加密市场崩盘的猜测加剧,BTC和ETH期权到期

随着九月接近尾声,数字资产行业处于紧张状态,投资者关注着另一次重大加密市场崩盘的迹象。近期市场趋势表现出清算和价格下跌的增加。历史趋势也表明,九月对加密货币来说是一个不利的月份。

目前,全球3.74万亿美元的加密货币行业下跌了显著的2.29%。预计随着比特币和以太坊期权合约的即将到期,这一下降将进一步加剧。历史会重演,还是会被改写?

加密市场崩盘在即?

九月历来是加密货币面临挑战的月份,今年似乎也不例外。目前,包括BTC和ETH在内的顶级代币的表现突显了该领域的负面趋势。此外,分析师Ash Crypto指出,今天将有210亿美元的BTC和ETH期权到期,这确实会引发巨大的波动,导致另一次加密市场崩盘。

目前,BTC的交易价格为109,535美元,过去一天和一周分别下跌了2.1%和6.5%。与此同时,ETH的价值为3,941美元,日跌幅和周跌幅分别为2.17%和13.5%。其他主要代币如XRP、Solana、BNB和狗狗币也经历了大幅下跌。

加剧加密市场崩盘猜测的是,多个交易所的大量资产正在被清除。根据清算数据,过去24小时内,超过9.69亿美元的加密货币从主要平台上被清除。大约2.5亿美元的比特币被清算,而以太坊的清算总额达到了3.1亿美元。

历史趋势

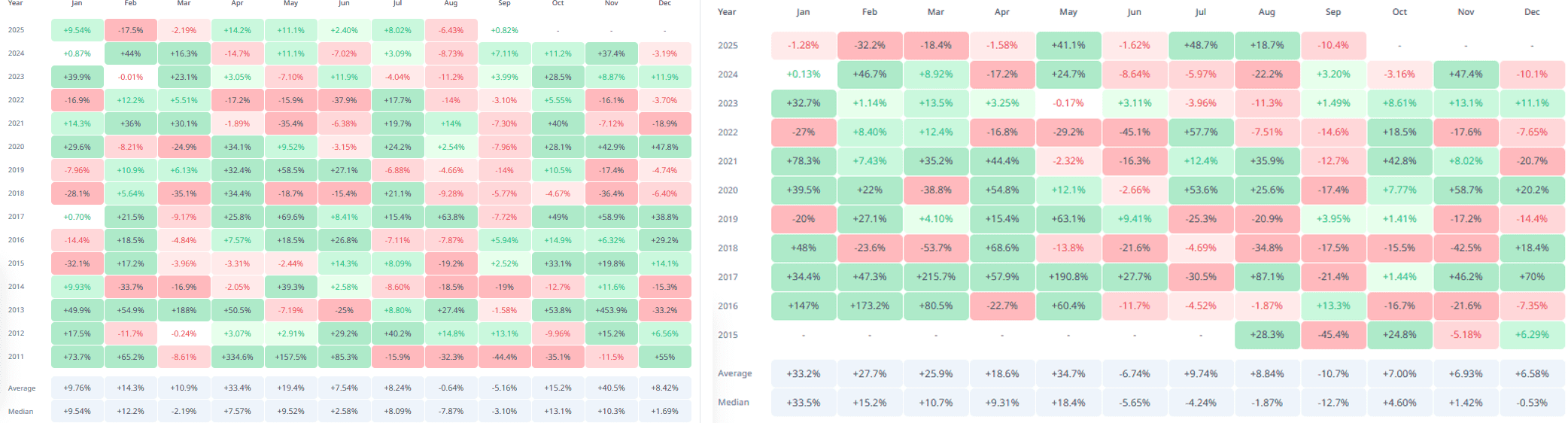

值得注意的是,比特币在九月的历史表现以负回报为特征,平均下降5.16%,中位数下降3.10%。虽然大多数九月都出现了亏损,包括2011年和2018年的大幅下跌,但也有例外,比如2017年的49%激增。值得注意的是,近年来的趋势有所逆转,2023年(+3.99%)、2024年(+7.11%)和2025年(+0.82%)均出现了正回报。通常被称为“红色九月”,今年这个月份也预计将保持在负值区间。

这个月份对以太坊来说也表现疲软,倾向于负回报。在11年的数据中,有9年记录了亏损,导致平均回报为-10.7%,中位回报为-12.7%。这些数字在所有月份中都是最低的,突显了其持续的弱势。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。