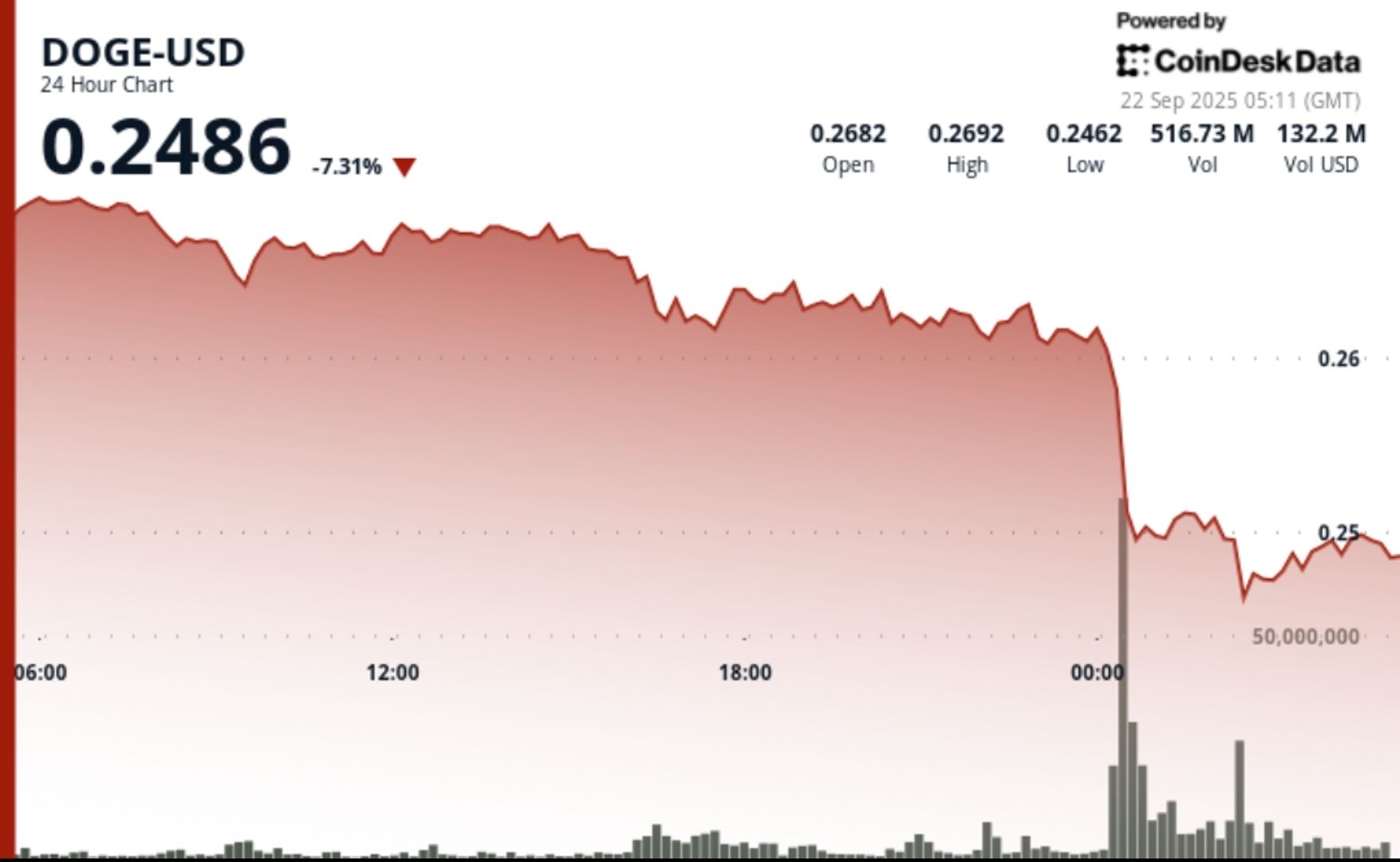

Dogecoin endured a sharp overnight selloff, sliding from $0.27 to $0.25 during the September 21–22 session, as institutional traders offloaded positions on record volumes exceeding 2.15 billion tokens.

The midnight rout carved through support levels and established fresh resistance zones, leaving DOGE consolidating around $0.25 as traders monitor for recovery or continuation lower.

News Background

• DOGE fell 7% over the 24-hour period ending September 22 at 02:00, retreating from $0.27 to $0.25.

• Midnight trading saw a collapse from $0.26 to $0.25 on record 2.15 billion volume, dwarfing the 24-hour average of 344.8 million.

• Analysts flagged a “1-2 pattern” formation that has historically preceded DOGE breakouts above $0.28–$0.30.

Price Action Summary

• DOGE’s range spanned $0.02 (≈8%) between a $0.27 high and $0.25 low.

• Resistance solidified near $0.27 following repeated rejections.

• Institutional support emerged around $0.25, with recovery attempts keeping DOGE anchored above this level.

• In the final hour (01:14–02:13), DOGE bounced within a narrow $0.25–$0.25 channel, showing accumulation patterns with spikes at 01:25 and 02:03.

Technical Analysis

• Record 2.15B tokens traded during the midnight dump confirms heavy institutional activity.

• Support confirmed at $0.25; failure here risks extending decline toward $0.23.

• Key resistance sits at $0.27, with next upside tests at $0.28–$0.30 should buying resume.

• Volume spikes during recovery attempts highlight potential bottoming interest.

• Pattern recognition: technicians identify a recurring “1-2 setup” consistent with prior rally structures.

What Traders Are Watching

• Whether $0.25 can hold as durable support after record liquidation flows.

• Institutional positioning around the $0.28–$0.30 resistance band if recovery gains traction.

• Follow-through volumes in upcoming sessions to confirm whether accumulation or further distribution dominates.

• Broader sentiment impact from ETF delays and ongoing regulatory uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。