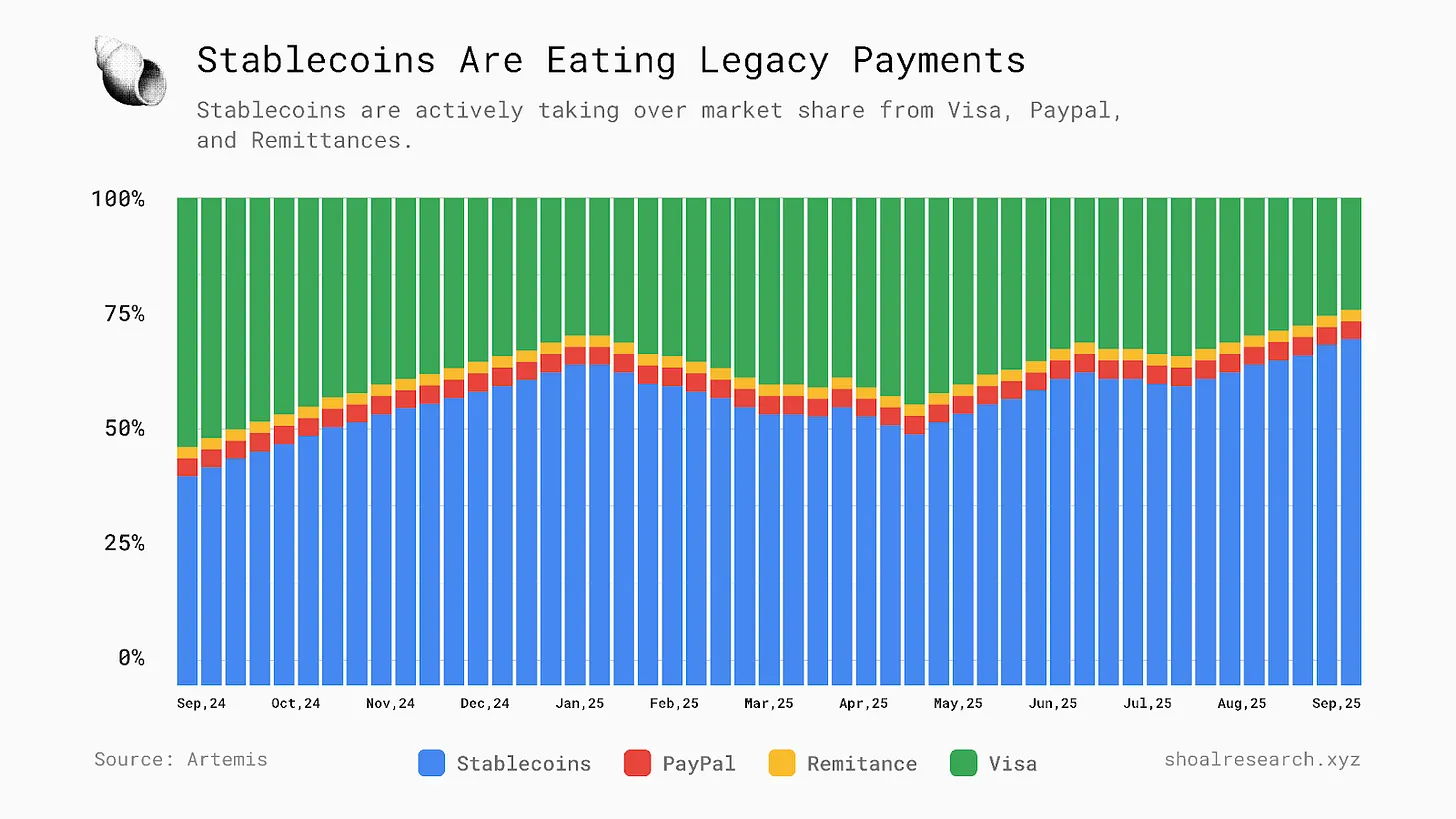

Impressively, stablecoins are not only growing but also eroding traditional payment networks.

We believe that stablecoins will inevitably permeate various sectors of the financial services system, not just payments, ultimately disrupting consumer banking, lending, B2B settlements, payroll systems, and more. But this raises a question: what is so special about these digital dollars?

Value Proposition of Stablecoins

"Tools can be created that allow end users to create currency protocol layers with stable value pegged to external currencies or commodities. This way, users of these currencies can have stable virtual currencies pegged to the dollar, euro, gold, oil, etc." — Mastercoin White Paper (2012)

Fundamentally, stablecoins are digital assets designed to maintain the value of the underlying asset to which they are pegged. The most common case is that stablecoins are pegged to fiat currencies, especially the dollar (which is why we refer to them as digital dollars). To maintain this peg and stable value, stablecoin issuers implement specific mechanisms to ensure that each stablecoin is pegged 1:1 to its underlying asset. The most common practice is to hold cash and short-term U.S. Treasury bills as reserves, matching the supply of stablecoins in circulation. For every new stablecoin issued, users must deposit dollars with the issuer. These funds are held by regulated financial institutions and custodians. When stablecoins are redeemed, an equivalent amount of funds is withdrawn from these reserves and returned to the redeemer, and the corresponding stablecoin supply is removed from circulation or "burned."

*Note: There are other stablecoin anchoring mechanisms, some represented by OG leading stablecoin protocols like Maker DAO (now Sky), which built a CDP protocol allowing anyone to borrow DAI. Conversely, there are cases like Luna/UST that faced massive failures, losing billions of dollars.

The value proposition of stablecoins is by no means singular:

Global 24/7 Settlement: Stablecoins can be transferred globally at any time of day, any day of the week. They are based on blockchain technology, designed to settle in minutes or even seconds. In contrast, traditional transfer systems like ACH or international wire transfers often take days to clear and can only be processed during limited business hours, with weekends or holidays potentially causing further delays.

Superior User Experience: Stablecoins outperform traditional payment systems in both speed and cost. On certain blockchains, stablecoin transfers can be completed in just seconds. Traditional systems like ACH or wire transfers may take hours or even several business days to complete.

Stablecoins are also several times cheaper than traditional payment networks. Stablecoin transactions are merely reallocations of digital ledger balances. The primary resource consumed is the computational power required to update balances, paid in the form of transaction fees or Gas fees. Today, Gas fees are approaching zero as low-cost transactions become the norm on most blockchains.

In contrast, wire transfers or ACH transactions involve multiple intermediaries—remitting banks, receiving banks, clearinghouses—all of which charge substantial fees for the transfer. Traditional cross-border transfers still average a 6.49% fee.

It is worth noting that while stablecoins offer near-instant and low-cost blockchain transfers, converting funds from on-chain to bank accounts or cash, known as "offramping," may still involve traditional fees, foreign exchange spreads, and delays. However, overall, even with this final step included, stablecoin-based transfers remain faster and cheaper than today's traditional networks.

Permissionless Global Access: Stablecoins inherently democratize access to stable currencies like the dollar. Anyone with an internet connection can send, receive, and hold stablecoins, regardless of whether they have a bank account or can access financial services. Despite increasing global financial inclusion, over 1 billion adults still lack bank accounts and access to formal financial services, often being excluded from the digital economy. Meanwhile, many countries still face hyperinflation and currency devaluation. By enabling permissionless global access to dollars, stablecoins provide a financial lifeline for residents in these developing regions.

Programmable: Since stablecoins are built on blockchain rails, they exist in the form of tokenized smart contracts. In short: they are code. This unique design means that specific conditions and rules (such as settlement rules, transfer restrictions, etc.) can be directly programmed into the asset itself. This programmability helps streamline operations, as writing code is easier and more predictable than anticipating human error. Moreover, since the crypto-native economy consists of a coalition of open, permissionless protocols, stablecoins can naturally integrate and enhance almost any application based on public chains: earning yields through lending or liquidity provisioning, serving as collateral for borrowing other assets, acting as margin for perpetual contract trading, betting on various quirky prediction markets, and more.

Native PMF

Unlike most other blockchain-native innovations, stablecoins have stood the test of time because the market demand for them has always existed. Their development has largely been determined by organic applications catalyzed by clear catalysts at each stage.

Trader's Best Friend

Stablecoins were initially favored by traders looking for a simple way to transfer value in and out of volatile positions without converting to fiat. In the early 2010s, there were few other uses beyond trading Bitcoin, and traders lacked a convenient way to store funds between trades.

The early mention of the stablecoin concept first appeared in the Mastercoin white paper and was put into production with the launch of Realcoin (now known as Tether) in 2014.

USDT was initially issued on Bitcoin via the Omni Layer and traded on exchanges like Bitfinex. After USDT launched, it brought new utility to cryptocurrency traders: transferring funds between assets, stabilizing volatility risk exposure, and executing more complex trading strategies without first converting to fiat and then back to cryptocurrency. However, due to its small audience, its adoption rate was quite limited.

Global Access to Stable Currency

As stablecoins matured, their influence has far exceeded the speculative market. In countries with hyperinflation, local currencies can depreciate significantly overnight, making the value of stable currencies like the dollar invaluable. Today, the best way to access dollars is through stablecoins.

Some notable data points:

In 2024, stablecoin purchases accounted for over 4% of Turkey's GDP.

In 2024, Argentina led the region in stablecoin trading volume share, with over 61% of crypto trading volume coming from stablecoins.

From June 2024 to June 2025, the amount traded via stablecoins in the Asia-Pacific region reached $2.36 trillion.

In 2025, the on-chain value in Sub-Saharan Africa (SSA) grew by $20.5 billion, reflecting a 52% year-over-year increase in cryptocurrency adoption since 2024.

Thus, stablecoins have become an essential tool for millions of people in much of Latin America, Africa, and Asia for personal savings, payments, and remittances.

Best Partner for Reserve Currency

As stablecoins gain popularity in emerging markets, their role in solidifying the dollar's global dominance has become increasingly prominent. However, while the value of accessing digital dollars is evident in emerging economies, it is harder to grasp in the West, especially in the U.S. Most Americans have savings accounts. They can make instant transfers through apps like Venmo. Few lose sleep over the fear of the dollar depreciating overnight (20-30%).

The strongest argument for U.S. policymakers to support stablecoins is geopolitical: to solidify the dollar's global dominance. For a long time, the U.S. has leveraged the dollar's status as a reserve currency to maintain global financial power, most commonly through the petrodollar system.

Today, this opportunity lies with stablecoins. The concept is simple: dollar stablecoins are almost entirely backed by cash and short-term U.S. Treasury securities, with each stablecoin issued requiring real dollar reserves. For every stablecoin minted, overseas investors choose to hold one dollar, thus becoming a new source of demand for U.S. government debt.

Some may argue that the U.S. has no choice but to embrace stablecoins. In the fourth quarter of 2024, Tether was ranked as the seventh largest foreign holder of U.S. Treasury securities, with annual inflows surpassing countries like Canada and Mexico. Tether's latest stablecoin report confirms that Tether holds over $127 billion in U.S. Treasury securities, making it one of the largest non-sovereign holders of U.S. government debt.

This dynamic is reshaping policy. The U.S. recently passed the landmark Stablecoin Act (GENIUS Act), which lays the groundwork for a regulatory framework for U.S. stablecoin issuance for the first time. Unsurprisingly, the Stablecoin Act requires that dollar stablecoins must be fully backed by [U.S. assets], and it also mandates monthly disclosures of reserves and independent third-party audits. This helps reinforce a kind of flywheel effect between stablecoins and debt financing: for every new token issued, a new buyer for U.S. debt is effectively created, making the adoption of stablecoins a powerful strategic tool for maintaining the dollar's dominance. Treasury Secretary Scott Benset has publicly stated, "We will maintain the dollar's status as the world's primary reserve currency and will leverage stablecoins to achieve this goal."

In short, dollar stablecoins are evolving from mere crypto products into key tools of U.S. geopolitical strategy, indicating that the U.S. government is very keen to see the adoption of U.S.-backed stablecoins continue to grow from now on.

Current Challenges and Pain Points

Despite the large scale and wide application of today's stablecoin rails, they were not originally designed to serve as a global-scale payment network outside of crypto-native rails. Specifically, the current stablecoin infrastructure has shortcomings in three key areas: scalability performance, actual user experience, and integration infrastructure with fiat rails.

Scalability Performance

Since the Layer-1 Gas wars on Ethereum, standards for blockchain performance and network capacity have made significant progress. The fees for stablecoin transfers (which can reach tens of dollars during peak congestion on Layer-1 networks) have dropped significantly and stabilized. Even so, most public chains still lag behind traditional payment networks in terms of scalability and uptime. Ethereum and its Layer-2 solutions have an average daily TPS of about 244. Solana's daily TPS often reaches 2000-3000, with previous peaks around 4800 (though it is always important to note the nuances between voting and non-voting transactions). However, the design goal of global payment networks is to support tens of thousands of TPS, which cannot withstand downtime even during peak congestion.

There are many promising developments on the horizon that could improve this situation. From the rise of application-specific perpetual decentralized exchange (DEX) chains to the upcoming launches of Firedancer and Alpenglow on Solana, to the performance enhancements expected from Monad and MegaEth, as well as the rise of SVM L2. However, these are not specifically targeted at stablecoins. As network activity and adoption rates expand, stablecoin transfers on these chains still compete for more block space among exchanges, perpetual contract trading, and all other operations users can perform on these chains.

User Experience

Although on-chain transaction settlement speeds are far faster than banks, the user experience remains poor. The Boston Consulting Group's 2025 stablecoin report points out that "gas token management for transaction fees" and liquidity fragmentation are key technical barriers faced by retail and enterprise users when using stablecoins for payments.

The most obvious and easily solvable issue is gas token friction: receiving USDC on Ethereum or SOL on Solana essentially requires ETH or SOL to transfer or use their funds. The onboarding training for net new users remains impractical.

Liquidity is another challenge. Currently, the supply of stablecoins is dispersed across hundreds of blockchains, making it more difficult to transfer large amounts of funds outside of Ethereum or guarantee immediate conversion back to fiat. This dispersion also dilutes network effects, forcing users and institutions to seek various bridging tools, gas tokens, and liquidity sources instead of relying on a single, unified liquidity market.

Today's stablecoin infrastructure also lacks privacy protection. Public chains default to exposing transaction details. While there are some privacy-preserving applications, users must go to great lengths to find and use them. Stablecoins do not have a built-in "switch" to enable private transactions. This means that using stablecoins for everyday payments is much more transparent than using cash or even traditional banking. For individual consumers, this may simply feel like an invasion of privacy. For businesses and financial institutions, this is simply untenable.

On-chain user experience has improved significantly, but there is still room for enhancement.

Lack of Integrated Infrastructure

One underestimated challenge facing today's stablecoin channels is the lack of integrated infrastructure, especially integration with fiat channels. Sending USDT to a friend is a different matter than spending USDT at a grocery store. In practice, when users attempt to transfer between blockchain channels and local payment systems, they still face foreign exchange spreads, hidden fees, and compliance bottlenecks.

The so-called "offshore" refers to using centralized exchanges or other intermediaries, requiring users to create accounts (often requiring KYC verification) and pay service fees. Cross-border transactions become even more complicated, as they typically introduce more intermediaries and foreign exchange spreads, further eroding the transfer amount.

Before stablecoins can seamlessly integrate into fiat currency rails, they are well-suited for transferring value between cryptocurrencies, but remain impractical for mainstream global payments.

So, What’s Next?

Stablecoins have crossed the chasm. They are no longer niche byproducts of the cryptocurrency market. Their clearing volumes reach trillions of dollars annually, sometimes even monthly, and they have already powered cryptocurrency trading, DeFi, and peer-to-peer markets in emerging economies.

However, while this level of adoption is significant, it still falls short of the standards required to become a pillar of the global financial rails. Settlement systems like VisaNet, SWIFT, and ACH have much stricter operational requirements: near-instant finality, reliability, and a unified compliance framework across different jurisdictions. Stablecoins have processed vast amounts of data, but the blockchains they operate on were never designed to consistently meet these standards on a global scale.

One solution is to wait for universal chains to develop and strengthen as payment-grade infrastructure. Another solution is to adopt dedicated stablecoin infrastructure.

Dedicated Stablecoin Infrastructure

Almost every industry that prioritizes reliability, risk management, and performance is built around specialized, dedicated infrastructure.

Global payment networks like Visa and SWIFT have specific functionalities for secure global fund transfers and operate in isolated environments optimized for data integrity, regulatory compliance, and uptime. In the cloud computing space, financial institutions and research centers do not use AWS or Google Cloud, but instead rely on purpose-built setups for handling PB-level physical data. In finance, high-frequency trading firms colocate servers with exchange matching engines because general-purpose infrastructure cannot provide the latency or reliability required in a millisecond-sensitive market. Compared to general-purpose infrastructure, using industry-specific data for training legal language models (LLMs) in healthcare, insurance, or finance consistently yields higher accuracy, lower error rates, and stronger regulatory compliance.

The same applies in the cryptography space. Standards critical to the expansion of the internet—RSA for secure communication, SSL for browser authentication, and ECDSA for digital transactions—were all built for a common mission: to protect and verify data between online transaction counterparts.

Stablecoins are now at this turning point.

Application Chain Theory

Blockchains follow the same logic. As applications become more popular and activity scales up, the limitations of general-purpose chains become increasingly apparent. Unpredictable gas fees, throughput limits, compliance gaps, and more are just a few examples. Therefore, applications are increasingly motivated to launch their own chains.

We have already seen this trend: decentralized exchanges like Osmosis, dYdX, and the recent Unichain; gaming and NFT platforms like Immutable; data networks like Pyth; all adopt some version of the application chain model. This argument originates from Cosmos, which posits that applications should have their own autonomous block space and be optimized according to their needs while still being interoperable with the broader ecosystem.

When a chain is purpose-built, it can provide deterministic performance and predictable pricing, free from the demands of unrelated block space. It can embed compliance routines, information disclosures, and risk management tailored for regulated products. It can directly align economic incentives, governance, and value capture with the needs of its user base and community.

Dedicated application infrastructure allows blockchains to break free from the constraints of one-size-fits-all environments, enabling more customization, stronger performance, and better user experiences. Given the trend of stablecoin adoption, we believe it is only a matter of time before stablecoins require the same dedicated infrastructure. Plasma is one of the first teams moving toward this vision.

Plasma: A Blockchain Built for Stablecoin Circulation

Plasma is a new Layer 1 layer built specifically for the circulation of stablecoins. It combines a custom consensus protocol, an EVM-compatible execution layer, and dedicated smart contracts to support large-scale high-performance operations while providing security by publishing state roots to the Bitcoin network through a native Bitcoin bridge.

Plasma's mission is simple: to change the way global funds flow through specialized stablecoin infrastructure. Just as TCP/IP made the internet a global information hub, Plasma aims to empower stablecoins to become the center of global payments.

Plasma aims to address the pain points of today's infrastructure—performance, user experience, and integration—through its core functionalities:

First-Day Liquidity: Plasma launches with native USDT and $2 billion in first-day stablecoin liquidity.

Zero-Fee USDT Transfers: Transferring USDT directly through the Plasma frontend is free. Gas fees are subsidized by Paymasters contracts within the protocol, using authorization-based transfer controls to limit transfer rates and prevent abuse.

Custom Gas: Users and applications on Plasma can pay gas fees using whitelisted tokens. After Plasma goes live, it will support paying gas fees with native USDT and pBTC.

Specialized Architecture: Plasma is built on a modular architecture that combines a custom high-performance consensus protocol with an EVM-compatible execution environment.

Bitcoin Security: Plasma anchors its state root to Bitcoin through a trust-minimized bridge, enabling direct programmability of BTC-EVM. This bridge also supports native BTC deposits, which can be converted to pBTC on Plasma.

Integrated Infrastructure: Plasma will support over 100 DeFi applications at launch, including leading protocols like Aave, Ethena, Fluid, and Euler, as well as various physical peer-to-peer cash networks. Additionally, Plasma will support a wide range of developer tools and an infrastructure ecosystem covering account abstraction, on-chain analytics and block explorers, interoperability protocols, oracles, indexers, and RPC providers.

To better understand how Plasma actually achieves these functionalities, it is worth delving into its core architecture.

System Architecture

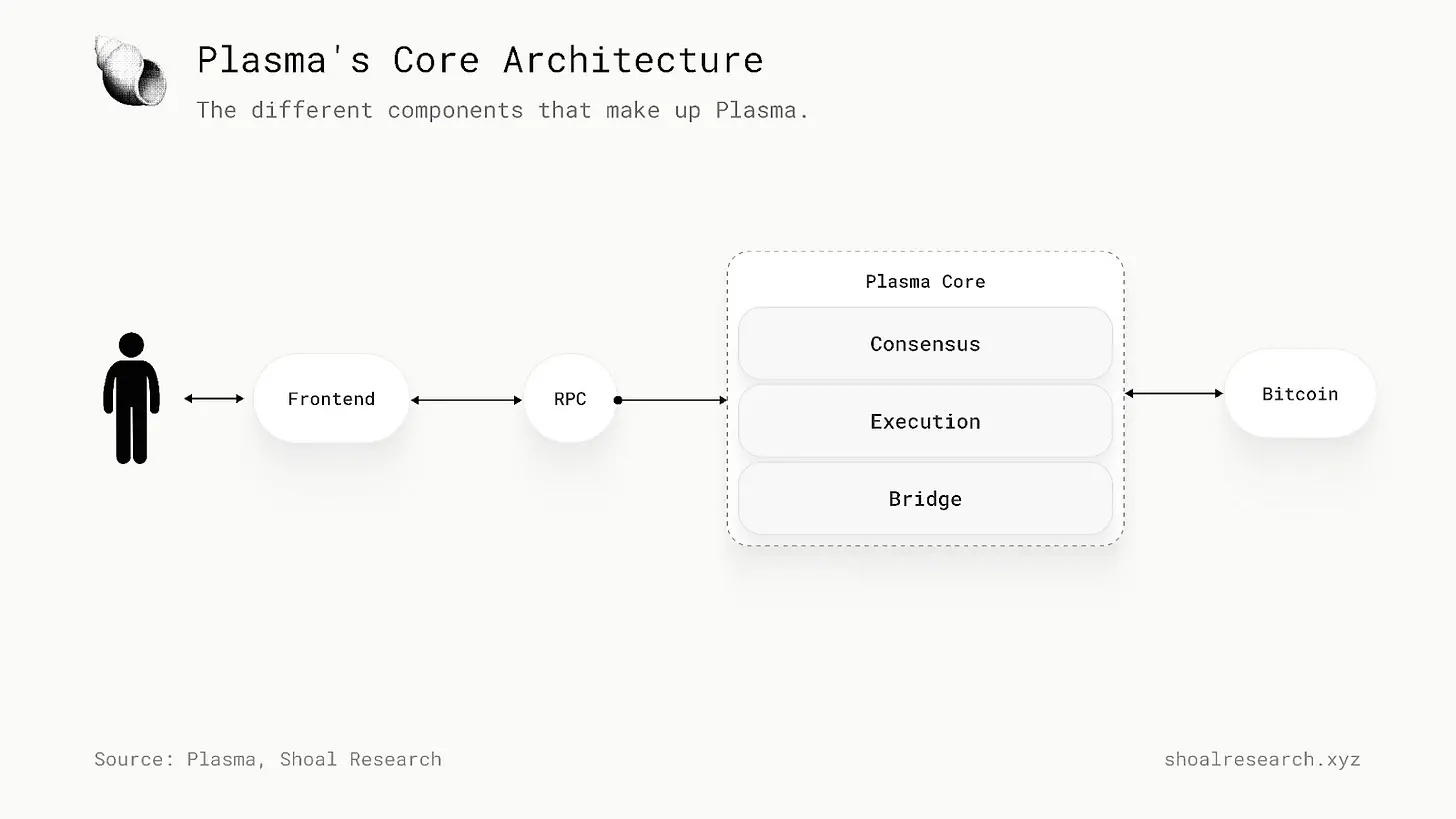

Essentially, Plasma is a Bitcoin sidechain that maintains its own consensus and publishes state proofs to Bitcoin. It is built on a modular multi-layer architecture that combines a custom BFT consensus protocol (PlasmaBFT), an EVM-compatible execution environment based on Reth, a trust-minimized Bitcoin bridge, and protocol-native stablecoin smart contracts.

Transactions on Plasma begin at the user layer through supported frontends. They are broadcast to the Plasma chain via RPC. After that, consensus is reached, and once 2/3 of the PlasmaBFT validators successfully validate, the user's transaction is executed. Plasma then regularly publishes the state root to the Bitcoin network through its native bridge.

Let’s take a closer look at these core components.

PlasmaBFT

Consensus is at the heart of on-chain systems. It is a coordination mechanism that distinguishes blockchains from banks and fintech: transactions are verified not by a single authority but by a decentralized network of distributed nodes. However, this design mechanism can introduce latency, especially as the network scales and more validators are added, and for many of today’s blockchains, this comes at the cost of performance.

To overcome latency bottlenecks, Plasma introduces PlasmaBFT, a custom consensus protocol designed to support high throughput. PlasmaBFT is a pipelined implementation of the Fast HotStuff protocol, written in Rust. Finality is deterministic and can be achieved within seconds.

As the name suggests, PlasmaBFT follows the classic Byzantine Fault Tolerance (BFT) assumptions. In practice, this means that as long as no more than one-third of the validators are malicious, the network can remain secure _ (this can be reflected as n ≥ 3f + 1, where n is the total number of nodes and f is the number of Byzantine nodes) _.

To participate, validators must stake XPL and run supported hardware (2 CPU cores, 4 GB RAM, SSD-based persistent storage). Validators are then selected to propose and validate blocks on Plasma based on an XPL stake-weighted voting process.

The protocol finalizes blocks through a dual-chain proposal process. Validators vote on block proposals, and once two consecutive quorum certificates (QCs) are formed, the block is finalized. A QC is an aggregated proof from validators; linking them together enforces a single canonical history.

PlasmaBFT is optimized for high performance on Layer-1. This is thanks to Plasma's pipelining technology: while one block is being finalized, the next block can already be proposed. Thus, only two rounds are needed to finalize a block.

This design is derived from Fast HotStuff, a modern BFT protocol designed with speed in mind. HotStuff introduces a leader-based structure and QC chaining to reduce communication overhead. Fast HotStuff further optimizes the chain submission path, thereby reducing latency and increasing throughput.

Similar to HotStuff, PlasmaBFT adopts a leader-based polling structure aimed at minimizing communication overhead while maintaining fault tolerance. The leader proposes a block, validators vote, and once enough votes are collected, a QC is generated. If the leader fails or goes offline, the protocol will use the aggregated QC to transition to a new leader.

Plasma plans to expand validator participation in several phases. Initially, the priority is to ensure baseline network stability, so Plasma will launch with a whitelist of validators. Over time, the number of validators will gradually increase to stress-test under a larger committee until the final phase opens participation to the public.

Plasma's Execution Environment

The virtual machine (VM) handles transactions, runs smart contracts, and maintains state synchronization among all participants on its underlying chain. The VM reads the current state of the chain, executes new inputs, and then deterministically updates the state. It ensures that the same code always produces the same results and that the state is consistently updated across all nodes.

Plasma adopts a general Ethereum Virtual Machine (EVM) execution environment. This means developers can deploy existing EVM smart contracts and use familiar tools and infrastructure.

Plasma's execution engine is Reth, a Rust-based modular Ethereum client that separates consensus from execution. This makes updates more efficient, clarifies the boundary between block production and execution, and enhances performance and predictability of behavior.

When transactions are submitted on Plasma, the execution environment processes them through the EVM, ensuring that the relevant smart contracts run and that the state is consistently updated across all Plasma nodes.

Bitcoin-Level Security

Blockchains typically secure themselves solely through their own set of validators. This security is limited by the size of the validator pool and the economic weight behind it. For stablecoins that may involve significant value, relying solely on a new or relatively small set of validators can pose risks.

To mitigate this, Plasma regularly publishes its state root to Bitcoin. Anchoring to Bitcoin provides additional settlement assurance: once the Plasma state is recorded on Bitcoin, changing it would require rewriting Bitcoin's history. This makes censorship or rollback extremely difficult and provides Plasma with a stronger security baseline than simply relying on its validator set.

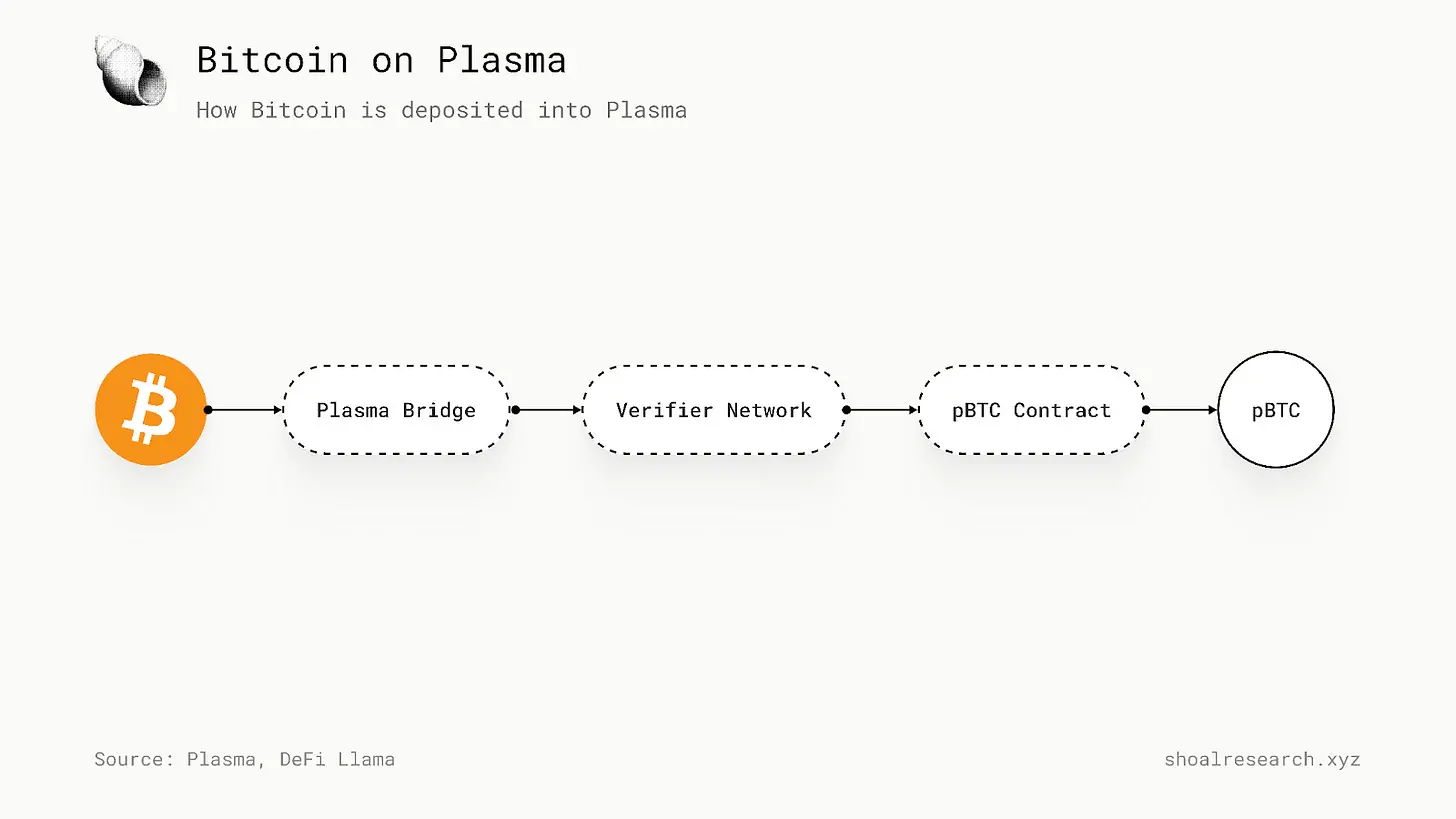

Plasma achieves this through a native Bitcoin bridge. This bridge consists of a network of validators, each running a full Bitcoin node to monitor deposits and validate state anchoring. Plasma's state root is regularly submitted to Bitcoin through transactions (e.g., OP_RETURN), and the validator network proves that these anchors match Plasma's canonical chain.

In addition to settlement, the bridge also allows native BTC to flow into Plasma. Users deposit BTC into a designated address, validators confirm the transaction on the Bitcoin network, and then Plasma mints pBTC: a fungible ERC-20 token backed 1:1 by BTC. Withdrawals follow the opposite process: users burn pBTC on Plasma, and after validator confirmation, BTC is released on the base chain.

This bridge enables native BTC to be used within Plasma smart contracts. pBTC is issued in the standard ERC-20 token format, built on the LayerZero OFT standard for cross-chain portability, without compromising the verifiability of the underlying Bitcoin itself. Users always receive pBTC on Plasma at a 1:1 ratio with the BTC deposited.

To ensure withdrawal security, Plasma relies on multi-party computation (MPC). Unlike single-party key holding, Plasma's private keys are jointly generated and signed by multiple validators, ensuring that no single entity can unilaterally release funds.

Native Stablecoin Smart Contracts

In the current trajectory of stablecoin development, stablecoins exist in the form of generic ERC-20 tokens. They are applications built on top of the base chain. This design is effective to some extent, but still presents friction: transaction fees are paid with separate gas tokens. Each application or wallet must run and maintain its own custom payment system. Private payments are impractical.

On Plasma, this functionality is directly built into the protocol. A set of protocol-native contracts written in Solidity and integrated into the execution layer provides first-class handling for stablecoins. These contracts are written in Solidity, integrated into Plasma's execution layer, and compatible with any EVM wallet or contract system, including AA standards like EIP-4337 and EIP-7702.

Plasma is set to launch two core modules. The first is the Protocol-Managed Paymaster for Zero-Fee USDT Transfers. This contract covers the gas fees for direct USDT transfers (transfer() and transferFrom()), allowing users to send stablecoins without XPL. The scope of this module is narrowly designed: it only applies to official USDT transfers and only for direct peer-to-peer transfers, not for arbitrary contract calls. To prevent abuse, eligibility is controlled through lightweight identity verification (e.g., zkEmail, zkPhone, or verification code systems) and is rate-limited. Economically, Plasma's fund pool is managed by the foundation, which pre-funds XPL to cover gas fees on behalf of users. Developers do not need to perform custom integrations beyond routing transfers through standard smart account processes, and the system supports both EOA and smart contract wallets. Plasma is gradually exploring features such as reserving block space for eligible USDT transfers to ensure inclusivity even during network congestion.

The second module is the ERC-20 Payment Module for Custom Gas Tokens. This contract allows users to pay for any transaction using whitelisted tokens (initially supporting USDT and pBTC), not just transfers. The process is straightforward: users approve the payment module to use the selected token, the payment module queries an oracle to calculate how much of that token is equivalent to the required gas, and then pays the validators in XPL in the background while deducting the equivalent gas from the user's account. This eliminates the need for transaction or native token balances, simplifying the onboarding process for new users. Developers will benefit from this as the payment module handles it at the protocol level, so they do not need to build or maintain their own fee extraction systems. Wallets only need to display approvals and error handling, while users can enjoy a unified and intuitive user experience.

By running these modules at the protocol level rather than leaving them to individual applications, Plasma ensures consistent behavior across applications, achieving subsidized gas without external funding tokens, and directly binding these functionalities to block production and execution.

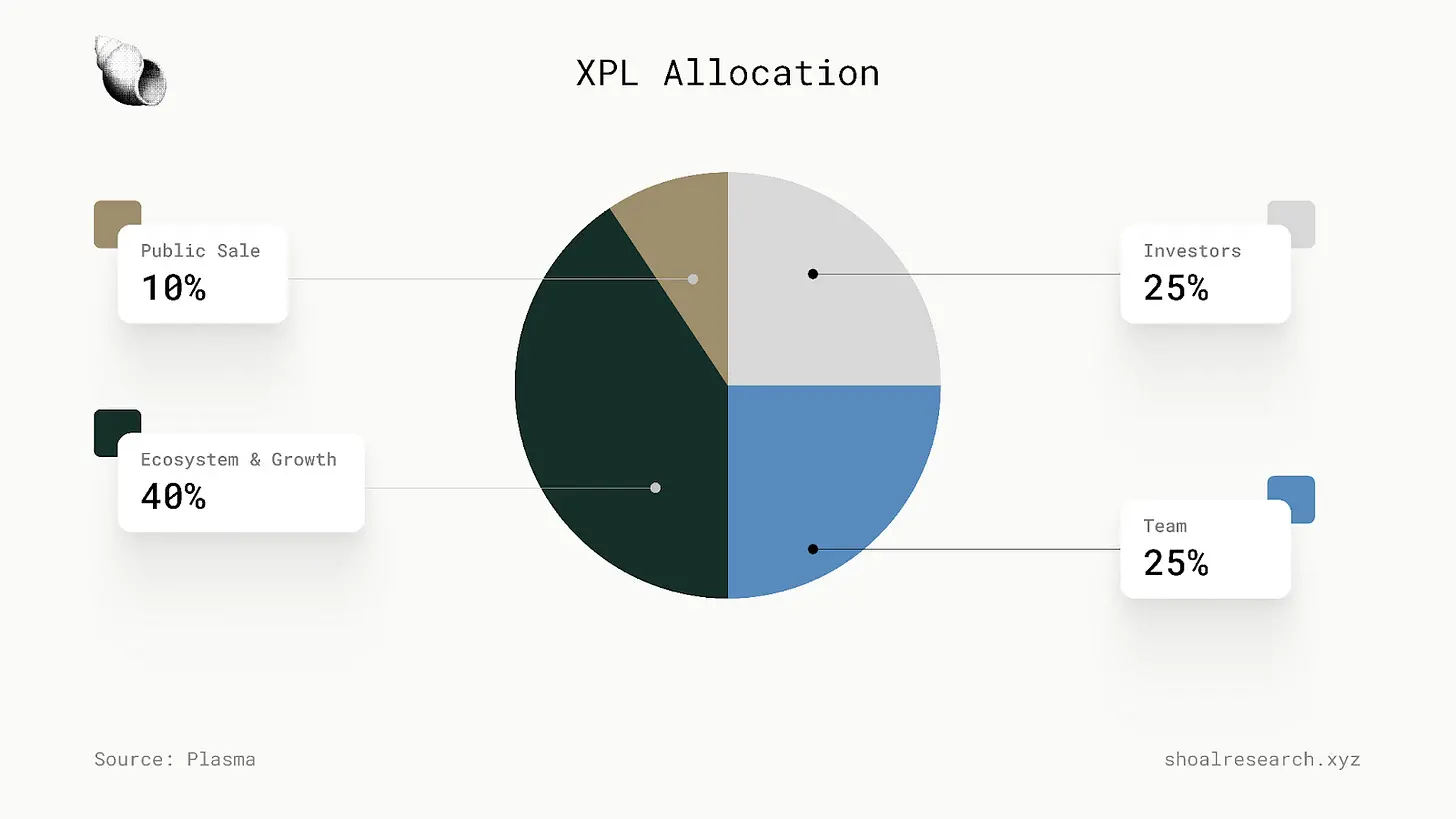

XPL and the Economics of Plasma

At the core of Plasma's business model is its native token XPL, which secures the network and subsidizes PlasmaBFT validators.

Every transaction on Plasma requires a base fee, which is dynamically adjusted based on demand. These fees, along with newly issued tokens, form a reward pool to maintain validator incentives.

Plasma employs a unique penalty mechanism. It does not punish malicious validators but instead incentivizes honest behavior through a novel reward-penalty mechanism. In this model, misbehaving or inactive validators will lose their block rewards but retain their principal. The penalties are lighter, reducing participation risk for institutional operators, as sudden capital losses are often commercially unacceptable. Importantly, Byzantine security is still guaranteed under the assumption that less than one-third of validators are malicious.

Validators earn XPL rewards by proposing blocks, participating in consensus voting, and validating transactions. Their rewards come from transaction fees and token issuance, directly linking validator incentives to network activity and the overall economic performance of XPL.

Plasma Ecosystem

Plasma's technical work revolves around a continuously evolving and integrated ecosystem. Plasma is set to launch with $2 billion in stablecoin liquidity and has integrated over 100 DeFi projects, including Aave, Ethena, Fluid, and Euler.

Plasma recently released its consumer-facing flagship application Plasma One. It is a native stablecoin wallet and card interface that provides users with a "one-stop" platform to hold, send, and use USDT. Transfers incur no gas fees, balances can be used directly for payments, and users can issue virtual cards in just a few minutes.

In terms of integration, Plasma has partnered with Binance Earn, allowing users to access yield products directly from the network. Additionally, development work is underway for fiat on/off ramps and peer-to-peer cash networks in emerging markets, aimed at reducing reliance on centralized exchanges for stablecoins and local currencies.

Plasma will also launch a comprehensive ecosystem of developer tools and infrastructure, covering account abstraction, on-chain analytics and block explorers, interoperability protocols, oracles, indexers, and RPC providers.

The Future of Plasma

Given our current understanding of Plasma, it is worth looking ahead and considering some of the most important catalysts and factors that will influence its future development direction.

Competitive Landscape

Plasma carries an ambitious and important mission: to change the way global capital flows. Unsurprisingly, it faces competition from multiple fronts.

First, general-purpose blockchains are not going away. Ethereum still dominates in terms of stablecoin liquidity and network effects. Tron holds the largest share in USDT transfers and peer-to-peer transaction volume, while Solana continues to improve its performance. Meanwhile, new chains like Monad and MegaETH are also competing on high performance and full EVM compatibility.

At the same time, we are seeing the rise of stablecoin-specific chains (or "stable chains") similar to Plasma. Circle is building Arc, a permissioned chain designed for regulated USDC settlements. Stripe is developing Tempo, focusing on embedding stablecoins into merchant payments. Google recently announced the launch of Google Cloud Universal Ledger (GCUL), an L1 platform focused on providing digital payments and tokenization for financial institutions. Meanwhile, other companies are also emerging with differentiated approaches and unique value propositions. For example, Payy has introduced new banking stablecoin infrastructure, including its proprietary dedicated chain, but its core focus is on privacy-preserving transfers.

Even outside the cryptocurrency space, non-blockchain payment channels are converging, offering many of the same key advantages as stablecoins. This means Plasma must not only meet cryptocurrency benchmarks but also traditional standards, including performance, speed, and coverage.

Key Focus Areas

With this in mind, what key areas can help the Plasma team?

First, distribution is crucial. Like any business, for a chain to grow, it must get its product into the hands of users. For blockchains, this is primarily limited to crypto-native applications, exchanges, inter-chain, and DeFi protocols. Although Plasma will launch with over 100 applications integrated and $2 billion in liquidity, the more daunting challenge lies in how to expand applications from crypto-native to retail and enterprise-level crypto-related areas.

Plasma plans to support over 100 countries, over 100 currencies, and over 200 payment methods, laying the groundwork for a robust initial distribution layout. However, maintaining real-world adoption in the long run requires continuous effort: attracting merchants, collaborating with fintech partners, and leveraging Tether/Bitfinex's existing network. The rise of Tron illustrates the power of grassroots distribution. The question is whether Plasma can retain users and establish lasting channels beyond its crypto-native user base.

Liquidity is another key focus area. For a blockchain built specifically around stablecoins, deep liquidity is essential. Plasma issued billions of dollars in native USDT on its first day, making it the eighth-largest USDT blockchain. To ensure it can continue to grow, bridges, ramps, and deposit processes must be as simple and frictionless as possible.

Privacy is another underestimated feature. Confidential payment functionality is planned but will not be included in the Plasma mainnet Beta release. The core idea of this feature is to protect sensitive transfer data while maintaining composability and auditability. This feature will initially be implemented as a lightweight optional module, but Plasma is likely to embed privacy features into the protocol layer in the future.

With its novel architecture, ecosystem coverage, and liquidity foundation, Plasma is well-positioned:

Anchoring to Bitcoin provides a differentiated advantage. Plasma regularly publishes its state root to Bitcoin, providing additional settlement assurance beyond relying solely on its validator set.

Additionally, building a public permissionless chain allows Plasma to reach a broader audience while enabling features like identity-based transfers to facilitate special experiences such as zero-fee USDT transfers.

Utilizing a custom consensus protocol enables Plasma to support high-throughput rapid execution.

With over 100 DeFi integrations and $2 billion in USDT, it has become the eighth-largest chain by stablecoin supply from day one.

Applications and Use Cases

Plasma supports a range of stablecoin-specific use cases and applications.

Global Payments and Remittances

One of the most direct applications is as a global payment channel. A worker in the U.S. can remit $100 USDT to a relative in Nigeria. The relative can then spend it directly through integrated merchants, use a crypto card, or withdraw through local over-the-counter trading desks and exchanges.

In countries like Nigeria, Argentina, and Turkey, stablecoins have become tools for hedging against inflation and lifelines for remittances, and Plasma can further reduce friction. Success in these countries depends on integration with local wallets, ATMs, and payment systems. Tron achieved this through years of grassroots promotion, so Plasma will also need similar partnerships, potentially leveraging Tether's existing network. If executed well, Plasma could serve as the backend for remittance companies or new banks, providing instant dollar transfer services without requiring them to build blockchain infrastructure themselves.

Merchant Payments and Micropayments

Due to volatility and fee issues, the use of cryptocurrency for payments has been rare, but zero-fee USDT transfers on Plasma could change that. Merchants can accept stablecoins at the point of sale via QR codes, avoiding credit card fees and chargebacks.

Privacy features will enable businesses to protect revenue data from competitors, while micropayments will become feasible. Platforms can charge a few cents for each article, stream, or download without impacting profits. For merchants, the key lies in user-friendly tools and compliance. Stablecoin payment processors may emerge on Plasma, and over time, even traditional service providers may integrate them in regions with high fees or limited banking services.

Forex and Cross-Currency Trading

The stablecoin market has expanded beyond the dollar, with euro, offshore yuan, and gold-backed tokens also in circulation. If Plasma supports multiple fiat stablecoins, it is poised to become a hub for on-chain forex trading.

For example, users could exchange USDT for EURT at near-zero cost on a Plasma-based decentralized exchange (DEX). This makes forex trading cheaper and faster than banks. Imagine a multinational company instantly converting millions of dollars into euros and settling the transaction on-chain to pay European suppliers. This requires ample liquidity, but zero fees and institutional demand could attract market makers.

DeFi with Stablecoins and BTC

Plasma's compatibility with EVM opens the door to decentralized finance focused on stablecoins and Bitcoin. Potential applications include:

Stablecoin DEX and AMM: Low-cost, high-volume trading of stablecoin pairs (USDT/USDC, USDT/EURT) or stablecoin/BTC pairs.

Money Markets and Lending: Platforms can allow users to borrow or lend USDT against BTC collateral.

BTC-DeFi Innovations: Bitcoin-backed stablecoins minted on Plasma without custodianship.

Institutional Finance and Settlement

Institutions such as exchanges, fintech companies, and even banks can use Plasma as a settlement layer for large transfers. Due to Plasma's speed and zero fees, exchanges may prefer to use Plasma for USDT cross-exchange trading rather than Tron or Ethereum.

Banks or corporate alliances can also run private overlay layers on Plasma for Bitcoin-backed finality in settling large interbank transfers. For corporate finance departments, transferring $50 million between subsidiaries could take just seconds, while using SWIFT would take days. The privacy module will allow auditors or regulators to selectively disclose information. If U.S. legislation like the "GENIUS Act" progresses, regulated entities may adopt public stablecoins like USDT and USDC, and Plasma is expected to meet this demand.

In addition, there are more crypto-native use cases worth exploring for the team to build on Plasma. Zero-fee USDT transfers could be a very compelling case for building autonomous agent payment infrastructure on Plasma. With $2 billion invested from day one, Plasma can provide deep stablecoin liquidity forecasts, thereby maintaining meaningful user activity. Plasma can also serve as a routing layer for stablecoin liquidity across multiple chains.

Conclusion

The Plasma mainnet beta is now live. We look forward to witnessing the flourishing of dedicated stablecoin infrastructure. Stablecoins are bound to disrupt global payments and other financial service systems, but they need purpose-built tracks to thrive. While Plasma is not the only project chasing this North Star, it offers one of the most promising solutions to help you seize the trillion-dollar stablecoin opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。