The token $XPL will be listed on major trading platforms such as Binance at 21:00 Beijing time.

Written by: Deep Tide TechFlow

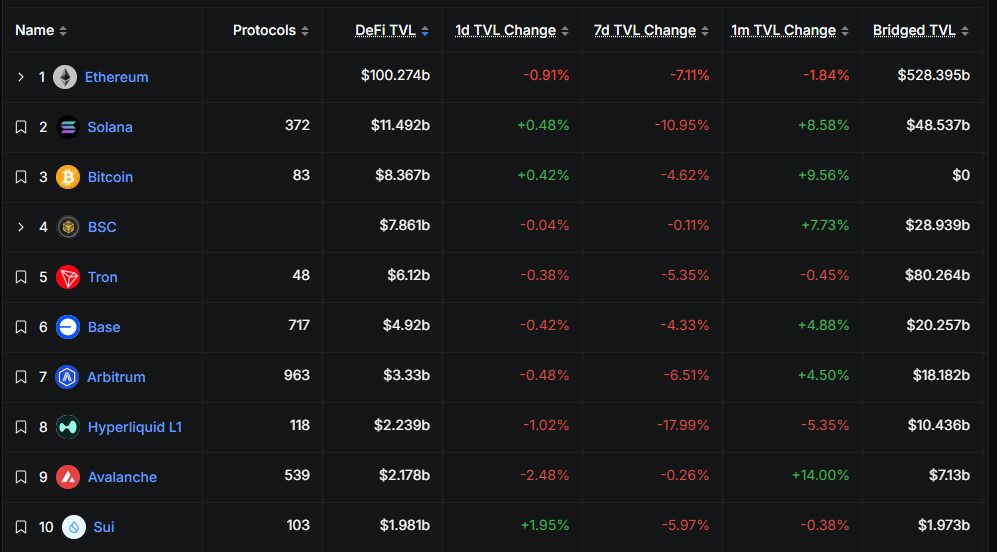

This year's largest stablecoin project Plasma ($XPL) will officially launch its TGE at 20:00 Beijing time on September 25. Supported by Tether, the issuer of the world's largest stablecoin USDT, Plasma will inject $2 billion in initial liquidity, positioning itself among the top ten blockchains by TVL after launch.

As of the time of writing on September 25, the price of $XPL is $0.73, corresponding to a fully diluted valuation (FDV) of approximately $7.3 billion. We have compiled all current information regarding the Plasma project as follows.

Source: DeFiLlama Current top ten TVL ranked Chains

Project Background and Origin

Plasma was born during the stablecoin boom at the end of 2024. At that time, Tether was attempting to expand its influence from Ethereum and Tron to a new independent network.

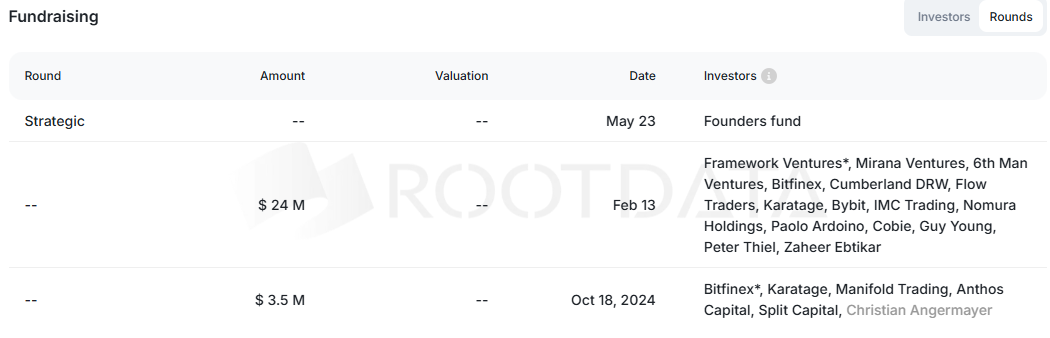

Plasma focuses on the issuance, transfer, and cross-chain circulation of stablecoins, aiming to solve high gas fees and network congestion issues. In its early stages, the project completed $27.5 million in financing, with team members including core personnel from FTX's payments business.

Since the development began in early 2025, Plasma has gradually gathered its first user base through testnets, Discord community incentives, and XPL liquidity mining activities.

In terms of strategic partnerships, Plasma has collaborated with several major DeFi and blockchain projects:

Binance Earn: Launched Plasma USDT fixed deposit products, combining the security of BTC anchoring and zero-fee USDT transfers. This product has been in high demand in the market, with user subscriptions reaching $1 billion after multiple rounds of sellouts;

Aave: Providing exclusive lending pools;

Pendle: Integrating yield splitting and derivatives strategies;

EtherFi: Supporting re-staking of LST assets;

Maple Finance: Launching syrupUSDT vault and providing exclusive XPL rewards;

USDai: Offering Plasma a $250 million exclusive deposit limit.

These collaborations will drive Plasma's rapid expansion in DeFi, credit, stablecoins, and compliance, laying a long-term ecological foundation.

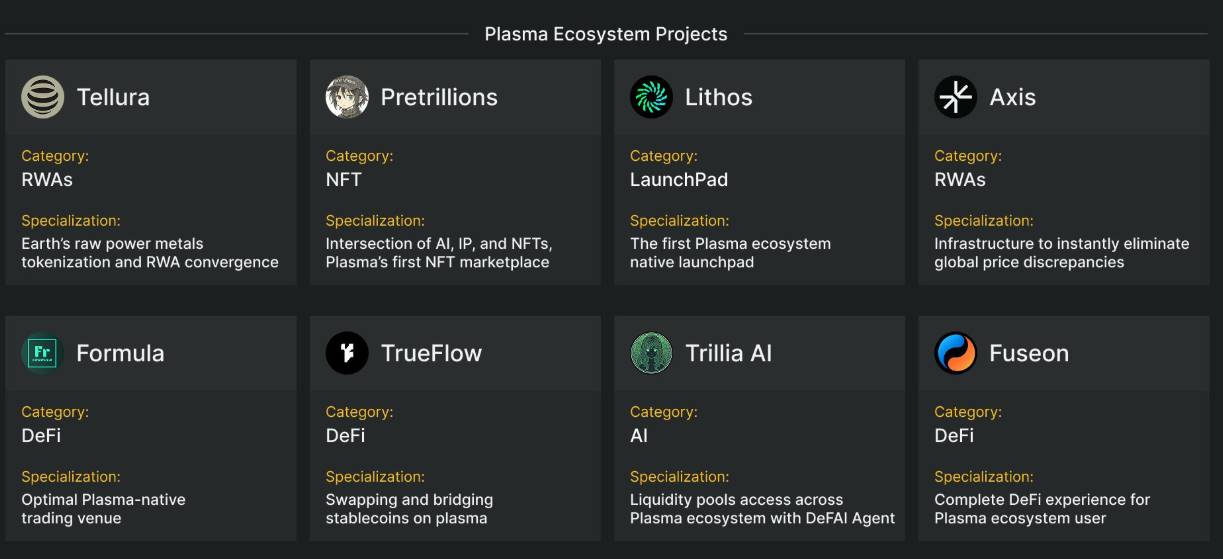

At the same time, Plasma's layout of ecological applications has also accelerated, with eight publicly announced projects:

Tellura: An RWA project that tokenizes natural resources, energy, and computing power to promote sustainable development;

Pretillions: Plasma's first AI-NFT project, exploring the fusion of AI and NFTs;

Lithos: A native Launchpad that assists new protocols in token issuance and financing while attracting new users;

Formula: A DeFi project with a native CLO structure that supports a lossless environment for large transactions;

Axis: An RWA project that synchronizes global asset price infrastructure, eliminating arbitrage opportunities and rewarding liquidity providers;

TrueFlow: A DeFi project that routes multi-chain stablecoin liquidity, responsible for enhancing cross-chain efficiency;

Trillia AI: An AI Agent project that has launched. A DeFi smart agent that optimizes pool selection and automates strategies;

Fuseon: A DeFi project that serves as a core liquidity hub with diverse functions such as trading, staking, wealth management, and voting.

Core Technology and Unique Advantages

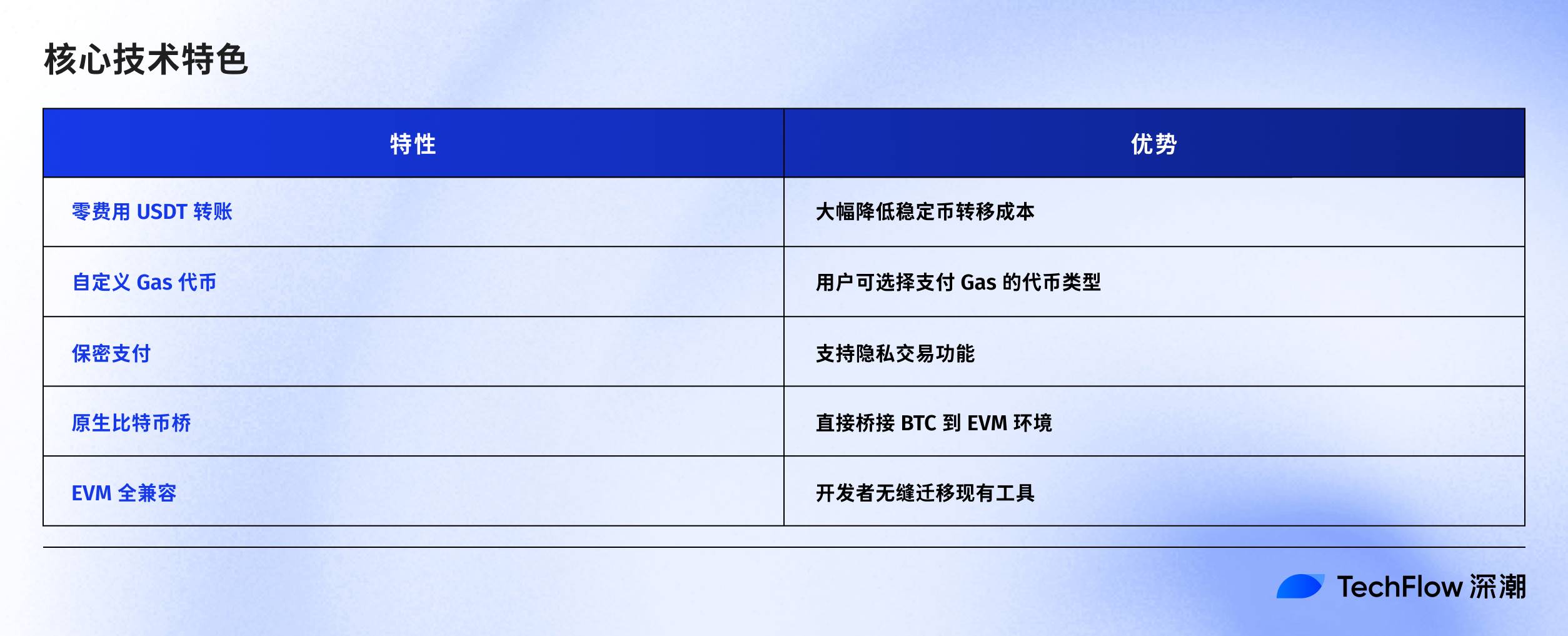

Plasma adopts the PlasmaBFT consensus mechanism, a customized Byzantine Fault Tolerance protocol that ensures decentralization and security while providing high-performance processing capabilities. Its TPS exceeds 1000, and block confirmation time is less than 1 second, making it very suitable for high-frequency applications of stablecoins, such as asset tokenization and cross-border payments.

Unlike the general designs of Ethereum or Solana, Plasma's "stablecoin-first" architecture significantly reduces costs and network bottlenecks, making it particularly attractive to institutional users.

With $2 billion in USDT liquidity and collaborations with DeFi star projects like Aave, Pendle, and EtherFi, it is anticipated that Plasma will quickly form a considerable DeFi effect after its launch.

TGE Event Details and Market Performance

Plasma's TGE will begin at 20:00 Beijing time on September 25, 2025, and will simultaneously launch the mainnet test version. The token $XPL will be listed on major trading platforms such as Binance at 21:00 Beijing time.

Gate Launchpad Sale:

Total issuance: 3,000,000 XPL

Issuance price: 1 XPL = $0.35

Subscription time: September 23, 13:30 to September 25, 10:00 UTC

Distribution method: Unified distribution within 2 hours after the subscription ends

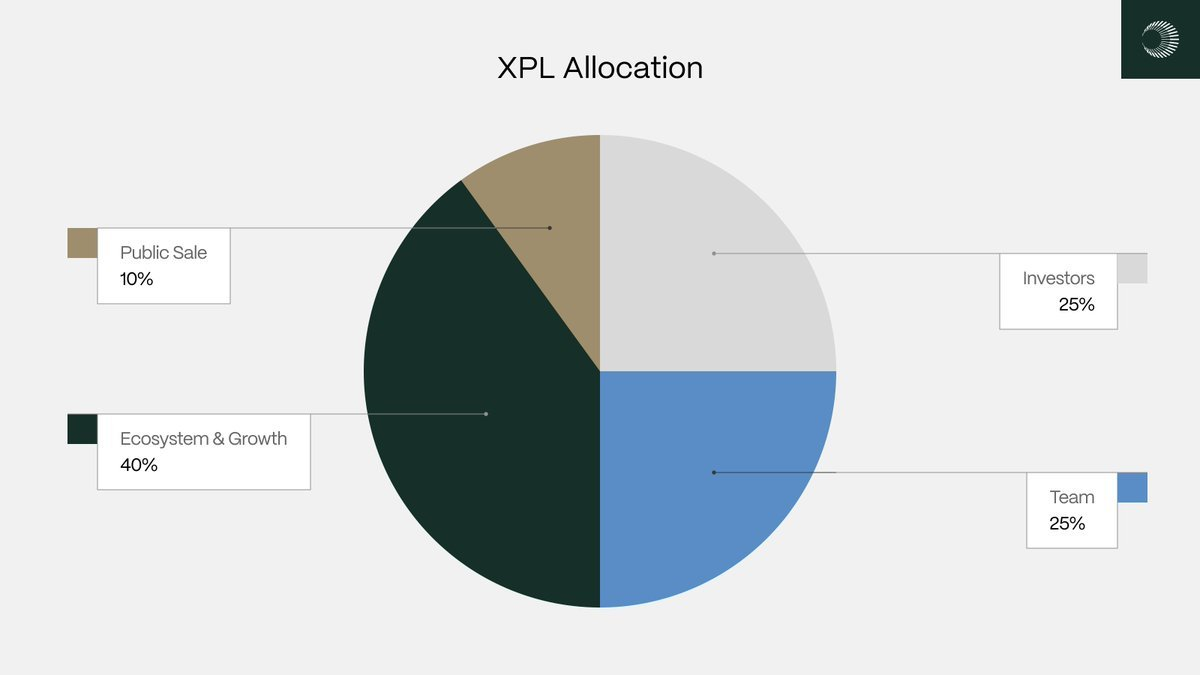

$XPL Token Economics:

Total supply: 1 billion XPL

Specific allocation ratios:

Public sale: 10% (100 million)

Ecosystem: 40% (400 million)

Team: 25% (250 million)

Investors: 25% (250 million)

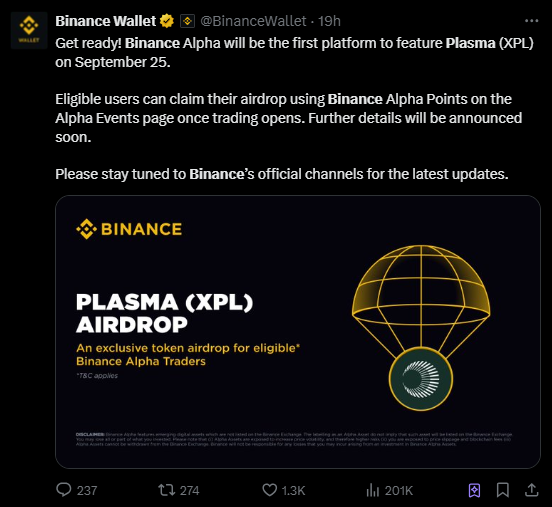

Airdrop Highlights:

Binance Alpha will be the first to launch $XPL, eligible users can receive airdrops

Community rewards: 27.5 million allocated to test users and the Stablecoin Collective

Pre-TGE Revelations about the Team and Tether

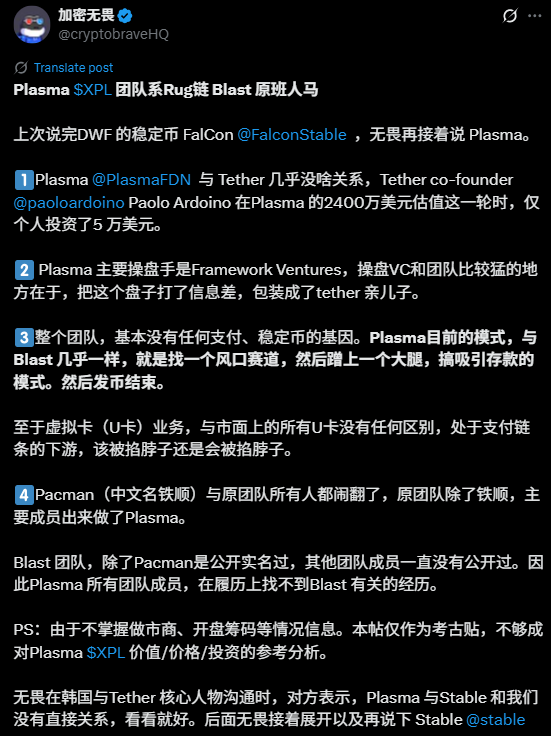

As the TGE approaches, rumors about the Plasma team have surfaced on X.

Well-known KOL Crypto Brave revealed that the Plasma team consists of the original team from the L2 project Blast, and that their relationship with Tether is not close.

The main operator behind Plasma is Framework Ventures, which has packaged Plasma as Tether's favored child by exploiting information asymmetry, but the entire team has virtually no background in payments or stablecoins. After splitting from Blast founder Pacman, the Plasma team continued down the old path of "chasing trends, leveraging big names, attracting funds, and issuing tokens."

This revelation has sparked community discussions, but some have pointed out that Plasma's ability to complete USDT integration and attract institutional support on the first day contradicts the claims made in the revelation. Most rebuttals argue that these revelations lack key evidence and resemble FUD from competitors.

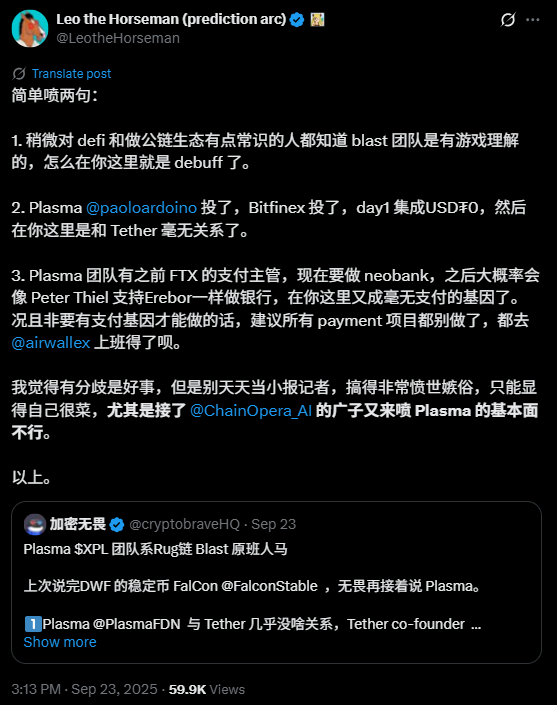

Another KOL @LeotheHorseman expressed that Plasma's financing and endorsements are undeniable, and the team has capable leaders in payment operations, believing that Crypto Brave's revelations are overly extreme.

As of now, neither Plasma nor Tether has officially responded to this matter. It seems like a pre-TGE hype show, with Crypto Brave's revelation post already garnering nearly 220,000 views, providing sufficient exposure for Plasma before the TGE.

Plasma's TGE Outlook and Potential Risk Analysis

As the largest stablecoin project TGE of the year, Plasma's debut is likely to boost the stablecoin ecosystem, drive growth in DeFi TVL, and encourage innovation in payments and asset tokenization.

Some analysts believe that XPL may experience significant volatility in the short term, but with $2 billion in TVL and Tether's backing, there is still room for long-term growth.

However, the project also faces uncertain risks:

First, there remains uncertainty regarding U.S. regulation of stablecoins in the long term;

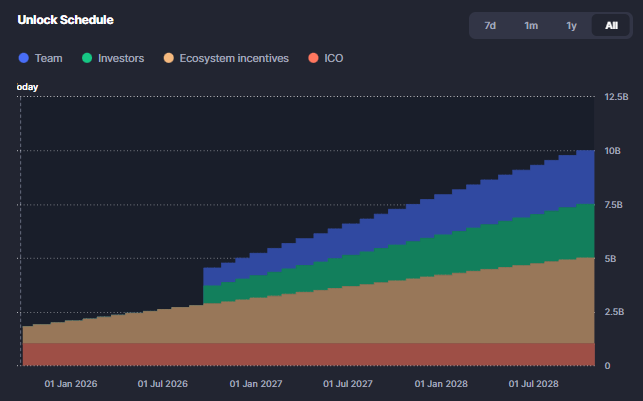

Second, token unlocks may also bring varying degrees of selling pressure;

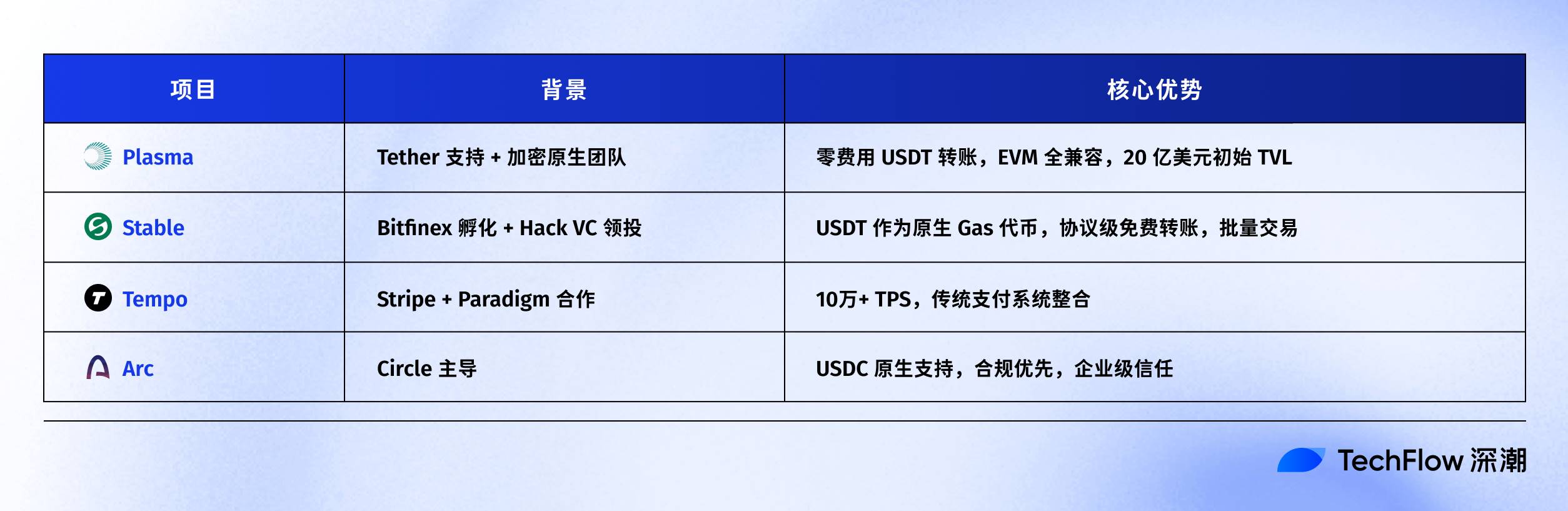

- Most importantly, competition in the Layer 1 stablecoin space is becoming increasingly fierce. Plasma faces dual competition from traditional payment giants and crypto-native projects, such as Tempo, Arc, and Stable. However, considering Plasma's crypto-native architecture and first-mover advantage, it brings unique competitiveness. Whether it can succeed in the future will depend on real market adoption rather than short-term superficial market speculation;

- Additionally, the current $7.3 billion pre-market valuation of the project has raised some concerns. Whether it can maintain this valuation will depend on factors such as on-chain activity, successful partnerships, and continuous capital inflow. If the rumors continue to escalate, it may amplify FUD and trigger market volatility.

⚠️ Disclaimer: This article is a neutral project analysis and does not constitute investment advice. Investors should conduct their own research and make cautious decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。