Author: arndxt

Compiled by: Tim, PANews

Macroeconomic Liquidity and Federal Reserve Policy

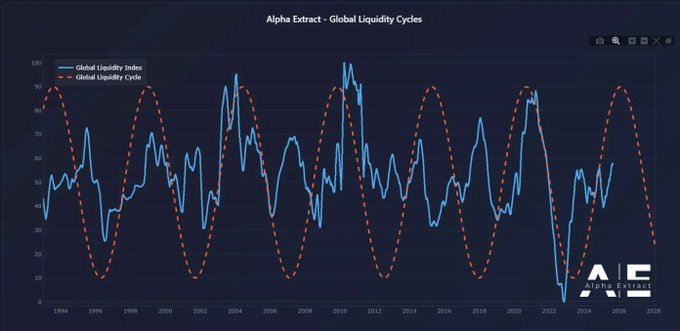

The biggest overall conclusion is that the crypto market will not decouple from the macro economy but will instead become more closely integrated with it.

The timing and scale of capital rotation, the Federal Reserve's interest rate path, and institutional adoption will determine how this cycle evolves.

Unlike in 2021, the upcoming altcoin season (if there is one) will be slower, more selective, and more focused on institutional direction.

If the Federal Reserve implements easing policies through interest rate cuts and bond issuance, while resonating with institutional adoption, then 2026 could become the most significant risk cycle since 1999-2000, benefiting the crypto market, although its performance will be more restrained rather than explosive.

1. Differentiation of Federal Reserve Policy and Market Liquidity

In 1999, the Federal Reserve raised interest rates by 175 basis points, yet the stock market soared to its peak in 2000. Today, the forward market is pricing in the opposite scenario: a 150 basis point rate cut by the end of 2026. If this becomes a reality, it will create an environment that injects liquidity rather than withdraws it.

The market landscape in 2026 may mirror the risk appetite of 1999 and 2000, but the interest rate trend will be completely opposite. If this judgment holds, 2026 may witness a "1999, 2000 enhanced version" market trend.

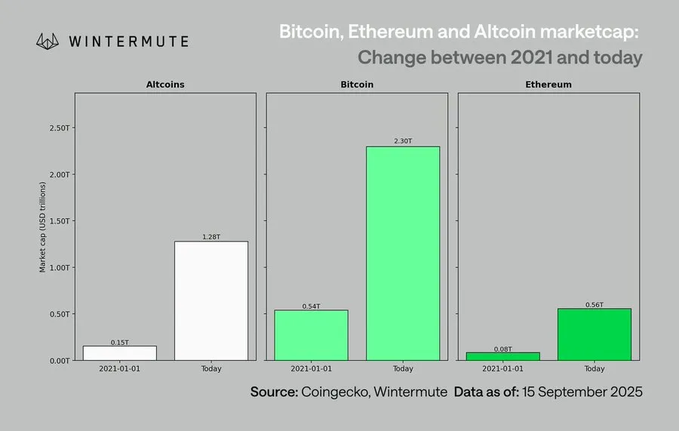

2. Comparison of the Current Crypto Market Landscape to 2021

Comparing today with the last bull market cycle:

- Stricter capital discipline: Rising interest rates and persistent inflation prompt companies to take on risk more selectively.

- The liquidity surge during the COVID-19 pandemic will not be repeated: Without an M2 surge, growth must be driven by adoption and allocation.

- Market size has expanded tenfold: A larger market capitalization base means deeper liquidity, but the likelihood of achieving 50-100 times oversized returns will decrease.

- Institutional capital flow: With mainstream and institutional adoption now established, capital flow is more gradual, leaning towards slow rotation and consolidation rather than explosive cross-asset rotation.

3. Bitcoin's Lagging Performance and Liquidity Chain

Bitcoin's performance relative to liquidity conditions is lagging because new liquidity is constrained by upstream government bonds and the money market. As the furthest end of the risk curve, cryptocurrencies will only benefit when liquidity flows downstream.

Catalysts driving the crypto market:

- Bank credit expansion (ISM > 50)

- Outflow of funds from money market funds after interest rate cuts

- The Treasury issuing long-term bonds, lowering long-term interest rates

- A weakening dollar is alleviating global financing pressures

When these conditions are met, the crypto market has historically risen in the later stages of the cycle, specifically after stocks and gold.

4. Risks Under the Benchmark Scenario

Despite this bullish liquidity structure, some risks are emerging:

- Rising long-term yields (due to geopolitical pressures).

- A stronger dollar leading to tightening global liquidity.

- Weak bank lending or tightening credit conditions.

- Stagnation of liquidity in money market funds, rather than rotation into risk assets.

The characteristics of the next cycle will be less defined by speculative capital shocks and more dependent on the structural integration of the crypto market with global capital markets.

As institutional capital flows, disciplined venture capital behavior, and policy-driven liquidity shifts intertwine, 2026 may become a key turning point for the crypto market, transitioning from isolated boom-bust cycles to global systemic correlation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。