Author: @0xBenniee

In the current market environment where liquidity is not yet sufficient during the interest rate cut cycle, the bull market of Binance Alpha continues to unfold: an obscure project can often quietly achieve several times the increase in a short period.

This article will discuss the market-making strategy of launching Alpha + Perp from the perspective of market makers, as well as the inner monologue of market makers, aiming to "dance with the whales."

Binance Alpha serves as a natural liquidity pool, concentrating massive attention and retail resources on the launch day, while also attracting a group of native Alpha users to participate in trading—some may choose to sell off, while others may choose to buy in, with each "Alpha worker" placing their bets from their own perspective.

However, if we switch to the perspective of the project party and market makers, the inner thoughts are actually more straightforward: I have already spent 1-2% of the chip cost to launch Alpha, and additionally incurred costs to open Perp; having paid so much "protection money," the probability of abandoning the project later is low.

Thus, we see the subsequent "Alpha on-chain bull market." In fact, relying solely on the Alpha spot market makes it difficult to achieve large-scale distribution. Whales and market makers must leverage Perp to continuously increase open interest (OI) to attract more retail investors, turning this trading into a "casino."

Today's project logic is different from the past "narrative-driven" approach; it has completely shifted to capital-driven: whoever has thicker chips can pull off a stronger market; as long as there are enough gamblers entering the market, market makers can continuously create volatility and extract profits from it.

Summary as follows

- Alpha provides a natural attention pool and a base of initial users;

- Perp is the core tool for whales/market makers to increase OI and attract traffic.

For market makers, the key logic on the launch day is:

- Alpha → Accumulate chips + Build positions;

- Perp → Pump prices + Distribute.

"Taking the launch of a new coin as an example, let's see how market makers profit through Alpha + Perp"

The launch time for Alpha is 8:00 (UTC), and the launch time for Perp is 10:30, leaving market makers with only two and a half hours to collect chips. This period is essentially the stage where market makers and retail investors compete for chips; proactive market makers will grit their teeth and take the goods. If this portion of chips is snatched away by a large number of free-rider retail investors, the subsequent cost for market makers to pump prices will increase.

(From the market situation, the main market-making force on Alpha is primarily proactive market makers. According to industry speculation, their funding scale usually ranges in the millions of dollars, while the liquidity supply on the spot side is relatively sufficient.)

After Perp goes live, market makers will attract more retail investors by pushing up OI (open interest), turning this game into a "gambling table that gets more lively." The core role of Perp is not just to provide hedging tools, but to amplify market attention and trading participation**.

At the same time, market makers often coordinate with relevant KOLs for promotions and some positive news or marketing PR to further create topics and heat, attracting more attention. Whether going long or short, they are essentially contributing liquidity to the market, which also provides whales with greater maneuvering space and more abundant profit sources.

As shown in the figure, after Perp goes live, OI is quickly pushed up and remains stable at a high level. In the early stages, whales usually do not choose to complete distribution through significant price increases or violent sell-offs. The reason is: if they sell off too early, the chips may not be able to be bought back at the same or even lower cost, which would instead raise their overall pumping cost. The core goal of the whales is to hand over the chips to retail investors as much as possible at high levels, ensuring smooth distribution.

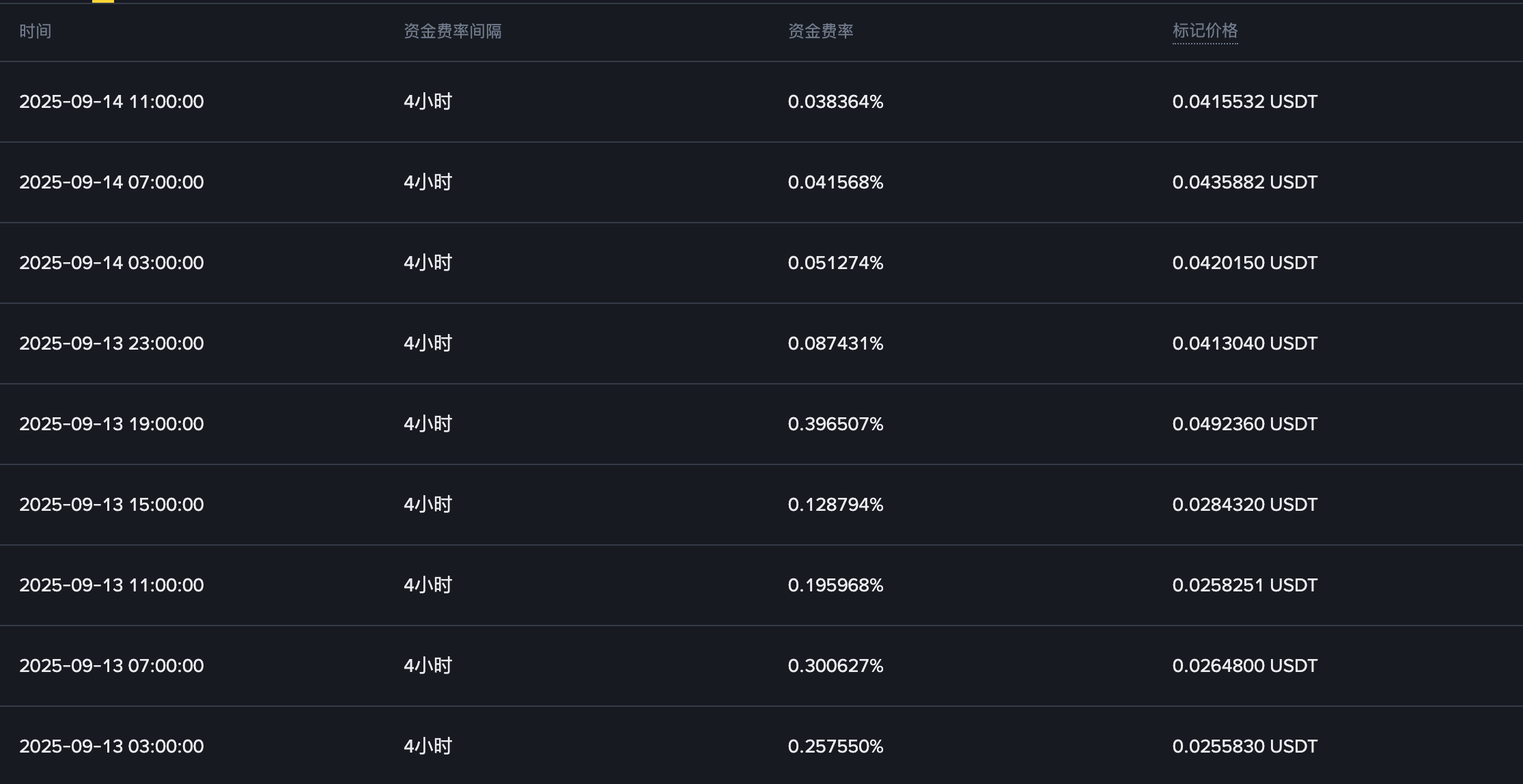

During the price increase process, funding rates often provide key references. By observing changes in funding rates, whales can gauge whether market sentiment is overheated and optimize details based on that. For example, when funding rates spike abnormally, market makers can use futures hedging or short-term funding rate arbitrage to lower their holding costs, further enhancing overall returns.

With all the spot market in the hands of market makers, as long as they do not sell off, through the funding rate market, during the price increase phase from 9/12 to 9/15, OI continues to rise, and funding rates spike multiple times,

- Peak: 0.3–0.4% / 4h (annualized approximately 270%–360%);

- Average: 0.1–0.2% / 4h (annualized approximately 90%–180%).

This means that market makers can establish hedged short positions in the futures market while continuously collecting funding rates in the spot market, forming a stable arbitrage cash flow, serving as an important means of optimizing costs.

On 9/16, when OI remains high and long positions are heavily accumulated, whales choose to sell off significantly, profiting from short positions while distributing in the spot market:

- Price drops from 0.058 → 0.035, a decline of about 40%;

- Whale cost range 0.015–0.02, average selling price about 0.045–0.05;

- Profit margin per transaction approximately +150%–200%.

(In an ideal scenario, the revenue from the on-chain liquidity pool has not been included in the overall calculation. Different market makers have slightly different specific strategies.)

Key Points for Dancing with Whales

If you see a project highly controlled in the early stages with a lot of community FUD, it is often worth paying more attention; while grand slam projects are inherently more complex due to their chip structure, caution is advised in participation.

If Alpha + Perp can be launched simultaneously on the first day, it usually indicates sufficient liquidity, and price volatility will be more intense.

Attempting to estimate the profits of whales during each wave of price increases and corrections can help understand their trading logic.

When Alpha opens, pay attention to the pricing on Pancake V3; if the opening price is too high, it may be more prudent to wait for a more suitable rhythm.

Conclusion

The launch model of Alpha + Perp is reshaping the current market landscape. On the surface, this is a narrative-driven new coin bull market, but in reality, it resembles a structured game directed by market makers. Alpha provides chip accumulation and initial flow, while Perp amplifies liquidity and volatility, with OI and funding rates becoming key tools for whales' operations. Retail investors may capture short-term opportunities from this, but more importantly, they need to understand the logic behind it: how far the market can go does not depend on how compelling the story is, but on how thick the capital is and how precise the rhythm is.

Disclaimer: The content of this article is solely for market observation and personal opinion sharing and does not constitute any investment advice. Trading digital assets carries high risks; please make careful judgments and assume risks independently.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。