Original | Odaily Planet Daily (@OdailyChina)

In just one hour, the liquidation amount reached as high as $1.03 billion. The sudden crash in the market seems to have stunned everyone.

Just over the weekend, the market was still immersed in a carnival atmosphere. After its launch, ASTER surged ahead, skyrocketing 60 times, AVNT more than tripled in just six days, and the PerpDEX sector showed signs of revival. However, today, it faced a heavy blow without any warning. Bitcoin fell below the critical level of $11,500, currently hovering around $11,280; Ethereum once approached the psychological barrier of $4,000, currently reported at $4,190; SOL hit a low of $214, now rebounding to $224.

However, looking around, we seem unable to find a clear trigger for this sudden drop.

Macroeconomic Factors: Rate Cuts Fail to Stir Waves, Market Expects More

Last week, the Federal Reserve announced a rate cut of 25 basis points as expected, but the market's performance was surprisingly flat. There was no significant surge or a sharp drop after "buying the expectation, selling the fact." This indicates that the 25 basis point cut had already been fully priced in by the market, making it difficult to provoke additional volatility; on the other hand, it is more likely that the market's focus has shifted, with greater concern about how many rate cuts the Fed will implement this year and whether the policy path can signal stronger easing. Meanwhile, there have been no unexpected negative factors emerging from other areas, and the current external environment for the market is relatively stable.

Liquidity: Hidden Concerns Amid Stability

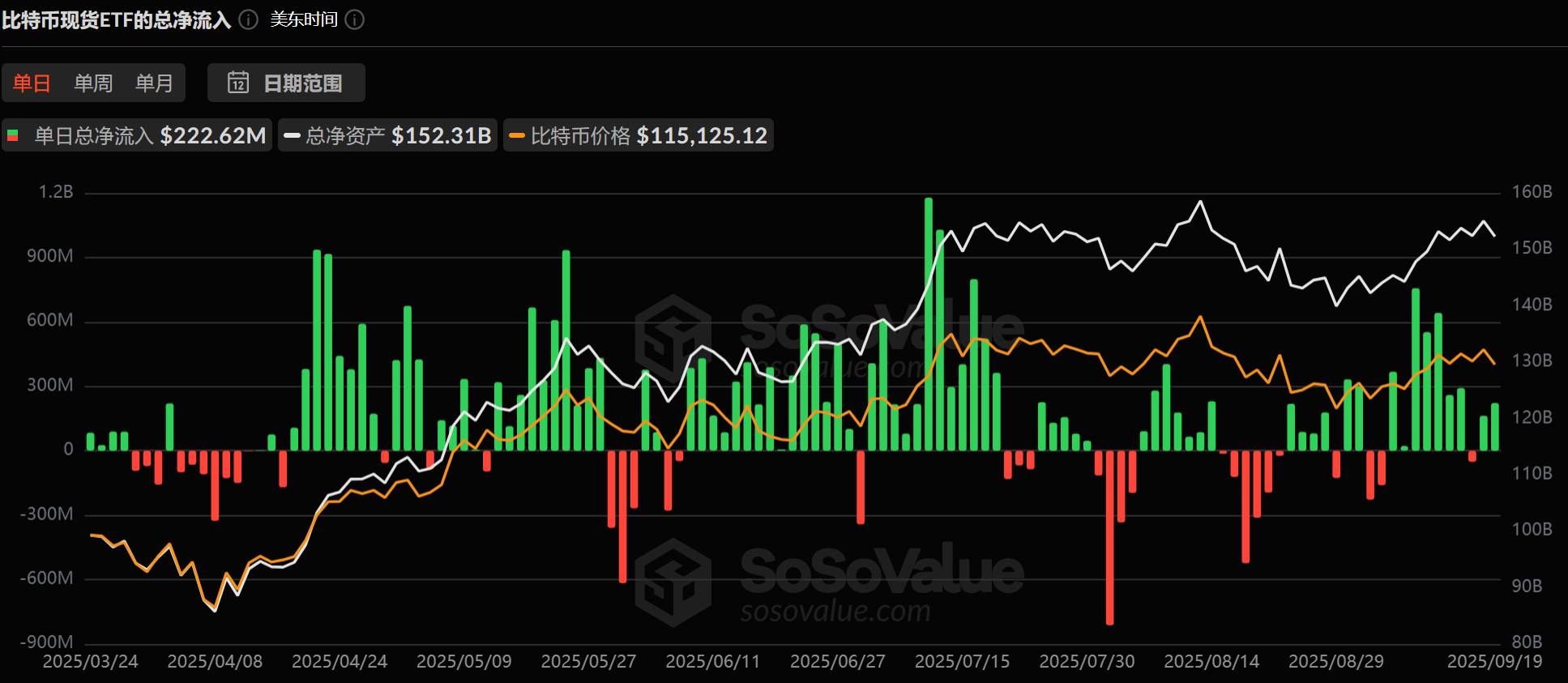

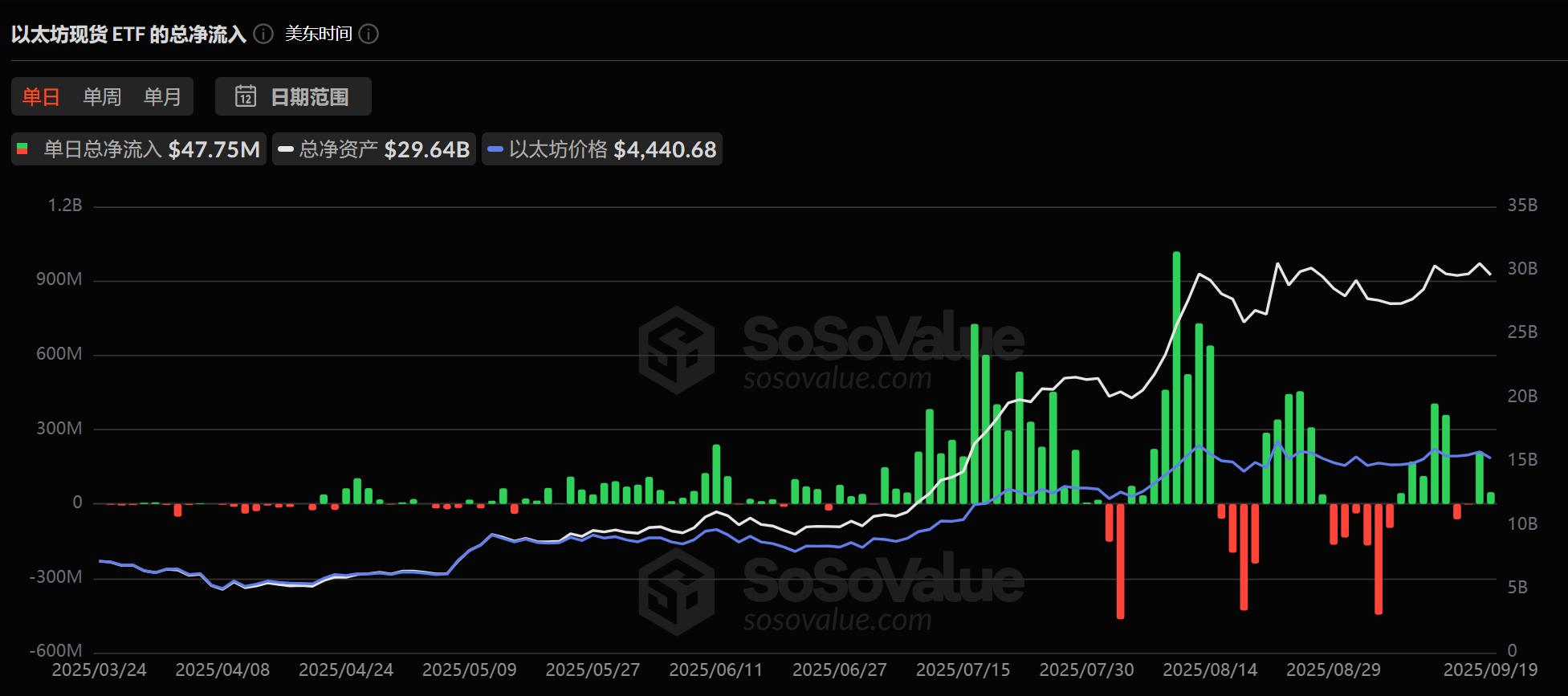

From the perspective of capital flow, the recent inflow of Bitcoin and Ethereum spot ETFs has slowed down, but there are no significant outflow signs. Bitcoin has recorded net inflows for four consecutive weeks, indicating that market sentiment has not completely turned pessimistic.

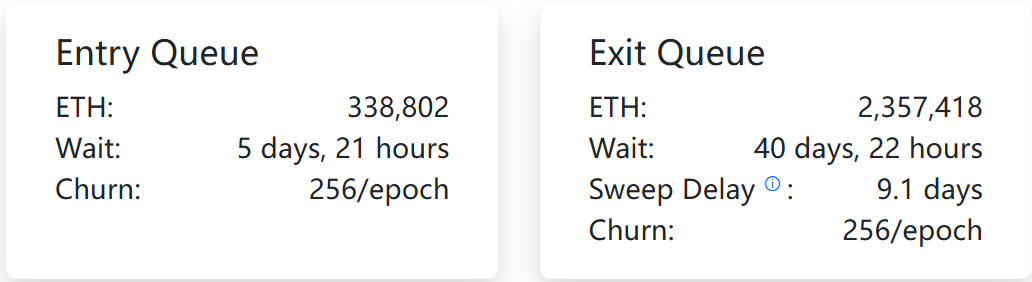

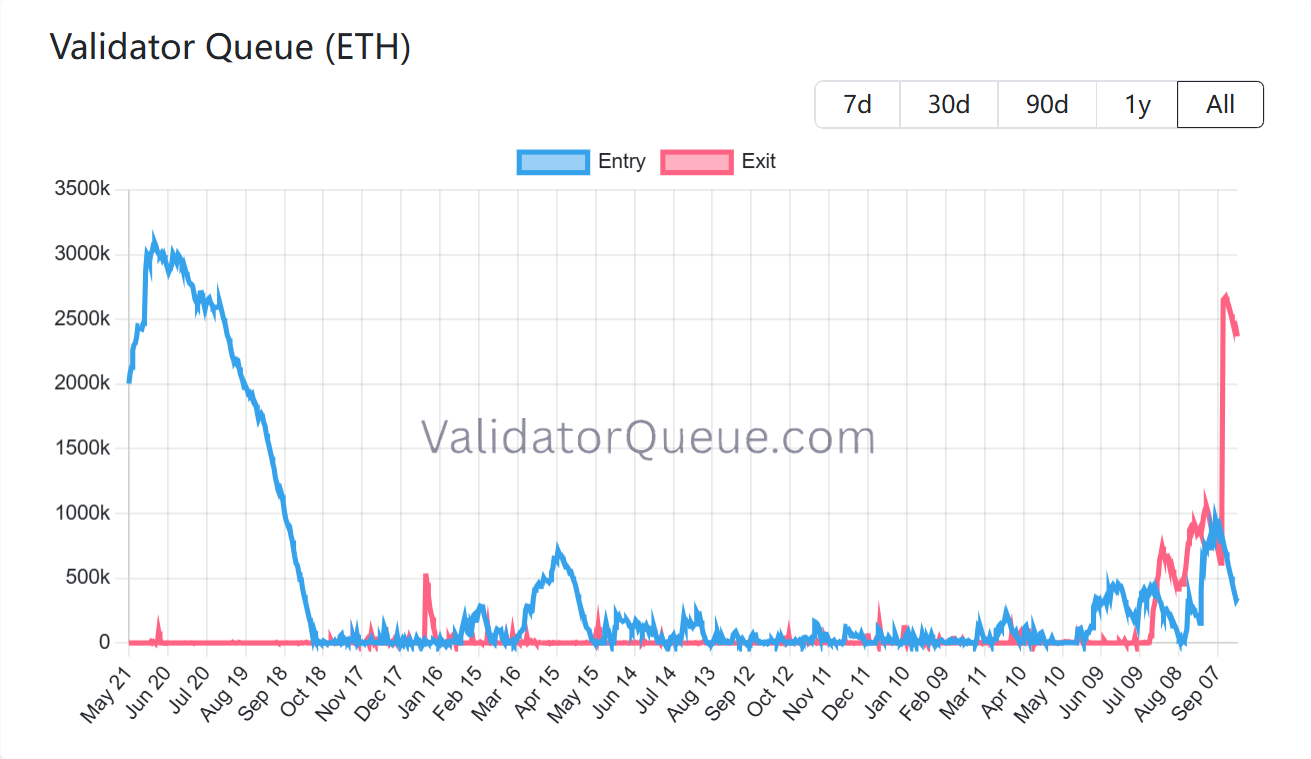

If we must find a potential risk point, it may have to do with Ethereum. As ETH prices soared, the activities of staking entry and exit for Ethereum became intense. Currently, the number of ETH waiting to exit has surged to 2.357 million, worth nearly $10 billion. Although it cannot be directly asserted that these unlocked tokens will necessarily flow into the secondary market, this scale alone is enough to create psychological pressure on the market. Moreover, the institutions related to Ethereum reserves have not shown significant buying actions.

"Insider" Operations: The "Survivors" with Precise Withdrawals

After this drop, two survivors with extremely "precise" actions may attract more attention, as their operations can almost be described as "insider-level."

According to crypto analyst Ai Yi @ai_9684 xtpa's monitoring, addresses associated with Trend Research redeemed 16,800 ETH from Aave this morning and quickly transferred it to Binance, worth about $72.88 million. Thus, this once large holder, who held 152,000 ETH at an entry cost of only $2,869, has almost completed the entire process of cashing out, with only 214.8 ETH remaining in that address.

Just yesterday, Trend Research transferred 346 million NEIROETH (worth about $14.36 million) to Gate and Bybit, and on September 4, another 324.7 million (worth about $22 million) flowed into exchanges. The two transfers totaled 670 million, accounting for 67% of the total NEIROETH supply. Since it began transferring to exchanges, the price of NEIROETH has cumulatively dropped by about 60%.

BitMEX co-founder Arthur Hayes also sold 96,600 HYPE on the evening of September 21, with a transaction amount of about $5.1 million. Just three weeks ago, he had predicted that HYPE's price could rise 126 times in the coming years.

He jokingly responded that he "needs to pay a deposit for a Rari 849 Testarossa (luxury car)," but the "official reason" given this morning was that HYPE is about to face its real test, as its tokens will begin linear unlocking on November 29, with a total of 237.8 million tokens to be unlocked by the team over the next 24 months, amounting to about $11.9 billion at the current price of $50, with about $500 million entering the market each month. The current repurchase level can only absorb about 17%, leaving a remaining monthly supply pressure of about $410 million, which could become a risk. It is worth mentioning that Hayes is not the first to perform the "buy high, sell low" act; he has left similar operational tracks on ETHFI.

Market Voices: Long-term Optimism for Bitcoin, Short-term Stability in Gold

In terms of market opinions, American investment bank Jefferies stated in a report aimed at large institutional investors that the development stage of cryptocurrencies is similar to that of the internet in 1996, still possessing vast growth potential. Analysts pointed out that one should not only focus on Bitcoin's price fluctuations but also recognize the industry-wide disruption that blockchain may bring. Just like internet investments back then, the key is not short-term prices but long-term utility and selectivity. Currently, some institutions have begun to position themselves through ETFs and digital asset treasury management (DAT) companies.

In contrast, analysts from Citigroup Research indicated that the gold bull market may continue in the short term. Analysts noted that cyclical factors (such as the continued weakness in the U.S. labor market) and structural factors (such as concerns about the independence of the Federal Reserve) are expected to continue to favor gold in the short term. They added, "Almost all factors are currently favorable for the gold bull market." Previously, Citigroup set a target price of $3,800 per ounce for gold over the next three months.

Arthur Hayes stated that once the U.S. Treasury reaches its goal of injecting $850 billion into the TGA (Treasury General Account), the crypto market will enter a "only up, not down" mode. Hayes wrote at the time when the U.S. TGA's initial balance exceeded $807 billion: "As the liquidity drought ends, the 'only up, not down' trend will reappear." When the Treasury fills its general account, funds are usually isolated and do not flow into the private market. However, not all analysts believe Hayes's prediction that once the U.S. Treasury reaches its goal, liquidity will flow into financial markets. André Dragosch, head of European research at investment firm Bitwise, responded: "However, the correlation between net liquidity and Bitcoin and cryptocurrencies is at best loose. In my view, this is fundamentally a futile effort."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。