撰文:1912212.eth,Foresight News

9 月 22 日今晨,BTC 还维持在 11.5 万美元上方,不过仅数小时后于今日 2 时许,BTC 失守 11.5 万美元后,突然大幅下跌接连失守整数关口位,一度下探至 11.18 万美元,现回升至 112800 美元。ETH 则从 4500 美元附近一度下探至 4077 美元,现回升至 4100 美元上方。SOL 一度下探至 214.5 美元,众多山寨币也遭遇普跌。

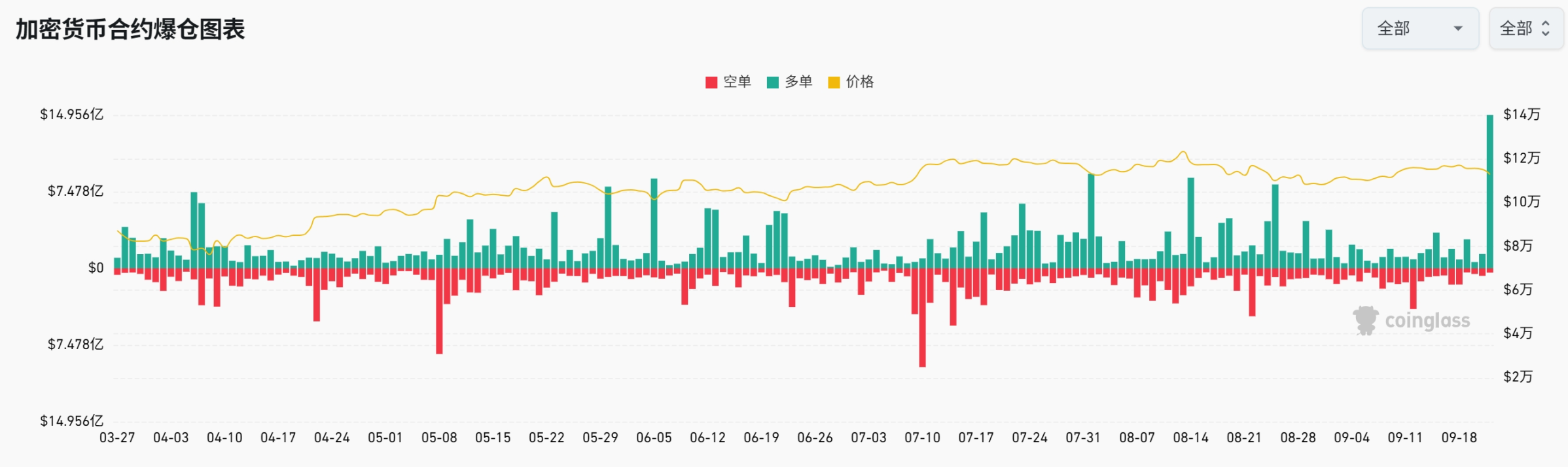

coinglass 数据显示,全网未平仓合约 24 小时爆仓 17 亿美元,创年内新高,其中多单爆仓 16.17 亿美元,最大单笔爆仓发生在 OKX 上的 BTC-USDT,价值 1274 万美元。

美联储鲍威尔宣布降息 25 个基点才不过数天,市场便迎来如此下跌,是牛市暂停,还是市场已经悄然转向?

ETH 鲸鱼大幅抛售,市场消化美联储降息利好

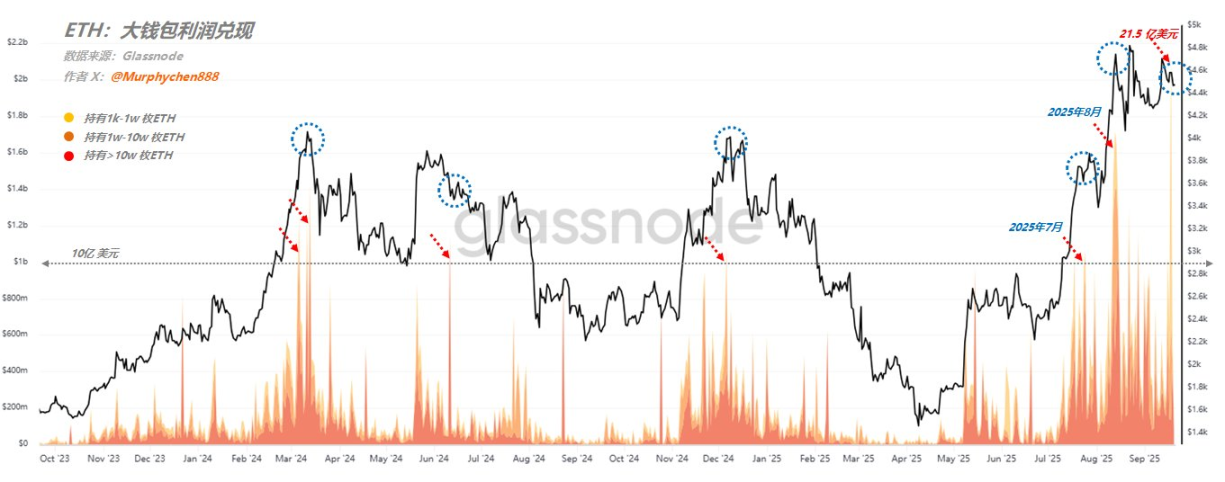

聪明的鲸鱼总是在市场情绪火热以及阶段性顶部区间不断获利止盈。数据分析师 Murphy 援引 glassnode 图表显示,9 月 18 日,持有 1000-1 万枚 ETH 的鲸鱼单日套现 15 亿美元,加上 1 万 -10 万枚,以及超 10 万枚 ETH 的鲸鱼之外,总规模套现 21.5 亿美元。

今年 7 月,当 ETH 突破 3500 美元后,也出现了巨额套现,不过因部分美国财库公司积极买入,因而价格并未下跌。

值得一提的是,财库公司 Bitmine 现在持有 215.1 万枚的 ETH (90 亿美元 ),成本价 3949 美元,尽管公司此前明确表示短期内不会出售持仓,但市场关注若 ETH 跌破成本其股价表现及后续增持能力打个问号。

ETH 表现乏力,山寨币表现可想而知,除部分 BNB Chain 生态以及 DEX 衍生品之外均出现不小跌幅。

此外,9 月初以来,市场普遍预期美联储将会降息 25 个基点。因而 BTC 从 10.7 万美元一路震荡上扬,美联储决议公布之后一度触及 11.79 万美元。利好出尽,往往会迎来市场回调。

后续市场方向分析

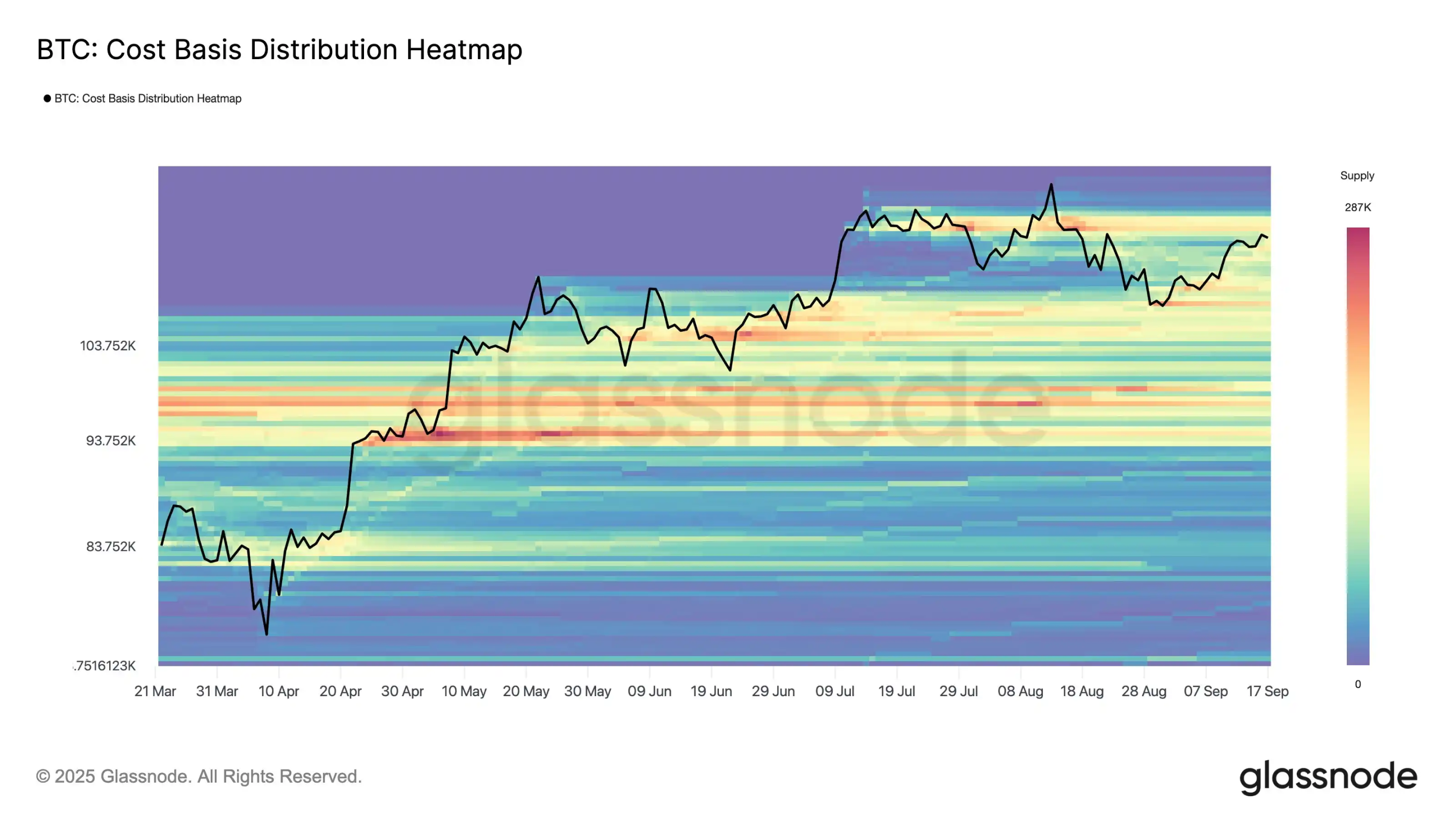

glassnode 早前发布分析表示,比特币的 CBD(Cost Basis Distribution)热图显示,供给集中在 11.7 万美元左右,构成关键阻力区。突破该水平可能开启进一步供应减少的通道,若未能突破则可能延长盘整或引发回调。

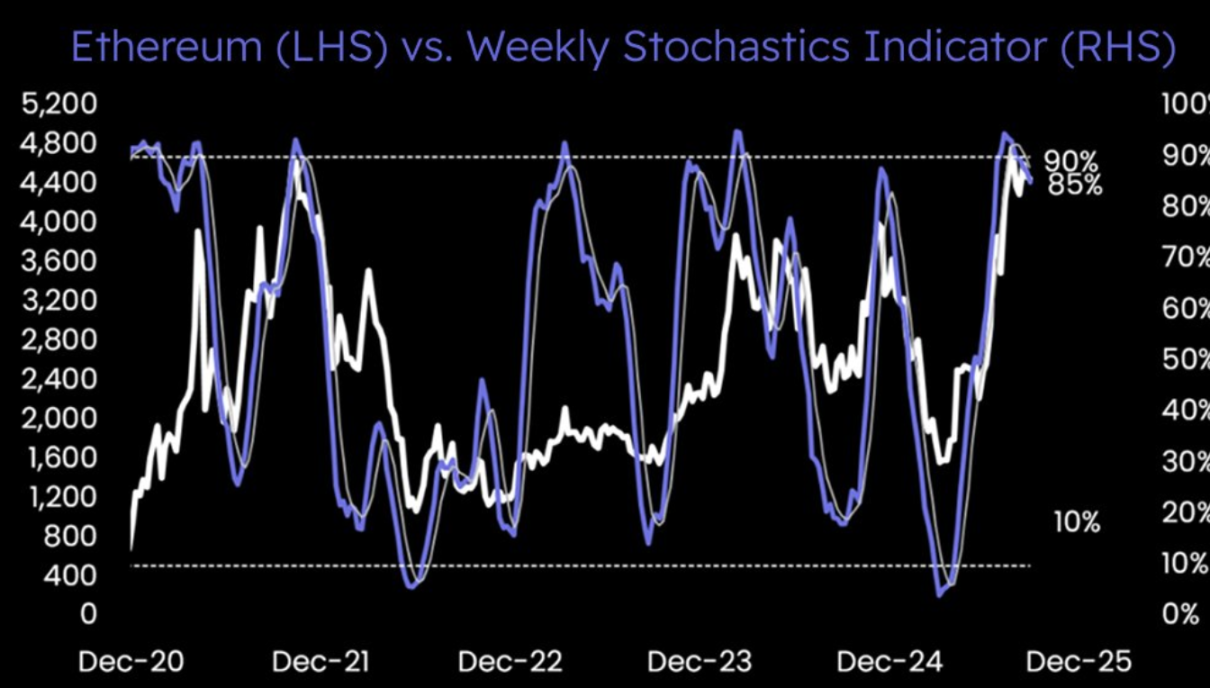

Matrixport 发布市场观点称,「在过往一段时间里,以太坊多头仓位的风险回报更为优越。但随着行情进入快速拉升阶段,技术指标往往失效。尤其当周度随机指标触及极端高位并出现反转时,投资者的谨慎与否,往往决定了盈利能否锁定。过去几月,以太坊财库公司一直是主要买方,随着净资产缩水,其追加资金的能力或将受到限制。在此背景下,严格的风险管理显得更为稳妥。」

Weiss Crypto 则发推表示,美联储降息的效果需等到 12 月中旬才能真正显现。其模型显示,横向震荡可能还会持续 30 至 60 天,10 月 17 日可能会出现明显底部。值得一提是,近期 Weiss Crypto 预测行情阶段性顶部为 9 月 20 日附近。

历史数据显示,BTC 往往在 9 月份迎来下跌,虽然今日出现了一波小幅跳水,但目前 BTC 月线仍保持小阳线的状态,若 9 月月线下跌「玄学」成真,那么在接下来的一周左右时间里,BTC 恐怕还要出现超 3% 的进一步回调。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。