When speculation ultimately aligns with execution, repricing can be extremely severe.

Author: Kyle

Translated by: Deep Tide TechFlow

The Turning Point from 0 to 1

Mantle ($MNT) is at a compelling asymmetrical opportunity window, transforming from a loosely associated token with Bybit into an integrated utility exchange native token—this is a true "from 0 to 1" moment. The investment logic revolves around MNT's key turning point, similar to the early integration of utility functions with BNB and Binance, and MNT possesses several structural advantages that suggest significant revaluation potential.

Key Investment Drivers:

FDV of approximately $11 billion, presenting a huge opportunity for meaningful position allocation.

Multiple catalysts converging to form structural demand drivers.

Bybit, as the world's second-largest derivatives exchange, has strong business fundamentals.

Strong leadership led by Ben Zhou (CEO of Bybit).

- Token economic model aligned with token holder interests.

Permanent capital inflow achieved through utility functions.

Supported by multiple narrative angles, creating an easily tellable story.

- Good risk-reward profile at current valuation multiples.

History shows that when tokens transition from "exchange-associated" to "exchange utility" status, the market often rewards explosive revaluation: BNB soared from $15 to $690 after integrating with Binance, while OKB rose from $1 to $45. Mantle is currently at a similar structural turning point, with comparable utility integration but significantly lower valuation multiples.

Catalyst Analysis and Growth Dynamics

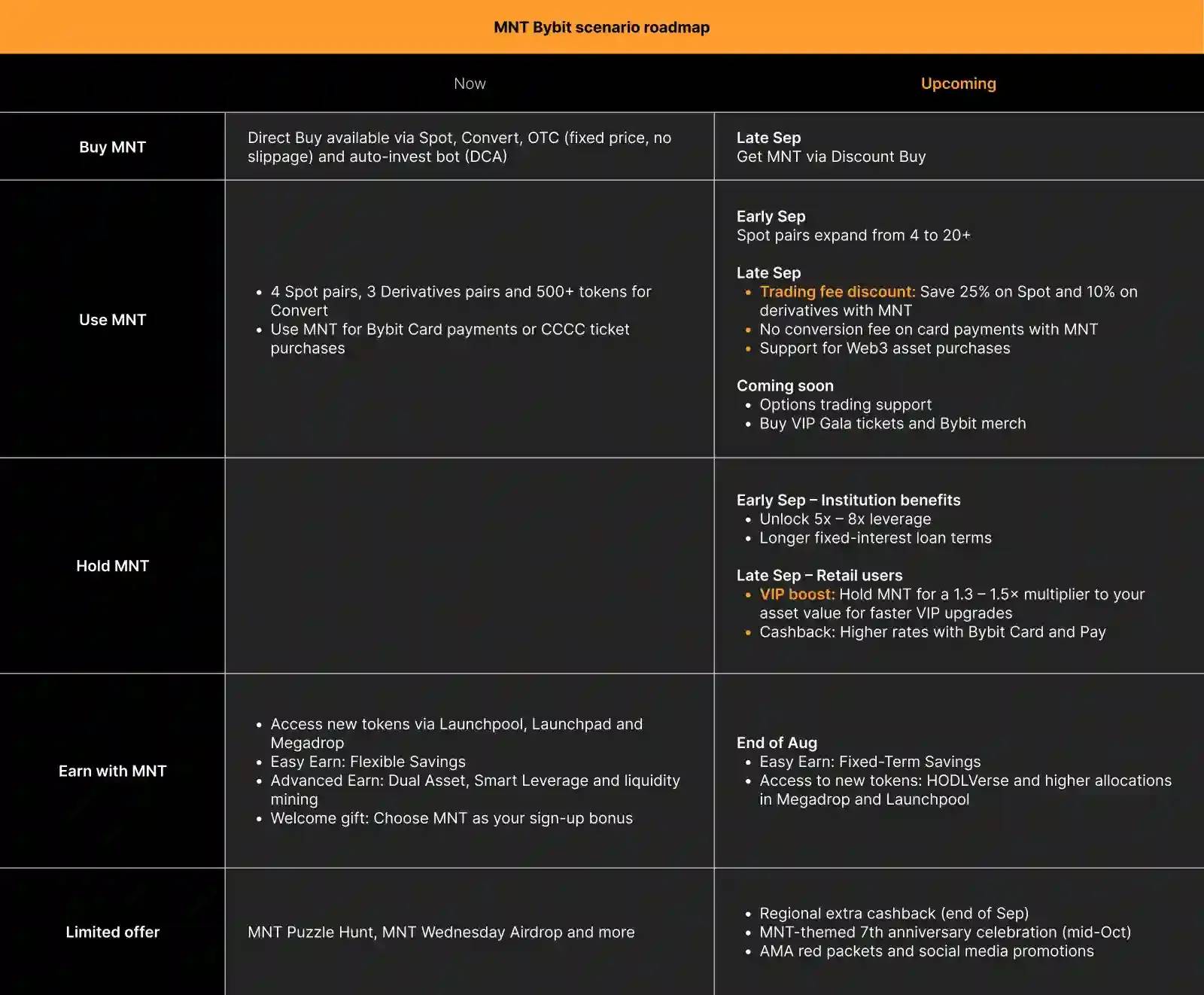

Source: Bybit

A). Immediate Catalysts

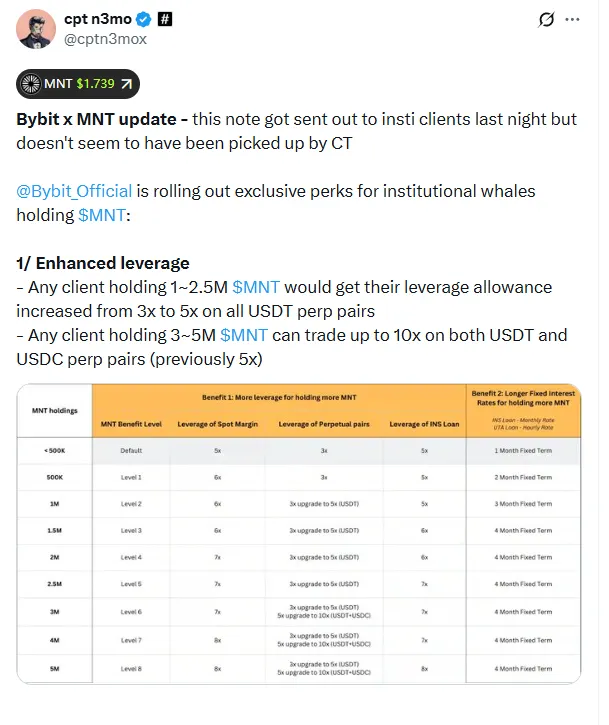

Enhanced Institutional Leverage.

Holding 1-2.5 million MNT → USDT perpetual contract leverage increases from 3x to 5x.

Holding 3-5 million MNT → USDT/USDC perpetual contract leverage increases to 10x.

Directly targeting institutional traders who require higher leverage strategies.

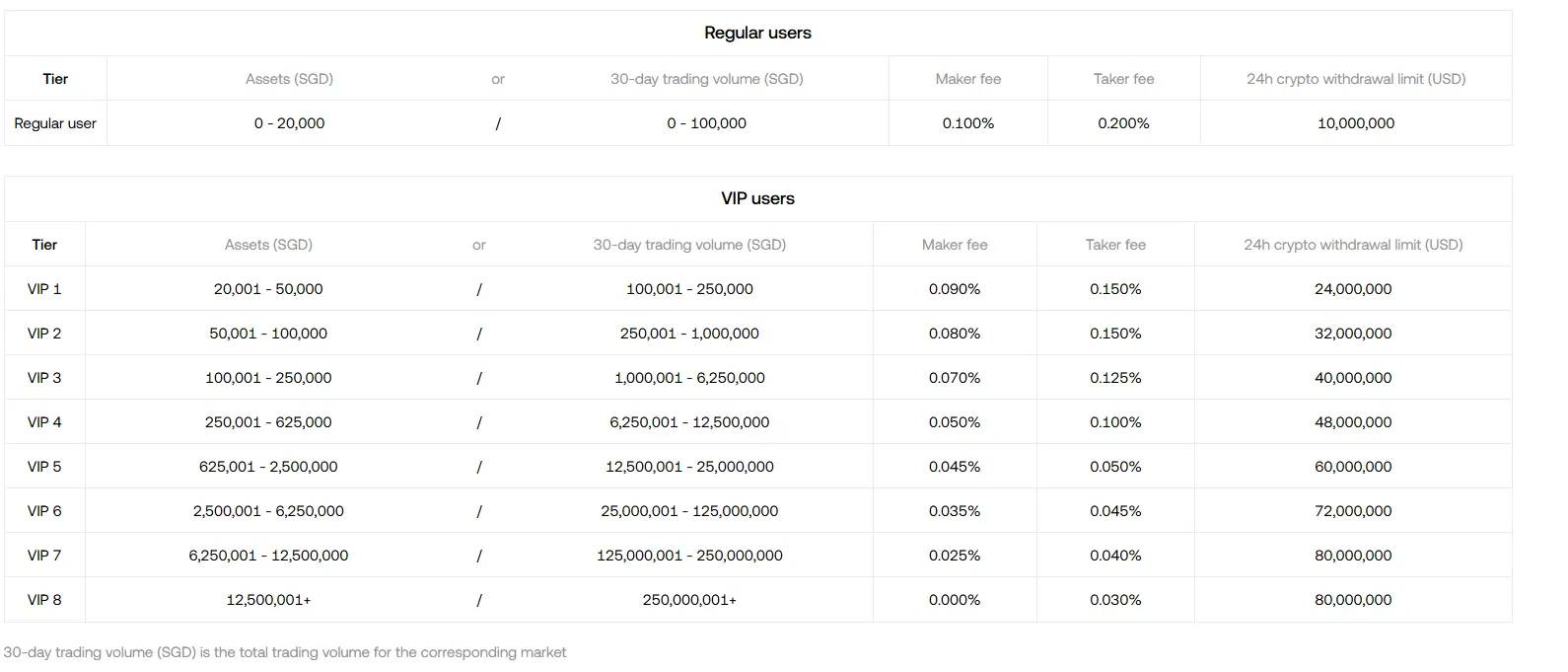

VIP Fee Discounts.

25% discount on spot trading fees.

10% discount on derivatives trading fees.

Collateral Optimization.

- MNT's loan-to-value ratio increases from 10% to 60%—a 6-fold increase, reducing capital requirements for large traders.

OTC Portal (expected Q4 launch).

Direct purchasing channel for institutions, addressing current liquidity constraints.

Automated block trading system to meet the accumulation needs of whales and funds.

Demand Quantification

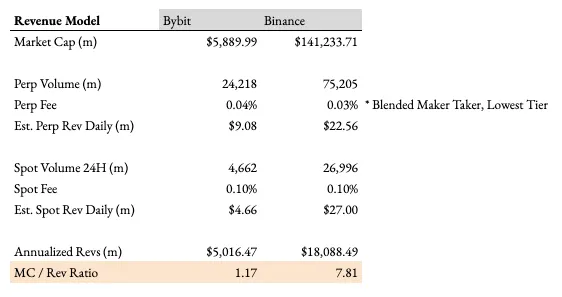

These catalysts work together to create significant token demand. According to Emily, head of Bybit's spot business and a key advisor to Mantle, if 20-30% of VIP traders (representing 75-80% of trading volume) utilize the fee discounts, then 15-20% of Bybit's total volume will be paid in MNT.

With Bybit's annual revenue estimated at around $4-5 billion, this could generate over $500 million in MNT token demand annually. This demand differs from speculative narratives, as the fee discounts create permanent structural buying pressure, as evidenced by BNB's sustained performance.

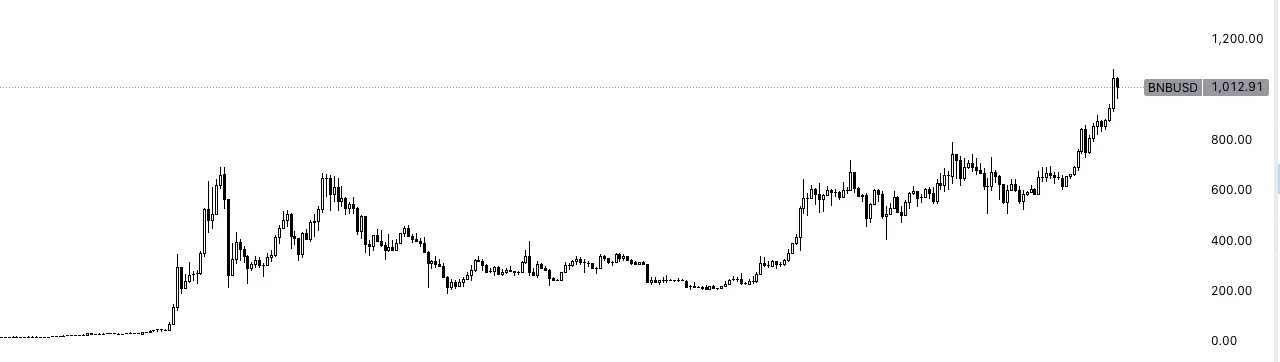

Source: TradingView

High-frequency traders and institutions require these discounts daily. Cost savings are an indispensable tool, continuously generating buying demand over time.

B). Bybit's Outstanding Growth Performance

Compared to the scale at which BNB was activated in its early days, Bybit's scale at the launch of utility integration is much larger. Bybit is already one of the top three exchanges globally, allowing MNT to skip the "early adoption" phase and directly reach a large VIP user base that has an urgent need for cost savings.

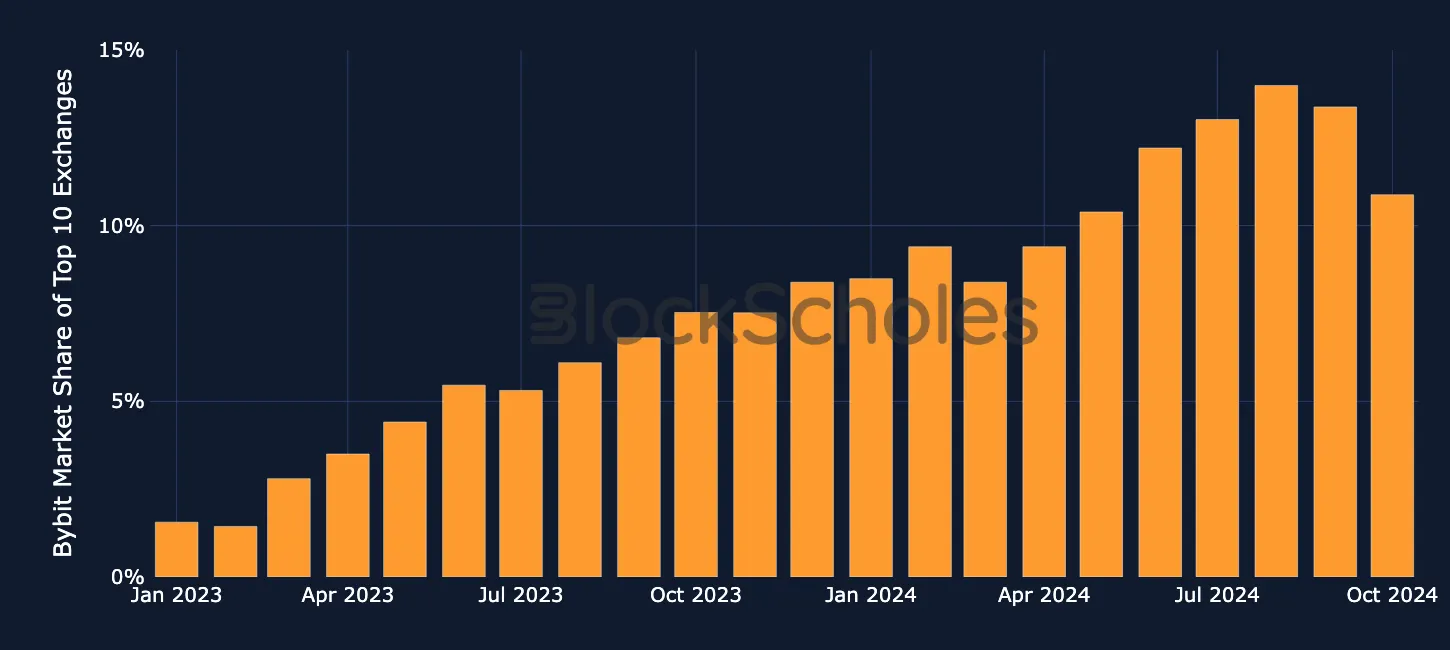

Growth Metrics

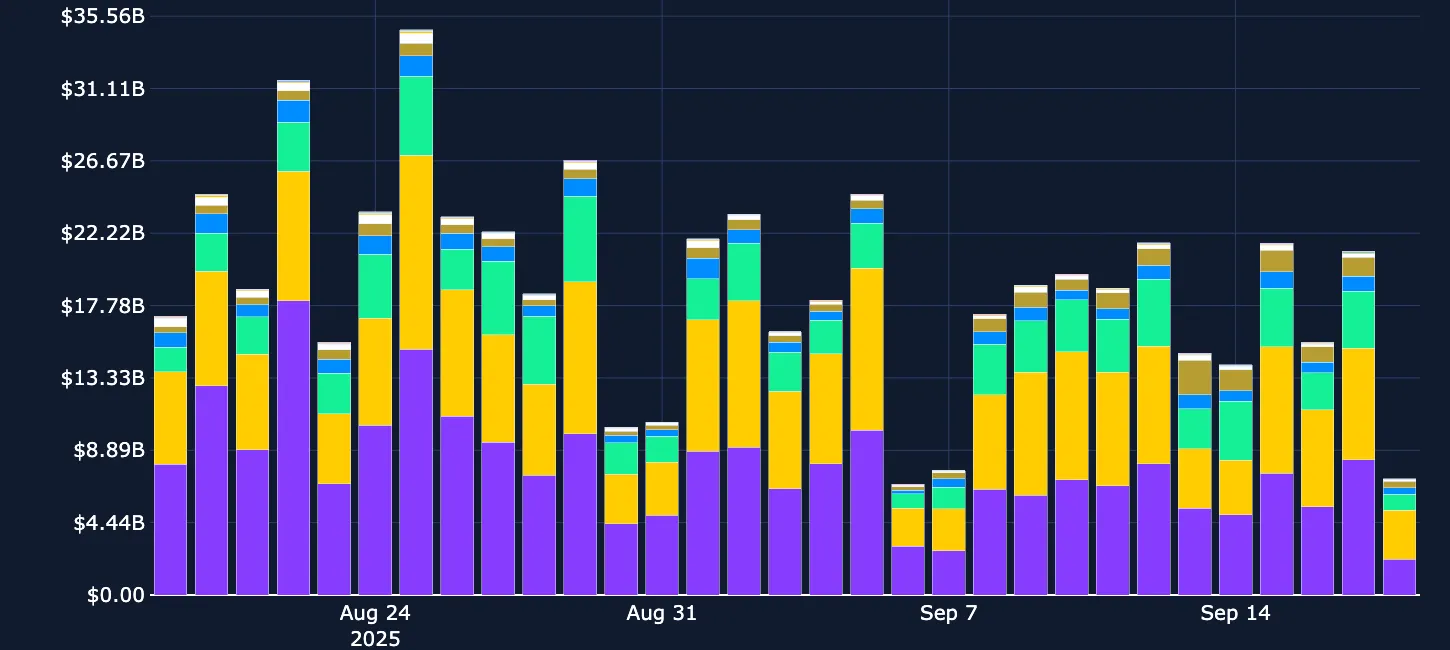

By trading volume, Bybit's market share among the top ten centralized exchanges.

Source: Block Scholes

Explosive market share growth: skyrocketing from 1.56% to 12.21% in two years (a 7-fold increase, while competitors stagnated). By 2024, Bybit is expected to become the second-largest centralized cryptocurrency exchange by trading volume. Its market share has surpassed 10%, demonstrating its increasing success in attracting more cryptocurrency traders.

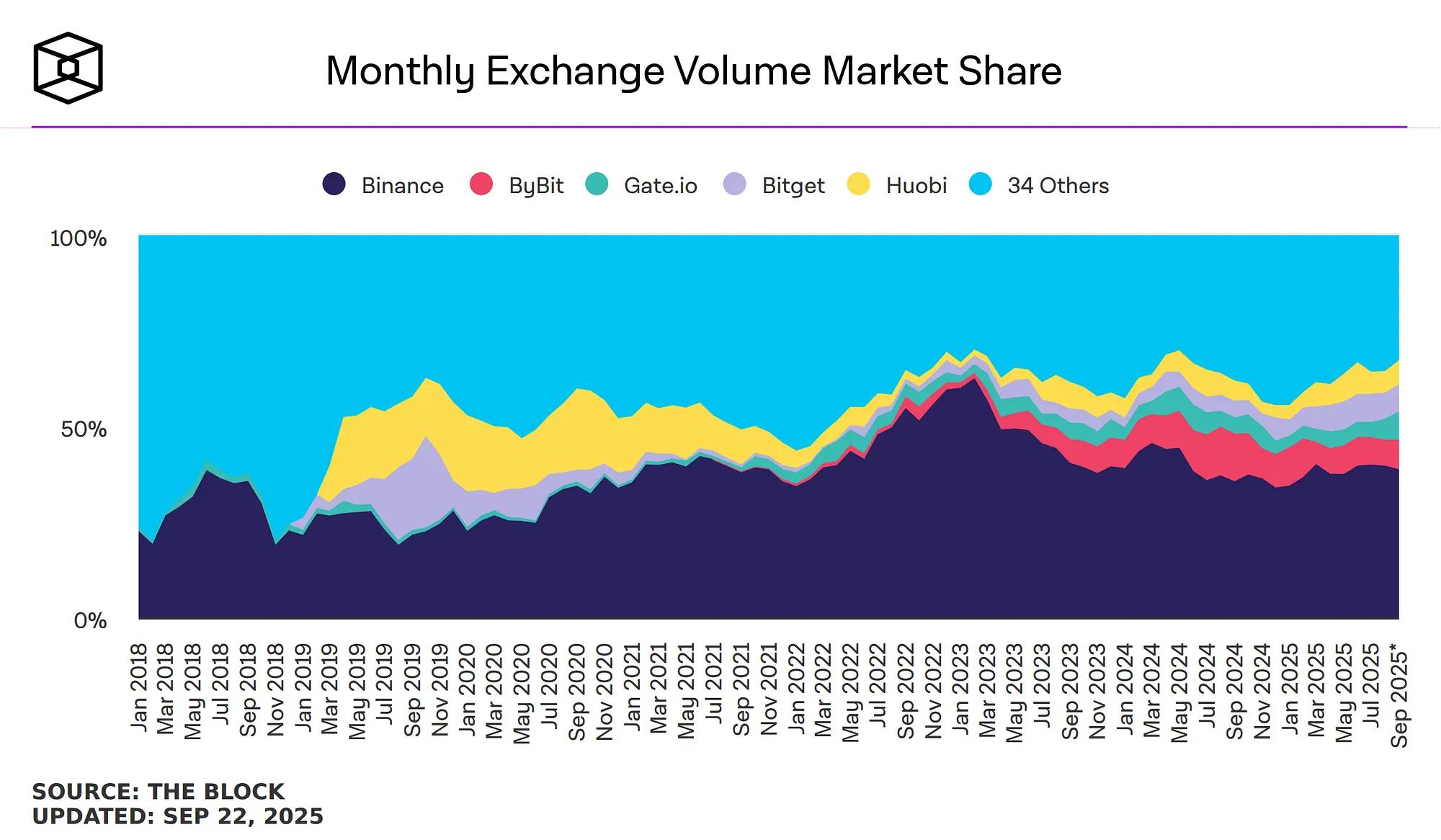

By trading volume, Bybit's market share among the top ten centralized exchanges. Bybit ranks second with 7.75%.

Data Source: The Block

The same comparison applies to the top ten perpetual contract exchanges by trading volume. Bybit's monthly trading volume share for perpetual contracts is 7.75%, second only to Binance's 38.76%.

Bybit perpetual contract trading volume.

Source: Block Scholes

Overall, Bybit is in a strong position. Their user growth rate is also remarkable—growing from 20 million users at the end of 2023 to 60 million users in Q3 2024, and as of May 9, 2025, registered users have reached 70 million. This provides the necessary user base for the large-scale adoption of MNT.

C). Leadership and Crisis Management

During the February 2025 Lazarus Group hacking incident, Bybit's leadership team demonstrated exceptional capability, with losses amounting to $1.5 billion. CEO Ben Zhou led the team to exhibit one of the strongest crisis management capabilities in cryptocurrency history, replenishing customer funds in full within 72 hours while maintaining a reserve ratio of over 100% and operational continuity. The exchange's market share briefly dropped from 12% to 8% but then rebounded, fully demonstrating user confidence in Bybit's leadership.

Given their outstanding leadership, in the latest Bybit x Mantle Live Recap event, Bybit co-CEO Helen Liu and head of spot trading Emily Bao were appointed as core advisors to Mantle in August 2025, which is of significant strategic importance. When such exceptional executives invest resources at the highest level, it marks a fundamental shift in Mantle's strategic commitment.

Overview of Strategic Focus:

Maximize Bybit platform resources for Mantle—fee discounts, trading pairs, loans, VIP benefits.

Build efficient infrastructure for RWA tokenization—positioning Mantle as an institutional-grade asset.

Cross-chain expansion—attracting users and assets through ecosystem interconnectivity.

D). Exchange Chain Dynamics

This strategic direction aligns with the rise and development of "exchange chains"—Base and Binance Smart Chain (BSC) have performed exceptionally well over the past year. It has been proven that exchange-native chains are one of the most successful models in the cryptocurrency space—they combine the user base, liquidity, and brand trust of exchanges with native blockchain utility. Base has become the dominant Layer-2 by leveraging Coinbase's institutional credibility and user base, while BSC has utilized Binance's trading volume and ecosystem to create sustainable on-chain activity.

Today, the competition among exchanges is intensifying: BNB represents BSC and Binance, while Base also hints at an upcoming token issuance. Mantle enters this competitive landscape with its institutional-grade infrastructure. The recent launch of UR Bank built on the Mantle chain highlights its commitment to connecting traditional banking with DeFi and creating a "core hub for on-chain RWA." As Helen Liu stated, this builds a "closed loop" of asset on-chainization, liquidity, and product-to-user coverage.

Thus, the key distinction of Bybit Mantle is that Bybit enters this field with a broader outlook. Bybit has complied with MiCA regulations, established institutional relationships, and demonstrated growth momentum. If this execution advantage can be effectively realized, it should drive a significant increase in its valuation.

Narrative Consistency and Token Economics

Mantle ($MNT) aligns with the strongest narratives currently in the crypto space. The market is rewarding tokens that can generate actual cash flow and possess real business models, such as:

Launchpads

Perpetual DEXs

Exchange Tokens

Stablecoins

DeFi Protocols

These areas represent the financial infrastructure developed in cryptocurrency over the past five years, with the market gradually accepting financial services as the primary application of cryptocurrency, rather than purely speculative narratives.

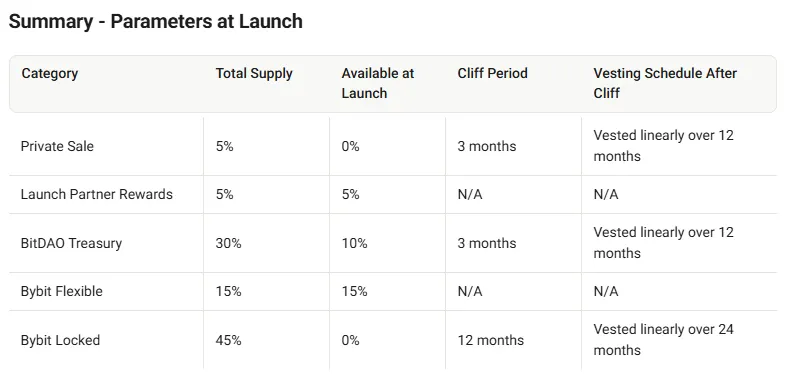

Supply Structure

From a token economics perspective, MNT's token economic model reflects a highly centralized control, with approximately 90% of the effective supply controlled by Bybit and affiliated entities. Although public disclosures show that 48% of the tokens are held by the treasury and 52% are in circulation, the actual situation based on historical BitDAO allocation data is as follows:

45% Bybit allocation

30% BitDAO treasury

15% Bybit flexible allocation

Source: BitDao Docs

This centralized control may seem to pose significant governance risks, but in reality, it is a structural advantage. Market evidence supports two sustainable token economic models:

Fully diluted assets that have completed their allocation cycle, with sell pressure absorbed.

Strategically controlled tokens held by entities with non-trading business models.

Examples of the first category include tokens like Raydium and Aave, which have passed their major unlocking periods. Mantle belongs to the second category, creating better incentive mechanisms rather than facing structural sell pressure due to fund lifecycle and LP return requirements like traditional venture-backed projects.

Bybit's operating model differs from other projects. As an exchange with annual trading fees of $4 billion, token sales account for only a small portion of its revenue and would dilute its core business model. Bybit's success relies on MNT as an effective utility infrastructure—providing fee discounts, serving as collateral, and driving institutional adoption. Each use case requires price stability and appreciation, rather than token liquidation.

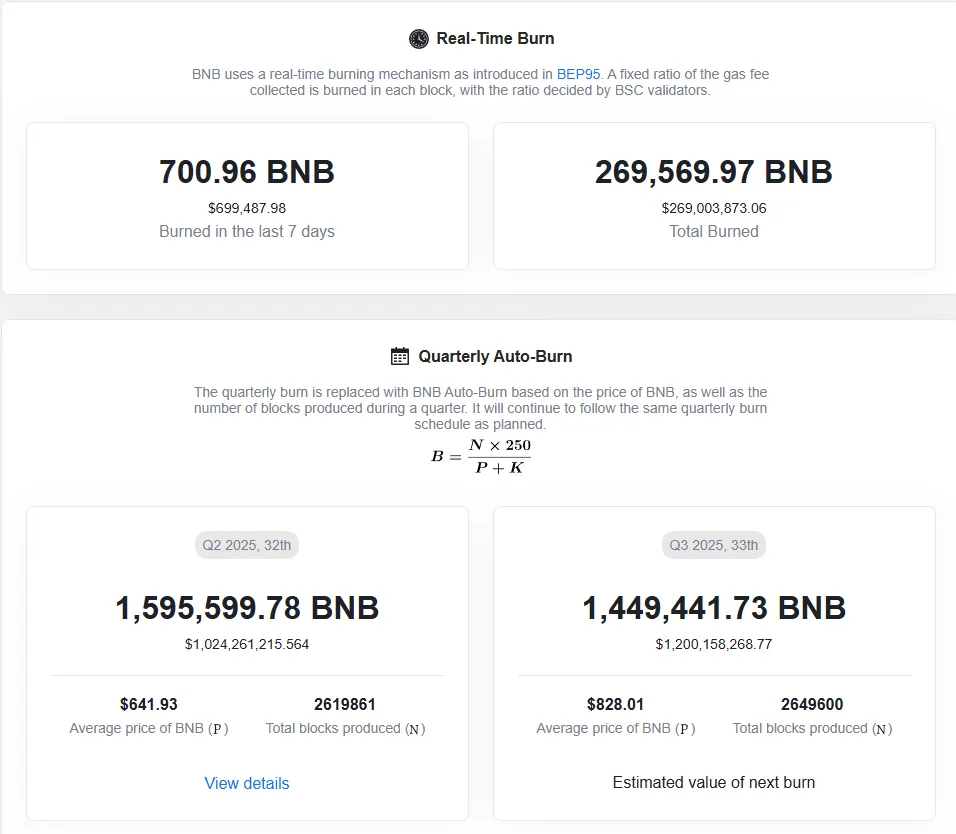

This token economic model has historically proven successful. BNB demonstrates how exchange-controlled tokens perform well when the parent company has complementary business incentives. Binance holds a significant amount of BNB while focusing on token burns rather than sales, having burned over $1 billion in BNB in the past quarter. Additionally, Binance's revenue model naturally creates demand for BNB's utility, supporting price appreciation that benefits both the exchange and token holders.

Source: BNBurn

The case of OKX further validates the power of exchange-led token economic optimization. In August 2025, OKX burned 279 million tokens worth $26 billion, reducing the total supply by 93% to 21 million tokens. This deflationary event triggered a 200% price surge within hours, showcasing the potential of exchange-led token economic optimization.

By controlling over 90% of the supply, exchanges can execute strategic plans without interference from conflicts of interest. This centralized control enables rapid decision-making and strategic flexibility, which distributed governance models cannot match. Centralized control is not a risk; rather, it creates a high degree of consistency between token performance and core business success—a dynamic that continues to be favored by the market in the exchange token space.

Relative Valuation Analysis: Exchange Token Discrepancies

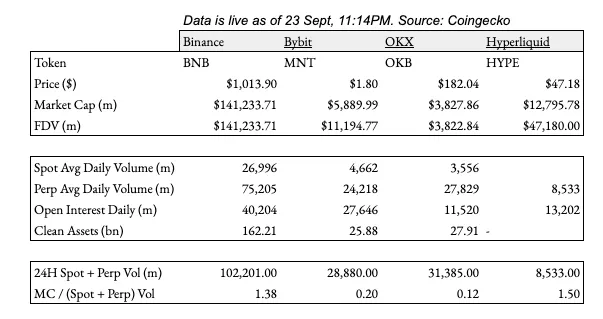

This leads to a perfect entry point—discussing Bybit and Mantle's positioning among other centralized exchanges (CEX). While exchange tokens are experiencing industry-wide appreciation, significant valuation discrepancies have emerged. A comparative analysis of major exchange tokens shows that despite similar underlying business metrics, MNT's trading price is far below its peers.

Source: TradingView

Performance Comparison

Metric Comparison

Profit Model

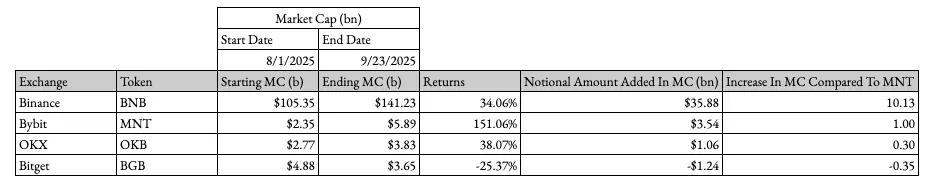

Since August 1, 2025, exchange tokens have performed strongly:

BNB: Market cap increased by $35 billion.

OKB: Significant appreciation after supply reduction.

BGB: Strong performance in the burn plan.

MNT: Market cap increased by $3.5 billion (only 1/9 of BNB).

There is a disconnect between trading volume and valuation. Since August 1, BNB's increase is ten times that of MNT's $3.5 billion increase. However, the key point is that Bybit's spot and derivatives trading volume consistently accounts for about one-third of Binance's trading volume.

Volume analysis reveals a fundamental pricing error. This is even more apparent when looking at the ratio of market cap to trading volume:

MNT: 0.12x

BNB: 1.15x

HYPE: 1.05x

Although MNT's trading infrastructure and revenue-generating capacity are comparable to BNB, its trading price is still about 10 times lower based on this metric. Ultimately, according to the hypothetical revenue model, MNT's trading price is below 1x MC/Rev, while BNB's trading price is about 7.26x. In any case, MNT has room for growth.

Structural Differences with OKX

Although OKX is similar to Bybit in trading volume metrics, key structural differences limit OKB's utility integration. OKX does not include OKB holdings in its trading fee calculations, eliminating an important demand driver, while Bybit has committed to implementing this into MNT's token economic model.

Source: OKX Fees

Additionally, OKB's value proposition on its website primarily focuses on launchpad access and staking rewards, rather than core exchange functionality integration. This limits structural demand drivers and suggests that OKX's recent burn initiatives may be passive rather than strategic.

Information Gap

There is also an undervalued geographical factor in this opportunity. Due to information flow differences, exchanges focused on Eastern markets face systematic undervaluation in Western markets. While Binance has gained global recognition, Bybit remains more focused on regional markets despite having comparable operational scale.

This creates an information asymmetry, which generates alpha returns—when one market is more informed than another, the trading valuations of comparable assets will differ. The opportunity lies in the gap between the operational realities in the East and the perceptions in the West.

Execution and Strategic Positioning

Overall, compared to centralized exchanges outside of Binance, Bybit's management execution and strategic vision appear to be higher. With support at the CEO level, MNT has now become a core priority rather than just a side project. It is at the beginning of its journey to integrate practical functionalities, with each integration milestone representing a catalyst that the market has yet to fully digest.

Timing and Risk Assessment

Let's discuss an obvious topic: for four years, MNT has been a controversial trade in the Asian cryptocurrency circle. The chart says it all—based on speculation about Bybit integration, MNT has made multiple attempts to break through, but ultimately failed each time.

Source: TradingView

Why This Time is Different

Previously, MNT's upward momentum was built on hope rather than substance. For four years, MNT has existed as an independent L2 token, with Bybit owning it, but operational synergies were zero. The timeline reveals its development history:

August 2021: Launched as BITDAO (Investment DAO token)

May 2023: Converted to MNT, focusing on L2

July 2025: First real Bybit integration announcement

August 2025: Bybit executives join the Mantle advisory board

The current market belief is that this breakthrough reflects actual integration progress rather than speculative positioning. As Bybit's exchange infrastructure operationally integrates with Mantle's practical functionalities, this indeed marks a trend shift in Mantle's lifecycle.

Risk #1: Execution Failure

The primary risk remains Bybit's failure to deliver on integration promises. If promised fee discounts, leverage features, or the launch of the OTC portal are delayed or poorly implemented, the utility narrative will completely collapse.

Risk Mitigation: Recent signals indicate that Bybit has made a serious commitment. In an interview with BidClub, Bybit's head of spot business and key advisor to Mantle, Emily, described the timeline as "to be completed as soon as possible, given CEO Ben's urgency." More importantly, communication with institutional clients on September 10 confirmed that Bybit has delivered on its commitments as planned.

Source: @Cptn3mox on X

Risk #2: Competitive Alternatives

BNB maintains a significant advantage through its proven utility and institutional adoption. Accelerated innovation from Binance or other exchanges could still suppress MNT despite strong fundamentals.

Risk Mitigation: Multiple exchange tokens can successfully coexist, similar to L1 ecosystems or derivatives platforms. The market size is large enough to accommodate multiple businesses sharing.

Risk #3: Industry Timing

Currently, the market may be entering late in the exchange token cycle. BNB, OKB, and other peers have already achieved significant growth during 2024-2025, which may limit the upside for later entrants.

Risk Mitigation: Exchange tokens are still in the early stages relative to traditional financial penetration. More importantly, MNT represents a "from 0 to 1" utility integration story, while peers have matured. Even in bear markets, exchanges with strong utility tokens often gain market share due to cost savings when profits are compressed.

Risk #4: Geographic Limitations

Bybit is excluded from major markets (U.S., U.K.), limiting its addressable market size, especially compared to regional competitors like Coinbase.

Risk Mitigation: This limitation may be rapidly diminishing. Caroline Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), recently announced plans to allow U.S. citizens to trade on offshore exchanges under CFTC regulation, specifically mentioning Binance, Bybit, and OKX. This regulatory change could unlock significant growth potential without the need to establish a separate U.S. entity.

Final Thoughts

MNT appears to be at the beginning of its utility integration cycle rather than the end. Specific operational progress, structural demand drivers, and potential regulatory tailwinds create an asymmetric opportunity as the market shifts from speculation to substance.

The failures of the past four years actually reinforce the current argument—previous failures were based on hope, while the current momentum reflects operational reality. When speculation finally aligns with execution, repricing could be very dramatic.

Important Note: This document is for informational purposes only. The views expressed in this document are not investment advice or recommendations and should not be construed as such. Recipients of this document should conduct their own due diligence before investing and consider their specific financial situation, investment objectives, and risk tolerance (which are not taken into account in this document). This document does not constitute an offer or invitation to buy or sell any assets described herein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。